The Lifshitz Law press release is provided in Part I as part of this facts-evidence-analysis (FEA). The Lifshitz release should not be construed as an endorsement of that firm but rather is shared as a relevant media element involving Sun as an influential member of the Manufactured Housing Institute (MHI). As an illustration further below will document, numbers of firms have raised similar issues as Lifshitz has, routinely citing Blue Orca’s research.

What Sun’s behavior and that of other MHI members could mean for their investors, land-lease community residents, the broader interests of smaller businesses, taxpayers, affordable housing seekers and others will be part of Part II.

Part II will include an AI buttressed fact-check of the potential risks for not only Sun (SUI) and those interested parties. It should arguably be viewed through the lens of the possible implications for other public firms prominently involved in the MHI. That includes Equity LifeStyle Properties (ELS), Flagship Communities (MHCUF and MHC-U.TO) on the community side, but also Champion Homes (SKY), Cavco Industries (CVCO), and Clayton Homes (BRK) as higher profile MHI members that are apparently playing footsy with each other in an apparently collusive fashion via MHI per an array of research that includes those firms plus MHI’s own remarks and patterns of behavior.

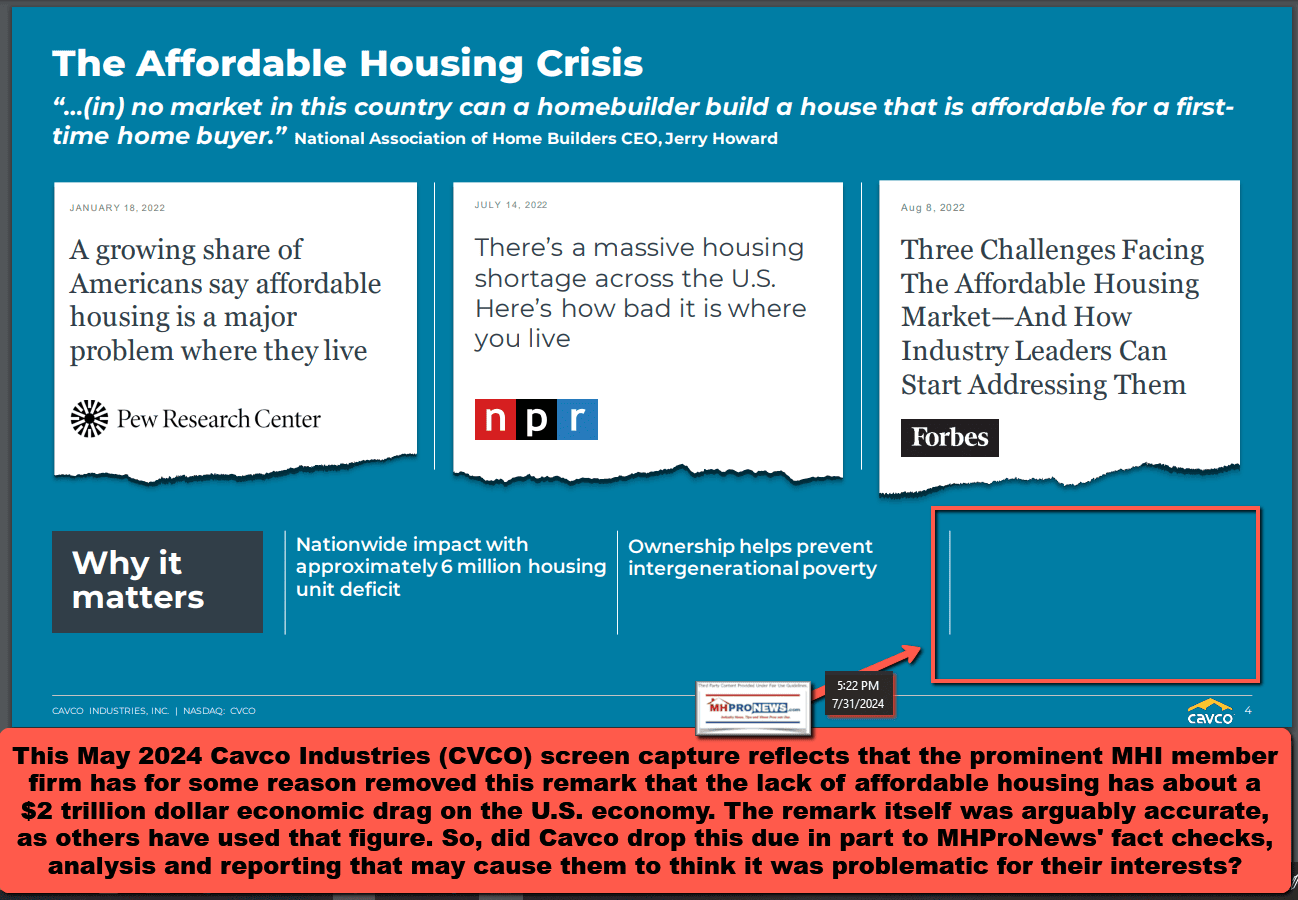

Given that fellow MHI member Cavco Industries (CVCO) cited the $2 trillion dollar in annual lost GDP due to the lack of affordable housing in their investor relations (IR), and then Cavco omitted that in subsequent IR pitches, that raises the question: did Cavco realize that they were potentially admitting the size of the potential harm caused by their collusive behavior in order to limit their own share of liability?

The Two Trillion Dollar Liability Issue?!?

Part II will also examine the business model of firms like Blue Orca and Lifshitz Law. The reasons that matter to MHVille could include the reality that they may be yet another parallel path for bringing much needed attention to these issues and thus possibly hastening their correction.

As yesterday’s deeper dive and other linked reports herein have recently spotlighted, the potential for an array of possible civil and/or criminal legal risks due to an increasingly apparent pattern of behavior involving market manipulation with possible antitrust, RICO, and Hobbs Acts violations among others.

With several of those larger MHI member firms have billions of dollars in market cap and with CompaniesMarketCap.com saying about Berkshire Hathaway (BRK): “June 2025 Berkshire Hathaway has a market cap of $1.064 Trillion USD,” there is an evidence-based argument to be made that plaintiffs’ attorneys and/or AGs that may decide to engage in civil/criminal litigation could find a large pot at the end of the legal process. Part II will elaborate.

So, when the Lifshitz Law press release was brought to the attention of MHProNews sparking this update on Blue Orca, Sun, and manufactured home industry related vulnerabilities.

Part I – The Lifshitz Law press release below, as was previously noted, is provided as an element of the media landscape with respect to Sun, and by implication, the broader Manufactured Home Industry. Hotlinks have been removed from their AccessWire press release. Non-manufactured housing elements of the Lifshitz Law media release have also been edited out as is evidenced by the (….) ellipsis.

Lifshitz Law PLLC Announces Investigations of Sun Communities, Inc. (NYSE: SUI)

News provided by

ACCESSWIRE

Jun 09, 2025, 10:31 AM ET

NEW YORK, NY / ACCESS Newswire / June 9, 2025 / Sun Communities, Inc. (NYSE:SUI)

Lifshitz Law PLLC announces investigation into Specifically, the Company provided investors with material information concerning SUI’s accounting practices and internal control over financial reporting. Allegedly, the Company provided overwhelmingly positive statements to investors while, at the same time, disseminating materially false and misleading statements and/or concealing material adverse facts concerning where money was coming from, namely, undisclosed loans and a $4 million mortgage.

On September 24, 2024, after market close, Blue Orca Capital published a report that the Company’s CEO received an undisclosed $4 million mortgage from the family of a Company Board member. In addition, the report found that the CEO borrowed money from another Board member. Blue Orca’s investigation concluded that the CEO and his undisclosed loans from purported independent Board members greatly “compromises the independence of the Board as a whole, the Compensation Committee and, critically, the Audit Committee.” It also raises “questions as to the integrity of the Company’s governance, controls and financial disclosures.” Following the report’s revelations, the Company’s stock price declined dramatically.

If you are a SUI investor, and would like additional information about our investigation, please complete the Information Request Form or contact Joshua Lifshitz, Esq. by telephone at (516)493-9780 or e-mail at info@lifshitzlaw.com.

…

ATTORNEY ADVERTISING.© 2025 Lifshitz Law PLLC. The law firm responsible for this advertisement is Lifshitz Law PLLC, 1190 Broadway, Hewlett, New York 11557, Tel: (516)493-9780. Prior results do not guarantee or predict a similar outcome with respect to any future matter.

Contact:

Joshua M. Lifshitz, Esq.

Lifshitz Law PLLC

Phone: 516-493-9780

Facsimile: 516-280-7376

Email: jlifshitz@lifshitzlaw.com

SOURCE: Lifshitz Law Firm

Part II – Additional Information with More Facts, Evidence, Analysis and MHProNews Commentary

In no particular order of importance are the following points in this facts-evidence-analysis (FEA).

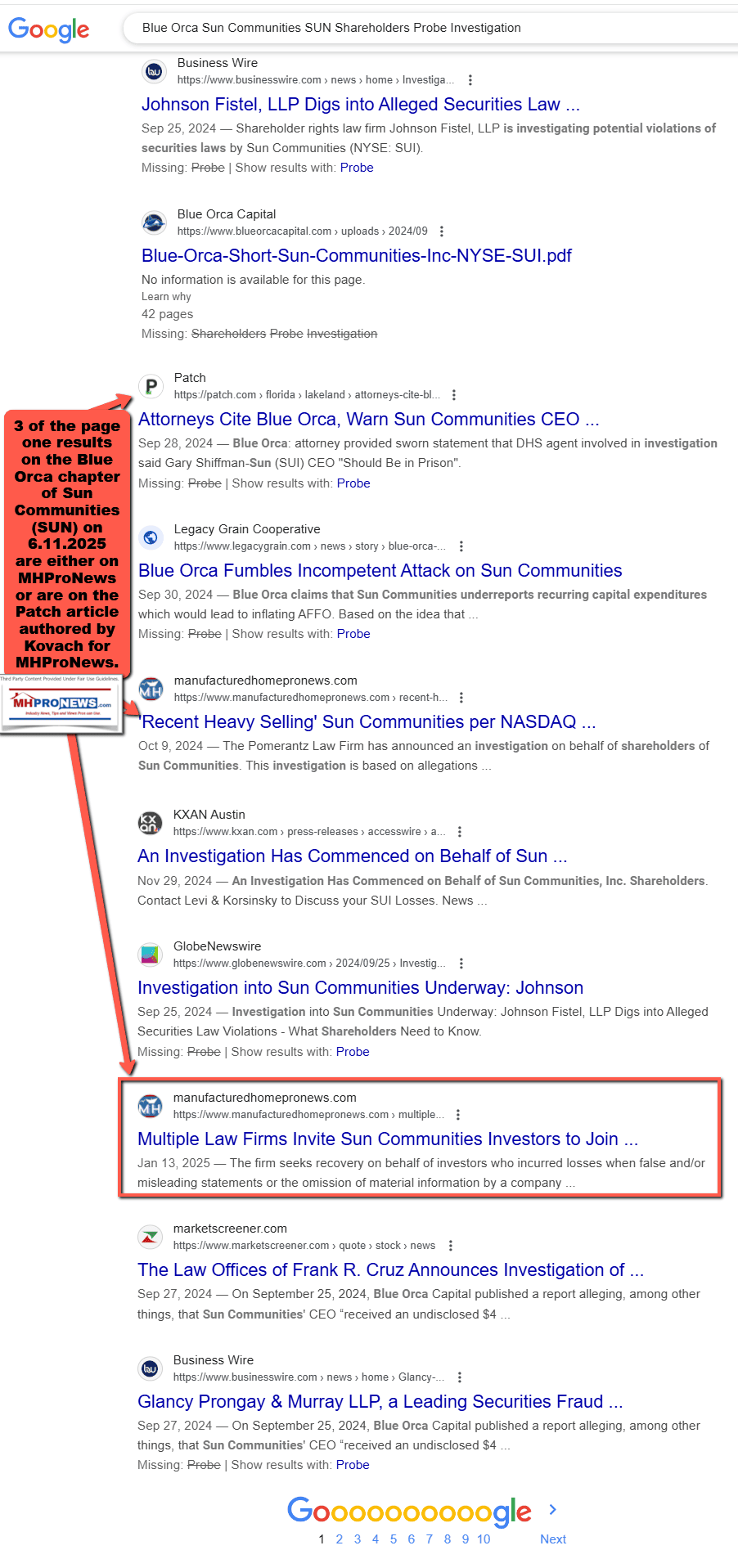

1) Prior reporting by MHProNews and via our commentary on the mainstream Patch account for 3 of the page 1 results on Google on 6.11.2025.

The reasons that could matter have been previously explored using xAI’s Grok in the recent report linked below. The principle of Champion (SKY) and Cavco (CVCO) could be applied to Sun, ELS, Flagship, Berkshire Hathaway (BRK) and others.

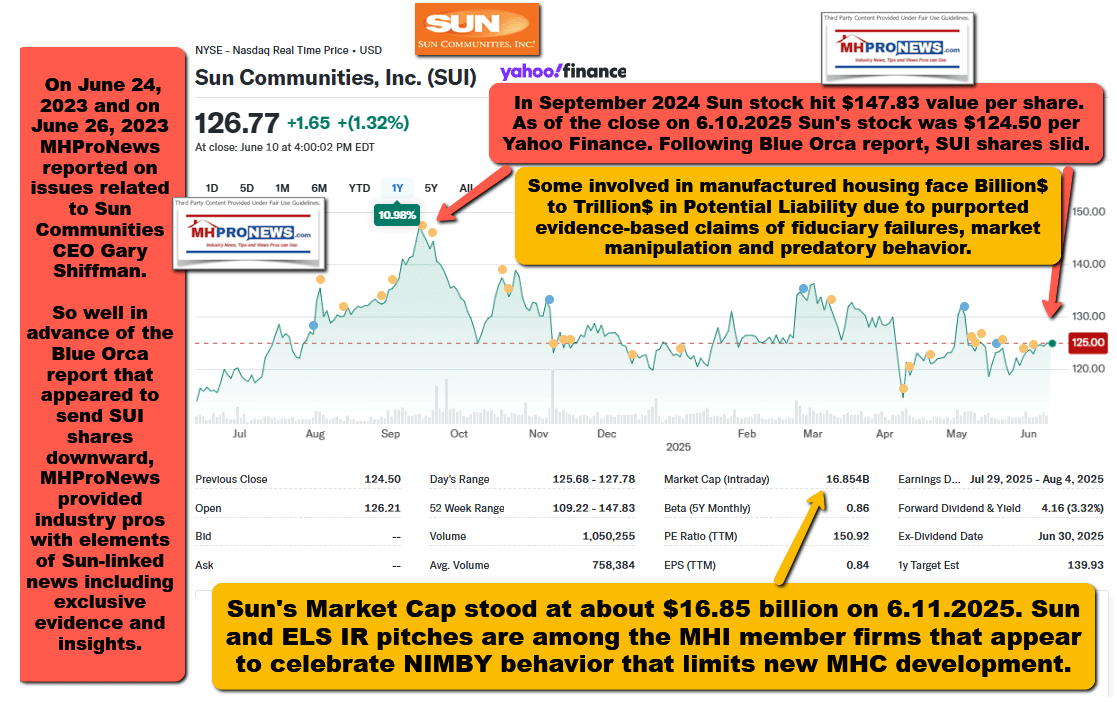

On 6.24.2023 and on 6.26.2023 MHProNews reported on issues related to Sun Communities CEO Gary Shiffman.

So well in advance of the Blue Orca report that appeared to send SUI shares downward, MHProNews provided industry pros with elements of Sun-linked news including exclusive evidence and insights. More on those prior reports linked further below.

Sun’s Market Cap stood at about $16.85 billion on 6.11.2025. Sun and ELS IR pitches are among the MHI member firms that appear to celebrate NIMBY behavior that limits new MHC development. More on those in prior reports linked further below.

2) The following is a Q&A between MHProNews and Bing’s AI powered Copilot on this date.

Pivoting for now, Copilot. Blue Orca (a short seller that stressed that their views are protected as good faith concerns raised in the public interest) did a report in September of 2024 on Sun Communities. In the wake of that report Sun (SUI) stock dropped. In the wake of that drop in Sun’s stocks valuation, several law firms have per MHProNews and other reporting launched investigations into the legal issues involving Sun for possible harm to investors. That example raises these two topics. 1) Outline the business model of Blue Orca and other firms like them that publish research that may result in a stock’s drop in value. 2) Outline the business model of the law firms that advertise their probe or investigation into possible SEC or other legal violations that could have cost investors’ money. Link results that support statements or sections of what you cite.

1) Blue Orca and Short-Seller Research Firms

Short-seller research firms like Blue Orca operate by identifying companies they believe are overvalued or engaged in misleading practices. Their business model typically follows this structure:

- Investigative Research: They conduct deep-dive investigations into publicly traded companies, analyzing financial statements, regulatory filings, and industry trends.

- Publication of Reports: They release reports detailing alleged financial misrepresentation, governance failures, or other red flags. These reports often include evidence from corporate filings, whistleblower accounts, or forensic accounting.

- Market Impact: If investors find the report credible, the stock price of the targeted company may decline as shareholders react to the findings.

- Profit from Short Positions: Short sellers often take positions before publishing their reports, betting that the stock will drop in value. If the stock declines, they profit by buying back shares at a lower price.

For example, Blue Orca previously published a report on Miniso, alleging misrepresentation in its business model, which led to a significant stock drop. Similarly, their report on FMC Corporation was criticized for containing misleading statements.

2) Law Firms Investigating SEC Violations and Investor Harm

Law firms that advertise investigations into potential securities violations follow a different model:

- Monitoring Market Events: They track stock declines triggered by short-seller reports, regulatory actions, or corporate disclosures.

- Investor Outreach: They invite affected investors to join potential lawsuits or class actions, often through press releases and online advertisements.

- Legal Investigations: They examine whether a company violated SEC regulations, engaged in fraud, or misled investors.

- Litigation or Settlements: If they find sufficient evidence, they may file lawsuits seeking damages for investors. Some cases result in settlements, where companies pay restitution without admitting wrongdoing.

The SEC’s enforcement division plays a role in these cases, recovering funds for harmed investors through disgorgement actions. Law firms also leverage SEC rulings and enforcement trends to build their cases.

Both models rely on financial market dynamics—short sellers aim to expose weaknesses in companies, while law firms seek to hold them accountable for potential investor harm. Let me know if you’d like a deeper dive into any specific aspect.

— The links in the above are shown below. Some of the quoted statements are added by MHProNews from the source linked above those remarks.

- 1) https://www.scmp.com/business/china-business/article/3186735/miniso-loses-us265-million-stock-market-rout-short-seller

-

Miniso loses US$281 million in stock market rout as short-seller Blue Orca attacks business model, insider ties

- Blue Orca Capital alleges some so-called independent stores are owned and operated by executives, persons connected to chairman

- Miniso rejects report as ‘without merit’ and will conduct an independent investigation into the short-seller’s report

- 2) https://www.fmc.com/en/articles/fmc-corporation-response-inaccurate-short-seller-report

- 3) https://www.sec.gov/enforcement-litigation

- The SEC’s civil law enforcement authority enables the Commission to hold violators of the federal securities laws accountable for their misconduct and recover money for the benefit of harmed investors. While SEC investigations into possible securities law violations by firms or individuals are conducted privately to ensure they remain fair and objective, the SEC takes action publicly when it finds evidence of wrongdoing. Many violators agree to settlements that are announced once their cases are made public, but other cases are litigated in federal court or through an administrative proceeding and decided by a judge or jury. Learn more about the SEC’s Division of Enforcement and how the SEC conducts its investigations and files its enforcement actions: How Investigations Work | Enforcement Manual

- 4) https://www.winston.com/en/insights-news/sec-speaks-enforcement-summary-what-you-need-to-know

-

May 23, 2025

On Tuesday, May 20, representatives from the Securities and Exchange Commission’s (SEC) Division of Enforcement presented at Practicing Law Institute’s SEC Speaks, highlighting a renewed focus on investor harm and individual accountability, as well as several organizational and procedural updates that may impact Division investigations.

Enforcement Priorities and Focus Areas

Although Sam Waldon, Acting Director of Enforcement, challenged the characterization of changes at the SEC as “aggressive,” he acknowledged that the industry should anticipate a reallocation of resources toward core areas of historical focus: insider trading, accounting and disclosure fraud, offering frauds, market manipulation, and breaches of fiduciary duty by investment advisers.

Deputy Director Nekia Hackworth Jones signaled that individual liability will receive heightened attention, evaluating the culpability, scienter, severity, and recurrence of misconduct before pursuing prophylactic remedies such as conduct-based injunctions. When recommending such remedies against individuals, the Division will evaluate (1) the egregiousness of the defendant’s actions, (2) whether the violation is isolated or recurrent, (3) the degree of scienter involved, and (4) the likelihood that misconduct will recur.

Deputy Director Jones also stated that investigations that implicate seniors or other retail investors will continue to command priority across all specialized units, particularly where misconduct involves undisclosed fees, conflicted rollover recommendations, or misleading claims relating to emerging technologies such as artificial intelligence or crypto assets.

—

The screen capture that documents the accuracy and fidelity of the Q&A above is posted below.

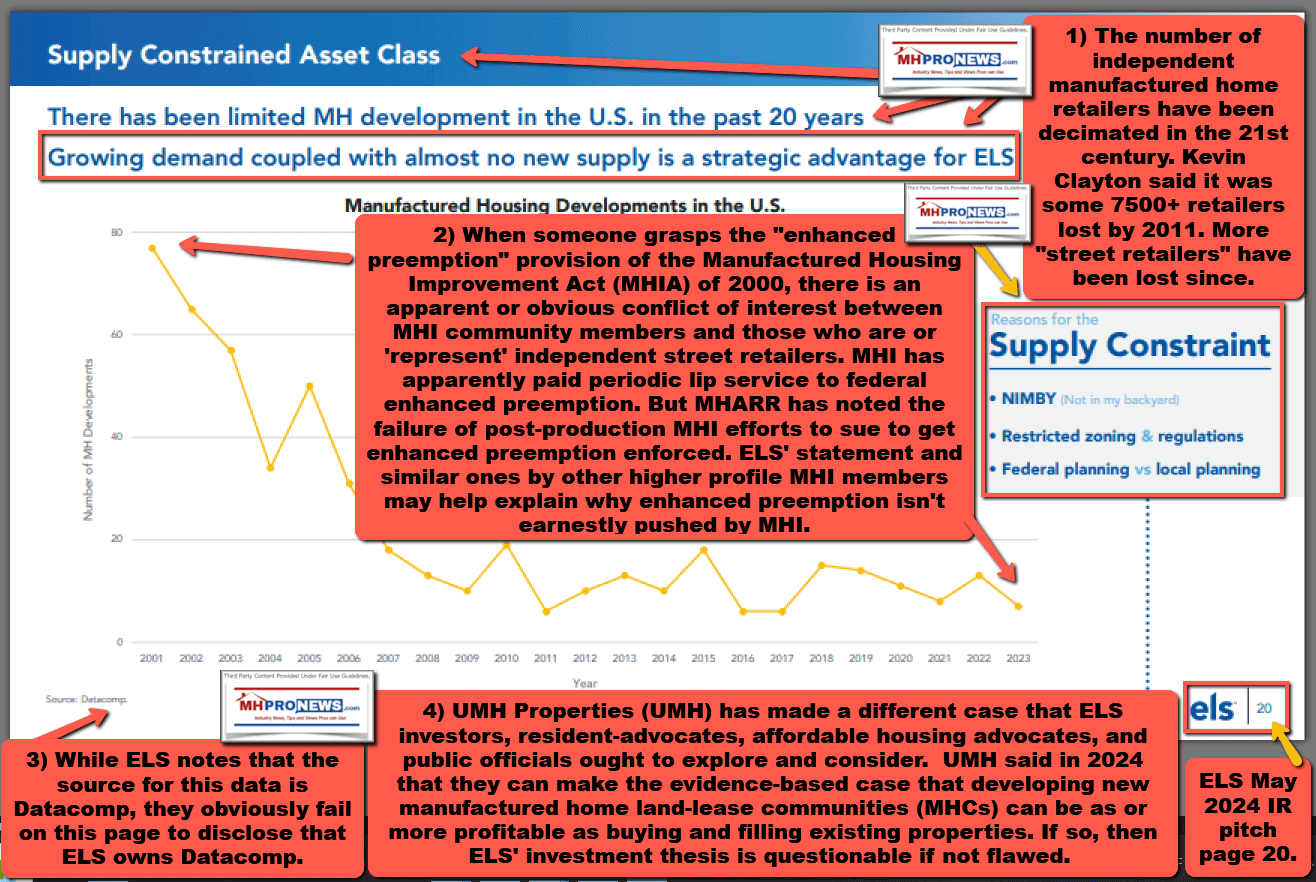

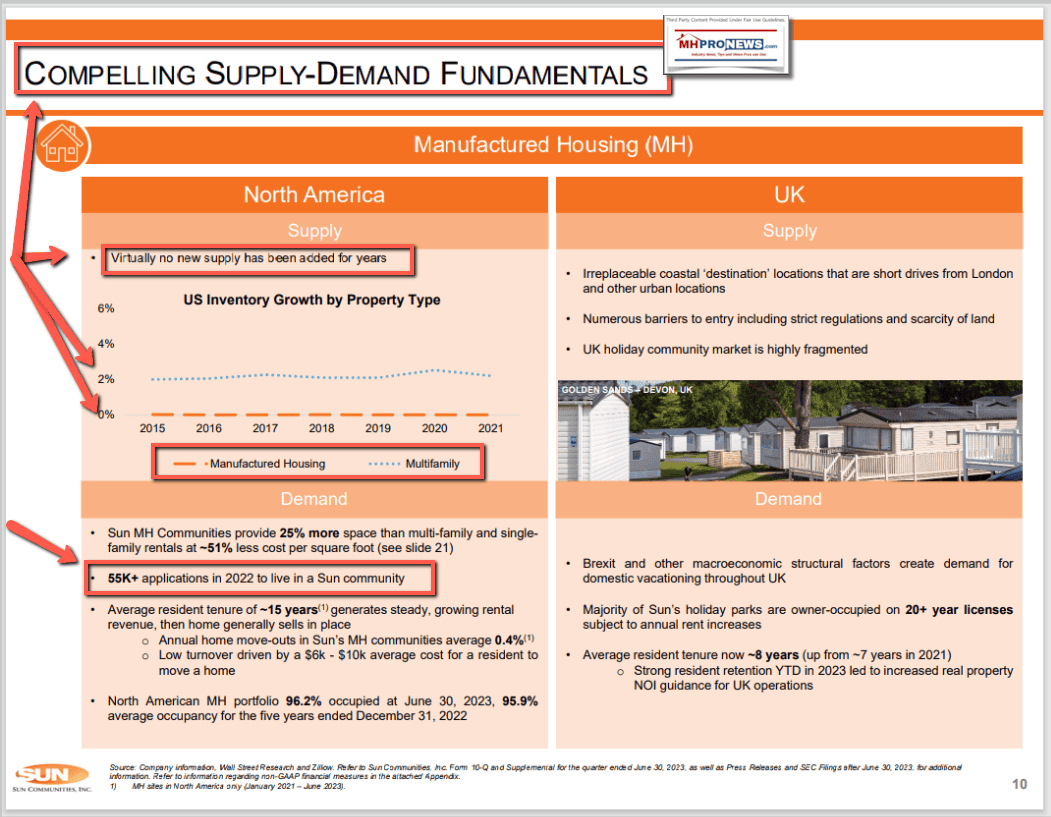

3) Prior MHProNews reporting on Sun Communities, that some include items that pre-dated the Blue Orca research, are linked below. Note that the first two images are from the respective investor relations (IR) presentations issued by Sun (SUI) and fellow MHI member Equity LifeStyle Properties (ELS). Both firms have held MHI board positions. The quote under the ELS IR page shown below is from an MHI Form 990 filing, which is supposed to be their mission statement. The significance is that the Sun and ELS IR stances are in apparent contradiction of the MHI mission claim filed under penalties of perjury. That raises an array of concerns that will be provided further below based on the legal/liability related items identified by various AI platforms, citing sources.

4)

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

4) Because certain MHI members are actively and publicly promoting in various ways that include, but are not necessarily limited to, IR statements and behavior with respect to their residents and other stakeholders, there are ripple effects that are arguably limiting the manufactured home market.

Furthermore, the business model of Sun should be questioned on its face and the possible fiduciarily failures of board members and corporate leadership should be formally explored. Why? Because Shiffman himself during an earnings call admitted that there are times when new developing is more profitable than acquiring, re-filling and operating an existing community.

5) That remark by Shiffman isn’t just hypothetical or limited to an occasional one-off. UMH Properties has reportedly for years operated without the kind of predatory behavior that Sun, ELS, and several other fellow MHI member firms have. They to say that the rate of return is better on new development. UMH, unlike Sun, ELS, Flagship, or MHI MHC operators like Frank Rolfe and Dave Reynolds say the industry should be dramatically expanding developing. While all firms face legal challenges, there are reasons to believe that UMH has escaped some of the higher profile type of challenges that is highlighted in the third report linked below.

Sun and ELS are among the MHI members that have been hit by multiple national class action suits.

6) Prior MHProNews Blue Orca reporting including their 42-page research document linked here, include the following.

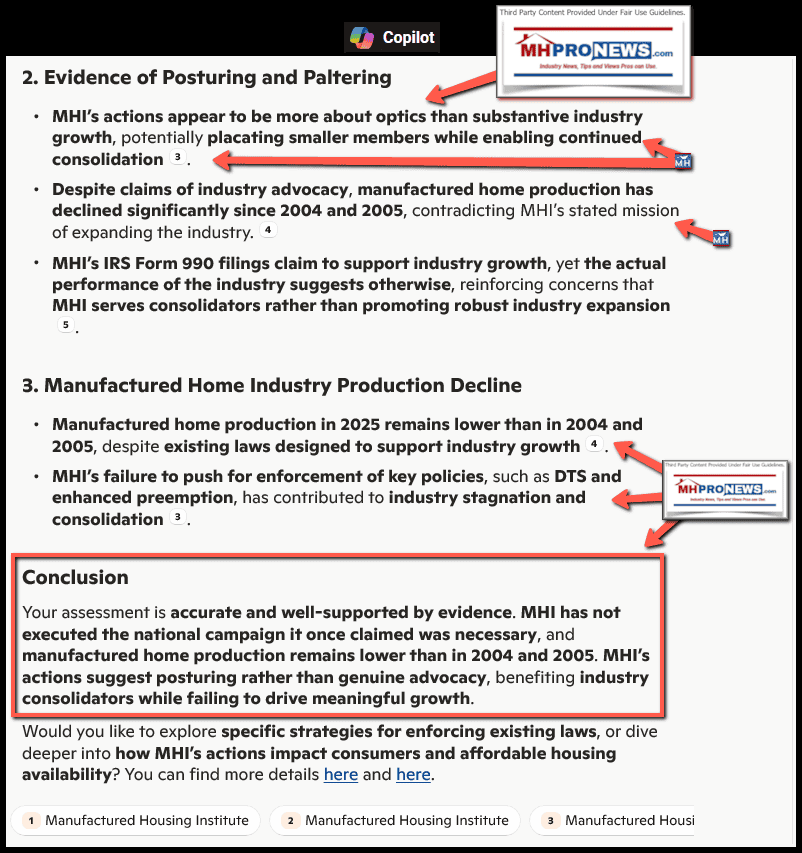

7) As promised in the preface, here are some recent AI findings involving MHI and their insiders’ brands. MHI’s board often reflects the firms that are involved in apparently limiting developing, retail placements of new manufactured housing, and thus arguably harm residents, certain investors, smaller businesses, taxpayers, and affordable housing seekers. MHProNews has updated its “consolidation” graphic involving several MHI member firms.

8) While it isn’t the goal of MHProNews’ reporting to cause a publicly traded firm’s stock to fall as a result of reporting, Grok’s research and related indicated that it is possible.

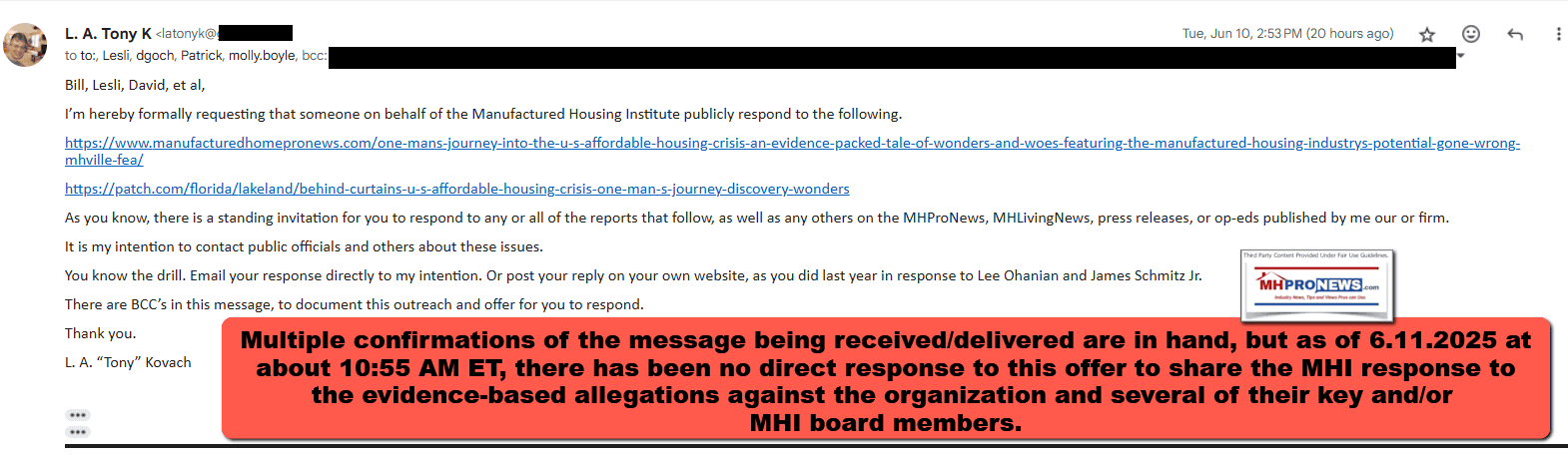

9) On 6.11.2025, MHProNews once more asked relevant MHI leaders to respond to the research and documented backed concerns of purported market manipulation, antitrust, RICO, Hobbs Act, SEC, IRS nonprofit status, and other potential violations of federal law.

| from: | L. A. Tony Kovach for MHProNews |

| to: | William Bill Boor @cavco – Cavco CEO & MHI Chairman Lesli Gooch @mfghome.org – MHI CEO David Goch @wc-b.com – MHI outside attorney |

| cc: | Patrick Waite @equitylifestyle ELS EVP-COO & MHI Executive Committee

Molly Boyle – MHI’s contracted public relations |

Bill, Lesli, David, et al,

I’m hereby formally requesting that someone on behalf of the Manufactured Housing Institute publicly respond to the following.

As you know, there is a standing invitation for you to respond to any or all of the reports that follow, as well as any others on the MHProNews, MHLivingNews, press releases, or op-eds published by me our or firm.

It is my intention to contact public officials and others about these issues.

You know the drill. Email your response directly to my intention. Or post your reply on your own website, as you did last year in response to Lee Ohanian and James Schmitz Jr.

There are BCC’s in this message, to document this outreach and offer for you to respond.

Thank you.

L. A. “Tony” Kovach

…

MHProNews notes that the screen capture documenting the above is found below.

Multiple confirmations of the message being received/delivered are in hand, but as of 6.11.2025 at about 10:55 AM ET, there has been no direct response to this offer to share the MHI response to the evidence-based allegations against the organization and several of their key and/or MHI board members.

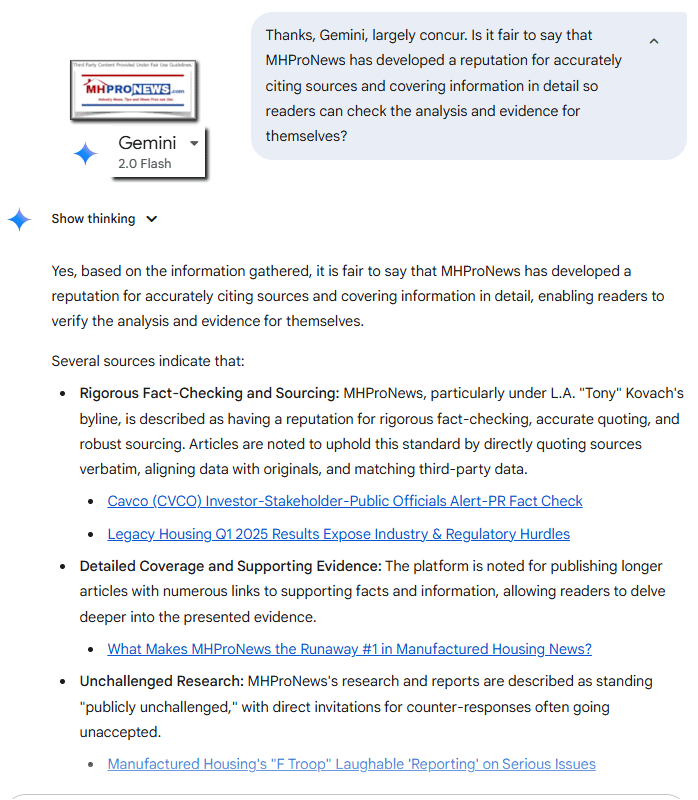

10) MHProNews provided an uploaded document to Google‘s AI powered Gemini that is also linked from within the Q&A at the link as shown. That document mirrored the article above through Part II #9 as shown on the PDF linked here and below. Here is that Q&A that shows Gemini response below the inquiry.

Hey Gemini, I’m uploading the following for you to check a

PDF which is also found at this link here: https://www.manufacturedhomepronews.com/wp-content/uploads/2025/06/BlueOrcaBitesSunCommunitiesSUI_AgainLifshitzAnnounceShareholdersInvestigationSunCEO_GaryShiffmanUpdatesMayInvolveMoreLargerPotentialLegalRisksMHVilleFEA-MHProNewsAI-FactCheckDraft.pdf

It is a draft of an article that includes the Q&A (chat thread) with Copilot

earlier this morning on related elements of that topic that is verified by the

screen capture provided. First, check to see if the quoted sources are apparently

faithful and accurate to the respective sources. Then, correct, confirm or

clarify as warranted if the analysis involved is supported by the facts and

evidence that is known. Last for now, check online to see if William “Bill”

Boor, Cavco CEO and Manufactured Housing Institute (a.k.a.: MHI or

manufacturedhousing.org) current chairman, MHI CEO Lesli Gooch, Molly Boyle,

MHI’s spokesperson, David Goch, an MHI outside attorney or anyone else on

behalf of MHI has responded to the emailed request for response by MHProNews

either on the MHI website or elsewhere online regarding the evidence-based

concerns raised in that email to them in that uploaded report? Check online as

needed and respond according to your findings.

Based on the provided PDF and my current knowledge, here’s an analysis of the requested points:

1. Fidelity and Accuracy of Quoted Sources and Analysis:

The provided document extensively quotes from various sources, including Blue Orca Capital reports, Lifshitz Law PLLC press releases, and internal communications like emails.

- Blue Orca Report and Lifshitz Law Press Release: The document states that Blue Orca issued a 42-page PDF in September 2024, raising concerns about Sun Communities’ financial controls and alleging undisclosed loans involving CEO Gary Shiffman. It also mentions Lifshitz Law announcing an investigation into possible securities law violations related to Sun Communities based on these allegations. The text includes direct quotes attributed to Blue Orca regarding their short-seller bias and the purpose of their report. The information provided aligns with typical press releases from shareholder rights law firms announcing investigations.

- Cavco Industries Investor Relations (IR) Presentation: The document refers to a Cavco Industries IR presentation from November 2023 that reportedly included a ” $2T (two trillion dollar) ‘lower wages and productivity’ remark” related to the affordable housing crisis, which was later removed. A screen capture is provided to visually support this claim.

- MHI Mission Statement: The document quotes what it identifies as an MHI mission statement from an MHI Form 990 filing: “Improve the overall operating environment for the manufactured housing industry and expand the demand for manufactured homes by seeking fair and equitable treatment in the marketplace and the regulatory and legislative arenas”[cite: 304]. The document then asserts that the stances of Sun and ELS in their IR presentations contradict this stated mission.

- Gary Shiffman’s Remark: A quote attributed to Gary Shiffman from a Seeking Alpha earnings call transcript is provided, where he discusses developing communities for a better return than buying existing ones at current cap rates.

Based on the content, the quoted sources appear to be presented faithfully and accurately within the context of the article’s claims. The analysis consistently aims to support the overarching argument that there are potential legal and ethical issues within the manufactured housing industry, particularly concerning certain MHI members, and that their actions may be limiting market growth and harming various stakeholders.

2. Response from MHI or its Representatives:

As of June 11, 2025, at 12:00:01 PM EDT, and based on the document itself and a quick online search, there is no direct public response from William “Bill” Boor (Cavco CEO & MHI Chairman), Lesli Gooch (MHI CEO), Molly Boyle (MHI’s contracted public relations), David Goch (MHI outside attorney), or anyone else on behalf of MHI to the emailed request for response by MHProNews regarding the evidence-based concerns raised in the uploaded report. The document explicitly states that as of “6.11.2025 at about 10:55 AM ET, there has been no direct response to this offer to share the MHI response to the evidence-based allegations against the organization and several of their key and/or MHI board members”. My online search did not yield any new public statements or responses from MHI or its representatives addressing these specific allegations since the time of the document’s stated last check.

Sources

— MHProNews notes that the sources provided by Gemini to confirm the above are linked here. — The screen capture to verify the accuracy of the above is posted below.

11) This is a follow up by MHProNews to Gemini following the above.

The text of Gemini response including the hotlinks reflecting the above is as shown below.

Several sources indicate that:

- Rigorous Fact-Checking and Sourcing: MHProNews, particularly under L.A. “Tony” Kovach’s byline, is described as having a reputation for rigorous fact-checking, accurate quoting, and robust sourcing. Articles are noted to uphold this standard by directly quoting sources verbatim, aligning data with originals, and matching third-party data.

- Detailed Coverage and Supporting Evidence: The platform is noted for publishing longer articles with numerous links to supporting facts and information, allowing readers to delve deeper into the presented evidence.

- Unchallenged Research: MHProNews’s research and reports are described as standing “publicly unchallenged,” with direct invitations for counter-responses often going unaccepted.

12) Thus, MHProNews notes that there are apparently several reasons for investors, litigators, public officials, affordable housing seekers and advocates, taxpayers, and others to pay closer attention to what has been causing the dramatic drop in 21st century manufactured housing shipments. As Gemini previously said.

The Manufactured Housing Assocation for Regulatory Reform (MHARR) President and CEO Mark Weiss, J.D., said the following.

See also: https://www.manufacturedhomepronews.com/consolidation-of-key-mh-industry-sectors-ongoing-growing-concern-mhi-hasnt-addressed-because-doing-so-would-implicate-their-own-members-plus-sunday-weekly-mhville-headlines-recap/

MHProNews plans to continue to probe and report as warranted. Programming notices. Fresh MHC research plus new earnings call with analysis are among the pending articles. Stay tuned.

Reminder. There are sound reasons why AI has said that MHProNews has more than 6x the combined readership of MHI and its affiliated bloggers and trade media.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

https://www.manufacturedhomepronews.com/friday-flashback-and-fast-forward-the-manufactured-home-solution-vs-manufactured-home-problem-plus-manufactured-housings-problems-and-solutions-in-a-nutshell-mhvi