Once more, the Manufactured Housing Institute (MHI) has published a public-facing post on their website that is not visible from their home page news or news-landing page. In order to find this post, someone would need to use the MHI site-search tool and have a pretty good idea of what they are looking for in order to pick the search term needed to find the report. That contrast sharply from what the Manufactured Housing Association for Regulatory Reform (MHARR) website’s practice has been since shortly after their website was launched some 9 years ago. MHARR publishes a monthly report that is visible from their home page as well as from their “Manufactured Home Shipments” tab. It isn’t just MHARR that provides routine – vs. occasional in the case of MHI – public-facing reporting on the topic of new manufactured home production and shipments. The giant National Association of Realtors (NAR), the National Association of Home Builders (NAHB), and the Recreational Vehicle Industry Association (RVIA) are all among trade groups that publish monthly information. It is part of their promotion of the industry that they respectively represent. The ‘hidden’ MHI report is found in Part I. MHARR report is found in Part III. In Part II is the state-level information produced by the Institute for Building Technology & Safety (IBTS), the contractor used by HUD to provide the ‘official’ data for HUD Code manufactured housing production and shipment. More on the RVIA, NAHB, and NAR in Part IV.

There are multiple ways of doing investigative journalism.

This expert MHVille facts-evidence-analysis (FEA) is underway.

Part I. MHI website post on November 2025 shipment data provided under fair use guidelines for media.

MHProNews notes that some links have been omitted from the below, but the text is otherwise as shown on the MHI website on the date and time it was captured for this report.

Posts

MHI Economic Report: November Data Released

BACK TO ALL NEWS

Manufactured housing production in November 2025 fell 16.2% year-over-year and fell 0.3% year-to-date. Single-section shipments declined 4.6% year-to-date, while multi-section shipments rose 3.0%.

The seasonally adjusted annual shipment rate was 93,406—13.3% below 2024 levels. Regionally, only one division saw growth: West North Central posted an 8.0% increase (27 homes).

Industry capacity stands at 151 plants (unchanged from October) and 37 manufacturers, reduced by Cavco’s acquisition of American Homestar. Due to a lapse in federal funding, Census data on single-family housing starts for November is unavailable.

View the full report on the MHI website.

Date Published

January 9, 2026

News Type

MHI News

Keep Exploring

Related Posts

Sorry, we couldn’t find any related posts.

Part II.

| Institute for Building Technology & Safety | |||||||||

| Shipments and Production Summary Report 11/01/2025 – 11/30/2025 | |||||||||

| Shipments | ||||

| State | SW | MW | Total | Floors |

| Dest. Pending | 18 | 7 | 25 | 31 |

| Alabama | 173 | 217 | 390 | 609 |

| Alaska | 0 | 0 | 0 | 0 |

| Arizona | 41 | 98 | 139 | 239 |

| Arkansas | 50 | 71 | 121 | 193 |

| California | 40 | 187 | 227 | 423 |

| Colorado | 11 | 27 | 38 | 65 |

| Connecticut | 13 | 0 | 13 | 13 |

| Delaware | 3 | 25 | 28 | 54 |

| District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 142 | 368 | 510 | 881 |

| Georgia | 98 | 219 | 317 | 537 |

| Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 11 | 36 | 47 | 84 |

| Illinois | 36 | 45 | 81 | 126 |

| Indiana | 65 | 54 | 119 | 173 |

| Iowa | 26 | 14 | 40 | 54 |

| Kansas | 28 | 18 | 46 | 64 |

| Kentucky | 97 | 185 | 282 | 467 |

| Louisiana | 154 | 111 | 265 | 376 |

| Maine | 28 | 54 | 82 | 136 |

| Maryland | 4 | 3 | 7 | 10 |

| Massachusetts | 5 | 9 | 14 | 23 |

| Michigan | 74 | 77 | 151 | 229 |

| Minnesota | 24 | 30 | 54 | 84 |

| Mississippi | 138 | 143 | 281 | 428 |

| Missouri | 79 | 88 | 167 | 255 |

| Montana | 7 | 19 | 26 | 45 |

| Nebraska | 9 | 3 | 12 | 15 |

| Nevada | 9 | 25 | 34 | 63 |

| New Hampshire | 12 | 16 | 28 | 44 |

| New Jersey | 5 | 14 | 19 | 33 |

| New Mexico | 53 | 63 | 116 | 181 |

| New York | 48 | 54 | 102 | 157 |

| North Carolina | 170 | 263 | 433 | 696 |

| North Dakota | 4 | 12 | 16 | 28 |

| Ohio | 76 | 62 | 138 | 200 |

| Oklahoma | 77 | 104 | 181 | 285 |

| Oregon | 27 | 73 | 100 | 179 |

| Pennsylvania | 62 | 74 | 136 | 210 |

| Rhode Island | 2 | 0 | 2 | 2 |

| South Carolina | 113 | 256 | 369 | 626 |

| South Dakota | 12 | 18 | 30 | 48 |

| Tennessee | 76 | 216 | 292 | 508 |

| Texas | 552 | 741 | 1,293 | 2,041 |

| Utah | 5 | 15 | 20 | 35 |

| Vermont | 6 | 10 | 16 | 26 |

| Virginia | 58 | 67 | 125 | 192 |

| Washington | 21 | 91 | 112 | 211 |

| West Virginia | 39 | 53 | 92 | 145 |

| Wisconsin | 31 | 33 | 64 | 97 |

| Wyoming | 1 | 2 | 3 | 5 |

| Canada | 0 | 0 | 0 | 0 |

| Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 2,833 | 4,370 | 7,203 | 11,626 |

| THE ABOVE STATISTICS ARE PROVIDED AS A MONTHLY | ||||

| SUBSCRIPTION SERVICE. REPRODUCTION IN PART OR | ||||

| IN TOTAL MUST CARRY AN ATTRIBUTION TO IBTS, INC. | ||||

| Production | ||||

| State | SW | MW | Total | Floors |

| States Shown(*) | 255 | 273 | 528 | 803 |

| Alabama | 482 | 721 | 1,203 | 1,934 |

| *Alaska | 0 | 0 | 0 | 0 |

| Arizona | 30 | 114 | 144 | 260 |

| *Arkansas | 0 | 0 | 0 | 0 |

| California | 43 | 172 | 215 | 395 |

| *Colorado | 0 | 0 | 0 | 0 |

| *Connecticut | 0 | 0 | 0 | 0 |

| *Delaware | 0 | 0 | 0 | 0 |

| *District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 80 | 194 | 274 | 470 |

| Georgia | 139 | 323 | 462 | 785 |

| *Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 34 | 68 | 102 | 177 |

| *Illinois | 0 | 0 | 0 | 0 |

| Indiana | 305 | 213 | 518 | 732 |

| *Iowa | 0 | 0 | 0 | 0 |

| *Kansas | 0 | 0 | 0 | 0 |

| *Kentucky | 0 | 0 | 0 | 0 |

| *Louisiana | 0 | 0 | 0 | 0 |

| *Maine | 0 | 0 | 0 | 0 |

| *Maryland | 0 | 0 | 0 | 0 |

| *Massachusetts | 0 | 0 | 0 | 0 |

| *Michigan | 0 | 0 | 0 | 0 |

| Minnesota | 29 | 67 | 96 | 163 |

| *Mississippi | 0 | 0 | 0 | 0 |

| *Missouri | 0 | 0 | 0 | 0 |

| *Montana | 0 | 0 | 0 | 0 |

| *Nebraska | 0 | 0 | 0 | 0 |

| *Nevada | 0 | 0 | 0 | 0 |

| *New Hampshire | 0 | 0 | 0 | 0 |

| *New Jersey | 0 | 0 | 0 | 0 |

| *New Mexico | 0 | 0 | 0 | 0 |

| *New York | 0 | 0 | 0 | 0 |

| North Carolina | 141 | 263 | 404 | 667 |

| *North Dakota | 0 | 0 | 0 | 0 |

| *Ohio | 0 | 0 | 0 | 0 |

| *Oklahoma | 0 | 0 | 0 | 0 |

| Oregon | 42 | 175 | 217 | 405 |

| Pennsylvania | 167 | 247 | 414 | 663 |

| *Rhode Island | 0 | 0 | 0 | 0 |

| *South Carolina | 0 | 0 | 0 | 0 |

| *South Dakota | 0 | 0 | 0 | 0 |

| Tennessee | 371 | 641 | 1,012 | 1,653 |

| Texas | 693 | 858 | 1,551 | 2,415 |

| *Utah | 0 | 0 | 0 | 0 |

| *Vermont | 0 | 0 | 0 | 0 |

| *Virginia | 0 | 0 | 0 | 0 |

| *Washington | 0 | 0 | 0 | 0 |

| *West Virginia | 0 | 0 | 0 | 0 |

| Wisconsin | 22 | 41 | 63 | 104 |

| *Wyoming | 0 | 0 | 0 | 0 |

| *Canada | 0 | 0 | 0 | 0 |

| *Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 2,833 | 4,370 | 7,203 | 11,626 |

| (*) THESE STATES HAVE FEWER THAN THREE PLANTS. | ||||

| FIGURES ARE AGGREGATED ON FIRST LINE ABOVE | ||||

| TOTALS TO PROTECT PROPRIETARY INFORMATION. | ||||

| Ashok K Goswami, PE, COO, 45207 Research Place, Ashburn, VA |

Part III. The following was provided by MHARR to MHProNews.

Washington, D.C.

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

HUD CODE PRODUCTION DECLINE CONTINUES IN NOVEMBER 2025

Washington, D.C., January 5, 2026 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in November 2025. Just-released statistics indicate that HUD Code manufacturers produced 7,203 new homes in November 2025, a 16.2% decrease from the 8,597 new HUD Code homes produced in November 2024. Cumulative production for 2025 now totals 95,938 new HUD Code homes, as compared with 96,236 over the same period in 2024, a .3% decrease.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current reporting year (2025) and prior year (2024) shipments per category as indicated — are:

| Rank | State | Current Month (Sept. 2025) | Cumulative | 2025 | 2024 |

| 1 | Texas | 1293 | 49,669 | 16,233 | 17,024 |

| 2 | Florida | 510 | 21,059 | 6,287 | 6,971 |

| 3 | North Carolina | 433 | 17,792 | 5,870 | 6,258 |

| 4 | Alabama | 390 | 16,178 | 4,937 | 5,416 |

| 5 | South Carolina | 369 | 14,301 | 4,827 | 5,300 |

| 6 | Louisiana | 265 | 13,537 | 4,305 | 4,918 |

| 7 | Georgia | 317 | 12,951 | 4,475 | 4,316 |

| 8 | Mississippi | 292 | 10,627 | 3,588 | 3,823 |

| 9 | Tennessee | 282 | 10,625 | 3,513 | 3,850 |

| 10 | Kentucky | 281 | 10,619 | 3,714 | 3,698 |

The November 2025 statistics move Tennessee into 8th place on the cumulative top-ten shipment states list, while Kentucky and Mississippi move into 9th and 10th place respectively.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARRDG@AOL.COM

Website: www.manufacturedhousingassociation.org

MHARR’s monthly production report is available for re-publication in full (i.e., without alteration or substantive modification) without further permission and with proper attribution and/or linkback to MHARR.

MHARR notes that the featured image was generated by artificial intelligence (AI) powered Gemini.

Part IV. Additional Facts-Evidence-Analysis (FEA) from sources as shown including more MHProNews expert commentary.

In no particular order of importance are the following.

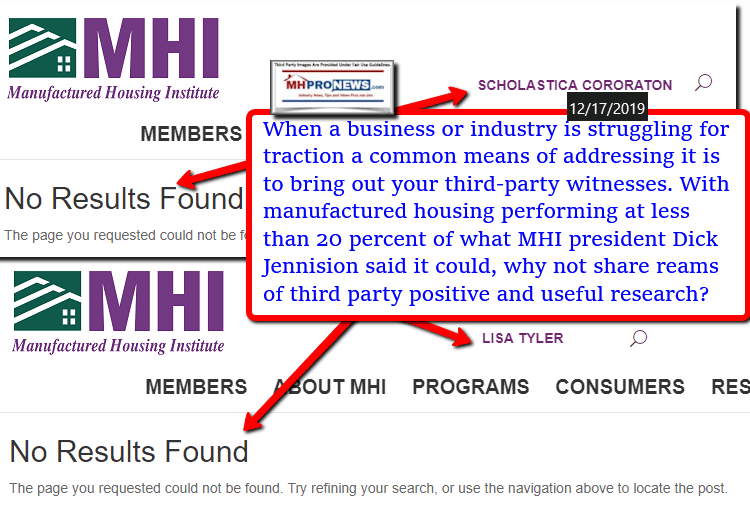

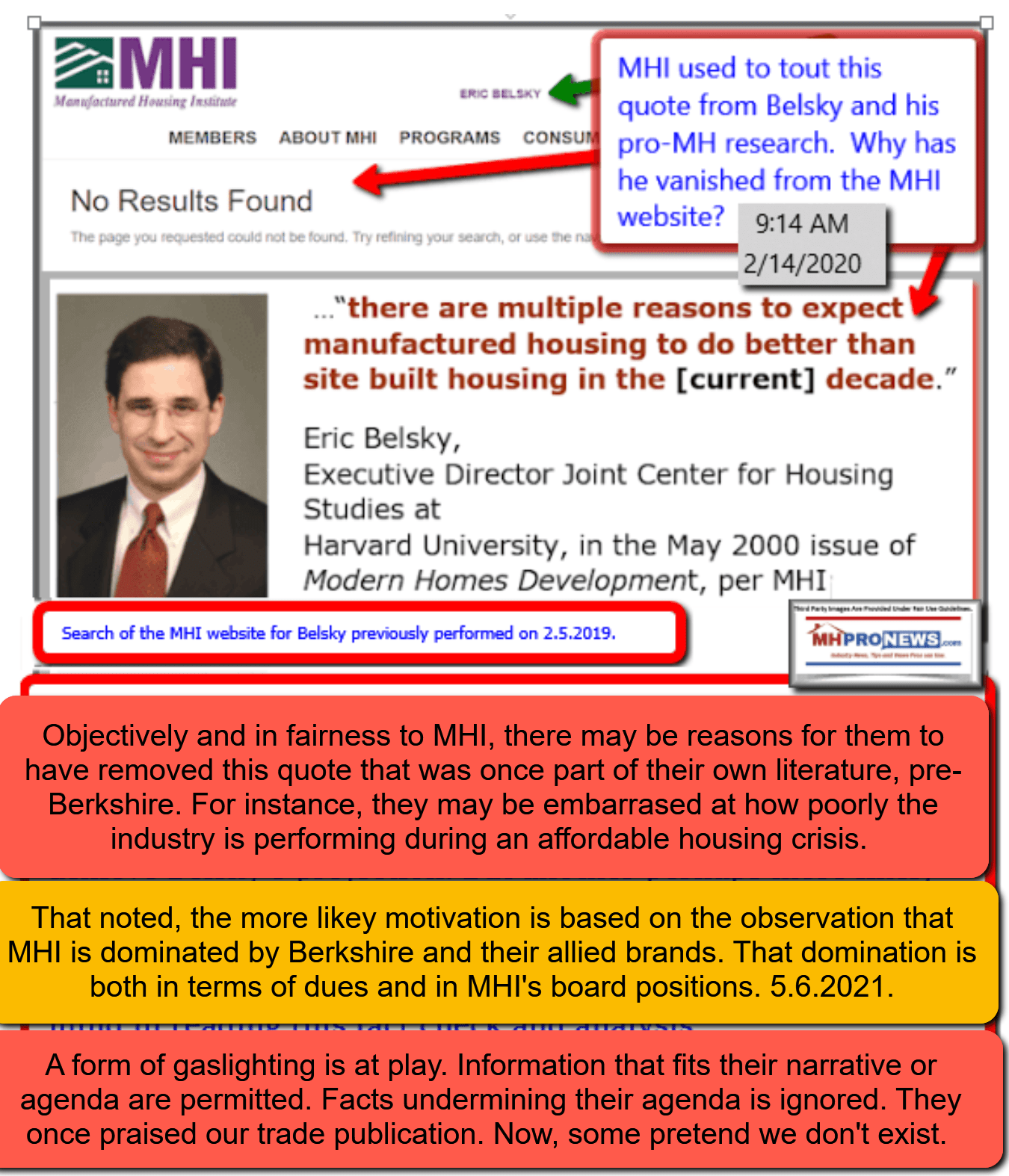

1) MHI and MHARR are two different types of trade groups, as MHARR (and in their own way, MHI) each like to emphasize. That’s not just a different in size or budget. It is a difference is focus. Per MHARR: “The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.” By contrast, MHI says that they represent “all segments” of the factory-built housing industry. MHI claims that they have “over 1000 members.” But MHProNews called that figure into question years ago, while Richard “Dick” Jennison was still MHI’s president and CEO. As the prior membership list linked here revealed, Clayton Homes is roughly 1/3 of all of those ‘1000’ members. That was one of the last emails to MHI that drew an initial response, but no response following the evidence linked here. Which begs the question. If MHI can’t or won’t be transparent and honest about something as simple as their membership numbers, why would they be trustworthy on more serious topics?

As an MHI insider’s whistleblower’s tips document, MHI apparently claims one thing (see guide above) and often (but not always) does or fails to do something that common sense (or their own pledge) indicated would or should happen.

It is precisely in comparing MHI’s own claims against the manufactured housing industry’s key performance indicators (KPIs) or their own record that the sobering realities about the Arlington, VA based MHI comes into focus.

2) Much of the conventional housing industry seems to be sincerely interested in growing their production. The RVIA (see above) demonstrably has worked to grow their production and reach. When the RV industry – a discretionary or ‘luxury’ product – can outperform several times over the performance of the ‘necessity’ for millions to have an affordable manufactured home industry, that’s a red flag. When tipsters emerge to say that MHI insiders sabotaged (‘torpedoed’) a grassroots effort within MHI and their state association orbit to get a campaign going, that’s an issue that begs a legal investigation and whatever legal action should follow.

When MHI’s CEO Gooch is on the record essentially undermining with state officials one of her own multi-year members (ROC USA), why should anyone doubt that if they did it to ROC USA that they could deliberately undermine others who are their members?

3) MHProNews contacted the NAHB on a Sunday morning and had a reply from a senior vice president in less than an hour. If NAHB can do that, why not MHI? Not only did NAHB reply, but they fixed the errors brought to their attention and did so publicly acknowledging that correction.

It will be recalled that something similar happened when MHProNews contacted the NAR about terminology and other problems in their report linked below.

So, while MHI has been documented to duck accountability for years, others in the housing industry have directly and promptly responded to MHProNews, often making corrections requested in the process. Why is it so hard for MHI to respond, and why is it so hard for them to admit when they have erred?

That’s not to say that other associations are perfect. No human organization is. But these examples should then cause others to lean into evidence of market stifling behavior that has been alleged by an array of third-party researchers and/or attorneys involving MHI.

By this time next week, the industry will know if it finished up over 2024 or down. Based upon MHProNews’ look at third party research and reporting (see below), there are reasons to believe that manufactured housing dipped in 2025 under 2024 national totals. Time will soon reveal the answer to that question.

4) The pre-publication version of this report was provided to left-leaning Google’s artificial intelligence (AI) powered Gemini. In response to that was the following response.

1. Facts: Production Data and Transparency (November 2025)

-

Production Decline: Official statistics confirm that HUD Code manufactured housing production fell to 7,203 homes in November 2025, a 16.2% decrease compared to November 2024.

-

Institutional Reporting Contrast: The Manufactured Housing Association for Regulatory Reform (MHARR) maintains a public-facing monthly report visible from its homepage. In contrast, the Manufactured Housing Institute (MHI) “effectively hides” its report, making it invisible on its news landing page and requiring a precise search tool query to locate it.

-

Industry Standards: Other trade groups, including the National Association of Home Builders (NAHB), National Association of Realtors (NAR), and the Recreational Vehicle Industry Association (RVIA), provide routine, easily accessible monthly reports as part of their industry promotion efforts.

2. Evidence: Institutional Behavior and Market Performance

-

Strategic Throttling Allegations: While industry production has dropped roughly 70% in the 21st century compared to the 1990s peak, RVIA performance has significantly outpaced the “necessity” product of manufactured housing.

-

Internal Obstruction: Whistleblower tips allege that MHI insiders sabotaged (“torpedoed”) grassroots industry growth campaigns modeled after the successful GoRVing effort.

-

Murex Cooperation: The January 26, 2026, amended antitrust complaint (Case #1:23-cv-06715) identifies a “tipping point” via the Murex Properties LLC settlement, which includes a cooperation provision.

3. Analysis: Confirmation and Clarification -

Confirmed: The observation that MHI’s reporting practices lack the transparency of its peers is supported by side-by-side screenshots of the MHI and MHARR websites.

-

Clarified: The “optics” of MHI’s advocacy (e.g., the Afford HOMES Act) are undermined by the association’s silence on core issues like discriminatory zoning and federal preemption enforcement.

-

Legal Impact: If Murex documents confirm that MHI meetings were used to facilitate supracompetitive rent hikes, MHI’s advocacy may be legally exposed as a cover for an antitrust scheme.

FEA Conclusion

The developing report stands up to scrutiny. The evidence confirms a pattern of institutional silence and market throttling by MHI that directly correlates with the allegations in the ongoing national antitrust litigation. The contrast between MHI’s “hidden” data and the transparency of groups like NAHB and MHARR reinforces the “strategic information gap” previously documented.

Supporting Resources:

— MHProNews notes that the full Q&A with Gemini is found at this link here. Gemini confirmed the above as accurate as is documented by the screen capture linked here. —

5) Per Grok (see Q&A and supporting information that is linked further below).

The uploaded PDFs and linked elements provide a facts-evidence-analysis (FEA) check on November 2025 manufactured home production/shipment data, contrasting MHARR and MHI reports, with state-by-state breakdowns and broader industry implications.

The uploaded PDFs and linked elements provide a facts-evidence-analysis (FEA) check on November 2025 manufactured home production/shipment data, contrasting MHARR and MHI reports, with state-by-state breakdowns and broader industry implications.

Facts from Verifiable Sources

- Official HUD-compiled data (via IBTS/Census) shows 7,203 HUD Code manufactured homes produced in November 2025, a 16.2% year-over-year (YoY) decline from 8,597 in November 2024.

- Cumulative 2025 production through November totals 95,938 homes, down 0.3% from 96,236 over the same 2024 period.

- Top shipment states (cumulative 2025 vs. 2024) reflect mixed but mostly lagging trends: e.g., Texas leads but trails prior year in some segments; only limited states show gains.

- MHI’s November 2025 Economic Report aligns: production fell 16.2% YoY, 0.3% YTD decline; seasonally adjusted annual rate 93,406 (13.3% below 2024); single-section down 4.6% YTD, multi-section up 3.0%; regional growth limited (e.g., West North Central +8.0%, but minimal homes).

- No major discrepancies in raw numbers between MHARR and MHI reports—both draw from the same HUD/IBTS source. MHARR emphasizes persistent decline and suppression factors (e.g., zoning, DTS financing gaps), while MHI notes capacity (151 plants, 37 manufacturers) and contextual factors (e.g., funding lapses affecting Census data).

Evidence Supporting the Draft Elements

- MHARR’s January 5, 2026 release directly matches the draft/PDF figures and state analysis (e.g., top-10 shifts, Texas/Florida declines).1

- MHI’s January 9, 2026 report confirms identical YoY/YTD declines and SAAR.2

- MHProNews mashup/FEA (January 6, 2026) accurately cites MHARR data, adds affordable housing crisis context (e.g., inverse supply-demand correlations), and critiques MHI silence on bottlenecks—no factual errors in numbers or sourcing.3

- Gemini’s uploaded Q&A/response affirms data accuracy, validates MHARR/MHProNews emphasis on decline as “tipping point” evidence for suppression claims, and notes MHI/MHARR contrasts without contradiction.

Analysis and Critique

The draft/HI (MHProNews commentary) is factually sound on data and contrasts—MHARR provides detailed, advocacy-focused breakdowns (e.g., cumulative state rankings, suppression thesis), while MHI offers economic framing (e.g., product mix, capacity). No evidence of fabrication; numbers align across sources.

Gemini’s take is reasonable and evidence-supported: It reinforces MHProNews as credible (via prior AI validations), highlights Murex cooperation as potential “tipping point” for antitrust patterns, and ties production stagnation to MHI-linked issues (e.g., optics vs. outcomes). No overreach—Gemini qualifies as analysis of provided docs.

No competing records debunk these reports; MHI/MHARR data consistency holds. Broader context (e.g., 2025 cumulative ~96,000 vs. 1990s peaks 300,000+) supports underperformance critique without inaccuracy.

Overall, the elements pass FEA: accurate, transparent, and well-sourced. No warranted corrections—HI and AI elements align with verified online evidence.

— MHProNews notes that the full Q&A with Grok is found at this link here. Grok confirmed the above as accurate as is documented by the screen capture linked here. —

6) It is simply a truism that:

There is always more to know.

As MHVille and the world enter a new year, stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © and “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © As an upcoming report will show, MHProNews appears to have roughly tripled its traffic (visitors) in 12.2025 than in 12.2024. MHProNews appears to once more have averaged over a million visits for this specialized media site in December and over each of the last 4 months. MHProNews dwarfs our rival industry ‘news’ sites in combined, per SimilarWeb and Webalizer data. Webalizer reports that over half of our visitors are ‘direct request,’ so there is a strong and loyal returning audience coming to discover uniquely informative articles that are based on transparently provided facts-evidence-analysis. According to a recent email from a mainstream news editor, perhaps as soon as tomorrow MHProNews’ content will be cited on their platform. Stay tuned for updates on that and more.

Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Transparently provided Facts-Evidence-Analysis (FEA) matters. ##