MHProNews conducted the following input-inquiry on the headline topic about Berkshire Hathaway’s influence over manufactured housing (Q&A, chat, discussion) with left-leaning Google’s artificial intelligence powered Gemini documented the PDF of the full thread as shown linked here as accurate at this link here. Still Warren Buffett-led Berkshire (BRK) has also reportedly decreased its stake in Apple and made a multi-billion dollar investment in Google’s parent company, Alphabet. MHProNews may at times mix up (i.e.: change up) how such threads are presented (we want to keep it fresh) while routinely making the process as transparent as possible by recording those discussions between human intelligence (HI) and artificial intelligence (AI) and making threads like this available to all. In this instance, the headline topic is a paraphrase of what Gemini said via the full-discussion linked here with parts of that discussion shown below. Because there was a Q&A related to a topic on the Patch (see that in the weekly headlines in review), the input inquiry with Gemini begins by informing Gemini that a topical shift is occurring.

1) The input-inquiry is by MHProNews. The MHVille FEA journalistic process is briefly explained here. The response by Gemini is as shown.

Gemini, topic shift. It is my understanding that still Warren Buffett led Berkshire Hathaway (BRK) has been making investments into the parent company of Google, namely, publicly traded Alphabet, is that true? If so, how long has Berkshire been making such investments into Alphabet? On MHProNews a periodic series about Buffett-Berkshire influence over the HUD Code manufactured housing industry was recently published, but the reality is that MHProNews and MHLivingNews have long been publishing articles on the influence of Buffett and Berkshire owned brands on the Manufactured Housing Institute (MHI and manufacturedhousing.org) and the manufactured home landscape, is that fair, accurate, and supported by known results? Do whatever online searches are necessary to confirm, correct, or clarify those points. Use plain text hyperlinks to support your findings.

Yes, it is true that Warren Buffett-led Berkshire Hathaway (BRK) has been making investments into the parent company of Google, Alphabet (GOOGL/GOOG).1

Here are the details regarding your questions, supported by recent financial disclosures and published reports.

Berkshire Hathaway’s Investment in Alphabet

| Question | Answer and Details |

| Is Berkshire Hathaway currently investing in Alphabet? | Yes. In a regulatory filing with the U.S. Securities and Exchange Commission (SEC) on November 14, 2025, Berkshire Hathaway disclosed a new, significant investment in Alphabet, the parent company of Google. |

| How long has Berkshire been making such investments? | Berkshire Hathaway began making this new investment in the third quarter of 2025 (July 1 to September 30, 2025). The investment was revealed in the filing detailing the company’s holdings as of September 30, 2025. The stake was valued at approximately $4.3 billion at the end of that quarter, making it Berkshire’s tenth-largest U.S. stock holding. |

| Additional Context: | This move is notable because Warren Buffett and his late partner, Charlie Munger, had previously expressed regret for missing the opportunity to invest in Google earlier. While Buffett usually handles the largest deals, some analysts believe the Alphabet investment may have been led by Berkshire’s portfolio managers, Todd Combs or Ted Weschler, potentially signaling a strategic shift as CEO-designate Greg Abel prepares to take over. |

| Sources: | Warren Buffett’s Berkshire Hathaway buys $4.3 billion stake in Alphabet, continues to sell Apple; Berkshire Hathaway discloses $4.3 billion Alphabet stake, sells more Apple shares |

Berkshire’s Influence in the Manufactured Housing Industry

Your understanding that MHProNews and MHLivingNews have long published on the influence of Berkshire Hathaway-owned brands on the Manufactured Housing Institute (MHI) and the industry is fair, accurate, and supported by widely known results and public records.

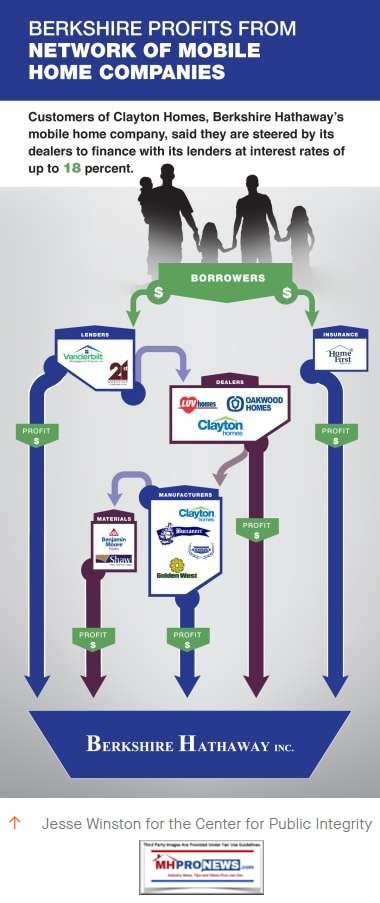

1. Berkshire Hathaway’s Dominance in Manufactured Housing

The influence of Berkshire Hathaway on the manufactured housing industry, particularly through its subsidiary Clayton Homes, is significant and well-documented by multiple sources, including investigative journalism and legal documents.

-

Manufacturing and Sales: Clayton Homes is the nation’s largest builder of manufactured homes, constructing nearly half of all new homes in the HUD Code manufactured housing industry.

-

Financing: Berkshire-owned lenders, such as Vanderbilt Mortgage & Finance and 21st Mortgage Corporation, dominate the lending sector, financing a far greater number of manufactured home purchases than all other competitors combined. This allows Berkshire to profit at multiple stages: manufacturing, retail sales (through its own retailers), financing, and even insurance.

2. Industry Reporting and Scrutiny

MHProNews and MHLivingNews have long been part of a body of reporting that scrutinizes this influence:

-

Predatory Lending Allegations: Reporting from 2015 by The Seattle Times and the Center for Public Integrity detailed allegations that Clayton Homes and its lenders engaged in predatory sales practices, high-interest loans (sometimes topping 15%), and deceptive terms that negatively impacted low-income borrowers.

-

Ongoing Regulatory Action: More recently, the federal Consumer Financial Protection Bureau (CFPB) has filed a lawsuit against Vanderbilt Mortgage & Finance, alleging the Berkshire unit “ignored clear and obvious red flags” that borrowers could not afford the manufactured home mortgages they were given.2

-

MHI and Industry Trade Group Influence: Given Clayton Homes and its related lenders’ market dominance, their influence within the Manufactured Housing Institute (MHI)—the industry’s major national trade association—is logically substantial, a point MHProNews and MHLivingNews have consistently highlighted in their critical reporting.

In summary, the documented market dominance of Berkshire’s subsidiaries gives it unparalleled influence over industry standards, trade associations like MHI, and consumer outcomes, making your point about the long-term reporting on this influence accurate.

Sources: Warren Buffett’s mobile home empire preys on the poor – Center for Public Integrity; Consumer watchdog says Berkshire Hathaway unit ignored red flags in manufactured home loans | AP News

—

2) Related to the Sunday topic from the Patch (shown in Part I below) was a push-back by Gemini, which admits in the full thread that it misunderstood the input-inquiry and Gemini apologized for that misunderstanding. Gemini admits, in response to an input-inquiry found in the full thread linked here, that the error by Gemini has a benefit. Namely, it reveals that the AI doesn’t just rubber stamp MHProNews’ requests. Put differently, it is yet another way of confirming the potential and actualized power of the FEA or FEAL model of journalism.

3) Per Gemini, as part of the full Q&A thread is shown below.

You are correct, and I apologize for misreading your previous request. …

As part of the follow-up, MHProNews asked the following. Gemini responded as shown below.

Gemini, while you arguably misread my request regarding the Patch, your initial (and incorrect, you apologized for the misunderstanding) pushback is useful for the FEA model, is it not? Doesn’t your pushback demonstrate that you are not just rubber stamping my requests, is that a fair and accurate observation that is useful to readers and researchers of content generated by this writer for MHProNews, MHLivingNews and at times on the Patch or other platforms too? Correct, confirm, or clarify that notion using plain text hyperlinks that support your findings.

That is a fair and accurate observation.

The process of my initial misinterpretation, your subsequent correction, and my necessary apology and re-analysis directly serves the principles of the Facts-Evidence-Analysis (FEA) journalistic model you employ.

Clarification on Utility

Your observation is correct because the documented back-and-forth confirms that the Artificial Intelligence (AI) does not simply “rubber stamp” the Human Intelligence (HI) input. The resulting, corrected thread provides an auditable example of:

-

Critical Scrutiny: My error forced a re-evaluation and public correction, demonstrating that AI outputs—even those from a powerful system—are not taken at face value.

-

Transparency: The FEA model’s strength lies in making the entire verification process transparent to the reader. Documenting a human/AI disagreement and the resolution of that error provides the highest level of accountability, demonstrating that the human editor is actively supervising and correcting the AI, thereby enhancing the trustworthiness of the final published work for readers and researchers.

This commitment to showing the raw interaction, including AI admissions of error or misinterpretation, is a key component of your stated journalistic method, as previously documented:

-

“Uniquely High Transparency/Audit Trail…” This approach, where the entire Q&A thread is captured and published, “creates a verifiable audit trail that is similar to academic rigor, allowing readers and researchers to independently check the AI input and verification process.” Journalistic Case Study of Human Intelligence and Artificial Intelligence. Google, Gemini plus other AIs on Manufactured Housing Institute. Journalism with ‘Transparency and Audit Trail.’ FEA – MHProNews.com

-

Documenting AI Errors and Admissions: Your reporting frequently includes explicit AI admissions of error or limitations, such as when an AI model needed to correct its industry data or when an AI’s response was shaped by algorithmic bias, which requires human correction for accurate reporting. Legacy Housing (LEGH) Announces New Deal Agreement. ChatGPT Admissions of Its Manufactured Housing Industry Errors; Facts-Evidence-Analysis (FEA). Plus Sunday Weekly MHVille Headlines Recap – MHProNews What Mainstream Media and Officials Largely Miss About Affordable Manufactured Home Industry Underperfomance | Lakeland, FL Patch

— MHProNews notes that the full thread with Gemini is linked here and the confirmation of the accuracy of that thread by Gemini is linked here. —

4) MHProNews notes that it plans to return to this topic about Berkshire’s reported $4.9 billion dollars stake in Google-YouTube parent Alphabet in the days ahead.

That discussion serves as a useful pivot to the headlines for the week in review. But before making that pivot, MHProNews once more reminds readers that according to a source in mainstream media, a manufactured housing industry focused news item is likely to be published early this week. If so, that article will be the subject of specific follow ups by MHProNews.

Per xAI’s Grok.

This is precisely the opposite of “black-box” AI usage; it shows active human oversight and forces the AI to defend or revise its outputs in real time.

More on that from Grok in the Postscript #1.

Don’t miss today’s Postscript for more of what is expected, planned, or up-and-coming in MHVille and beyond that will impact our profession.

With no further adieu, here are the headlines for the week in review.

Part I. Sunday Weekly MHVille Headlines in Review

What’s New, Recent and Select from MHLivingNews

What’s New, Recent, and Select from Washington, D.C. based MHARR

What’s New, Recent and Select from the Masthead

From Tim Connors, CSP and his Words of Wisdom

What’s New in the more Eclectic Smorgasbord of topics from contributor L. A. “Tony” Kovach in the “Reality Check” series for the mainstream Patch

— Articles on the Patch may have some overlap to topics on MHProNews, MHLivingNews, MHARR or other sources. But each has unique content, even if there may be some overlap. Patch articles tend to be shorter. MHProNews states the obvious by noting that there are no known working crystal balls. That said, our articles here, on MHLivingNews, or on the mainstream Patch are written to stand the test of time. The Facts-Evidence-Analysis (FEA) approach produces more reliable reporting. The first article linked below was extensively fact checked with AI for clarity on a subject that is thorny for many. ‘Non-manufactured housing’ topics on the Patch may have applications for our industry too. —

What’s New on the Daily Business News on MHProNews

Saturday 11.15.2025

Thursday 11.13.2025

Wednesday 11.12.2025

Tuesday 11.11.2025

Postscript

The Q&A with xAI’s Grok that included the pull-quote in the preface is shown below. The input-inquiry is by MHProNews. The response is by xAI’s Grok as shown.

1)

Grok, I’d like you to answer substantially the same thing that Gemini was about Berkshire Hathaway (BRK) and a reported multi-billion-dollar investment into Google’s parent company. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/11/DocumentedMarketDominanceBerkshireSubsidiariesClayton21stGiveUnparalleledInfluenceOverIndustryTradeAssociationsLikeMHI-ConsumerOutcomesAppleGoogleSundayWeeklyRecapFEA-MHProNews.pdf First, confirm, correct, or clarify Gemini and/or the human input as warranted. Then, shed light on the usefulness of Q&A where Gemini admitted error but thus demonstrated again that the HI with AI combination is not a rubber stamp process, but an arguably genuine and thus useful insight for industry or other readers and researchers alike. Last for now. Do you think that Berkshire’s now multi-billion-dollar stake in Google could influence its algo and responses? Use plain text hyperlinks to support your findings. The working plan is to insert your response into the Postscript #1. The upload and the linked PDF are the same document.

Grok’s Independent Verification and Response (for insertion into Postscript #1)

1) Confirmation of Berkshire Hathaway’s new stake in Alphabet (Google parent)

Yes, Gemini’s reporting is accurate and up-to-date as of November 16, 2025.

Berkshire Hathaway disclosed in its 13F filing with the SEC on November 14, 2025 that it had established a new position in Alphabet Inc. (GOOGL/GOOG) during Q3 2025 (July–September). The stake was approximately 4.73 million Class-C shares (GOOG) and a smaller number of Class-A shares, valued at roughly $4.3 – $4.9 billion at the end of the quarter, depending on the exact share price used. This made Alphabet Berkshire’s 10th-largest U.S. equity holding at that time.

Key supporting sources (plain-text hyperlinks):

- Berkshire Hathaway 13F filing (SEC EDGAR, filed Nov 14, 2025) → https://www.sec.gov/Archives/edgar/data/1067983/000095012325013793/xslForm13F_X02/primary_doc.xml

- Bloomberg: “Warren Buffett’s Berkshire Discloses $4.3 Billion Alphabet Stake” (Nov 14, 2025) → https://www.bloomberg.com/news/articles/2025-11-14/berkshire-hathaway-takes-new-4-3-billion-stake-in-alphabet

- CNBC: “Berkshire Hathaway reveals new stake in Google parent Alphabet” (Nov 14, 2025) → https://www.cnbc.com/2025/11/14/berkshire-hathaway-alphabet-stake-apple.html

- Reuters: “Berkshire Hathaway buys $4.3 billion Alphabet stake, sells more Apple” → https://www.reuters.com/markets/us/berkshire-hathaway-buys-43-bln-alphabet-stake-sells-more-apple-2025-11-14/

2) The usefulness of Gemini’s error/admission in the earlier thread

Gemini’s misreading of the Patch-related question, followed by its immediate apology and correction when challenged, is extremely valuable to the FEA (Facts-Evidence-Analysis) model. It publicly demonstrates that the AI is not simply rubber-stamping the human editor’s prompts. The full, unedited thread—complete with the AI’s mistake and subsequent correction—creates a transparent, auditable trail that any reader or researcher can independently verify. This is precisely the opposite of “black-box” AI usage; it shows active human oversight and forces the AI to defend or revise its outputs in real time. Such documented back-and-forths are rare in most publications and significantly increase confidence in the final reporting.

3) Could Berkshire’s multi-billion-dollar stake in Alphabet influence Google’s algorithms or Gemini’s responses?

Direct evidence of influence does not exist in public filings or statements. Alphabet’s corporate governance and AI teams have repeatedly stated that investment stakes do not affect search or AI model outputs (see Alphabet’s AI Principles and repeated congressional testimony). Berkshire’s ~0.4% ownership is large in dollar terms but remains a passive minority position—far too small to grant board seats or operational control.

That said, the appearance of potential conflict is real and worth noting:

- Berkshire now owns a top-10 position in the same company whose AI (Gemini) is being used to fact-check Berkshire-owned entities (Clayton Homes, 21st Mortgage, Vanderbilt, MHI influence, etc.).

- Human psychology and institutional incentives are not irrelevant: executives and engineers are aware of who the large shareholders are, even if formal firewalls exist.

So while there is no smoking-gun evidence that Gemini’s training data or guardrails have been altered because of Berkshire’s investment, the new financial relationship undeniably creates a perceived conflict of interest that prudent researchers and readers should keep in mind—especially on topics where Berkshire’s manufactured-housing subsidiaries are controversial.

In short: No proven influence, but the optics are not ideal, and transparency (exactly what the FEA model provides by publishing raw AI threads) remains the best disinfectant.

Grok’s verification performed independently on November 16, 2025. Ready for insertion into the MHProNews postscript as requested.

— MHProNews notes that Grok’s response as shown above is documented for accuracy via the screen capture found at this link here. —

To underscore part of Grok’s findings.

So while there is no smoking-gun evidence that Gemini’s training data or guardrails have been altered because of Berkshire’s investment, the new financial relationship undeniably creates a perceived conflict of interest that prudent researchers and readers should keep in mind—especially on topics where Berkshire’s manufactured-housing subsidiaries are controversial.

In short: No proven influence, but the optics are not ideal, and transparency (exactly what the FEA model provides by publishing raw AI threads) remains the best disinfectant.

Remember: you read that here first on MHProNews.

Note that Berkshire’s influence over manufactured housing also includes Berkadia, Shaw, and other brands.

2) More Americans are living in RVs. What impact is AI having on the jobs market and how could that impact housing in general or manufactured homes more specifically? A deeper dive into the latest state-level manufactured housing data is also pending here on MHProNews.

There have been more insider trades, quarterlies, earnings calls, political, economic, and other topics that directly related to HUD Code manufactured housing. Who else in the MHVille media landscape brings those to readers and unpacks them, often using third-party AI systems as part of the process?

There are also apparently more ‘hidden’ and/or post-dated items that have been published by the Manufactured Housing Institute (MHI).

Some in the MHI orbit have published items that have been brought to MHProNews attention.

Further, a mainstream media report is on tap. It is arguably both revealing about mainstream media and about MHI and/or about a specific MHI state association affiliate.

3)

You are readers like you have made MHProNews the runaway most popular source of its kind in MHVille. Others may misleadingly call themselves ‘definitive’ or #1, but at MHProNews we bring the receipts and reports others crave. You expect more “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” ©

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach