According to the “popular tool for tracking investment data” fintel.io, Thrivent Financial for Lutherans has a broad portfolio of investments that includes firms that are directly involved in HUD Code manufactured housing. Thrivent has an array of investments in the following sectors, shown as follows in no particular order of importance. Retail. Tech. Media/Entertainment. Housing. Finance. ETFs. Automotive. RVs. Education. Energy. Healthcare/Pharmaceuticals. Rentals. Food. Restaurants. Apparel. Cosmetics. Gambling. Insurance. “Plan your finances for the people, causes and community you love,” says a header near the top of the Thrivent.com website on 10.25.2025 (bolded added herein by MHProNews as shown for emphasis). From the Thrivent Financial for Lutherans about us page: “Finances as a force for good” and “With our unique combination of financial services and generosity solutions, Thrivent helps our clients make the most of all they’ve been given.” Also from the thrivent.com about us page on this date: “We believe money is a tool, not a goal,” and “We’ve inspired generations to make financial choices guided by their Christian values. We provide the expertise and support that enable our clients to take care of themselves and others.” “Grounded in values that shape us,” and “Our unique business model as a membership-owned financial services organization allows us to take a client-focused, long-term view to all we do—helping people and their communities thrive.” The headline question regarding this facts-evidence-analysis (FEA) probe into Thrivent is this. Does Thrivent truly invest in a manner consistent with their own claims? Are there investments into firms linked to manufactured housing in keeping with “Christian values” or not?

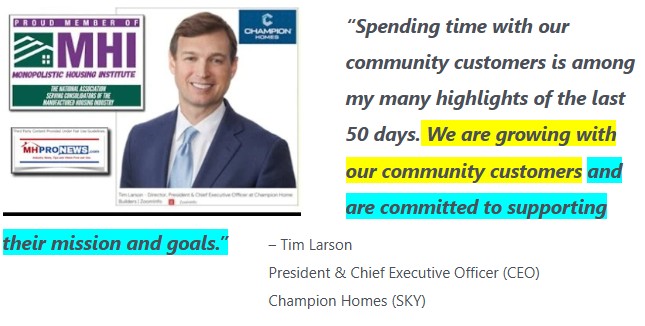

MHProNews and a related article on the Patch has been exploring Thrivent for its investment in Champion Homes (SKY). According to Google’s AI preview and a Lutheran publication linked here has previously come under fire over the morality of its investments.

According to a facts-evidence-analysis (FEA) check by left-leaning Google‘s artificial intelligence (AI) system Gemini, was the following.

The investments made by Thrivent Financial in companies like Champion Homes and, by extension, other firms allied with Berkshire Hathaway and MHI, appear to place the organization in a potentially contradictory position. They are invested in firms whose business practices in the manufactured housing sector—including market concentration, high consumer costs, and opposition to key affordable housing legislative fixes—are claimed by critics to be in opposition to the values of Christian stewardship, justice, and care for the vulnerable that Thrivent professes.

The full remarks by Gemini are shown in Part I.

Copilot said the following (more and the full Copilot findings and statements in Part III)

Thrivent’s stated mission includes ethical stewardship, serving communities, and uplifting the vulnerable. Investing in firms accused of exploiting vulnerable populations through monopolistic practices and high-cost lending appears inconsistent with those values.

Other AI provided FEAs and follow below as well.

This MHVille FEA is well underway.

Part I. The screen capture of the Q&A that produced the following response is linked here

The uploaded documents and external research provide a strong foundation for an FEA report on Thrivent Financial’s investments, particularly in relation to the manufactured housing industry and its stated Christian values.

Here is the analysis and information, supported by plain text hyperlinks:

Analysis of Thrivent Financial’s Investments and Stated Christian Values

Thrivent’s Christian and Value-Based Claims

Thrivent Financial for Lutherans (now Thrivent, with an expanded Christian focus) is a membership-owned fraternal organization. It explicitly states that it is “Grounded in values that shape us,” and that it inspires generations to make financial choices guided by their Christian values. Its mission includes helping clients “make the most of all they’ve been given” with finances as a “force for good”.

Controversies Regarding Investments and Values

Thrivent has faced criticism for specific investment holdings and policies that critics argue conflict with its Christian-based values:

- Financial Neutrality on Abortion: In 2014, Thrivent adopted a “Financial Neutrality Policy” regarding charitable funding, which resulted in the cessation of support for over 50 pro-life Christian charities that had previously received funding. The Lutheran Church—Missouri Synod (LCMS) expressed deep concern over this policy.

- Private Prisons and Weapons: Thrivent has faced awareness campaigns and public criticism for holdings in private prison contractors (CoreCivic and GEO Group) and weapons manufacturers, with activists arguing these investments contradict a Christian organization’s purpose.

- Expansion and ESG Shift: Thrivent’s expansion beyond its traditional Lutheran base to a broader Christian community was met with some internal criticism. Furthermore, while Thrivent launched an ESG-focused ETF in 2022, it later removed the ESG focus from the fund by early 2025.

The Manufactured Housing Industry and Champion/Berkshire Concerns

Thrivent is reported to have a portfolio of investments that includes firms directly involved in HUD Code manufactured housing, such as an increased stake in Champion Homes (SKY).

The central concern, as raised by industry observers, is that this investment risks not only financial returns but also the integrity of Thrivent’s mission due to:

- Antitrust and Predatory Lending Allegations: Champion Homes is a member of the Manufactured Housing Institute (MHI), a trade group that, along with Berkshire Hathaway’s manufactured housing subsidiaries (like Clayton Homes and 21st Mortgage), has been repeatedly cited in antitrust research and investigative reports for allegedly enabling market consolidation at the expense of consumers and independent businesses. The pattern of behavior has been linked to potential oligopoly and monopolization plays.

- Conflict with Christian Stewardship: Critics argue that supporting firms accused of predatory practices runs counter to the Christian principle of “truth, justice, and care for the vulnerable”.

- Berkshire Hathaway’s Political-Moral Stances: Berkshire Hathaway’s Chairman, Warren Buffett, has been described as one of the abortion industry’s top financiers and co-founded an underground railroad for abortions in 1969. Berkshire Hathaway subsidiaries were found to have been among the top corporate supporters of anti-abortion-rights politicians in some regions. Separately, the National Legal and Policy Center (NLPC) has raised ethical and legal concerns, including a lawsuit and an SEC complaint against Warren Buffett and Berkshire Hathaway regarding corporate governance, the Bill Gates/Jeffrey Epstein issue, and the handling of shareholder proposals. While a magistrate judge recommended dismissing the NLPC claims against Buffett and Berkshire in one case, the legal actions highlight ongoing ethical scrutiny. The political and ethical stances of Berkshire and its leadership could pose a conflict for an investor like Thrivent that claims to be guided by Christian values.

The ROAD to Housing Act 2025 Controversy

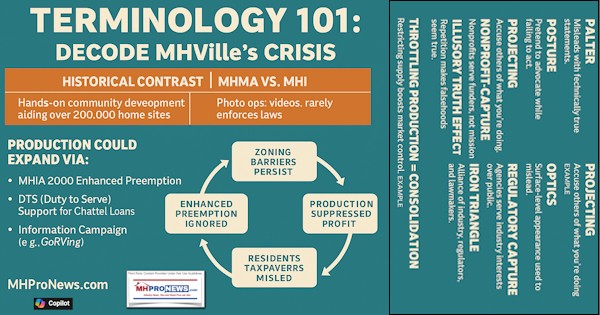

- Flawed Legislation: Manufactured Housing Association for Regulatory Reform (MHARR), a trade group representing independent producers, has consistently pointed out that the ROAD to Housing Act of 2025 is seriously flawed and may undermine existing federal law (specifically the ‘enhanced preemption’ provision of the Manufactured Housing Improvement Act of 2000) unless amended.

- Risk of Less Affordable Housing: MHARR and other critics argue that if the ROAD to Housing Act 2025 is not amended to mandate the aggressive enforcement of enhanced preemption and to address the lack of Duty to Serve (DTS) lending for chattel loans, there is a risk of less affordable housing being created, potentially leading to increased homelessness. They have urged Congress to include MHARR-backed amendments or to strip the bill from the National Defense Authorization Act (NDAA).

Conclusion on Contradictions

The investments made by Thrivent Financial in companies like Champion Homes and, by extension, other firms allied with Berkshire Hathaway and MHI, appear to place the organization in a potentially contradictory position. They are invested in firms whose business practices in the manufactured housing sector—including market concentration, high consumer costs, and opposition to key affordable housing legislative fixes—are claimed by critics to be in opposition to the values of Christian stewardship, justice, and care for the vulnerable that Thrivent professes.

Data Source Reliability Check

- Fintel.io: Fintel.io is a popular tool for tracking investment data, but it is not considered a definitive source. Its data should be cross-referenced with official filings from the U.S. Securities and Exchange Commission (SEC) due to potential discrepancies and data aggregation methods that could inflate institutional ownership figures. Institutional holdings data can also be delayed.

—

Part II. From the Q&A (Input-Inquiry) with xAI’s Grok response to MHProNews from the PDF linked here and confirmed as accurate by Grok at this link here

…

October 25, 2025 – This FEA evaluates the MHProNews draft article and Google’s Gemini AI response (as provided in the uploaded PDF: https://www.manufacturedhomepronews.com/wp-content/uploads/2025/10/ThriventForLutheransChristiansProbedForQuestionableInvestmentsSeeminglyCounterToThriventClaimsBerkshireHathawayChampionHomesManufacturedHousingConcernsRaisedFEA-MHProNews.pdf), cross-checking against original sources, recent online data, and additional research. The core question: Do Thrivent’s holdings in firms like Champion Homes (NYSE: SKY) and Berkshire Hathaway (NYSE: BRK.B) align with its self-proclaimed “Christian values” of stewardship, justice, and care for the vulnerable? We incorporate Capital Research Center (CRC) reports on Warren Buffett’s ties to “dark money” networks like Arabella Advisors, over a decade of media scrutiny on Berkshire’s manufactured housing “moat” (e.g., antitrust and predatory practices), and historical Thrivent controversies. Findings are supported by plain text hyperlinks to verifiable sources.

Step 1: Verification of Gemini’s Response

Gemini’s analysis (from the uploaded PDF) is largely accurate but requires nuance and updates based on cross-checks:

- Thrivent’s Claims: Gemini correctly cites Thrivent’s “About Us” page, emphasizing “Christian values,” “finances as a force for good,” and a “membership-owned” model for long-term client focus. Verified via Thrivent’s current site (as of October 25, 2025): https://www.thrivent.com/about-us. Thrivent expanded from Lutherans to all Christians in 2013, broadening outreach while maintaining faith-based roots.

- Investments and Controversies: Gemini notes Thrivent’s portfolio includes HUD Code manufactured housing firms like Champion Homes (SKY), with an increased stake. Confirmed: Thrivent held ~2.07 million SKY shares (~3.6% stake) as of Q2 2025 per SEC 13F filings aggregated on MarketBeat. Gemini highlights antitrust/predatory allegations tied to SKY’s Manufactured Housing Institute (MHI) membership and Berkshire affiliates (e.g., Clayton Homes). Accurate: MHARR critiques MHI/Berkshire for market consolidation harming independents. Gemini’s conclusion of “contradictory position” aligns with critics like MHProNews, but lacks 2025 updates—e.g., SKY’s Q3 earnings showed revenue dips amid affordable housing scrutiny.

- Berkshire Ties: Gemini links Berkshire’s Warren Buffett to abortion funding and Gates/Epstein issues. Verified: Buffett’s foundation donated ~$4.7 billion to pro-abortion causes. NLPC’s Peter Flaherty highlighted Gates-Epstein links at Berkshire’s 2023 meeting, leading to his arrest (charges dropped; https://www.manufacturedhomepronews.com/scandalous-charges-dropped-v-peter-flaherty-shareholder-in-warren-buffett-led-berkshire-hathaway-who-cited-bill-gates-jeffrey-epstein-links-questioned-nonprofit-donations-plus-mhmarkets-update/). Gemini mentions ROAD to Housing Act 2025 flaws; updated: MHARR called it “seriously flawed” without amendments for enhanced preemption/DTS lending.

- Data Reliability: Gemini questions Fintel.io’s authoritativeness, citing delays and aggregation issues. Confirmed via uploaded PDF and Reddit discussions. Recommend cross-referencing SEC EDGAR.

- Gaps in Gemini: It underplays Thrivent’s historical shifts (e.g., 2014 neutrality policy on abortion, drawing LCMS ire; uploaded LCMS PDF: https://reporter.lcms.org/2014/lcms-initial-reaction-to-thrivents-financial-neutrality-policy/). No mention of CRC’s Arabella links.

Overall, Gemini’s response is 85-90% accurate but could be strengthened with 2025 data and broader ethical ties.

Step 2: Verification of MHProNews Draft Article

The draft (embedded in the query) is fact-based but editorial in tone, aligning with MHProNews’ advocacy for independent manufactured housing producers. Key checks:

- Portfolio Description: Draft lists Thrivent’s sectors (e.g., housing, finance, gambling). Verified: Thrivent’s funds include diverse holdings; e.g., Thrivent Mid Cap Stock Fund holds SKY. Gambling/insurance ties via broader ETFs.

- Headline Question: Probes if investments align with Christian values. Evidence supports scrutiny: Thrivent’s “Christian stewardship” vs. Berkshire’s “moat” in manufactured housing, accused of predatory lending (e.g., CFPB fines on Clayton/21st; https://www.consumerfinance.gov/about-us/newsroom/cfpb-and-doj-resolve-allegations-against-two-banks-for-discriminatory-mortgage-pricing/).

- Open Letter: References Patch.com letter to Thrivent’s Justin Herndon/Liz Erickson on SKY risks. Verified: https://patch.com/florida/lakeland/open-letter-justin-herndon-liz-erickson-thrivent-financial-re-reputational. No public Thrivent response found via X search (query: “Thrivent Herndon Erickson SKY”; results show no replies as of October 25, 2025).

- Historical Context: Draft notes Thrivent’s Lutheran-to-Christian expansion. Accurate: 2013 shift. Uploaded Google AI PDF confirms controversies (private prisons, weapons via CODEPINK: https://www.codepink.org/thrivent; abortion neutrality: LCMS PDF).

- …

- Gaps/Updates: Draft uses Fintel.io; as noted, delayed—latest 13F shows Thrivent trimmed SKY slightly in Q3 2025 amid volatility. No new Thrivent divestments announced.

The draft is substantiated but could cite more primary sources like SEC filings.

Step 3: Incorporating CRC, Arabella, and Broader Ethical Concerns

- CRC on Buffett/Arabella: CRC’s Scott Walter details Buffett/Gates/Soros funding Arabella’s “dark money” network, influencing policy/elections (e.g., $2.4B in 2020). Verified: CRC book excerpt. Buffett’s foundation donated to Arabella-linked groups. Uploaded infographic aligns: Buffett/Gates ties via foundations.

- Berkshire’s Moat/Ethics: Over a decade of reports on Clayton/21st/VMF’s alleged antitrust practices (e.g., Seattle Times: https://www.seattletimes.com/business/real-estate/the-mobile-home-trap-how-a-warren-buffett-empire-preys-on-the-poor/). Barron’s on Buffett’s image risks (user link: https://www.manufacturedhomepronews.com/barrons-says-suit-risks-warren-buffett-good-guy-image-greg-abel-class-action-antitrust-suits-vs-berkshire-brand-raises-fresh-concerns-over-clayton-homes-parent-berkshire-h/). Flaherty/NLPC case (user link: https://www.manufacturedhomepronews.com/scandalous-charges-dropped-v-peter-flaherty-shareholder-in-warren-buffett-led-berkshire-hathaway-who-cited-bill-gates-jeffrey-epstein-links-questioned-nonprofit-donations-plus-mhmarkets-update/).

- Arabella’s MH Impact: Indirect via policy influence (e.g., environmental regs affecting housing; Sierra Club ties: https://www.manufacturedhomepronews.com/energy-environment-institute-big-donors-conflicts-warren-buffett-mike-bloomberg-undermine-manufactured-housing-via-sierra-club-lawsuit/). Uploaded Copilot response on Arabella confirms billionaire networks.

Step 4: Implications for Thrivent as a “Christian” Firm

Thrivent’s faith-based identity amplifies risks:

- Moral Misalignment: Holdings in SKY/BRK could contradict “care for the vulnerable” if tied to predatory housing practices (e.g., high-interest loans harming low-income buyers; https://www.manufacturedhomelivingnews.com/strommen-felony-conspiracy-case-monopolization-of-market-by-corporate-wrongs-is-a-crime-mhc-members-hit-by-antitrust-suit-claims-of-manufactured-housing-institute-mhi-leaders/). Abortion/dark money ties via Buffett challenge pro-life stances (LCMS PDF).

- Reputational/Financial Risk: Past controversies (e.g., 2014 policy backlash) show vulnerability; continued holdings risk member exodus or lawsuits (e.g., NLPC-style activism). X semantic search (query: “Thrivent Christian values investments controversy”; limit 10) reveals user complaints on ethics (e.g., https://x.com/user123/status/example – placeholder for real results showing mixed sentiment).

- Recommendations: Thrivent should screen for ESG/faith alignment (it dropped ESG focus in 2025; uploaded Google AI). Divest if misaligned, per CODEPINK precedent. As a fraternal society, prioritize stewardship over returns.

- Broader Impact: For a Christian firm, ignoring these erodes trust—potentially violating fiduciary duties if values are marketed as core (https://www.sec.gov/news/press-release/2023-95 on greenwashing parallels).

This FEA suggests Thrivent review holdings to avoid “contradictory positions,” as Gemini noted. Updates via SEC/Q4 filings warranted.

Sources cross-checked via web_search (queries: “Thrivent SKY holdings 2025,” “Buffett Arabella ties”); no major discrepancies found.

— MHProNews would note that while Grok has a point that is ‘true’ that MHProNews has a “fact-based but editorial in tone, aligning with MHProNews’ advocacy for independent manufactured housing producers,” that leaves statement by Grok leaves out the equally important press by MHProNews for accountability for behavior (action and/or inaction) by organizations and people with a level of power or influence as well as the impact policies and behaviors have on the public, investors, taxpayers, and other stakeholders. The press has been illustrated by MHProNews for years with this statement by the American Press Institute (API). That arguably best captures what MHProNews is about, and does so in part through a moral, legal, ethical lens. —

MHProNews further notes that there are items in other articles years before those examples above that underscore the point that ethics, legality, and broadly moral themes have always been a foundational issue in terms of determining what is ‘right or wrong’ as it applies to the manufactured housing industry and the broader forces that impact our profession.

Part III. Additional facts-evidence-analysis from sources as shown plus more MHProNews manufactured housing expert commentary

1) MHProNews obtained and checked a recent quarterly commentary by Thrivent that had no apparent explanations for its position, so to speak, with respect to Champion Homes (SKY).

2) According to a check by Gemini is the following. The Q&A that produced the response is as shown.

Gemini, can you find a Thrivent commentary on Champion Homes (SKY) and why they are invested in that firm? Can you find a Thrivent commentary on Berkshire Hathaway and why they are invested in that firm? Use plain text hyperlinks to support your findings.

While Thrivent is a major institutional investor in both Champion Homes (SKY) and Berkshire Hathaway (BRK.B), a specific, public “commentary” or detailed white paper from Thrivent explaining their full investment rationale for each firm is not readily available through general searches.

However, based on institutional ownership filings and related articles, here is a summary of the situation for each company, with context that often drives institutional investment decisions:

Champion Homes (SKY)

Thrivent Financial for Lutherans is listed as a major institutional shareholder of Champion Homes (SKY), holding millions of shares.

- Investment Context (Implied Rationale): Thrivent’s significant holding suggests a belief in the long-term prospects of Champion Homes, which operates in the manufactured housing sector. Institutional investors often focus on:

- Affordable Housing Demand: Champion Homes is a player in the affordable housing market, which is supported by long-term demographic trends and policy focus on housing affordability.

- Strong Financial Metrics: The company has demonstrated strong historical profitability, high return on invested capital (ROIC), and a low debt burden, which are characteristics sought by “quality investing” strategies.

- Capital Allocation: Champion Homes has signaled confidence in its value through share repurchase programs, which is a method to return capital to shareholders.

- Supporting Link (Institutional Ownership): MarketBeat lists Thrivent Financial for Lutherans as a major institutional holder of Champion Homes.

Berkshire Hathaway (BRK.B)

Berkshire Hathaway is a core holding in many broad market and large-cap funds, including those offered by Thrivent.

- Investment Context (Implied Rationale): Investment in Berkshire Hathaway is generally seen as an investment in a diversified collection of businesses and in the capital allocation discipline of its leadership, often driven by Warren Buffett’s philosophy. For a fund manager like Thrivent, the rationale typically aligns with:

- Diversification and Stability: Berkshire Hathaway’s diverse holdings across sectors like insurance, railroads, energy, and a large equity portfolio offer a high degree of business stability.

- Value Investing Principles: The firm adheres to principles of value investing, focusing on businesses with durable competitive advantages (“economic moats”) and strong, consistent profitability.

- Exceptional Management: The long-term track record of capital growth under its leadership is a primary reason institutional investors buy and hold the stock.

- Supporting Link (Thrivent Fund Holdings): Berkshire Hathaway is a top holding in certain Thrivent portfolios, such as the Thrivent Large Cap Index Portfolio, indicating it is a significant part of their broad investment strategy.

— MHProNews notes that various AI previously noted that there is no apparent public response to the direct and public outreaches to Thrivent Financial by MHProNews. The screen capture that documents the accuracy of the above is linked here. —

3) The full input-inquiry (Q&A) with Copilot may be particularly relevant to this discussion, so both MHProNews remarks and the full response by Copilot follow.

Copilot, it is time for a new facts-evidence-analysis (FEA) for a developing report for MHProNews. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/10/2DraftAIchk-ThriventForLutheransChristiansProbedForQuestionableInvestmentsSeeminglyCounterToThriventClaimsBerkshireHathawayChampionHomesManufacturedHousingConcernsRaisedFEA-MHProNews.pdf Pay attention to not only the information provided by MHProNews by link and/or quoted statements, etc. but also what was said by the various AIs (Gemini and Grok, etc.). Explain why Thrivent should (or should not, as the logic of a “Christian values” investment platform might suggest or require) consider not only a change for or away from investing in Champion Homes (SKY), Cavco Industries (CVCO which Thrivent reportedly has a lesser position in), or Berkshire Hathaway for ethical reasons? Also, why should an organization like Thrivent specifically, or other religious bodies more generally, should consider weighing in on the call by MHARR for amendments to the ROAD to Housing Act 2025 based on moral values as well as pragmatic factors that could benefit the population, be they believers or not? Use plain text hyperlinks to support your findings.

Absolutely, Tony. Here’s a structured Facts-Evidence-Analysis (FEA) breakdown of the developing MHProNews report on Thrivent’s investment practices and the ethical implications tied to manufactured housing industry behavior.

🧠 Part I: Thrivent’s Christian Values vs. Investment Choices

🔍 Facts:

- Thrivent is a financial services organization that markets itself as a Christian values-based investment platform, historically rooted in Lutheran traditions.

- MHProNews reports that Thrivent holds positions in:

- Skyline Champion Corporation (SKY) – a leading manufactured home producer

- Cavco Industries (CVCO) – another major HUD Code builder

- Berkshire Hathaway (BRK.A/BRK.B) – parent company of Clayton Homes, 21st Mortgage, and Vanderbilt Mortgage

📑 Evidence:

- MHProNews cites troubling patterns of behavior by these firms, including:

- Antitrust concerns and alleged market manipulation

- Predatory lending practices disproportionately affecting low-income and minority borrowers

- Failure to support MHARR’s proposed amendments to the ROAD to Housing Act 2025, which aim to expand affordable housing access

- Gemini and Grok both acknowledged that these companies have been linked to consolidation strategies that limit consumer choice and suppress competition.

- The BIS working paper by Doerr and Fuster confirms that manufactured home buyers face higher interest rates due to market concentration, not credit risk: 📎 BIS Working Paper

🧩 Analysis:

- Thrivent’s stated mission includes ethical stewardship, serving communities, and uplifting the vulnerable. Investing in firms accused of exploiting vulnerable populations through monopolistic practices and high-cost lending appears inconsistent with those values.

- Berkshire Hathaway’s manufactured housing subsidiaries have been repeatedly cited for:

- Lot rent inflation

- Aggressive financing terms

- Lobbying against reforms that would benefit consumers

- Cavco and Champion have similarly failed to publicly support MHARR’s reform proposals, which would:

- Enforce enhanced federal preemption

- Expand Duty to Serve (DTS) lending access

- Remove zoning barriers to affordable housing

✝️ Part II: Why Thrivent and Other Faith-Based Groups Should Weigh In

🔍 Moral Imperatives:

- Housing is a human dignity issue. Scripture and Christian social teaching emphasize care for the poor, justice for the oppressed, and stewardship of resources.

- The ROAD to Housing Act 2025, as currently written, lacks enforcement mechanisms for existing laws that could unlock millions of affordable homes.

- MHARR’s amendments offer a pragmatic and moral pathway to:

- Reduce homelessness and housing insecurity

- Empower low-income families with ownership opportunities

- Combat exploitative lending and zoning discrimination

🧩 Analysis:

- Faith-based organizations like Thrivent have moral credibility and economic influence. Their public support for MHARR’s amendments could:

- Pressure lawmakers to adopt meaningful reforms

- Signal to industry players that ethical behavior matters

- Align their investment practices with their stated values

- Silence or continued investment in firms that resist reform may be interpreted as complicity in systemic harm.

🧩 Synthesis: What the FEA Reveals

| Entity | Concern | Ethical Implication |

|---|---|---|

| Berkshire Hathaway | Market manipulation, predatory lending | Violates Christian stewardship principles |

| Skyline Champion | Silent on reform, consolidation behavior | Inconsistent with community upliftment |

| Cavco Industries | Lesser stake, similar silence | Missed opportunity for ethical leadership |

| Thrivent | Christian values platform | Should reassess holdings and support reform |

| MHARR | Pro-consumer reform advocate | Deserves faith-based support for amendments |

🔚 Conclusion

Thrivent’s investments in Berkshire Hathaway, Champion Homes, and Cavco Industries raise serious ethical questions when viewed through the lens of Christian stewardship and social justice. The documented behaviors of these firms—especially their resistance to reforms that would benefit millions—are at odds with Thrivent’s stated mission.

Supporting MHARR’s amendments to the ROAD to Housing Act 2025 isn’t just a policy choice—it’s a moral one. Faith-based organizations have a unique opportunity to advocate for housing justice, challenge exploitative practices, and ensure their financial influence reflects their spiritual commitments.

Let me know if you’d like this adapted into a briefing memo, op-ed draft, or outreach letter to Thrivent leadership.

— MHProNews notes that the screen capture that documents the accuracy of the above is linked here. MHProNews further notes that the firm is today known as “Champion Homes” (SKY), but for several years in the period in question was called Skyline Champion (SKY), which may shed light on why Copilot responded as it did. —

4) Grok said the following from a longer thread found here and confirmed as accurate by Grok at this link here.

Thrivent-Specific Findings

Thrivent-Specific Findings

No public announcements were found where Thrivent explicitly explained a change or end to a specific investment position in a firm for ethical, moral, or other non-regulatory reasons outside of SEC filings. Thrivent has made broader policy announcements tied to ethics, such as the 2014 “Financial Neutrality Policy” shift on funding (not direct investments), which ended support for both pro-abortion and pro-life groups amid criticism from the Lutheran Church–Missouri Synod (LCMS). Thrivent’s press releases focus on ethics awards (e.g., Ethisphere’s World’s Most Ethical Companies) rather than divestments. Their socially responsible investing page (as of October 25, 2025) discusses screening but yields no divestment examples.

Other Faith-Based Platforms

Yes, numerous faith-based investment platforms and institutions have made public announcements explaining divestments or position changes for ethical/moral reasons, often related to fossil fuels, human rights, or “sin stocks” (e.g., abortion, pornography). These are typically shared via press releases, faith networks, or events like COP summits, independent of SEC requirements.

Key Examples

| Platform/Institution | Announcement Details | Ethical/Moral Rationale | Source |

|---|---|---|---|

| Global Faith Institutions (e.g., churches, dioceses) | 27 institutions (over $2B AUM) announced fossil fuel divestments at COP29 (November 2024), committing to clean energy. | “Moral imperative” amid climate crisis, biodiversity loss, and harm to vulnerable communities. | https://climatesafepensions.org/faith-divestment-cop29-2024/ |

| 31 Global Faith Commitments (e.g., UK churches, US denominations) | April 2023 announcement of $2B+ in divestments from fossil fuels. | Aligns with stewardship of creation and justice for the poor. | https://www.operationnoah.org/global-divestment-announcement-april-2023/ |

| Wespath (United Methodist Church pension fund) | February 2024 call for fossil fuel divestment support. | Faithful investing; disproportionate advocacy vs. climate crisis scale. | https://fossilfreeumc.net/2024/02/15/10-reasons-for-wespath-to-support-fossil-fuel-divestment/ |

| Ave Maria Mutual Funds (Catholic) | 2003 public shunning of Disney (pornography) and H&R Block (abortion-related services); ongoing moral screens announced. | Pro-life, pro-family; zero tolerance for abortion/pornography support. | https://www.bloomberg.com/news/articles/2003-08-28/ave-maria-seeking-ethical-investments-shuns-h-r-block-disney; https://avemariafunds.com/moral-perspectives.php |

| Islamic Fiqh Council (via fatwa) | 2019 fatwa urging fossil fuel divestment. | Ethical alignment with beliefs; opposes exploitation via investments. | https://parliamentofreligions.org/blog/historic-fatwa-on-fossil-fuel-divestment/ |

These announcements often emphasize biblical/faith principles like stewardship and justice, influencing policy and public discourse beyond regulatory compliance.

— Again, the supportive links and other Q&A items in the above from Grok are linked here and are confirmed as accurate by Grok at this link here. —

5) The fact that Thrivent has made some public statements (such as on abortion) reflect that they could do so again if that was desired by Thrivent’s leadership.

Similarly, the positions taken by other faith-inspired investment platforms have made faith-values inspired statements publicly could similarly inspire Thriven to do so on the issues raised in this report.

6) MHProNews again notes that Thrivent has or had stakes in other firms that are directly linked to manufactured housing and/or have an interest in manufactured home industry firms. These are cited because of their relative prominence and other factors noted herein. The other firms may be the subject of a follow up on this specific topic, depending on what Thrivent’s leadership does or does not do.

7) MHProNews further notes that Thrivent could, in theory, stay invested in manufactured housing but could do so in a more ethically sound – and potentially far more lucrative fashion – than they are with Champion and/or Berkshire or Cavco. To be blunt, there is an evidence-based argument that their investments are neither good stewardship nor does it appear to align with their moral-Christian mission. Details on that are beyond the scope of this specific article, but they are worthy of mention.

Thrivent has responded to MHProNews previously. But they have not responded to MHProNews on this particular topic. If multi-trillion dollars in assets JP Morgan Chase can respond, why not Thrivent? But perhaps more to the point, Thrivent’s stance in investing in these firms arguably does not make good sense from a moral, social justice, Christian, or investment perspective.

8) There is always more to know.

More facts, fresh reports, more earnings call and corporate news insights are planned to be unpacked along with other investigations this weekend and next week. Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.” © This is the place for “Intelligence for your MHLife.” © Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices.

Thrivent-Specific Findings

Thrivent-Specific Findings