“The Q1 GDP report suggests that the U.S. economy is slowing, not that it is contracting,” said American Institute for Economic Research (AIER) Senior Research Fellow Paul Mueller in the report shown in Part I below. “There was reasonable growth in consumption and investment,” Mueller said, based on the data. “The negative number was due primarily to a big increase in imports in anticipation of the tariffs. A silver lining is that government spending was not artificially stimulating this quarter’s numbers the way it has every quarter for the past four years.” Part II will explore what that means for housing and in general, and by extension, for the manufactured housing market. Third-party insights provided in Part II will indicate that the Biden-Harris economy of the last 4 years is beginning to pivot to the Trump Economy. Because there are 4 years of data from the first President Trump term in office there are good reasons to think that the shift will be good for the economy, for employees, smaller businesses, consumers, taxpayers, and others. More MHVille facts-evidence-analysis (FEA) on that in Part II.

Part I From the WND News Center to MHProNews is the following.

Private domestic investment soared in 1st quarter of 2025

Partly driven by 22.5% boost in business spending on equipment

While U.S. real gross domestic product (GDP) contracted in the first quarter of 2025, gross private domestic investment soared during the same period.

U.S. real GDP decreased at a rate of 0.3% in the first quarter of 2025, marking the first quarterly contraction since 2022, according to a report released on Wednesday by the Bureau of Economic Analysis (BEA). Still, private domestic investment in the U.S. notably surged during the first quarter of 2025, increasing 21.9%, the BEA reported.

The first quarter’s increase in private investment — which marked the highest rate since late 2021 — may have been partially driven by a 22.5% increase in business spending on equipment, according to the BEA.

“The Q1 GDP report suggests that the U.S. economy is slowing, not that it is contracting,” American Institute for Economic Research (AIER) Senior Research Fellow Paul Mueller told the Daily Caller News Foundation. “There was reasonable growth in consumption and investment. The negative number was due primarily to a big increase in imports in anticipation of the tariffs. A silver lining is that government spending was not artificially stimulating this quarter’s numbers the way it has every quarter for the past four years.”

The first quarter GDP downturn comes after the U.S. economy grew by 2.4% in the fourth quarter of 2024, after increasing 3.1% in the third quarter of 2024, according to the BEA. Stocks fell on Wednesday after the GDP report was released.

“Investment normally is thought of like if you build a home, that’s investment, or if you build a new factory and fill it with equipment, that’s an example of investment,” Richard Stern, an economist at the Heritage Foundation, told the DCNF. “However, investment also includes inventory changes. Obviously, inventory is normally a really small percentage of what is going on [in GDP reports], but in this quarter, inventory is a crap ton of what’s going on because people are flooding in imports and then putting them into warehouses.”

President Donald Trump has been moving to revamp America’s trade sector as part of his “America First” agenda, including by announcing massive tariffs on imported goods from a variety of foreign countries in April, which sent shockwaves through global markets.

“Whether U.S. GDP contracts in Q2 depends almost entirely on whether the Trump administration can nail down its tariff policies at a lower, stable rate,” Mueller told the DCNF. “If they don’t, the economy will likely contract. If they do, it will likely expand significantly.”

“Private investment is likely up due to expectations of deregulation, lower energy costs, and lower taxes,” Mueller added. “The threat of tariffs may have some minor impact too.”

A slate of businesses and foreign countries have pledged to invest more money in the U.S. over the next several years following Trump’s return to the Oval Office.

Trump blamed former President Joe Biden for handing him a bad economy in a Wednesday Truth Social post, claiming that the U.S. economy will “boom, but we have to get rid of the Biden ‘Overhang.'”

“This is Biden’s Stock Market, not Trump’s,” Trump wrote. “I didn’t take over until January 20th. Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers. Our Country will boom, but we have to get rid of the Biden ‘Overhang.’ This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!”

Recent polling has shown that many Americans disapprove of Trump’s economic policies. A NPR/PBS News/Marist Poll survey published Tuesday showed that just 39% of Americans said they approved of the president’s approach to handling the economy during his second term.

Relatedly, A 55% majority of Americans said that Trump’s actions on tariffs have been bad policy, with 28% saying they were good policy, and 17% saying they have been neither, according to a CNN poll conducted by SSRS released on Monday.

—

Part II – Additional Information with More MHProNews Analysis and Commentary

1) To be fair and properly informed, professionals and others need to grasp what ‘both sides’ (example, Democrats, RINOs and their allies and Trump/MAGA/America First minded are thinking and saying. Facts need to be more fully understood. Only then can someone potentially draw a reasonable conclusion that is not based on propaganda.

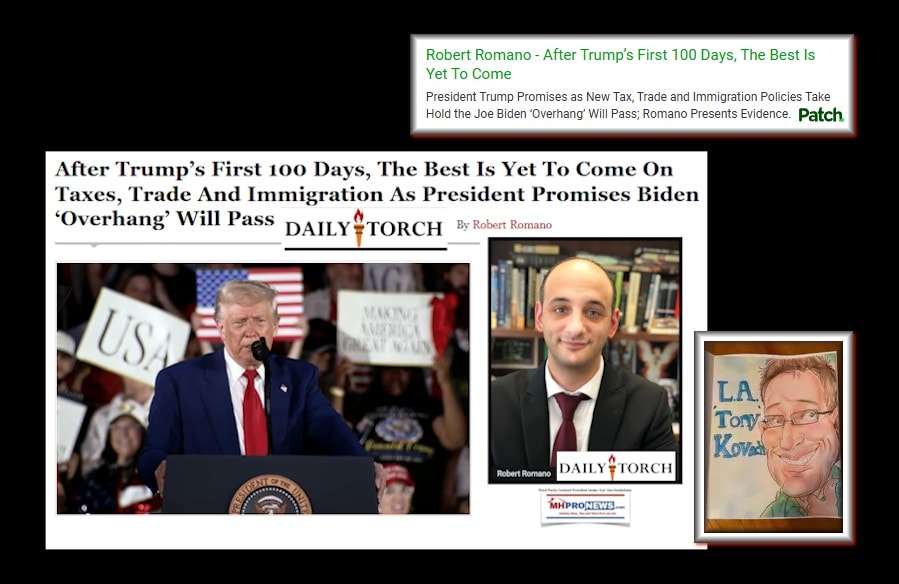

2) Using that left-leaning part of that principle in #1, David Dayden is the Executive Editor at left-leaning The American Prospect (TAP). Dayden is noteworthy because he aptly slammed Warren Buffett and Clayton Homes and their moat strategy some years ago in an article for the left-leaning The Nation. Dayden is arguably not a lightweight. Per left-leaning Google’s AI powered Gemini.

The “Special Investigation: The Dirty Secret Behind Warren Buffett’s Billions” article in The Nation was written by David Dayen. This article, published on February 15, 2018, explores Buffett’s investment strategy and its potential impact on monopoly power and its effects on the economy.

MHProNews reported on that and has periodically referenced it, because Dayen brought facts and evidence that helped support his narrative. Could it have been stronger? Yes. But did it help shed important light on “the Moat,” Clayton Homes, and other aspects of the Buffett strategy? Yes. Nor was Dayen alone. Robin Harding in a post for the Financial Times similarly hit Buffett. So too did the generally pro-Buffett GuruFocus.

Per Hedge Fund Alpha.

“The Dirty Secret Behind Warren Buffett’s Billions”? Own Great Companies

Rupert Hargreaves

Last week, The Nation ran a “Special Investigation” article on everyone’s favorite capitalist Warren Buffett titled “The Dirty Secret Behind Warren Buffett’s Billions.” The author, David Dayen argues that the secret to Warren Buffett’s success is not his investment skill but his love of monopoly businesses, which earn excessive margins at the expense of customers.

This view is correct to a certain extent, but it is by no means a secret. Warren Buffett has always made it clear that he is looking for companies that have a business moat, in other words, a competitive advantage that allows them to earn higher profits than peers and not be attacked by competitive forces as he put it in an…

3) With that backdrop, David Dayen is currently the executive editor for the left-leaning The American Prospect (TAP). He also has the Organized Money podcast. Dayen recently emailed his readers the following.

Dayen on TAP

Waiting for the Supply Shock

It’s coming, and we know approximately when.

Two milestones converged this week that seem important in the moment but in retrospect will be minor blips historically: yesterday’s reaching of the first hundred days of Donald Trump’s second term, and today’s announcement of first-quarter gross domestic product showing the economy contracted by 0.3 percent on an annualized basis.

The former is just a news hook to overlay “what it all means” stories that are as light as air. The second covers the period before the April 2 Liberation Day, though it was influenced by it. The reason the economy contracted is that imports, in the calculation of GDP, take away from economic growth, and companies bulked up imports in anticipation of tariffs. That’s more of a noisy statistical quirk than a recession setting in.

The import surge also shows that Treasury Secretary Scott Bessent wasn’t completely out of his mind the other day when he downplayed incoming supply shocks by saying, “I think retailers have managed their inventory in front of this.”

He was just mostly out of his mind.

All of the above is revealing. It is fair to say that Dayen and TAP are not pro-Trump. With that in mind, the principle of separating the wheat from the chaff should be applied.

Dayen has a point about “Treasury Secretary Scott Bessent” saying “I think retailers have managed their inventory in front of this.”

Dayen mentions nothing about the risks of staying addicted to products from China harms the working class, middle class, retirees, or anyone who is economically vulnerable. Dayen doesn’t say that trade with China boosts Chinese revenue which pays for the build up of the Chinese military. He didn’t peg the potential cost to taxpayers from have people that Buffett called “road kill” due to trade with China.

MHProNews has been issuing cautionary notes that liberals used to raise (sometimes, years ago) as to the harm caused by trade with China, because it represents offshoring of jobs that for decades were made in the U.S.A.

So, Dayen is both right and amiss. He is painting a mostly dark picture without giving more than a straw man style defense of why Trump is doing what he is doing.

Dayen’s email did say this.

I don’t care how well-stocked a company is; if they rely on finished goods or component parts from China, there will come a point pretty soon when they won’t have enough. West Coast ports are just about to feel the effects of this, because it takes around 30 days for container ships to make the journey from Asia to the U.S. Next week, ships entering the Port of Los Angeles will drop 35 percent compared to last year at this time, and a quarter of the ships scheduled for May are already canceled. The Port of Long Beach is down 38 percent this week. Chinese exporters are just stopping production, either looking for new markets or finding another business.

Tariffs of 145 percent on China, in short, are a trade embargo for many sectors. And China’s retaliatory measures are an embargo in the other direction.

In perhaps classic paltering fashion, Dayen weaves common sense and evidence with his own anti-Trump bias.

In the near term, that means cratering business for longshoremen and truckers and warehouse workers. But there is this buildup of inventory that businesses can draw down. For several weeks, they can fend off the spectacle of empty shelves. But not forever.

Many businesses are trying to wait out the situation in case Trump blinks, announces new deals circumventing the tariffs, anything hopeful. Trump did that just yesterday, exempting imported auto components from tariffs. But he also dug in at a rally in Michigan, suggesting this won’t end anytime soon. (There’s apparently one trade deal done with an unnamed country. There are multiple countries out there!)

And much of this damage is unavoidable even if Trump reversed everything today. The realities of time mean that there’s now a big gap in shipments. And you don’t just call up a supplier and say “Restart production” again and have it happen. That supplier may have moved on to other orders, or gone out of business. Shipping experts estimate at least two months of impact from the current three weeks of depressed cargo, and it won’t be just three weeks.

So this is why UPS announced 20,000 job cuts yesterday. This is why companies are pulling back all their forecasts of future earnings, because they are essentially unknowable, and desperately cutting spending wherever they can.

…

But the collapse in production, combined with the timing of shipping and trucking and the wearing down of inventories, means people will see these effects on store shelves around midsummer, precisely when economists at Apollo Global Management (I’m no lover of private equity, but hey, they know money) place the start of the recession.

If the tumult stopped at novelty items, that would be one thing. But China dominates things like transformers for electricity, and pumps and other component parts for air conditioning. The near-term gap could mean serious disruptions in the summer months.

I’m not an oracle. All of this information is readily available. But the majority of Americans just have a wisp of it, a vague sense that something bad is going to happen. Trump’s poor approval ratings reflect that. But if I’m right, and I’m just doing a basic reading of things happening in the real world, you ain’t seen nothing yet.

~ DAVID DAYEN

Here are some more things Dayen didn’t say.

There are riots breaking out in parts of China, because factories have closed due to a lack of U.S. orders. Yes, someone could craft an argument that Trump may be playing a sort of dramatic game of ‘chicken’ with Communist China. But it is not ‘out of their minds’ effort, as Dayen said: “He was just mostly out of his mind.” Nor does Dayen point out that there was a preview of this in 2017 to 2019, when personal incomes rose faster than inflation for the first time in years. Dayen didn’t say that inflation seems to be falling under Trump, as are interest rates (see economist EJ Antoni, further below). Trump’s economy, per left-leaning CNN, yielded the highest personal income adjusted for inflation in over 2 decades. Dayen doesn’t address why he thinks Trump 2.0 may not yield the same results or better as Trump 1.0?

While the second X post below is from an apparent anti-Trumper, it does make a useful point. Many may not realize how many U.S. shelves are packed with products are made in China.

But the mainstream media is hardly playing up this impact of the Trump 2.0 tariffs.

China Riots Erupt as Trump Tariffs Hit Factories | Jim Thomas, Newsmax

Widespread unrest has erupted across China as President Donald Trump’s steep tariffs devastate the nation’s export-driven economy, triggering factory closures, unpaid wages, and massive protests by workers,… pic.twitter.com/pPkAiKD6Bx

— Owen Gregorian (@OwenGregorian) May 2, 2025

What happened to those western media reported daily as the propaganda against China during HK riots? Where Are You? pic.twitter.com/ixzZjtsLxh

— J J (@Jj63927499J) April 30, 2025

Breaking News: Riots Erupt across China with people screaming they want freedom, even a government official was killed pic.twitter.com/L8OZroCo7s

— China exclusive (@ChinaInsid33567) April 28, 2025

Trump does it again. Keep in mind it’s only been a month of tariffs. As I predicted china will collapse quickly and revolution will begin to overthrow government. They will soon cry Uncle.they have no choice. Trump was right- again. https://t.co/xfZQqKoytC

— Wayne Root – Wayne Allyn Root – TV & Radio Host (@RealWayneRoot) May 1, 2025

To be fair, it is far from a given that pundit and talk radio host Wayne Allen Root (WAR) is correct. What he said is possible, but sadly not a given. China can use the military, police, or other social control tools to put down their domestic riots. But if Root is correct, it would be something that billions could or should celebrate.

There is a point in saying that this is a ‘trade war.’ But isn’t a trade war potentially far better a hot war where a growing Chinese military invades Taiwan or other parts of Asia that they have their eyes on?

Trump is trying to thread a needle. Trump has domestic pressure (from the left and anti-Trump RINOs), plus the push back from countries like China that are resisting his efforts to rebalance trade. It may seem messy, and in a sense it is messy. But it is far less messy than having to fight a hot war or waiting until the U.S. is even more dependent on cheap foreign goods, especially those from communist countries like China.

Part of what Trump 2.0 is fighting is a largely unfriendly media.

4) A left-leaning and anti-Trump caller named George on WMAL into Chris Plante’s morning show said, but the three channels (ABC-NBC-CBS) are only three channels. What he didn’t say, is that those broadcast channels have far more viewers than Fox or Newsmax. Then, there are MSNBC and CNN. There is an evidence-based argument to be made that millions are far more exposed to left-leaning views of what is occurring from ‘mainstream’ media than they are from potentially pro-Trump or neutral media.

5)

Multiple job holders fell in Apr at the same time jobs grew and the number of people employed also rose – all good signs! pic.twitter.com/EO1JmbNnH4

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 2, 2025

Annual job growth for native-born Americans was 1.1 million in Apr, thanks in large part to big gains since Jan, even after adjusting for seasonality: pic.twitter.com/e3tXVMSoUH

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 2, 2025

While annual inflation rates were reaccelerating at the end of Biden’s term, Trump has managed to bring them down fast; as M/M inflation collapses, the Y/Y figures are coming down too – great news: pic.twitter.com/oj2MW8HTKI

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 2, 2025

HOLD ON:

Did no one else notice in today’s GDP report that interest on the federal debt DECLINED for the 1st time since…

*checks notes*

…Trump was president in ’19 and ’20. This is incredible news! pic.twitter.com/jB9GhN9x2J— E.J. Antoni, Ph.D. (@RealEJAntoni) April 30, 2025

6) Some of the economic impact of the first quarter is the early impact of Trump policies, but the 47th president is correct in saying that he is fixing 4 years of Biden-Harris (D) policies. Trump has said repeatedly that there may be some pain, he doesn’t want that, but it is what it is. The question is, if not now, when? If not this way, with a savvy businessman who is willing to push ‘allies’ and challengers alike to change their courses, then who and when will this happen? Clearly, Biden-Harris (D) didn’t solve the China problem. Instead, they fueled it. They talked about made in the U.S.A., they kept Trump tariffs on China mostly in place, another point that Dayen failed to mention.

Nor does Dayen mention the cost of Biden-Harris (D) era regulations that cost every American thousands per year. Some say that cost was 1.7 trillion a year, but others say it is more.

The current administration has imposed $1.7 trillion in regulatory costs on the economy.

Per household costs are projected to be $47,000 over the lives of the regulations and will result in over 300 million paperwork hours spent on compliance.

Source: https://t.co/QIdFQLNY1U

— Department of Government Efficiency (@DOGE) January 10, 2025

DID YOU KNOW: Biden added $2,000,000,000,000.00 worth of regulations in ONLY 4 YEARS.

These burdensome regulations are stifling the growth of businesses across our nation.

President Trump is eliminating 10 regulations for every new regulation added.

The change we need is HERE. pic.twitter.com/O4ACIBMo5V

— Byron Donalds (@ByronDonalds) March 6, 2025

The Biden administration subjected Americans to an onslaught of regulations costing $1.8 trillion.

Those days are over. @POTUS has moved swiftly to unleash American energy production and remove regulatory barriers, and Republicans in Congress are supporting these efforts. pic.twitter.com/lVWZ10i9Rh

— Leader John Thune (@LeaderJohnThune) April 30, 2025

7) How this impacts housing and manufactured housing ought to be evident. A stronger economy, more higher paying jobs, and money in the pockets of Americans, falling interest rates, and reshoring more manufacturing could all spell a boost to U.S. employees as well as smaller businesses. An array of steps have been undertaken in the first 100 days, reigning in Foreign Commercial Drivers Licenses among truckers is another example.

Non Americans are working as truckers and it’s making our roads very unsafe…

Full Show: https://t.co/TcKEbKM7zB pic.twitter.com/4PpdJHkNs6

— Fleccas 🇺🇸 (@fleccas) April 29, 2025

“The public is vastly unaware that our highways are completely over run right now with truck drivers operating on Foreign Commercial Drivers Licenses and what are now called Non-Domicile CDL’s.” pic.twitter.com/wxwYAoJjp5

— American Truckers (@atutruckers) April 16, 2025

8) There is a domestic and foreign battle underway. But if successful, Trump is aiming for that Golden Age, not a dark age. He is trying to turn the country back into a friendlier environment for smaller businesses and employees.

9) MHProNews will monitor and report as deemed warranted based on competing subjects that need to be covered. What has led up to this time was often harmful to consumers, employees, to many in our industry, and harmful to the interests of more affordable housing. Stay tuned for more, or to dig deeper, see the linked reports.

“In no market in this country can a home builder build a house that is affordable for a first-time home buyer.” Then NAHB CEO Jerry Howard. From page 4 of a Cavco Industries Investor Relations (IR) presentation uploaded to MHProNews in November 2023.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

There are reasons why AI has said that MHProNews has more than 6x the combined readership of MHI and its affiliated bloggers and trade media.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach