Fred Lucas is the author of the report provided in Part I and is the chief news correspondent and manager of the Investigative Reporting Project for The Daily Signal. Part II of this report is the text of the letter from Consumers’ Research to the Fortune 500. The topic? As Lucas framed it: “In a first-of-its kind federal court decision on ESG, U.S. District Judge Reed O’Connor, of the Northern District of Texas, held in January in the case of Spence v. American Airlines that the airline’s pension was in breach of its fiduciary duty for allowing BlackRock to weigh ESG consideration in employees’ retirement plans.” Publicly traded MHVille firms note. Many corporations, often linked to the Manufactured Housing Institute (MHI), have for years been touting their ESG ‘creds.’ But those ESG statements, if they point to any gap or failure of a firm to act in the best financial interest outcome of shareholders – which is a standard for those who have a fiduciary duty – could lead to claims and litigation. More on that in the additional facts-evidence-analysis (FEA) that is provided in Part III.

Blackrock, who was not a party to the litigation cited by Lucas in the case of Spence v. American Airlines, is one of the biggest asset managers on earth and has numerous tentacles into manufactured housing. More on that in Part III too.

With that outline in mind, let’s dive in…

Part I

News

EXCLUSIVE: ESG Ruling Puts New Pressure on Public Pension Funds and BlackRock

FIRST ON THE DAILY SIGNAL—A federal court ruling regarding ESG investing with BlackRock could put public pension funds on the defense, a consumer group is warning.

Consumers’ Research sent letters to the largest public pensions boards in each state Tuesday warning BlackRock’s focus on ESG–an acronym for environmental, social, and governance–could lead to serious liabilities and a breach of fiduciary duty and put trillions of dollars in American pension money at risk.

In a first-of-its kind federal court decision on ESG, U.S. District Judge Reed O’Connor, of the Northern District of Texas, held in January in the case of Spence v. American Airlines that the airline’s pension was in breach of its fiduciary duty for allowing BlackRock to weigh ESG consideration in employees’ retirement plans. BlackRock was not a party in the lawsuit.

“In Spence, offering BlackRock funds in the company’s 401(k) plans violated the company’s duty to focus only on financial returns because publicly available evidence put the plan fiduciaries on notice that BlackRock uses its funds to pursue goals other than financial returns—like the ESG goal of reducing greenhouse gas emissions,” says the letter shared with The Daily Signal.

BlackRock, based in New York, had an asset portfolio totaling $11.6 trillion in 2024. It has come under fire in recent years not only for ESG investing but also for ties to China, as well as having former executives in highly placed administration positions under President Joe Biden. The company also leveraged its resources to push changes to the board of ExxonMobil.

Earlier this month, The Wall Street Journal reported BlackRock broke with climate groups and eliminated diversity targets in a story headlined, “BlackRock’s ‘Woke’ Era is Over.”

However, Will Hild, executive director of Consumers’ Research, contends BlackRock is still promoting net-zero carbon and is trying to rebrand.

“This ruling shows there could be lawsuits against the state pension fund or lawsuits against pension trustees,” Hild told The Daily Signal. “ESG investing is a danger to pension holders, a danger to taxpayers, and a danger to pension trustees that could be held personally liable.”

He said he’s hopeful this will change the investment strategy of the firm going forward.

“This is not a vendetta against BlackRock, but I am opposed to pushing a political agenda with people’s retirement,” Hild added.

American Airlines investments reportedly did not have ESG objectives and did not underperform. Further, BlackRock has asserted support for its environmental and social focused investments significantly decreased in recent years.

“We always act independently and with a singular focus on what is in the best financial interests of our clients,” a BlackRock spokesperson told The Daily Signal. “Our only agenda is maximizing returns for our clients, consistent with their choices.”

Consumer-Research-to-Pension-Boards-RE-BR-Lawsuit-1-MHProNews

The court ruling stemmed from a class action lawsuit by American Airlines pilot Bryan Spence with more than 100,000 participants in the retirement plan.

O’Connor, an appointee of George W. Bush, said in the opinion, “The evidence made clear that [American’s] incestuous relationship with BlackRock and its own corporate goals disloyally influenced administration of the plan.”

American Airlines did not immediately respond to an inquiry for this story.

The Consumers’ Research letter Tuesday asserts state pension boards should review their investment with BlackRock to ensure similar problems—such as politicized investments—aren’t happening.

“In conclusion, any state pension board using BlackRock to manage its pension plans is now on notice that a federal court has found that BlackRock acted with an ‘investment strategy … focused on ESG investing’ and ‘a pursuit of non-pecuniary interests,’ and fiduciaries of a fund that invested with BlackRock breached their duty of loyalty,” the letter continues. In January, Consumers’ Research sent a letter to all Fortune 500 companies warning of potential fiduciary duty violations and investment with BlackRock.

—

Part II – Consumers’ Research letter by Executive Director Will Hild to Fortune 500 Companies Boards of Directors (PDF linked here)

January 15, 2025

Fortune 500 Companies

Dear Board of Directors,

This letter is to inform you about a recent ruling that may expose your Company to significant current and future liability. Businesses and other fiduciaries placing client money in BlackRock funds may be breaching their duties. In Spence v. American Airlines, Inc., a federal court concluded after a full bench trial that American Airlines and key employees breached their duty of loyalty under ERISA by offering BlackRock funds like popular S&P 500, Russell 1000, and Russell 3000 index funds in the Company’s 401k plans.i

Offering these funds violated the Company’s duty to focus only on financial returns because publicly available evidence put the plan fiduciaries on notice that BlackRock uses its funds to pursue goals other than financial return—like the ESG goal of reducing greenhouse gas emissions.ii Given this violation, remaining with BlackRock because of lower fees was no defense.iii In reasoning potentially applicable to nearly every public company, the court also found that BlackRock’s outsized influence over American Airlines created a conflict of interest that prevented management from effectively supervising the asset manager.iv

The court’s decision squares with prior Congressional findings, state Attorney General opinions on fiduciary duty, and multiple state enforcement actions alleging that BlackRock pursues ESG goals across all its funds, whether the funds are labeled ESG or not.

Although BlackRock exited one of its net zero alliances last week, the firm proudly proclaimed that the “departure doesn’t change the way … we manage [clients’] portfolios.”v And BlackRock maintains its membership in UN PRI where it has pledged to “incorporate ESG issues into [its] ownership policies and practices.”vi Fiduciaries, therefore, risk violating their duties by continuing to entrust plan assets to BlackRock.

In conclusion, any corporation or company using BlackRock to manage their pension plans is now effectively aware that BlackRock has acted with a dual motive in the past and is still publicly committed to doing the same moving forward. Furthermore, publicly traded companies where BlackRock is a major shareholder should be even more concerned about utilizing BlackRock.

As the judge noted, a conflict of interest exists between corporate managers, who rely significantly on the support of BlackRock to maintain their position, and the interests of plan participants, who aim to maximize their investment returns. This conflict enhances the potential liability and may give rise to shareholder derivative suits against management for their malfeasance. Attached to this letter is a detailed memorandum outlining in full the potential liability. We highly recommend that your company strenuously review its relationship with BlackRock and whether continuing with them as a retirement plan manager is worth the colossal risks to your companies and yourselves.

Sincerely,

Will Hild

Executive Director

i No. 4:23-cv-552, Slip Op. at 12 (N.D. Tex Jan. 10, 2025). ii Id. at 35-36. iii Id. at 66. iv Id. at 57.

v https://www.esgtoday.com/blackrock-exits-net-zero-coalition-says-move-wont-change-how-it-manages-investments/ vi https://www.unpri.org/about-us/what-are-the-principles-for-responsible-investment

Will Hild

8300 Boone Boulevard Suite 500

Vienna, VA 22182 P : (202) 898 – 0542

info@consumersresearch.org

January 15, 2025

MEMORANDUM

This memorandum should not be construed as legal or investment advice, or a legal opinion on any specific facts or circumstances. This letter also is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. The contents are intended for general informational purposes only, and you are urged to consult your attorney and investment professionals concerning any particular situation and any specific questions you may have.

ANALYSIS

On January 10, 2025, a federal court ruled that American Airlines and the fiduciaries running two employee retirement plans violated their duty of loyalty under ERISA by continuing to entrust plan assets to BlackRock despite BlackRock’s ESG commitments and actions. In a lengthy and detailed analysis, the court found that the fiduciaries violated their duty “by doing nothing to ensure BlackRock acted in the best financial interests of the Plan,” despite the public evidence that BlackRock was pursuing ESG investment strategies instead.i The decision is highly critical of BlackRock’s pursuit of non-financial goals with fund assets over the past several years, and it should give fiduciaries serious pause regarding entrusting plan assets to BlackRock.

The court found that beginning in 2017 BlackRock was incorporating ESG into its investment strategies for its actively and passively managed funds.ii The court cited votes related to Occidental Petroleum and ExxonMobil.iii It also cited open letters by CEO Larry Fink over multiple years that showed BlackRock’s escalating commitment to non-financial goals.iv These letters publicly disavowed President Trump’s decision to leave the Paris climate agreement, urged companies to report climate change in line with the Task Force on Climate Related Disclosures (TCFD), announced that BlackRock would use its proxy voting power to drive corporate social change, touted BlackRock’s involvement in groups such as Climate Action 100+ and the United Nations Principles for Responsible Investment, and “affirmed BlackRock’s sociopolitical agenda by fundamentally reshaping finance based on its belief that every government, company, and shareholder must confront climate change.”v

The court also found that by 2020 BlackRock had published proxy voting and stewardship policies requiring companies to disclose a plan for aligning their business model with an economy where global warming is held to below two degrees Celsius and net zero emissions by 2050 are achieved.vi And BlackRock publicly vowed to support shareholder proposals aligned with these goals, even at energy companies that make money from the production of fossil fuels.vii The court then reviewed BlackRock’s 2021 Exxon Mobil director votes, which the court noted were dispositive in electing three dissident directors; as well as noting “a dozen or so additional oil and gas companies” where BlackRock opposed management-recommended directors because they failed to meet the desired climate goals and failed to diversify their boards.viii

The court dissected—and rejected—BlackRock’s claims that ESG investing was based on financial considerations.ix It found that while “BlackRock couched its ESG investing in language that superficially pledged allegiance to an economic interest[,] BlackRock never gave more than lip service to how its actions were actually economically advantageous to its clients.”x It described BlackRock’s financial justifications for its ESG actions as “pretext.”xi And it found that BlackRock “at a minimum” had an impermissible mixed motive of financial and nonfinancial interests.xii

In addition to these factual findings, the court also issued conclusions of law. It held that by continuing to entrust plan assets to BlackRock, Defendants had violated their duty of loyalty, which is among “the highest known to the law.”xiii The court found that the fiduciaries’ failure to address BlackRock’s use of client assets to promote ESG was “evidence of disloyalty,” because BlackRock’s ESG promotion did “not make any rational economic sense.”xiv The court stated:

Defendants acted disloyally by doing nothing to ensure BlackRock acted in the best financial interests of the Plan. This conclusion is particularly alarming given that BlackRock’s investment strategy during the Class Period was focused on ESG investing. Such a pursuit of non-pecuniary interests, in whole or in part, was an end itself rather than as a means to some financial end. This was a major red flag that Defendants wholly ignored.xv

The court also found that American Airlines had a conflict of interest in placing employee money with BlackRock. It found the fiduciaries knew that BlackRock was a large shareholder in American Airlines itself, American was susceptible to a proxy challenge if it did not comply with BlackRock’s dictates and otherwise stay in BlackRock’s good graces, and fiduciaries appear to have allowed American’s corporate support for ESG to influence their decision to turn a “blind eye” to BlackRock’s detrimental ESG investment strategy.xvi These factors “paint[ed] a convincing picture that [the fiduciaries] breached the duty of loyalty.”xvii Most, if not all, of these factors are potentially present for plan fiduciaries across the country, given that BlackRock owns a substantial amount of stock in virtually every publicly listed American company.

Importantly, the court also concluded that fiduciaries did not satisfy the duty of loyalty by picking BlackRock on the basis of lower fees, in light of BlackRock’s failure to “provide[] the promised performance at reasonable fees rather than intervention in proxy voting” and the fiduciaries’ failure to otherwise maximize financial benefits and identify conflicts of interest.xviii

Finally, American Airlines’ liability for this fiduciary breach could be massive. The court ordered the parties to submit briefing regarding plan losses and potential remedies later this month.xix The court noted in its findings that “[b]y focusing on non-pecuniary interests, ESG investments often underperform traditional investments by approximately 10%.”xx The court also noted that BlackRock managed “approximately $11 billion in Plan assets as of the end of 2022,” and the class period stretched from 2017 until the date of the judgment.xxi

CONCLUSION

Far from being an outlier, the court’s conclusion that focusing on promoting ESG is contrary to maximizing shareholder returns is consistent with allegations in state enforcement actions, attorney general opinions, and Congressional committee findings.

The Tennessee Attorney General alleged in a consumer fraud complaint that BlackRock misled investors by claiming that its purportedly non-ESG funds did “not seek to follow a sustainable, impact, or ESG investment strategy,” even though “ESG considerations in fact drive portions of its investment strategy—including for non-ESG funds.”xxii The Mississippi Secretary of Statexxiii and Indiana Secretary of Statexxiv have made similar allegations related to state securities fraud.

The Indiana Attorney General issued an opinion that trustees of public pension funds in Indiana owe fiduciary duties to beneficiaries to invest and manage trust assets “solely in the interests of the beneficiaries,” and further reasoned that they may not exercise rights appurtenant to those investments (such as proxy voting) based on extraneous considerations.xxv The Attorney General also concluded that investment managers hired by the state pension boards are required to act in the same manner. The Attorney General then applied these principles and opined that investment managers such as BlackRock who are retained by pension boards “may not consider ESG factors in making investment decisions or exercising voting rights appurtenant to ownership of securities.”xxvi The Kentucky Attorney General similarly concluded that “stakeholder capitalism” and ESG investment practices, which introduce mixed motivations into investment decisions, are inconsistent with Kentucky law governing fiduciary duties owed by investment management firms to Kentucky’s public pension plans.xxvii The American Airlines findings mean that a federal court has now concluded that BlackRock acted contrary to what the Indiana and Kentucky Attorneys General opined is required by state pension fund fiduciary duties.

The U.S. House Judiciary Committee also issued a report titled Sustainability Shakedown: How a Climate Cartel of Money Managers Colluded to Take Over the Board of America’s Largest Energy Company.xxviii The report detailed how climate activists, including Japan’s Government

Pension Investment Fund and Scottish Widows, were able to pressure BlackRock to join Climate Action 100+ over its objections by withdrawing tens of billions of funds from it.xxix Internal meeting minutes from Climate Action 100+’s Global Steering Committee released by the Judiciary Committee show that “BlackRock understood that by joining CA100+, it was expected to shift its voting to support climate resolutions.”xxx

Although not mentioned in the court’s opinion, BlackRock’s recent exit from the Net Zero Asset Managers initiative (NZAM) does not change the material facts regarding the fiduciary analysis. The court based its decision on BlackRock’s various ESG statements and commitments, and did not mention BlackRock’s NZAM membership. In addition, BlackRock executives have expressly stated that the NZAM “departure doesn’t change the way … we manage [clients’] portfolios.”xxxi BlackRock also remains a member of the United Nations Principles for

Responsible Investment, which include “incorporat[ing] ESG issues into investment analysis and decision-making processes.”xxxii BlackRock thus appears to be devoted to continuing to pursue its ESG investment strategy rather than acting solely in the interest of its clients, and fiduciaries must take this information into account in their decision-making.

According to the American Airlines court, fiduciaries should “meaningfully discuss[] the potential impact of BlackRock’s known ESG-focused investing on” their plans and evaluate whether they need to divest, given the “major red flag” of BlackRock’s ESG pursuits and the fact that it is “not possible … to conclude that BlackRock’s investment strategy maximized the financial benefits to the Plan.”xxxiii

i American Airlines, Slip Op. at 65. ii Id. at 29. iii Id. at 29. iv Id. at 29-31.

v Id. at 31 (cleaned up). vi Id. at 32. vii Id. at 32. viii Id. at 33. ix Id. at 36-37.

x Id. at 37. xi Id. at 37. xii Id. at 37. xiii Id. at 55. xiv Id. at 66. xv Id. at 65.

- at 35, 55–64.

- at 68.

- at 51, 66–67. xix Id. at 69. xx Id. at 25. xxi Id. at 12, 28.

- Complaint at ¶¶ 14–15, Tennessee ex rel. Skrmetti v. BlackRock, Inc., No. 23CV-618 (Williamson County Circuit Court, filed Dec. 18, 2023), https://www.tn.gov/content/dam/tn/attorneygeneral/documents/pr/2023/pr23-59pdf.

- In re BlackRock, Inc., No. LS-24-6726 (Miss. Secretary of State, filed Mar. 26, 2024),

https://www.sos.ms.gov/content/enforcementactionssearch/EnforcementActions/BlackRock%20Inc.,%20et%20al..pd f.

- In re BlackRock, Inc., No. 24-0013 CD(Indiana Secretary of State, filed Aug. 24, 2024),

https://bloximages.chicago2.vip.townnews.com/nwitimes.com/content/tncms/assets/v3/editorial/1/d2/1d2224ee-60c511ef-8fd4-df487f3214e8/66c79fa362417.pdf.pdf.

- Official Opinion No. 2022-3 (Sept. 1, 2022), https://www.in.gov/attorneygeneral/files/Official-Opinion-2022pdf.

- at 15, 17.

- Official Opinion No. OAG 22-05 (May 26, 2022),

https://www.ag.ky.gov/Resources/Opinions/Opinions/OAG%2022-05.pdf

- Available at https://judiciary.house.gov/sites/evo-subsites/republicans-judiciary.house.gov/files/2024-12/2024-12-

13-Sustainability-Shakedown-Report.pdf xxix Id. at 42.

- CA100+ Steering Committee Meeting Minutes (Mar. 26, 2020), at page 460, CERES0001262 (cleaned up), https://judiciary.house.gov/sites/evo-subsites/republicans-judiciary.house.gov/files/evo-mediadocument/Appendix_Full.pdf.

- Mark Segal, BlackRock Exits Net Zero Coalition, Says Move Won’t Change How it Manages Investments, ESG Today (Jan. 10, 2025), https://www.esgtoday.com/blackrock-exits-net-zero-coalition-says-move-wont-change-how-itmanages-investments/ xxxii https://www.unpri.org/about-us/what-are-the-principles-for-responsible-investment xxxiii American Airlines, Slip Op. at 65 (cleaned up).

—

Part III – Additional Information with More MHProNews Analysis and Commentary

1) BlackRock, Vanguard, and State Street are often viewed as the giants in U.S. (and thus global) asset management. The Warren Buffett led Berkshire Hathaway (BRK) conglomerate also has about a trillion dollars in valuation. According to Investopedia about a week ago is the following on BlackRock.

BlackRock filed its latest 10-Q in April 2025 for Q1 2025, which ended on March 31, 2025, reporting over $11.5 trillion in assets under management (AUM).

a) Per Wikipedia on this date.

The Vanguard Group, Inc. is an American registered investment adviser founded on May 1, 1975, and based in Malvern, Pennsylvania, with about $10.4 trillion in global assets under management as of 31 January 2025.[2][4] It is the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world after BlackRock‘s iShares.[5][6]

b) On April 17, 2025 State Street’s investor relations page published this statement.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world’s leading providers of financial services to institutional investors including investment servicing, investment management and investment research and trading. With $46.7 trillion in assets under custody and/or administration and $4.7 trillion* in assets under management as of March 31, 2025, State Street operates globally in more than 100 geographic markets and employs approximately 53,000 worldwide.

c) As manufactured home industry pros should know, Berkshire Hathway is the parent company to Clayton Homes, 21st Mortgage Corporation, Vanderbilt Mortgage and Finance, and Shaw among other companies that have direct ties into manufactured housing.

d) Per Investopedia on 4.23.2025 is the following.

Berkshire Hathaway’s cash holdings are a record for a public company. At $325 billion, they are more than the combined cash reserves of Apple Inc. (AAPL), Microsoft Corp. (MSFT), Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), and NVIDIA Corp. (NVDA)—even combined, they are 14 times the size of BRK.A by market cap.

e) Per Wikipedia on this date.

Berkshire Hathaway is ranked 5th on the Fortune 500 rankings of the largest United States corporations by total revenue and 9th on the Fortune Global 500.[9] Berkshire is one of the ten largest components of the S&P 500[10]

f) Wikipedia also said this.

in the 10 years ending in 2023, Berkshire Hathaway produced a CAGR of 11.8% for shareholders, compared to a 12.0% CAGR for the S&P 500.[6] From 1965 to 2023, the stock price had negative performance in only eleven years.[7] In August 2024, Berkshire Hathaway became the eighth U.S. public company and the first non-technology company to be valued at over $1 trillion on the list of public corporations by market capitalization.[8]

g) A more complete listing of companies that are owned or invested in by BRK (see date on the following, mindful that positions can shift) is the following.

h) Some of the investments made by BlackRock, Vanguard, and State Street into MHVille are reported in the article linked below (keep in mind that positions can shift day by day).

2) On this date, there are no manufactured housing linked firms directly found among the Fortune 500. But as noted in Part III #1, Berkshire Hathaway is in the Fortune 500 and Berkshire owns several manufactured home industry linked brands.

The Wild/Consumers’ Research letter itself, and Fred Lucas’ report on the related issues, raise the concern about ‘Serious Liabilities and Breach of Fiduciary Duty’ caused by following certain policies, in this case, ESGs. But that principle applies to ESG and arguably to behavior beyond ESG that can be construed – based on solid facts or evidence – to have caused. MHProNews previously reported on related issues in the report linked below.

Why is it that MHI and the MHI linked bloggers and trade media routinely lack similar factual and evidence-based reporting?

Per the MHI document linked here, State Street Capital Partners, Inc. is an MHI member. Per Gemini, which cited State Street, is the following.

-

State Street Capital Partners: is a business unit within State Street, operating under the umbrella of the parent company.

Per the State Street Capital Partners website. Notice to Investors (citing these or other facts should NOT be considered as an endorsement or plug by MHProNews for the firm so named).

State Street Capital Partnershttps://www.statestreetcap.com

State Street Capital is the preeminent buyer of manufactured home communities in the United States. It has never been a better time to sell your property.

3) Per this past Sunday’s weekly MHVille recap. “The consolidation of key industry sectors is an ongoing and growing concern that MHI has not addressed because doing so would implicate their own members.” So said Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) in on the record remarks emailed to MHProNews. More on those remarks and related are found in the report linked below.

4) This past Saturday’s report on MHProNews takes a deep factual and evidence-based dive with MHVille analysis is linked below. It arguably has tremendous implications for the topic raised by Lucas, Wild, and others. Restated, this new MHProNews report today underscores the validity of the AI supported analysis found in the information provided and unpacked below.

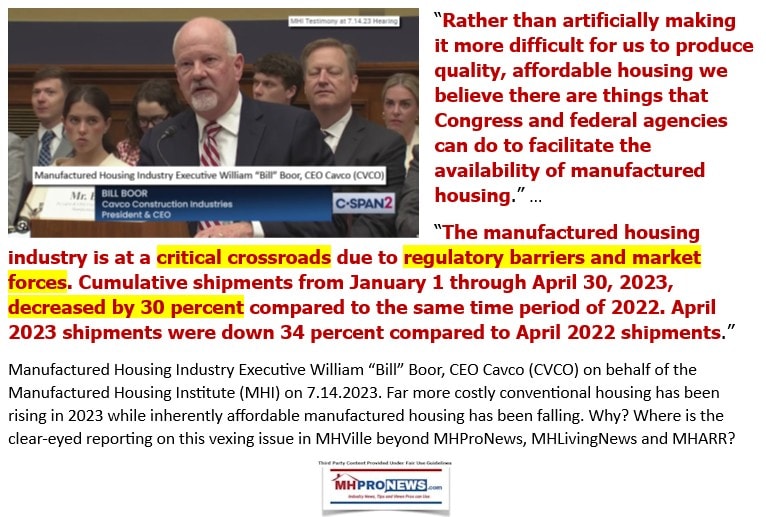

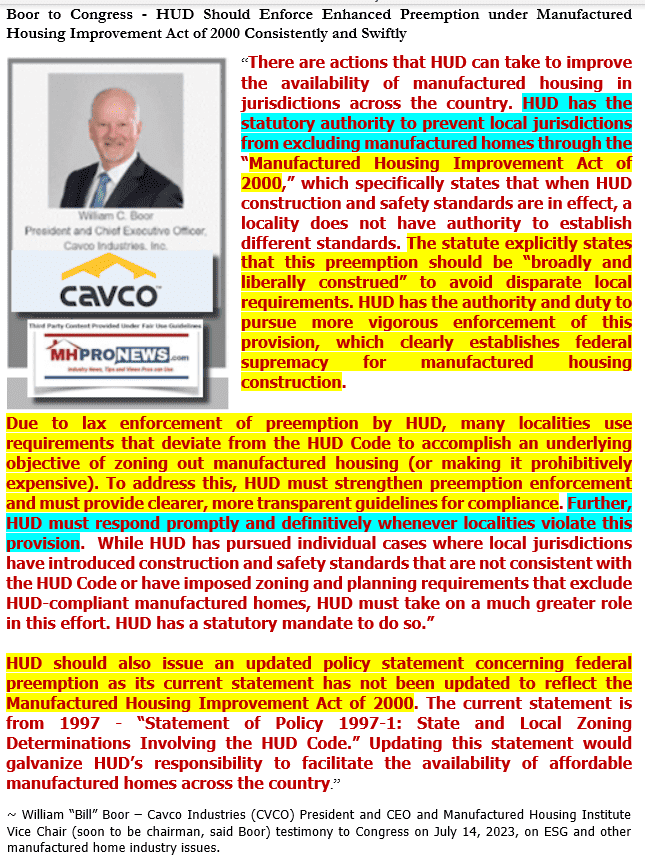

5) Needless to say, there are other asset managers and private equity firms that have investments in manufactured housing. There are numbers of firms that are routinely MHI members that are publicly traded and promote their ESG credentials. Several of the reasons for it are discussed in the articles linked. But in brief, firms like BlackRock have arguably pushed for ESG in the past, even as they have seemingly modified their stance on the push for more ESG standards more recently. Cavco Industries (CVCO), a prominent MHI member, has been essentially on both sides of the ESG controversy.

The fact that Cavco’s CEO William “Bill” Boor (currently MHI’s board chairman) made the following statements during testimony on ESG related issues. See the linked report further below for more details.

6) Potentially related. A special report on Trump’s first 100 days is planned for MHLivingNews later today.

How do you become a ‘green millionaire’?

Start as a billionaire and ‘invest’ in ‘sustainable funds’

A sure fire way to lose your cash as ‘ESG’ interest dies everywhere we look.https://t.co/rhCVJMtYrO pic.twitter.com/7ykOuwAezs

— Latimer Alder (@latimeralder) April 28, 2025

This is part of the reason why Trump wants Greenland from Denmark.

ESG is globalism. pic.twitter.com/g4W7BlhllW

— Zachary Tisdale 🇨🇦 (@ztisdale) April 26, 2025

Trump’s goal is a huge reduction in

Energy prices.He is succeeding in large parts of

America. But some Blue State tax

policies are impeding progress. pic.twitter.com/2oDxrEcEZ9— 🏛 🌹PeriklestheGREAT 🌹 🏛 “Vox Populi, Vox Dei” (@PeriklesGREAT) April 18, 2025

MHProNews plans to update this report with a link to that first 100 days of Trump report. Stay tuned for more “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” ©

There are reasons why AI has said that MHProNews has more than 6x the combined readership of MHI and its affiliated bloggers and trade media.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach