The headline will be answered in two ways. Let’s proceed with a systematic look at a release to MHProNews from the Apartment List that spotlighted research which said the following. In 2018 “At current savings rates, two-thirds of millennials need more than two decades to save for a down payment.”

Ouch. Twenty years for a down payment? No wonder there are so many renting instead of buying.

Here are some factoids, per that same source.

- Nine out of ten millennial renters want to purchase a home, but few plan to do so in the near term. Of those who say that they plan to purchase a home, just 4.9 percent say that they will do so within the next year, while 34 percent expect to wait five years or more.

- 72 percent of millennial renters who plan to purchase a home cite affordability as a reason that they are delaying homeownership, with 62 percent pinpointing a lack of down payment savings specifically. 48 percent of millennial renters have zero down payment savings, while just 11 percent have saved $10,000 or more.

- We analyze millennial saving rates to estimate that two-thirds of millennial renters would require at least two decades to save enough for a 20 percent down payment on a median-priced condo in their market. Just 11 percent would be able to amass a 20 percent down payment within the next five years.

- Student debt is keeping homeownership out of reach for many millennials. We estimate that 23 percent of college graduates without student debt can save enough for a down payment within the next five years, compared to just 12 percent of college graduates who are currently paying off student loans. That said, those without a college education fare worst, with just six percent able to save a down payment within five years.

- Down payment help from family can make homeownership more attainable, but this benefit accrues primarily to the highest earners. Of millennial renters who expect to receive assistance with a down payment, those with incomes over $100,000 per year expect to receive $51,172 on average, which is over ten times the average expected assistance of $4,358 for those making less than $25,000.

Apartment List also made these added points.

· Conventional wisdom states that a college education is a strong factor in whether or not someone can afford to purchase a home. But for millennials in particular, rising tuition costs introduce a second dimension: whether or not they incurred debt to achieve that education.

And the results are clear:

· On average, college-educated, debt-free millennials have nearly three times the down payment savings as those with debt

· We estimate that in five years, nearly twice as many debt-free millennials will be able to afford a 20% down payment on a median-priced starter home

What This Data Means to Manufactured Housing Investors, Businesses, Advocates

The National Association of Realtors (NAR) – as one example – cited a somewhat lower rate in their research for what percentage of all renters want to own, which in recent years tends to hover in the 80 to 85 percent range (+/-). But that doesn’t necessarily contradict what Apartment List said, because they are focused in this research on millennial renters. Rather, each tends to confirm the other’s findings on that point.

So, let’s take this research at face value for now, to spotlight the ‘stating the obvious’ for manufactured housing professionals.

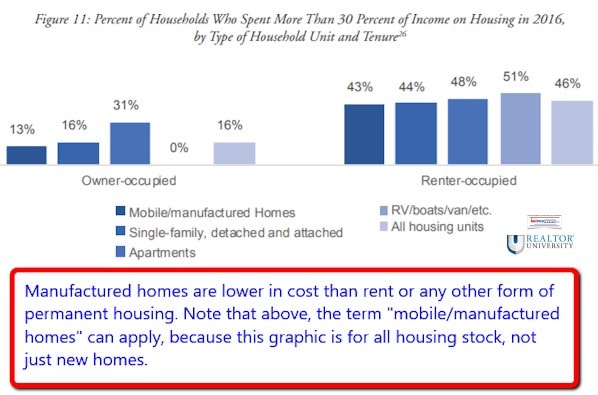

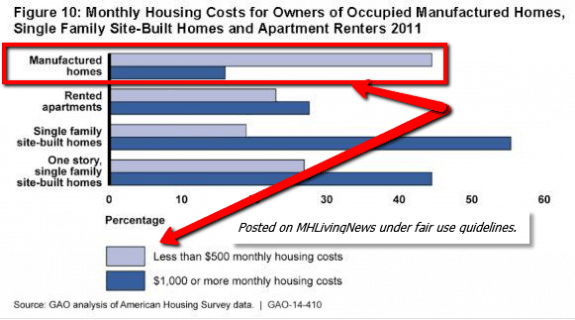

The NAR has said in their seminal 2018 research on manufactured homes that millions of renters could afford to buy a manufactured home on the basis of the monthly cost.

Lower cost for manufactured homes means lower down payments than what are commonly necessary for conventional housing.

Rephrased, this research is one more third-party data-point that tells us that manufactured homes has enormous market potential.

That’s a wrap on this hump-day final installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

News Tip – Cavco Industries Legal Woes with SEC, Insider Insights

New Investigation, Insider Trades, Hedge Fund Dumps Cavco Industries (CVCO)

Sounding Off! Going “On the Record” – Manufactured Housing Controversies, Opportunities

Facts are Stubborn Things, Manufactured, Modular Home Professionals Celebrate Victories