The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks.

By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Google profits take a hit from antitrust fine

- Ivanka Trump’s finances: What we’ve learned

- Europe to US: Russia sanctions would hurt us too

- Why NYT wants an apology from Fox News

- Uber’s Southeast Asia rival Grab gets $2B stronger

- Your summer guide to media and entertainment

- Former Xerox CEO: US needs to help lift up the poor

- 2,500 products in U.K. hit by ‘shrinkflation’

- KKR buying WebMD

- IMF slashes U.S. growth forecasts

- How tax reform could change your 401(k) tax break

Selected headlines and bullets from Fox Business:

- Health care turnaround: How the White House is trying to get Sen. Lee to vote ‘yes’

- Nasdaq, tech shine as earnings pick up; Dow, S&P lag

- Oil rises 1 percent after Saudi vows to cap crude exports next month

- Amazon jacked up Prime Day prices, misleading consumers, says seller

- GM earnings and slow-selling cars in focus Tuesday

- Trump: ObamaCare is death

- Google’s Alphabet sees profit slump as EU’s record $2.7B fine looms

- Wisconsin company to implant microchips in its employees in August

- Democrats’ ‘Better Deal’ economic blueprint takes aim at big companies

- Trump in cross hairs as veterans’ group slams VA Choice funding plan

- Health care has to happen before September, Mick Mulvaney says

- Apple warns cyber threat could wipe out iPhones, issues fix

- Arconic stops selling panels from London fire for high-rises amid installation concerns

- Blue Apron stock surges as Wall Street offers rosy outlook

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Today’s markets and stocks, at the closing bell…

S&P 500 2,469.91 -2.63 (-0.11%)

Dow 30 21,513.17 -66.90 (-0.31%)

Nasdaq 6,410.81 +23.05 (+0.36%)

Crude Oil 46.41 +0.64 (+1.40%)

Gold 1,255.60 +0.70 (+0.06%)

Silver 16.47 +0.06 (+0.34%)

EUR/USD 1.1641 -0.0018 (-0.16%)

10-Yr Bond 2.254 +0.022 (+0.99%)

Russell 2000 1,438.05 +2.22 (+0.15%)

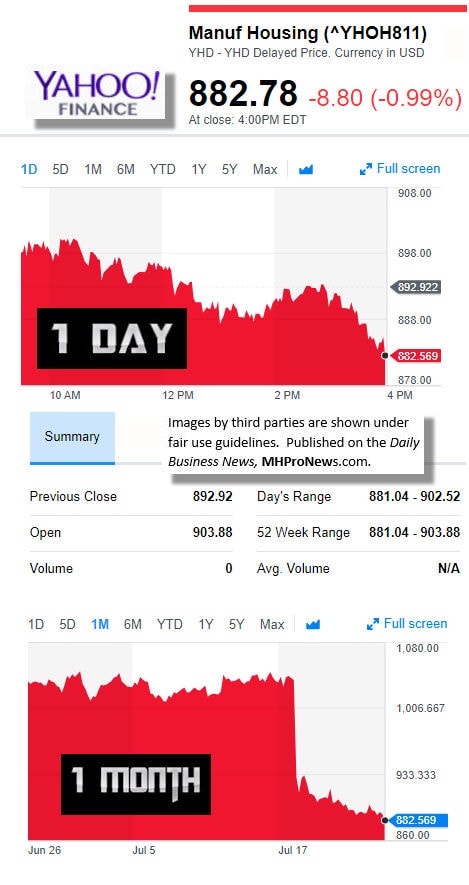

Manufactured Housing Composite Value

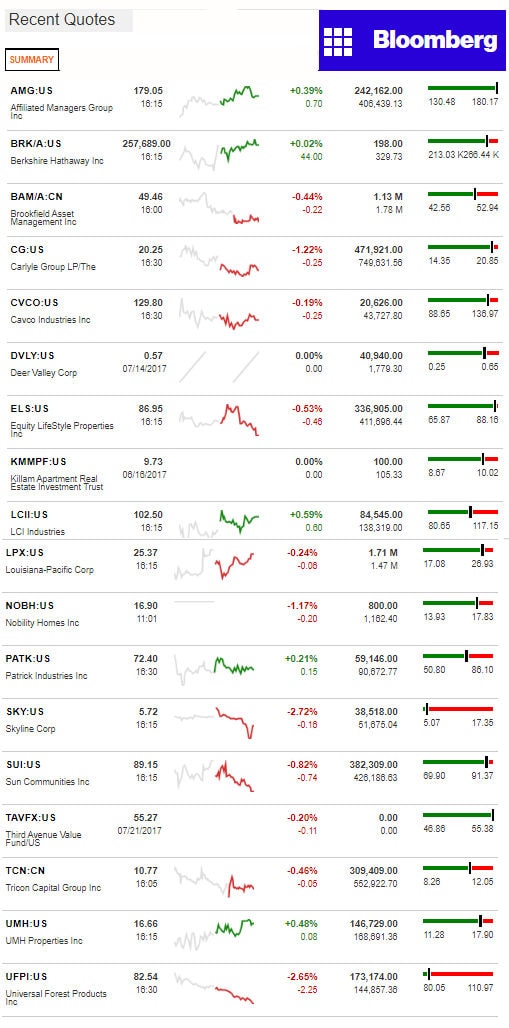

Today’s Big Movers

Killam and LCI led risers.

Skyline and UFPI led decliners.

For all the scores and highlights on tracked stocks today, see the Bloomberg graphic, posted below.

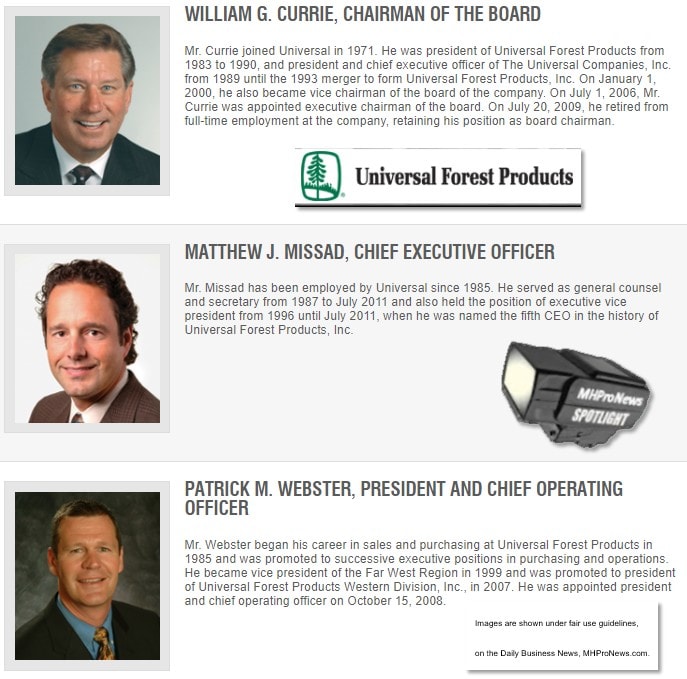

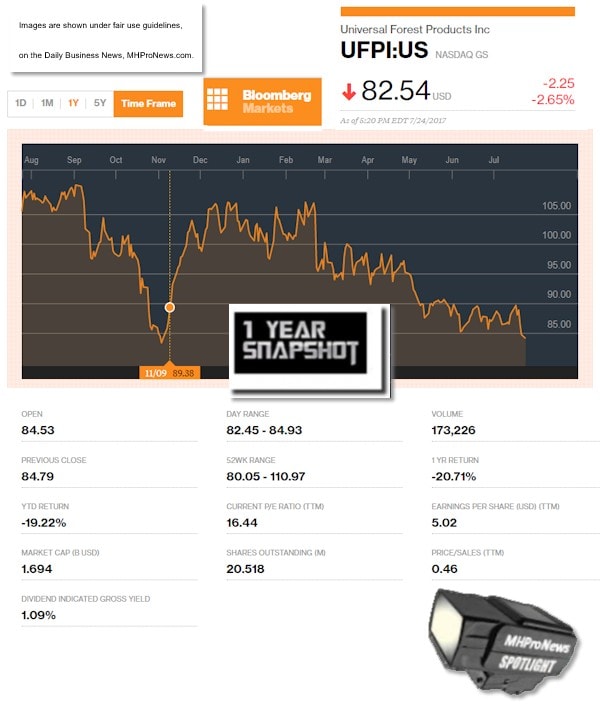

Today’s MH Market Spotlight Report – UFPI

UFPI is a supplier to the manufactured housing industry’s producers of HUD Code homes.

The above are some of the recent news headlines on manufactured housing.

GRAND RAPIDS, Mich., July 18, 2017 (GLOBE NEWSWIRE) — Universal Forest Products, Inc. (Nasdaq:UFPI) today reported financial results for the second quarter ended July 1, 2017.

The Company’s net sales rose 23 percent over the same quarter of 2016, led by double-digit gains in each of its markets. Net earnings were up slightly over 2016. Both results are records for the company.

“Many companies would be satisfied with our second-quarter performance. Not us,” said CEO Matt Missad. “We are excited about our sales growth, yet disappointed that we only had a modest growth in profits. We won’t make excuses and will aggressively pursue our goal to convert more of our sales revenue to earnings growth. I am confident that the great people of Universal will overcome challenges such as the lumber market volatility that occurred in the second quarter and continue to improve.”

“We are excited about the second half of 2017 and look forward to returning to more normal lumber market conditions as the details of the next Canadian softwood lumber agreement become known,” Matt added. “We expect to see the benefits of our investments in acquisitions, new product development and our international division. We also expect to see the benefits of our efforts to manage costs, as acquisitions such as idX Corp. continue to implement cost-saving synergies ahead of schedule.”

Second Quarter 2017 Highlights (comparisons on a year-over-year basis):

· Net earnings attributable to controlling interest were $33.6 million, up 1 percent

· Diluted earnings per share were $1.64

· Net sales of $1,072.4 million represent a 23 percent increase

· Unit sales accounted for 16 percent of the Company’s gross sales growth; higher lumber prices accounted for 7 percent

· New product sales were $115.9 million, up from $97.8 million. The Company has introduced 23 new products in 2017 to date, including 11 during the second quarter.

By market, the Company posted the following second-quarter 2017 gross sales results:

Retail

$459.1 million, up 13 percent over the same period of 2016

Sales to the Retail market grew 13 percent, led by acquisitions, which contributed 8 percent of unit sales growth, while price increases accounted for 5 percent of sales growth.

The Company has benefited from new product sales and growth with independent and big box retailers, the latter of which have reported increases in comparable sales in their most recently reported quarters.

Construction

$295.2 million, up 17 percent over the same period of 2016

The 17 percent increase in Construction sales was led by sales to manufactured housing builders, which grew 24 percent, and residential builders, which grew 14 percent. Sales to commercial builders rose 10 percent. Overall, unit sales grew 9 percent, while prices increased 8 percent.

The Company has benefited from the increase in manufactured home production, which is up 18.5 percent for the year through April 2017, and from rising U.S. housing starts. The Company remains focused on growing business selectively in areas where housing markets are the most stable.

Industrial

$335.9 million, up 47 percent over the same period of 2016

The Company’s growth in this market is primarily due to its September 2016 acquisition of idX Corp. Excluding acquisitions, the Company grew unit sales in this market by 8 percent in the second quarter through market share gains and by adding new customers.

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

You will find only the very best manufactured home industry coverage, every business day. We’re not perfect, but we are by far the best. No one else in covering our industry even comes close. Which is why you and thousands of others join us here, daily. Thank you for that vote of confidence.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)