The source of the provocative paraphrase in the headline is found further below. It arrived after MHProNews had drafted this Monday morning report, which is based on U.S. Census Bureau information. The Census Bureau website says that data on the Manufactured Housing Survey was recently updated: “Last Revised: June 8, 2022.” Their website also features the U.S. Department of Housing and Urban Development (HUD) logo, under the caption “sponsored by” and the HUD logo. The following information is the June 2022 table of the MHS Latest Data, “Manufactured Housing statistics at a glance.”

|

Average Sales Price of New Manufactured Homes by Region |

|

(Dollars) |

| United States | |||

| Total1 | Single | Double | |

| 2022 | |||

| January | 122,500 | 84,600 | 152,800 |

| 2021 | |||

| December | 123,200 | 80,900 | 150,300 |

| November | 111,900 | 76,400 | 139,900 |

| October | 112,000 | 81,700 | 138,200 |

| September | 118,300 | 78,800 | 141,300 |

| August | 112,000 | 80,000 | 138,000 |

| July | 118,700 | 76,000 | 137,800 |

| June | 106,800 | 70,200 | 128,100 |

| May | 106,500 | 69,900 | 128,300 |

| April | 100,200 | 66,700 | 122,500 |

| March | 98,100 | 63,300 | 123,200 |

| February | 98,300 | 65,400 | 122,500 |

| January | 95,000 | 64,100 | 118,500 |

| 2020 | |||

| December | 90,200 | 62,600 | 110,800 |

| November | 92,600 | 63,500 | 112,800 |

| October | 89,400 | 57,200 | 110,000 |

| September | 87,300 | 58,300 | 107,800 |

| August | 88,200 | 57,700 | 109,300 |

| July | 84,200 | 59,800 | 102,700 |

| June | 85,600 | 52,900 | 109,800 |

| May | 85,900 | 55,200 | 109,100 |

| April | 86,900 | 53,300 | 108,200 |

| March | 82,900 | 53,800 | 106,900 |

| February | 83,400 | 55,600 | 107,500 |

| January | 86,400 | 55,300 | 107,900 |

| 2019 | |||

| December | 86,400 | 54,400 | 105,700 |

| November | 81,600 | 52,100 | 107,100 |

| October | 81,700 | 53,900 | 103,800 |

| September | 81,500 | 55,600 | 101,800 |

| August | 84,100 | 49,200 | 107,900 |

| July | 82,000 | 54,000 | 106,500 |

| June | 84,400 | 52,800 | 103,800 |

| May | 78,100 | 53,800 | 98,100 |

| April | 78,900 | 55,700 | 100,700 |

| March | 78,900 | 50,400 | 102,100 |

| February | 85,000 | 52,600 | 107,600 |

| January | 81,800 | 53,400 | 103,400 |

| 2018 | |||

| December | 82,400 | 52,100 | 106,000 |

| November | 79,900 | 55,400 | 100,500 |

| October | 82,400 | 54,500 | 106,000 |

| September | 83,600 | 54,400 | 105,400 |

| August | 81,500 | 55,100 | 100,900 |

| July | 78,900 | 52,000 | 99,300 |

| June | 85,400 | 54,900 | 101,300 |

| May | 81,200 | 57,100 | 99,100 |

| April | 74,900 | 50,600 | 98,700 |

| March | 70,600 | 49,800 | 91,400 |

| February | 73,400 | 47,900 | 93,800 |

| January | 69,000 | 47,300 | 92,100 |

| 2017 | |||

| December | 72,900 | 53,400 | 91,800 |

| November | 71,800 | 46,600 | 99,100 |

| October | 68,300 | 46,400 | 95,500 |

| September | 71,800 | 47,100 | 93,800 |

| August | 73,800 | 47,600 | 94,300 |

| July | 75,300 | 47,900 | 93,800 |

| June | 75,600 | 49,500 | 97,400 |

| May | 71,800 | 49,100 | 87,900 |

| April | 73,300 | 47,400 | 89,900 |

| March | 70,100 | 50,800 | 88,000 |

| February | 71,000 | 48,700 | 92,500 |

| January | 68,100 | 44,900 | 89,700 |

| 2016 | |||

| December | 73,100 | 49,900 | 90,800 |

| November | 71,700 | 47,000 | 90,900 |

| October | 71,600 | 48,300 | 87,400 |

| September | 69,400 | 46,700 | 93,000 |

| August | 74,200 | 50,000 | 93,100 |

| July | 73,300 | 49,500 | 91,000 |

| June | 70,500 | 46,600 | 87,000 |

| May | 71,300 | 45,800 | 87,800 |

| April | 67,800 | 44,100 | 87,500 |

| March | 69,800 | 44,500 | 88,300 |

| February | 67,600 | 43,900 | 92,600 |

| January | 67,600 | 45,900 | 84,100 |

| Northeast | |||

| Total1 | Single | Double | |

| 2022 | |||

| January | 120,600 | 85,900 | 141,800 |

| 2021 | |||

| December | 104,700 | 73,900 | 127,200 |

| November | 100,900 | 71,600 | 133,500 |

| October | 110,300 | 74,400 | 138,700 |

| September | 102,100 | 76,100 | 124,100 |

| August | 105,000 | 86,000 | 117,000 |

| July | 98,500 | 74,100 | 125,700 |

| June | 101,600 | 73,700 | 124,200 |

| May | 98,400 | 69,900 | 121,500 |

| April | 95,900 | 73,800 | 113,300 |

| March | 91,400 | 58,600 | 121,300 |

| February | 88,300 | 59,400 | 113,800 |

| January | 102,600 | 67,900 | 116,200 |

| 2020 | |||

| December | 93,600 | 58,200 | 115,300 |

| November | 85,600 | 63,600 | 103,900 |

| October | 91,000 | 57,700 | 112,100 |

| September | 84,800 | 61,000 | 105,600 |

| August | 87,600 | 56,700 | 109,600 |

| July | 78,600 | 58,600 | 100,300 |

| June | 91,700 | 55,400 | 117,000 |

| May | 79,100 | 56,300 | 100,200 |

| April | 86,100 | 53,900 | 105,200 |

| March | 79,100 | 54,400 | 102,400 |

| February | 81,500 | 54,000 | 109,800 |

| January | 77,700 | 52,900 | 104,800 |

| 2019 | |||

| December | 79,500 | 54,000 | 98,500 |

| November | 79,200 | 49,400 | 113,100 |

| October | 80,600 | 61,200 | 101,600 |

| September | 84,100 | 59,600 | 103,700 |

| August | 81,900 | 45,700 | 101,200 |

| July | 88,000 | 51,600 | 129,500 |

| June | 84,800 | 57,800 | 109,100 |

| May | 76,400 | 49,200 | 105,200 |

| April | 82,000 | 59,300 | 109,000 |

| March | 74,500 | 48,000 | 98,400 |

| February | 74,100 | 52,300 | 97,500 |

| January | 86,600 | 60,100 | 109,000 |

| 2018 | |||

| December | 79,600 | 57,500 | 93,600 |

| November | 81,400 | 52,300 | 104,700 |

| October | 81,600 | 59,300 | 96,200 |

| September | 78,800 | 57,600 | 97,300 |

| August | 82,900 | 58,400 | 113,000 |

| July | 73,600 | 33,900 | 100,600 |

| June | 82,400 | 52,900 | 97,500 |

| May | 81,700 | 62,400 | 104,300 |

| April | 87,300 | 54,900 | 109,900 |

| March | 70,900 | 50,400 | 96,600 |

| February | 80,400 | 50,800 | 98,200 |

| January | 79,500 | 52,400 | 106,000 |

| 2017 | |||

| December | 76,900 | 49,200 | 100,300 |

| November | 75,300 | 49,400 | 107,000 |

| October | 76,300 | 45,100 | 96,900 |

| September | 72,400 | 50,800 | 92,700 |

| August | 70,400 | 50,400 | 88,700 |

| July | 80,700 | 52,500 | 102,100 |

| June | 84,800 | 57,300 | 95,500 |

| May | 78,800 | 55,500 | 93,300 |

| April | 79,600 | 53,800 | 100,200 |

| March | 76,900 | 56,700 | 100,700 |

| February | 86,500 | 48,700 | 96,300 |

| January | 84,700 | 59,900 | 99,600 |

| 2016 | |||

| December | 73,900 | 44,200 | 92,800 |

| November | 70,800 | 45,500 | 94,000 |

| October | 75,300 | 45,700 | 90,700 |

| September | 79,600 | 55,400 | 101,800 |

| August | 86,100 | 57,500 | 106,600 |

| July | 73,900 | 53,400 | 103,600 |

| June | 85,000 | 50,900 | 113,700 |

| May | 75,900 | 45,900 | 99,600 |

| April | 78,600 | 45,400 | 100,100 |

| March | 72,800 | 45,100 | 103,200 |

| February | 81,500 | 50,000 | 97,300 |

| January | 69,400 | 48,100 | 90,700 |

| Midwest | |||

| Total1 | Single | Double | |

| 2022 | |||

| January | 108,300 | 82,800 | 145,400 |

| 2021 | |||

| December | 103,300 | 88,200 | 129,400 |

| November | 107,300 | 78,100 | 143,800 |

| October | 101,000 | 81,000 | 132,600 |

| September | 109,300 | 80,900 | 142,300 |

| August | 100,000 | 77,000 | 132,000 |

| July | 110,500 | 79,100 | 139,300 |

| June | 94,900 | 65,600 | 125,800 |

| May | 94,300 | 67,500 | 128,200 |

| April | 85,400 | 61,800 | 125,400 |

| March | 86,400 | 60,800 | 119,100 |

| February | 87,300 | 62,400 | 118,100 |

| January | 83,000 | 62,100 | 112,700 |

| 2020 | |||

| December | 77,100 | 55,800 | 107,900 |

| November | 81,000 | 62,400 | 117,400 |

| October | 81,700 | 58,300 | 108,000 |

| September | 72,100 | 52,800 | 98,300 |

| August | 75,900 | 59,500 | 97,600 |

| July | 72,600 | 56,900 | 97,000 |

| June | 81,400 | 56,100 | 115,200 |

| May | 73,400 | 56,800 | 100,900 |

| April | 79,500 | 57,000 | 105,000 |

| March | 79,200 | 55,300 | 108,400 |

| February | 70,900 | 55,200 | 98,200 |

| January | 74,200 | 55,400 | 101,800 |

| 2019 | |||

| December | 70,200 | 54,400 | 96,100 |

| November | 73,400 | 50,600 | 104,000 |

| October | 72,100 | 53,800 | 100,200 |

| September | 71,900 | 55,900 | 98,400 |

| August | 75,700 | 52,500 | 99,800 |

| July | 74,400 | 53,900 | 105,700 |

| June | 72,600 | 52,700 | 97,100 |

| May | 72,300 | 56,000 | 98,100 |

| April | 70,800 | 56,700 | 91,900 |

| March | 71,300 | 49,900 | 96,300 |

| February | 72,500 | 56,000 | 97,200 |

| January | 68,000 | 54,200 | 98,000 |

| 2018 | |||

| December | 74,300 | 53,800 | 96,400 |

| November | 74,100 | 56,200 | 101,900 |

| October | 73,100 | 56,700 | 94,300 |

| September | 76,700 | 58,300 | 105,500 |

| August | 73,600 | 54,500 | 97,800 |

| July | 79,600 | 57,300 | 104,500 |

| June | 77,400 | 52,700 | 99,700 |

| May | 72,500 | 57,600 | 92,900 |

| April | 67,300 | 51,600 | 92,800 |

| March | 67,700 | 50,600 | 93,800 |

| February | 72,100 | 49,700 | 98,000 |

| January | 59,300 | 44,900 | 85,600 |

| 2017 | |||

| December | 64,900 | 48,700 | 84,500 |

| November | 68,100 | 48,500 | 90,500 |

| October | 65,600 | 48,600 | 88,600 |

| September | 62,800 | 45,500 | 87,200 |

| August | 65,300 | 48,200 | 88,600 |

| July | 70,900 | 48,200 | 89,400 |

| June | 69,400 | 49,900 | 94,300 |

| May | 64,600 | 45,200 | 84,400 |

| April | 63,900 | 47,800 | 84,500 |

| March | 64,500 | 49,600 | 83,900 |

| February | 61,500 | 46,800 | 84,700 |

| January | 59,800 | 45,800 | 85,100 |

| 2016 | |||

| December | 67,100 | 45,000 | 85,800 |

| November | 58,900 | 46,500 | 84,700 |

| October | 60,200 | 47,600 | 81,300 |

| September | 62,400 | 46,100 | 96,500 |

| August | 60,800 | 45,500 | 84,300 |

| July | 65,900 | 48,200 | 91,700 |

| June | 61,500 | 45,100 | 84,100 |

| May | 63,500 | 46,700 | 86,600 |

| April | 61,600 | 45,900 | 86,900 |

| March | 59,200 | 46,200 | 83,200 |

| February | 57,900 | 45,600 | 85,100 |

| January | 61,400 | 48,200 | 86,800 |

| South | |||

| Total1 | Single | Double | |

| 2022 | |||

| January | 122,700 | 85,400 | 153,300 |

| 2021 | |||

| December | 123,500 | 80,000 | 149,600 |

| November | 110,700 | 77,000 | 138,400 |

| October | 110,700 | 81,900 | 136,400 |

| September | 119,300 | 78,500 | 142,200 |

| August | 112,000 | 80,000 | 139,000 |

| July | 119,200 | 74,500 | 137,100 |

| June | 107,500 | 70,700 | 128,000 |

| May | 109,900 | 70,600 | 129,200 |

| April | 100,400 | 67,700 | 122,200 |

| March | 98,100 | 63,700 | 122,400 |

| February | 98,100 | 67,100 | 121,800 |

| January | 94,000 | 64,600 | 117,300 |

| 2020 | |||

| December | 90,100 | 64,500 | 109,900 |

| November | 92,600 | 64,200 | 109,700 |

| October | 87,400 | 56,500 | 107,900 |

| September | 86,900 | 58,400 | 105,700 |

| August | 87,900 | 56,800 | 109,100 |

| July | 83,700 | 59,500 | 101,300 |

| June | 82,700 | 51,700 | 106,800 |

| May | 85,200 | 54,100 | 108,500 |

| April | 84,000 | 51,600 | 106,100 |

| March | 82,000 | 53,300 | 106,900 |

| February | 82,000 | 55,300 | 105,600 |

| January | 86,200 | 55,200 | 108,100 |

| 2019 | |||

| December | 87,900 | 54,600 | 106,900 |

| November | 79,500 | 52,500 | 104,800 |

| October | 81,600 | 52,500 | 103,400 |

| September | 80,200 | 55,100 | 99,300 |

| August | 81,400 | 48,700 | 106,600 |

| July | 78,100 | 54,900 | 100,300 |

| June | 83,400 | 53,200 | 100,500 |

| May | 75,800 | 53,600 | 95,000 |

| April | 77,100 | 54,000 | 99,300 |

| March | 77,800 | 50,900 | 101,600 |

| February | 84,800 | 52,600 | 106,600 |

| January | 81,100 | 51,400 | 101,700 |

| 2018 | |||

| December | 80,100 | 51,500 | 104,900 |

| November | 77,100 | 54,600 | 97,800 |

| October | 79,800 | 53,500 | 105,900 |

| September | 81,600 | 51,900 | 104,500 |

| August | 79,800 | 54,500 | 98,100 |

| July | 74,900 | 51,300 | 94,000 |

| June | 83,200 | 55,100 | 97,100 |

| May | 79,000 | 56,300 | 97,000 |

| April | 71,100 | 48,600 | 95,300 |

| March | 68,900 | 50,000 | 88,900 |

| February | 70,600 | 46,700 | 91,200 |

| January | 64,400 | 46,300 | 85,900 |

| 2017 | |||

| December | 70,000 | 54,000 | 89,000 |

| November | 65,800 | 45,900 | 91,600 |

| October | 64,200 | 45,700 | 93,600 |

| September | 68,800 | 46,600 | 89,000 |

| August | 72,500 | 47,200 | 91,500 |

| July | 70,300 | 47,900 | 88,400 |

| June | 70,800 | 49,300 | 91,600 |

| May | 68,500 | 49,400 | 84,000 |

| April | 70,900 | 45,500 | 86,600 |

| March | 67,000 | 50,700 | 84,600 |

| February | 66,200 | 48,400 | 87,300 |

| January | 64,600 | 44,000 | 85,900 |

| 2016 | |||

| December | 71,400 | 50,100 | 89,000 |

| November | 72,100 | 47,100 | 88,000 |

| October | 71,300 | 47,500 | 84,700 |

| September | 65,300 | 45,400 | 89,300 |

| August | 71,600 | 46,100 | 91,300 |

| July | 70,200 | 47,700 | 87,100 |

| June | 66,800 | 44,900 | 81,500 |

| May | 69,800 | 45,000 | 84,600 |

| April | 64,900 | 42,500 | 85,000 |

| March | 69,600 | 44,100 | 86,300 |

| February | 65,300 | 43,000 | 89,700 |

| January | 65,200 | 44,600 | 80,200 |

| West | |||

| Total1 | Single | Double | |

| 2022 | |||

| January | 140,800 | 80,700 | 161,000 |

| 2021 | |||

| December | 145,200 | 76,900 | 170,600 |

| November | 128,800 | 68,400 | 145,500 |

| October | 131,600 | 85,000 | 150,400 |

| September | 132,100 | 76,200 | 141,600 |

| August | 135,000 | 79,000 | 143,000 |

| July | 131,100 | 81,700 | 142,800 |

| June | 116,400 | 72,200 | 131,500 |

| May | 104,400 | 70,300 | 125,500 |

| April | 118,400 | 65,000 | 125,000 |

| March | 113,000 | 67,300 | 130,800 |

| February | 116,900 | 60,900 | 131,900 |

| January | 113,400 | 62,300 | 129,500 |

| 2020 | |||

| December | 108,800 | 64,500 | 115,900 |

| November | 115,400 | 60,100 | 128,200 |

| October | 108,900 | 61,200 | 120,000 |

| September | 110,100 | 68,600 | 126,600 |

| August | 104,900 | 60,500 | 119,500 |

| July | 103,700 | 72,100 | 113,200 |

| June | 102,700 | 55,600 | 117,000 |

| May | 105,100 | 60,700 | 117,800 |

| April | 111,800 | 64,500 | 120,300 |

| March | 92,600 | 54,300 | 106,700 |

| February | 103,500 | 59,600 | 118,900 |

| January | 103,400 | 59,900 | 111,300 |

| 2019 | |||

| December | 97,700 | 52,100 | 107,600 |

| November | 101,400 | 54,100 | 114,700 |

| October | 96,600 | 58,800 | 109,100 |

| September | 99,500 | 55,300 | 113,000 |

| August | 107,500 | 48,200 | 120,700 |

| July | 108,400 | 45,700 | 121,000 |

| June | 100,600 | 47,000 | 118,800 |

| May | 96,300 | 55,000 | 106,800 |

| April | 95,400 | 63,600 | 109,100 |

| March | 92,900 | 49,100 | 108,500 |

| February | 103,100 | 43,500 | 119,400 |

| January | 95,800 | 59,000 | 110,400 |

| 2018 | |||

| December | 101,400 | 51,600 | 120,400 |

| November | 99,300 | 62,600 | 107,800 |

| October | 105,100 | 57,300 | 116,500 |

| September | 102,600 | 62,000 | 111,600 |

| August | 97,400 | 57,600 | 110,300 |

| July | 102,800 | 59,300 | 118,200 |

| June | 105,000 | 57,600 | 122,900 |

| May | 104,000 | 60,300 | 108,900 |

| April | 103,100 | 67,400 | 113,400 |

| March | 82,900 | 45,800 | 98,700 |

| February | 87,100 | 53,900 | 100,600 |

| January | 98,900 | 59,400 | 114,200 |

| 2017 | |||

| December | 96,400 | 58,600 | 103,900 |

| November | 114,500 | 49,800 | 130,300 |

| October | 95,200 | 50,900 | 106,900 |

| September | 95,600 | 51,700 | 116,700 |

| August | 91,600 | 46,600 | 110,900 |

| July | 99,700 | 44,500 | 111,900 |

| June | 106,300 | 46,600 | 125,000 |

| May | 94,900 | 47,800 | 104,500 |

| April | 93,000 | 57,200 | 104,300 |

| March | 89,800 | 49,400 | 99,400 |

| February | 104,200 | 59,000 | 115,100 |

| January | 93,600 | 45,800 | 107,100 |

| 2016 | |||

| December | 85,900 | 56,000 | 101,500 |

| November | 89,200 | 48,100 | 108,900 |

| October | 85,100 | 54,100 | 104,000 |

| September | 93,900 | 58,000 | 99,000 |

| August | 95,000 | 79,900 | 99,600 |

| July | 96,800 | 67,700 | 100,600 |

| June | 89,000 | 57,100 | 100,300 |

| May | 83,500 | 48,000 | 96,400 |

| April | 85,400 | 53,900 | 92,900 |

| March | 83,200 | 42,500 | 97,000 |

| February | 84,800 | 45,400 | 106,600 |

| January | 86,900 | 50,000 | 96,100 |

Additional Census Bureau Provided Facts

Wealth inequality between homeowners and renters is striking: Homeowners’ median net worth is 80 times larger than renters’ median net worth.

That’s just one of the findings of a recent U.S. Census Bureau report and detailed tables on household wealth in 2015 that reveals wide variations across demographic and socioeconomic groups.

New household wealth measures became available with the release of the redesigned Survey of Income and Program Participation (SIPP). The SIPP’s sample size enables comparisons of the assets of many populations and groups, such as low-income households and households with or without children.

Household Wealth Highlights

- Biggest contributors: Just two assets — home equity and retirement accounts — accounted for 62.9% of households’ net worth in 2015.

While many households owned these assets, others did not: 37% of households did not own a home and 47.1% of households did not have a retirement account. This gap in two key assets contributes to wealth inequality. - Bank accounts: Some commonly held assets make up a small portion of household wealth.

In 2015, 90.9% of households held accounts at a bank or credit union. However, the accounts were only 8.5% of total household net worth. - Health insurance: Households in which people were without health insurance all or part of the year had dramatically lower median wealth: $16,860, compared with $114,000 for households in which all members had health insurance for the entire year.

- Age and gender: Unmarried female householders (the person who owns or rents the home) ages 35 to 54 had a median wealth of $14,860. That represented 39.5% of their unmarried male counterparts’ wealth.

The difference disappeared at ages 55 to 64, when both unmarried women and men who were heads of households had a wealth of about $60,000. - Race and Hispanic origin: Non-Hispanic white and Asian householders had more household wealth than black and Hispanic householders.

Non-Hispanic whites had a median household wealth of $139,300, compared with $12,780 for black householders and $19,990 for Hispanic householders.

Asians had a median household wealth of $156,300, which is not statistically different from the estimate for non-Hispanic whites. - Education: Higher education is associated with more wealth. Households in which the most educated member held a bachelor’s degree had a median wealth of $163,700, compared with $38,900 for households where the most educated member had a high school diploma.

- Employment: The unemployed and those who work part-time have less wealth.

Households in which at least one person had a full-time job for the entire year had a median wealth of $101,000, compared with $61,690 for households where one or more members had a part-time job during the year, and $22,100 for households where one or more were unemployed. …##

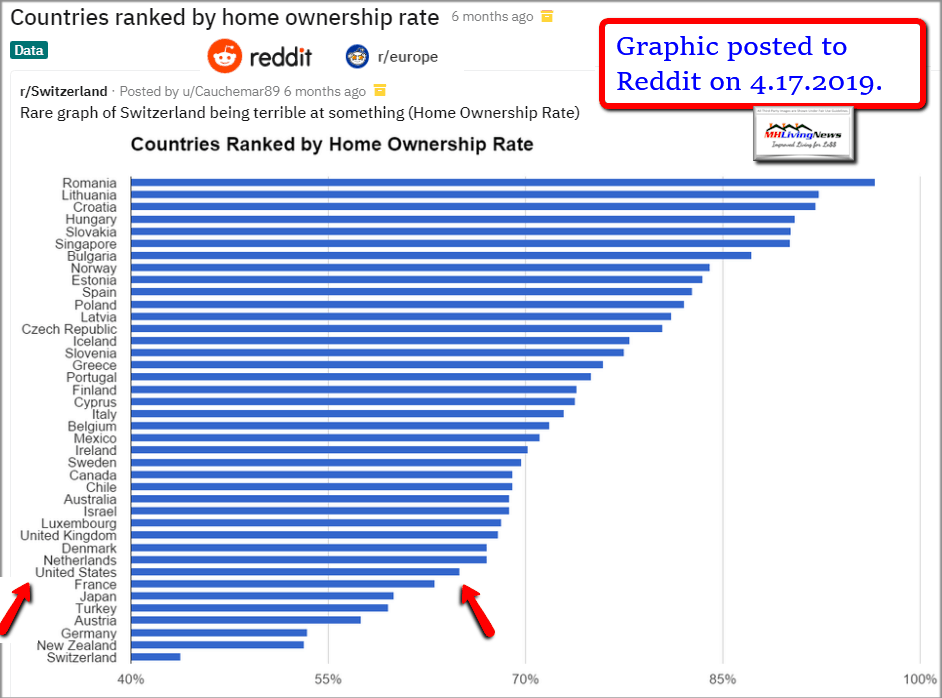

As part of the broader context for the above ought to be a comparison between the U.S. rate of homeownership vs. that of the top nations by percentage of homeownership on earth. The U.S., per Reddit and Wikipedia trails over 40 nations in the rate of homeownership. Yet, the average household incomes in the U.S. are higher than many of these other nations.

Jun 12, 2022 14:55 UTC

TOP 10 MOST POPULOUS COUNTRIES (JULY 1, 2021)

| China | 1,410,539,758 |

| India | 1,389,637,446 |

| United States | 332,838,183 |

| Indonesia | 277,329,163 |

| Pakistan | 242,923,845 |

| Nigeria | 225,082,083 |

| Brazil | 217,240,060 |

| Bangladesh | 165,650,475 |

| Russia | 142,021,981 |

| Mexico | 129,150,971 |

With the Census Bureau provided facts in mind, consider the following extended quotation from Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR). Said Weiss, speaking about the elite leaders “of the “woke” mob – inside government and out — will never admit that they actually oppose affordable housing and homeownership for millions of lower and moderate-income Americans, including inherently affordable manufactured housing. But they do, with every means available to them. Naturally, they deny the truth of what they do to undermine affordable homeownership for lower-income Americans. In fact, they will tell you just the opposite – that they really care about lower-income people and that, through their various efforts, they simply want what (supposedly) is best for them. The comments filed by various “consumer” and “housing” organizations in the recent U.S. Department of Energy (DOE) rulemaking concerning manufactured housing “energy conservation” standards – and the standards themselves — are a good example. But it’s all a lie — a phony, fake narrative. The truth is that the “woke” elite hates affordable homeownership, at least for the lower and moderate-income Americans who they use as political pawns.”

More from that MHARR Mark Weiss thesis will be published this week. Stay tuned. In the meantime, see the related reports for more current data and insights.

Again, our thanks to you, our sources, and sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.