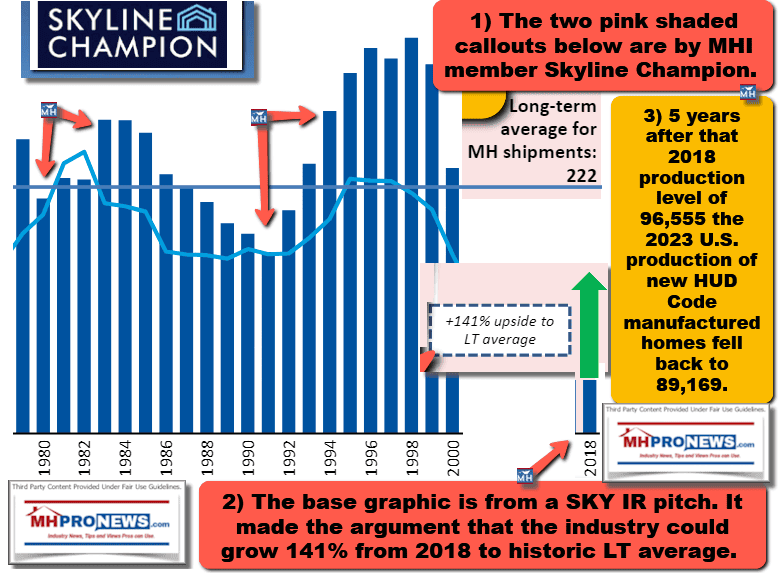

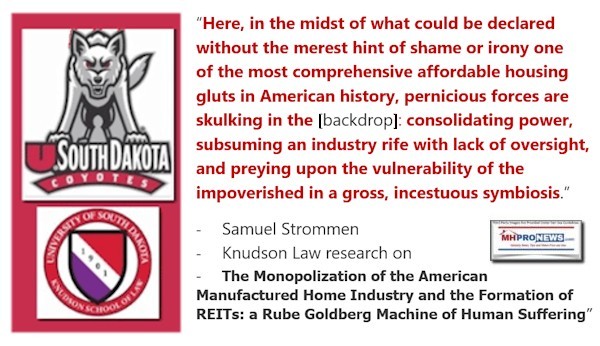

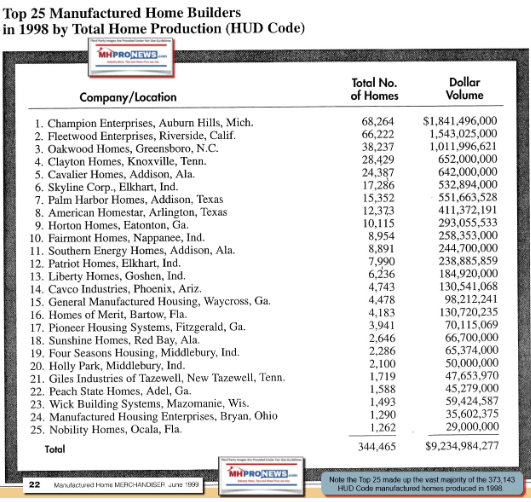

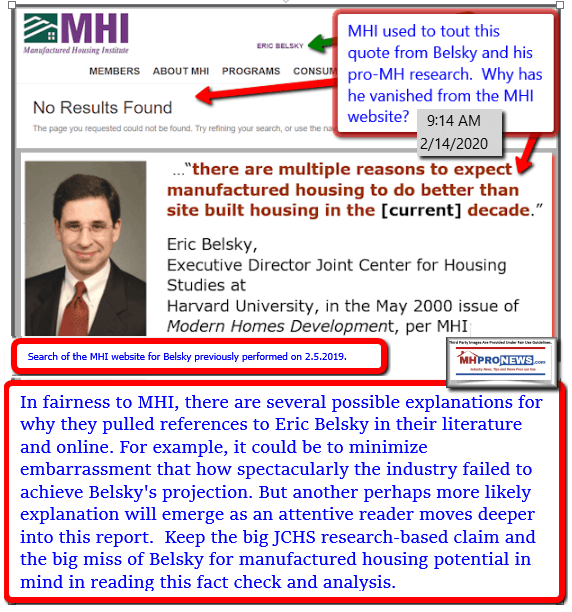

The National Association of Realtors (NAR) press release in Part I reveals that existing conventional housing sales took a dip in March by 5.9 percent. Other conventional housing market insights from the NAR are included. Part II is the state-by-state data from the Institute for Building Technology & Safety (IBTS), still HUD’s contractor for ‘official’ manufactured housing production/shipments data. Part III provides some insights from the market/news/investor site, Defense World, which mistakenly still calls “Skyline Champion” (SKY – since rebranded as Champion Homes). Despite that glitch, other insights from Defense World and other sources on Champion Homes (SKY) will be considered. Newcomers should know that MHVille is a term used to describe the artificially diminished manufactured home industry in the 21st century. Linked evidence for those concerns about MHVille are found in Part III. FEA is short for Facts-Evidence-Analysis.

MHProNews notes as a disclosure that reporting on Champion Homes (SKY) should NOT be considered as an endorsement of that firm or of their stock as an investment.

With that brief tee-up, let’s dive into new data and insights.

Part I

News Release

|

|

MEDIA COMMUNICATIONS

For further information contact: Troy Green, 202/383-1042

|

Existing-Home Sales Receded 5.9% in March

For the first time, the median home price eclipsed $400,000 for the month of March

Key Highlights

- Existing-home sales slipped 5.9% in March to a seasonally adjusted annual rate of 4.02 million. Sales slowed 2.4% from one year ago.

- The median existing-home sales price climbed 2.7% from March 2024 to $403,700, an all-time high for the month of March and the 21st consecutive month of year-over-year price increases.

- The inventory of unsold existing homes jumped 8.1% from the previous month to 1.33 million at the end of March, or the equivalent of 4.0 months’ supply at the current monthly sales pace.

WASHINGTON (April 24, 2025) – Existing-home sales descended in March, according to the National Association of Realtors®. Sales slid in all four major U.S. regions. Year-over-year, sales dropped in the Midwest and South, increased in the West and were unchanged in the Northeast.

Total existing-home sales[1] – completed transactions that include single-family homes, townhomes, condominiums and co-ops – fell 5.9% from February to a seasonally adjusted annual rate of 4.02 million in March. Year-over-year, sales drew back 2.4% (down from 4.12 million in March 2024).

“Home buying and selling remained sluggish in March due to the affordability challenges associated with high mortgage rates,” said NAR Chief Economist Lawrence Yun. “Residential housing mobility, currently at historical lows, signals the troublesome possibility of less economic mobility for society.”

Total housing inventory[2] registered at the end of March was 1.33 million units, up 8.1% from February and 19.8% from one year ago (1.11 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, up from 3.5 months in February and 3.2 months in March 2024.

The median existing-home price[3] for all housing types in March was $403,700, up 2.7% from one year ago ($392,900). All four U.S. regions registered price increases.

“In a stark contrast to the stock and bond markets, household wealth in residential real estate continues to reach new heights,” Yun said. “With mortgage delinquencies at near-historical lows, the housing market is on solid footing. A small deceleration in home price gains, which was slightly below wage-growth increases in March, would be a welcome improvement for affordability. With real estate asset valuation at $52 trillion, according to the Federal Reserve Flow of Funds, each percentage point gain in home prices adds more than $500 billion to the household balance sheet.”

According to the monthly REALTORS® Confidence Index, properties typically remained on the market for 36 days in March, down from 42 days in February but up from 33 days in March 2024.

First-time buyers were responsible for 32% of sales in March, up from 31% in February 2025 and identical to March 2024. NAR’s 2024 Profile of Home Buyers and Sellers – released November 2024[4] – found that the annual share of first-time buyers was 24%, the lowest ever recorded.

Cash sales accounted for 26% of transactions in March, down from 32% in February and 28% in March 2024.

Individual investors or second-home buyers, who make up many cash sales, purchased 15% of homes in March, down from 16% in February and unchanged from March 2024.

Distressed sales[5] – foreclosures and short sales – represented 3% of sales in March, unchanged from February and up from 2% the prior year.

Mortgage Rates

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.83% as of April 17. That’s up from 6.62% one week before but down from 7.1% one year ago.

Single-family and Condo/Co-op Sales

Single-family home sales retreated 6.4% to a seasonally adjusted annual rate of 3.64 million in March, down 2.2% from the previous year. The median existing single-family home price was $408,000 in March, up 2.9% from March 2024.

Existing condominium and co-op sales were unchanged in March at a seasonally adjusted annual rate of 380,000 units, down 5.0% from one year ago. The median existing condo price was $363,000 in March, up 1.5% from the prior year ($357,700).

Regional Breakdown

In March, existing-home sales in the Northeast declined 2.0% from February to an annual rate of 490,000, identical to March 2024. The median price in the Northeast was $468,000, up 7.7% from one year earlier.

In the Midwest, existing-home sales waned 5.0% in March to an annual rate of 950,000, down 3.1% from the previous year. The median price in the Midwest was $302,100, up 3.5% from March 2024.

Existing-home sales in the South contracted 5.7% from February to an annual rate of 1.81 million in March, down 4.2% from one year before. The median price in the South was $360,400, up 0.6% from last year.

In the West, existing-home sales plunged 9.4% in March to an annual rate of 770,000, up 1.3% from a year ago. The median price in the West was $621,200, up 2.6% from March 2024.

About the National Association of Realtors®

As America’s largest trade association, the National Association of Realtors® is involved in all aspects of residential and commercial real estate. The term Realtor® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of Realtors® and subscribes to its strict Code of Ethics. For free consumer guides about navigating the homebuying and selling transaction processes – from written buyer agreements to negotiating compensation – visit facts.realtor.

# # #

For local information, please contact the local association of Realtors® for data from local multiple listing services (MLS). Local MLS data is the most accurate source of sales and price information in specific areas, although there may be differences in reporting methodology.

NOTE: NAR’s Pending Home Sales Index for March will be released April 30, and Existing-Home Sales for April will be released May 22. Release times are 10 a.m. Eastern. See NAR’s statistical news release schedule.

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

[1] Existing-home sales, which include single-family, townhomes, condominiums and co-ops, are based on transaction closings from Multiple Listing Services. Changes in sales trends outside of MLSs are not captured in the monthly series. NAR benchmarks home sales periodically using other sources to assess overall home sales trends, including sales not reported by MLSs.

Existing-home sales, based on closings, differ from the U.S. Census Bureau’s series on new single-family home sales, which are based on contracts or the acceptance of a deposit. Because of these differences, it is not uncommon for each series to move in different directions in the same month. In addition, existing-home sales, which account for more than 90% of total home sales, are based on a much larger data sample – about 40% of multiple listing service data each month – and typically are not subject to large prior-month revisions.

The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. Seasonally adjusted annual rates are used in reporting monthly data to factor out seasonal variations in resale activity. For example, home sales volume is normally higher in the summer than in the winter, primarily because of differences in the weather and family buying patterns. However, seasonal factors cannot compensate for abnormal weather patterns.

Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began. Prior to this period, single-family homes accounted for more than nine out of 10 purchases. Historic comparisons for total home sales prior to 1999 are based on monthly single-family sales, combined with the corresponding quarterly sales rate for condos.

[2] Total inventory and month’s supply data are available back through 1999, while single-family inventory and month’s supply are available back to 1982 (prior to 1999, single-family sales accounted for more than 90% of transactions and condos were measured only on a quarterly basis).

[3] The median price is where half sold for more and half sold for less; medians are more typical of market conditions than average prices, which are skewed higher by a relatively small share of upper-end transactions. The only valid comparisons for median prices are with the same period a year earlier due to seasonality in buying patterns. Month-to-month comparisons do not compensate for seasonal changes, especially for the timing of family buying patterns. Changes in the composition of sales can distort median price data. Year-ago median and mean prices sometimes are revised in an automated process if additional data is received.

The national median condo/co-op price often is higher than the median single-family home price because condos are concentrated in higher-cost housing markets. However, in a given area, single-family homes typically sell for more than condos as seen in NAR’s quarterly metro area price reports.

[4] Survey results represent owner-occupants and differ from separately reported monthly findings from NAR’s REALTORS® Confidence Index, which include all types of buyers. The annual study only represents primary residence purchases, and does not include investor and vacation home buyers. Results include both new and existing homes.

[5] Distressed sales (foreclosures and short sales), days on market, first-time buyers, all-cash transactions and investors are from a monthly survey for the NAR’s REALTORS® Confidence Index, posted at nar.realtor.

—

Part II – Manufactured Home Production and Shipments in all 50 States, Washington D.C., and Puerto Rico for February 2025

| Institute for Building Technology & Safety | |||||||||

| Shipments and Production Summary Report 2/01/2025 – 2/28/2025 | |||||||||

| Notes: SW – Single Section | MW- Multi-Sectionals | Floors-a single section is one floor. Multi-sectionals are two or more floors. | |||||||

| Shipments | ||||

| State | SW | MW | Total | Floors |

| Dest. Pending | 9 | 20 | 29 | 49 |

| Alabama | 240 | 233 | 473 | 708 |

| Alaska | 0 | 1 | 1 | 2 |

| Arizona | 68 | 158 | 226 | 386 |

| Arkansas | 61 | 69 | 130 | 200 |

| California | 54 | 210 | 264 | 484 |

| Colorado | 27 | 35 | 62 | 97 |

| Connecticut | 9 | 0 | 9 | 9 |

| Delaware | 8 | 25 | 33 | 58 |

| District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 163 | 371 | 534 | 907 |

| Georgia | 143 | 284 | 427 | 710 |

| Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 7 | 18 | 25 | 47 |

| Illinois | 47 | 38 | 85 | 123 |

| Indiana | 96 | 59 | 155 | 214 |

| Iowa | 39 | 2 | 41 | 43 |

| Kansas | 12 | 6 | 18 | 24 |

| Kentucky | 129 | 182 | 311 | 493 |

| Louisiana | 281 | 141 | 422 | 564 |

| Maine | 8 | 27 | 35 | 62 |

| Maryland | 12 | 10 | 22 | 32 |

| Massachusetts | 9 | 1 | 10 | 11 |

| Michigan | 182 | 152 | 334 | 486 |

| Minnesota | 11 | 15 | 26 | 41 |

| Mississippi | 187 | 177 | 364 | 542 |

| Missouri | 40 | 71 | 111 | 182 |

| Montana | 13 | 13 | 26 | 39 |

| Nebraska | 0 | 1 | 1 | 2 |

| Nevada | 6 | 42 | 48 | 90 |

| New Hampshire | 8 | 4 | 12 | 16 |

| New Jersey | 11 | 14 | 25 | 39 |

| New Mexico | 41 | 83 | 124 | 208 |

| New York | 43 | 53 | 96 | 149 |

| North Carolina | 199 | 274 | 473 | 747 |

| North Dakota | 5 | 13 | 18 | 31 |

| Ohio | 138 | 61 | 199 | 260 |

| Oklahoma | 84 | 118 | 202 | 320 |

| Oregon | 31 | 79 | 110 | 194 |

| Pennsylvania | 83 | 97 | 180 | 276 |

| Rhode Island | 0 | 0 | 0 | 0 |

| South Carolina | 156 | 272 | 428 | 699 |

| South Dakota | 8 | 15 | 23 | 38 |

| Tennessee | 95 | 243 | 338 | 582 |

| Texas | 581 | 870 | 1,451 | 2,324 |

| Utah | 8 | 16 | 24 | 41 |

| Vermont | 9 | 5 | 14 | 18 |

| Virginia | 54 | 80 | 134 | 214 |

| Washington | 23 | 114 | 137 | 258 |

| West Virginia | 37 | 60 | 97 | 157 |

| Wisconsin | 28 | 22 | 50 | 72 |

| Wyoming | 8 | 3 | 11 | 14 |

| Canada | 0 | 0 | 0 | 0 |

| Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 3,511 | 4,857 | 8,368 | 13,262 |

| THE ABOVE STATISTICS ARE PROVIDED AS A MONTHLY | ||||

| SUBSCRIPTION SERVICE. REPRODUCTION IN PART OR | ||||

| IN TOTAL MUST CARRY AN ATTRIBUTION TO IBTS, INC. | ||||

| Production | ||||

| State | SW | MW | Total | Floors |

| States Shown(*) | 174 | 233 | 407 | 641 |

| Alabama | 710 | 764 | 1,474 | 2,245 |

| *Alaska | 0 | 0 | 0 | 0 |

| Arizona | 42 | 180 | 222 | 404 |

| *Arkansas | 0 | 0 | 0 | 0 |

| California | 61 | 202 | 263 | 474 |

| *Colorado | 0 | 0 | 0 | 0 |

| *Connecticut | 0 | 0 | 0 | 0 |

| *Delaware | 0 | 0 | 0 | 0 |

| *District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 33 | 168 | 201 | 370 |

| Georgia | 147 | 395 | 542 | 936 |

| *Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 31 | 73 | 104 | 185 |

| *Illinois | 0 | 0 | 0 | 0 |

| Indiana | 479 | 266 | 745 | 1,011 |

| *Iowa | 0 | 0 | 0 | 0 |

| *Kansas | 0 | 0 | 0 | 0 |

| *Kentucky | 0 | 0 | 0 | 0 |

| *Louisiana | 0 | 0 | 0 | 0 |

| *Maine | 0 | 0 | 0 | 0 |

| *Maryland | 0 | 0 | 0 | 0 |

| *Massachusetts | 0 | 0 | 0 | 0 |

| *Michigan | 0 | 0 | 0 | 0 |

| Minnesota | 32 | 49 | 81 | 130 |

| *Mississippi | 0 | 0 | 0 | 0 |

| *Missouri | 0 | 0 | 0 | 0 |

| *Montana | 0 | 0 | 0 | 0 |

| *Nebraska | 0 | 0 | 0 | 0 |

| *Nevada | 0 | 0 | 0 | 0 |

| *New Hampshire | 0 | 0 | 0 | 0 |

| *New Jersey | 0 | 0 | 0 | 0 |

| *New Mexico | 0 | 0 | 0 | 0 |

| *New York | 0 | 0 | 0 | 0 |

| North Carolina | 213 | 304 | 517 | 821 |

| *North Dakota | 0 | 0 | 0 | 0 |

| Ohio | 70 | 22 | 92 | 114 |

| *Oklahoma | 0 | 0 | 0 | 0 |

| Oregon | 44 | 184 | 228 | 422 |

| Pennsylvania | 178 | 242 | 420 | 660 |

| *Rhode Island | 0 | 0 | 0 | 0 |

| *South Carolina | 0 | 0 | 0 | 0 |

| *South Dakota | 0 | 0 | 0 | 0 |

| Tennessee | 457 | 750 | 1,207 | 1,957 |

| Texas | 811 | 1,001 | 1,812 | 2,815 |

| *Utah | 0 | 0 | 0 | 0 |

| *Vermont | 0 | 0 | 0 | 0 |

| *Virginia | 0 | 0 | 0 | 0 |

| *Washington | 0 | 0 | 0 | 0 |

| *West Virginia | 0 | 0 | 0 | 0 |

| Wisconsin | 29 | 24 | 53 | 77 |

| *Wyoming | 0 | 0 | 0 | 0 |

| *Canada | 0 | 0 | 0 | 0 |

| *Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 3,511 | 4,857 | 8,368 | 13,262 |

| (*) THESE STATES HAVE FEWER THAN THREE PLANTS. | ||||

| FIGURES ARE AGGREGATED ON FIRST LINE ABOVE | ||||

| TOTALS TO PROTECT PROPRIETARY INFORMATION. | ||||

| Ashok K Goswami, PE, COO, 45207 Research Place, Ashburn, VA |

Part III – Additional Information with More MHProNews Analysis and Commentary

According to Defense World, which cited SEC and other data, is the following. MHProNews note their report is dated 4.27.2025 and that they need to update their use of the name Skyline Champion to Champion Homes.

1)

Shares of Skyline Champion Co. (NYSE:SKY…) have earned an average rating of “Hold” from the five ratings firms that are currently covering the company, MarketBeat.com reports. Four analysts have rated the stock with a hold rating and one has given a buy rating to the company.

2) Insiders are Champion Homes (SKY) are selling, per Defense World which cited SEC filed data.

Insider Transactions at Skyline Champion

In other Skyline Champion news, VP Timothy A. Burkhardt sold 3,823 shares of the business’s stock in a transaction that occurred on Tuesday, February 11th. The stock was sold at an average price of $106.87, for a total transaction of $408,564.01. Following the completion of the sale, the vice president now directly owns 32,706 shares in the company, valued at approximately $3,495,290.22. The trade was a 10.47 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, EVP Joseph A. Kimmell sold 4,335 shares of the stock in a transaction that occurred on Monday, February 10th. The shares were sold at an average price of $104.21, for a total value of $451,750.35. Following the transaction, the executive vice president now directly owns 39,411 shares of the company’s stock, valued at $4,107,020.31. The trade was a 9.91 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 6.90% of the company’s stock.

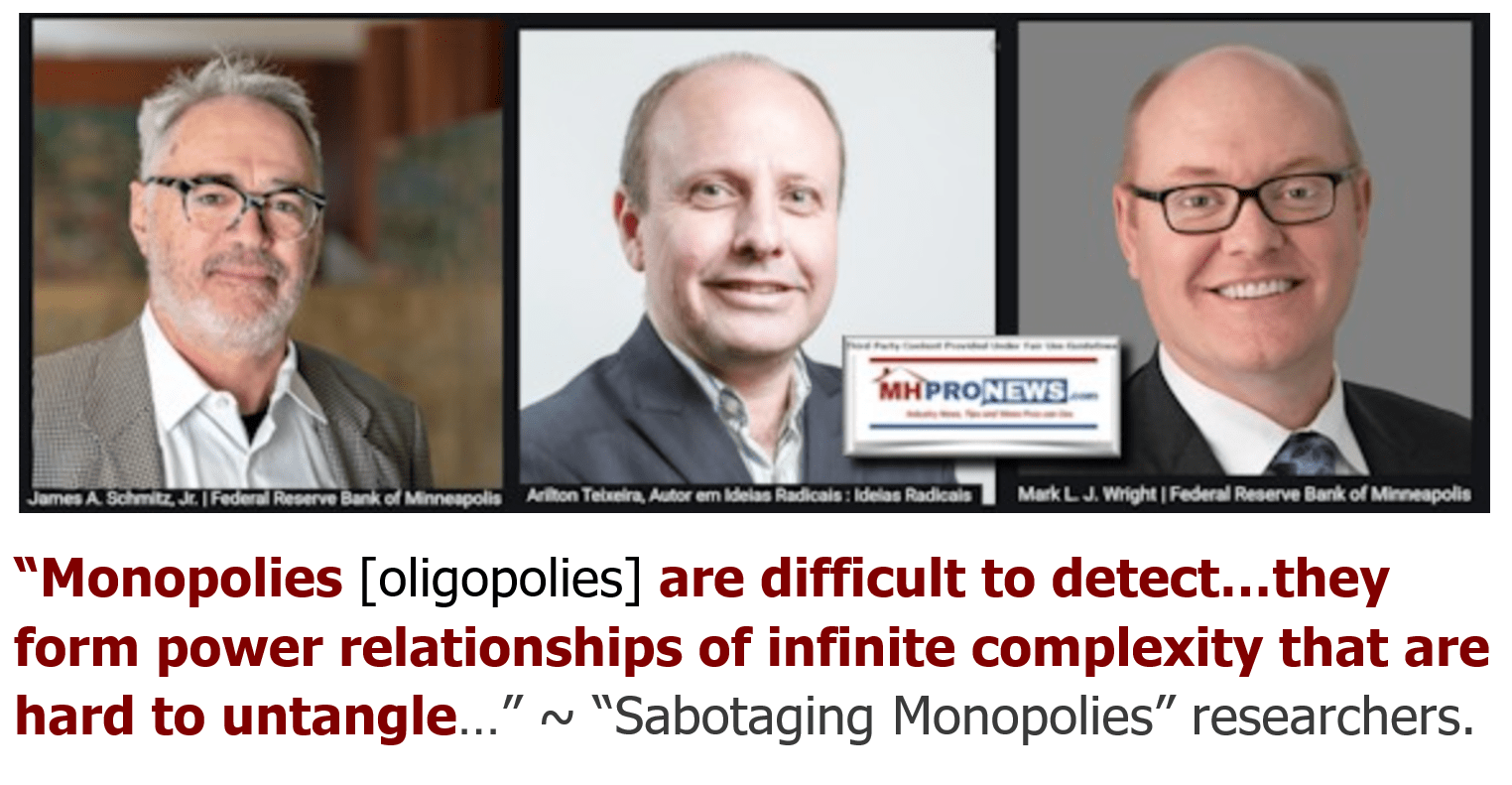

3) MHProNews previously reported that there has been a tendency among several Manufactured Housing Institute (MHI) member firm ‘insiders’ to sell rather than buy. Details are linked below.

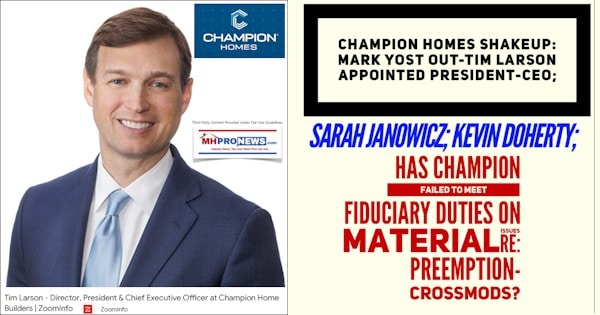

4) It should be recalled that MHProNews previously critiqued Champion’s succession plan and other announcements/IR statements at that time.

5) Per Google’s stock trends and market cap data is the following on 4.28.2025. It would seem that the markets have overall not embraced Champion’s moves since that report linked above dated December 30, 2024.

6) From the Champion Homes (SKY) website home page on this date (at about 5:35 AM ET).

A Smarter Way to Build™

We deliver innovative home designs that are high quality, affordable and attractive. We set standards that bring the dream of a quality home that much closer.