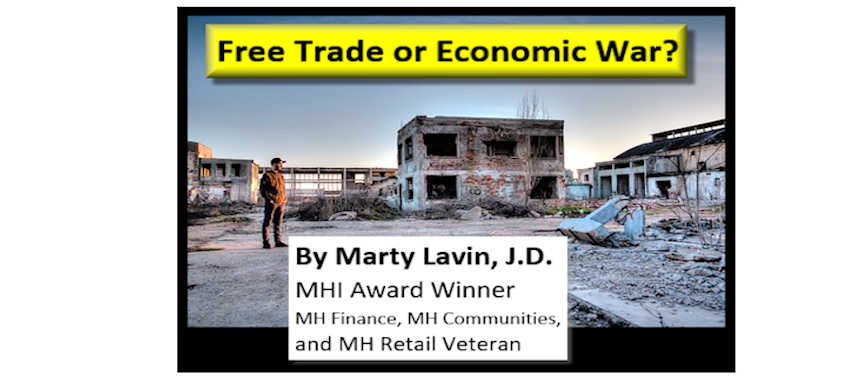

by Martin V. (Marty) Lavin

Our Friend

Ah, finally, I was intent on reviewing the innumerable documents, which built up on the computer I had used for several years. As I scanned the dozens, no hundreds of files in my documents, I came upon some, which stirred memories. Probably none more than R. C. “Dick” Moore’s “Perspective #61” of July 18, 2008. Mr. Moore, as most know, is a longtime MH retailer and community owner. As the spirit moves him, he puts out an occasional newsletter, Perspective.

And what was this memorable missive all about? Well it was a fairy tale about a mysterious “friend up east” who had MH powers similar to Superman, able to unite the GSE’s, (Fannie Mae and Freddie Mac), Clayton Homes and maybe even Citibank, and Warren Buffett himself, in an effort to stifle all competition for chattel retail lending to the industry. Wow! Strong stuff indeed.

The gist of the tale is that our “friend” was paid by the GSE’s to advise them “not to buy MH paper.” This would also lead to Citibank “pulling the rug” on Origen Financial and Palm Harbor. Then, as all competition is wiped away, Buffett borrows $2 billion in the market which he deposits in the account of the Clayton Homes’ lenders, Vanderbilt Mortgage and 21st Mortgage. While the story didn’t as much as make the back page of the Wall Street Journal, I hear Hollywood is interested enough in the story so they’ve spoken to Brad Pitt to play “our friend up east.”

Who is He!

Since “our friend” goes unnamed in the several other Moore Perspectives with stories which mention him, there has been substantial speculation on who “our friend up east” is. Presumably with all the players involved in the alleged scenario, this has got to be one powerful S.O.B. Who could it be to wield such power? It’s not Warren. He’s “our friend from Omaha.”

Some came forward during this series of Perspectives and had the gall to suggest that I, the writer herein, was the powerful and mysterious “friend up east.” They have also suggested that Brad Pitt is a good semblance of Marty, and would be perfect for the starring role in the movie, or TV miniseries. Well, I’m obviously flattered but can I be the mysterious, unnamed “friend up east.” As H. Ross Perot said, let’s go to the chalkboard to figure this out.

The first clue is that “our friend” has been paid by Fannie Mae and Freddie Mac to “advise them not to buy MH loans.” That assertion is partially right. I did advise Fannie Mae for a number of years on many matters MH, especially about retail chattel lending. Other than informal, unpaid conversation, which we all have with others, I did not work for or with Freddie Mac. Nice people and all, but I never did have that paid assignment there. Too bad.

No Secret

Parenthetically, my assignment with Fannie Me was never secret, no attempt was made to hide it, by either side, and I always had the assignment on my resume on my web site. So, if I am “our friend up east,” Mr. Moore, who writes that he uncovered that “our friend” was being paid to advise the two GSE’s “about MH paper,” that “secret” information was hiding in plain sight on my web site. Best place to hide is in plain sight, they say. And while I counseled caution in buying MH loans, based on MH loan portfolio experience, I never counseled anyone not to buy any loans, only those likely to cause alimentary canal back up. But that doesn’t establish me as “our friend up east,” does it?

A second allegation is that “our friend” and the Clayton folks were dining together.” Well, yes Kevin Clayton is a longtime friend of mine, I’ve dined with him contentedly many times, including once in D.C. when I went to the hopper late in the dinner and Kevin managed to convince me when I returned that I had lost in a game to determine who got the check for the night’s dinners. Since it was a very large group with lots of big eaters and drinkers the tab was well over $1,000.00. I’d have paid, but . . . . Kevin had the last laugh, he intended to pay all along and he did. Good boy.

Global Heart Burn

I must admit I did have dinner one night in Omaha, Nebraska with the Clayton folks during the Berkshire Hathaway annual meeting. Kevin had invited me out as a guest and I was invited to dinner by Keith Holdbrooks of Southern Energy Homes, a Clayton subsidiary, and a whole host of Clayton “Big Shots” were there. What was discussed at the table that night? The only memorable discussion I recall is that the table of 12 or 14 people all believed in the myth of man-made Global Warming, except OleMartyBoy, who tried to hold his ground. With religious fervor the group accused me of my disbelief as though I was skeptical of the Immaculate Conception, an uncomfortable situation for all. Since that 2008 dinner my vindication is nearer. But still, every American has the right to an opinion, even an uninformed one, and there are plenty around these days.

So the “dining with Clayton folks” can’t be used against me, unless we were discussing how man-made Global Warming could be used to de-stabilize MH chattel lending. Can it? Some would have you believe it can and perhaps that explains the religious fervor at the table that night.

Conspiracy Theory

So why do I go on about this? Certainly Mr. Moore is not the only MH figure to write about an industry conspiracy. The estimable George F. Allen, one of MH’s brightest stars, has often brought up the possibility of a conspiracy. And of course, the conspiracy always centers around Berkshire Hathaway and Clayton Homes. Fleetwood, Palm Harbor and Oakwood go unmentioned. The conclusion being that the reason Clayton Homes is the best of what’s left is conspiracy related. The strong management there, excellent home lines, disciplined retail lending by two of their companies, and the fortuitousness of being owned by cash rich Berkshire Hathaway, apparently account for nothing. Would or could Clayton Homes be brought down to Earth if their financial backing disappeared? Perhaps.

And finally, yes I do live in the “east,” Burlington, Vermont, being far east and regrettably, far north. But let’s go back to the chalkboard and look at facts, not conjecture. Here are some of the various facts to be considered to explain the industry slide.

- The packages of chattel loans originated and sold into the ABS market from 1995 to 2003 are amongst the very worst loans of any type ever sold to investors. If sub prime real estate is a problem, and it is, MH ABS paper is the Uber King-of-Sub Prime. Investors are loath to touch these MH ABS offerings, to this day.

- While the industry has severe operating model deficiencies, little has been done by the industry to shore up these deficiencies. Get the same liquidity to the industry it enjoyed in 1995-1999 and securitize these loans, and the result would still be bloody. Far too little has changed to make much difference. And investors not always being stupid, know this.

- The MH industry is not seen as important enough by government to subsidize its loan losses. It has been prepared to do so with conventional housing, but not chattel MH lending. Scream about it if you will, but that’s the way it is.

Subsidy Withdrawn

So, how much easier it is to cry conspiracy than to accept that from 1950 to 1998, when the music stopped, the success of the industry has constantly been subsidized by lenders? When that subsidy was withdrawn in the late ‘90’s-early 2000’s, the industry tanked. Yet, I still hear from many “it worked for 30 or 40 or 50 years.” Worked for whom, I might ask? It did not work for the lenders, so most have left.

This brings us to the present, with 2011 expecting between 40-50,000 new home shipments, a continuation of a slide of 90% since 1998. This is serious, right? Yet the industry response has been anything but serious. Most industry response has centered around Washington, D.C. activity. How’s that working for us?

The question for some would be how to return to the 1974-1995 trend line of about 240,000 new home shipments per year. This avoids the 1969-1973 bulge, during which we averaged 477,000 home shipments per year, and the 1996-1999 period when we were over 300,000 homes. You know the record since 1998.

Whence the Volume

Let’s look at this return to a much larger industry size for a moment. One would think that given the facts we know, the 40-50,000 home shipments might be “where it’s at” into the future. Baring any new flood of “loose” retail lending money, how do we get back to 250,000 homes annually, or even to the 2004-2007, 125,000 homes, give or take? We can depend on FEMA for some homes, floods, disasters and hurricanes willing, but not too many. The LLC’s would like to buy new homes, but their forays there with buy here – pay here have not created profit enthusiasm for this model. Thus we can’t expect much new home volume there. Retail chattel lending is very constricted, so retailers are unlikely to help with volume.

Title I, the former “great hope” has proven to be a volume dud, not surprisingly so. Most non-Clayton retail lenders have to stay on the positive side of 700 FICO to survive. Can’t look to them for much volume, eh?

The Berkshire Group goes deeper, but they ain’t Greenseco re-incarnate. Only their disciplined lending and strong servicing culture and yes, experience, makes it all work. They are not about to pump out $6.3 billion in MH loans as Conseco Finance did in one year around 2001-02. I would guess if the two Berkshire lenders got to $2 billion combined annually that would be a wondrous job. So even there, not too much excitement either.

This leaves real estate placements of HUD’s, a long cherished dream to go against the site built industry and whip their azz. We know that isn’t about to happen, no matter how fervent our dreams. New “easy” lenders coming to the rescue? Perhaps. Have you tried to finance anything in your personal life recently? If you have you well know the absolute difficulty of any sort of success. Add in our depreciating asset, the manufactured home, and generally scratch and dent credit capability for most of our buyers, and the hope of a new lender exploding on the scene seems demented. But hey, we all live in hope. Remember, Tarzan always said, as he went in and out of terrible scrapes, “Where there is life, there is hope.” Amen. Just don’t plan your entire business on the return of Conseco, CIT Group, The Associates, Green Point Credit and the others, though heaven knows their return could carry on long enough to shore up my retirement.

Regulatory Guillotines

Unaddressed yet are the new laws affecting lending and the new consumer agency. I can only make one comment here. When was the last time you encountered very complex lending laws, licensing requirements, and a super consumer agency which fueled a burst of sales activity for you? In my time in the industry since 1972, I’ve seen none. Perhaps the impact of many new laws, such as the very HUD code itself were overstated, but without the HUD we were shipping up to 580,000 homes per year. Have you seen that many since in one year?

My best guess, and it is only an experienced guess, is that the industry will not be able to roll back the requirement that most industry transactions will come under the purview of one or more of these regulations, will control transactions, and will cause another reduction in HUD volume. Even as the industry struggles with ways to avoid their prohibitions, the impact is most likely to be substantial. I do surely hope I’m wrong.

And what will be the impact of LLC owners extending their own financing for the sale, or rent with option for homes in their communities? Again, like everything, things not done during good times but becoming a fallback during bad times usually have warts on them. Self-financing may well be a necessity, and I readily accept that. If you have an LLC with substantial vacancy and the normal financing available will not fill it, one must save themselves, and self-financing, properly executed, can do that. But, it does not speak to the substantial work and personnel necessary to make it work, the need for your own capital, the ever-decreasing used homes availability, the specter of violating some arcane lending law, and not least, a liquidity crunch which would drive one to try to cash out their loans and find there are no buyers or only buyers with a huge 80-90% haircut in value. Some deal. Pay attention here.

LLC Fallback

So one can’t help but think that as the LLC sector, perhaps the most vibrant and last to fall goes through a contraction in numbers, that only well-located communities with a value component to their offering will weather the storm. It has been happening already, as the supply of used homes dries up, and new homes are found wanting for self-finance, the corn fields which became communities may be headed back to corn fields or for other use. Wal-Mart, anyone?

If you struggled through reading my “Saving Chattel Lending” you had to ask yourself, “Can it be this hard, Marty?” I surely ask myself the same question each time I prepare one of these papers. If it’s going to be this hard, where does one start, and of the umpteen cures I recommend, which are the five most important? Answer: I don’t know. Second answer: Note that virtually none of my suggested measures have been tried. The only change in the industry financing model, which is “the” defect, is that we’ve gone from “fogging a mirror” to 700 plus FICO, real credit capability, a completed application, full and adequate documentation and a belief the borrower is qualified in every way to get the loan and pay for the home successfully thereafter. That is the quantum industry leap, which has occurred, and it certainly increases lender survivability, but has destroyed lender and industry new home volume. Want to increase home sales volume? Find a way to attract many more folks with better credit. Stop building many new HUD code homes and selling them and what do you think the outcome will be for most industry segments?

So I come back to an industry conspiracy. This all has to have happened because a mysterious, unnamed “friend up east” used his magical powers to convince some very large, knowledgeable lenders to quit MH chattel lending to throw all the volume to just a few special lenders. Now if only that powerful friend can get SACU, Triad, and USBank to leave the industry, that will be the final step in the conspiracy.

Come Now

Speaking from atop the “Grassy Knoll,” I’d feel better if the industry might look at the known factors, which have brought the industry to its knees, and worked hard to Saving Chattel Lending. Believing in “The Conspiracy” may let you off the hook of having to do anything, but will do nothing in resurrecting the industry. It will take far more than conspiracy theory to do that. # #

Martin V. (Marty) Lavin

attorney, consultant, expert witness

practice only in factory built housing

350 Main Street Suite 100

Burlington, Vermont 05401-3413

802-660-9911, 802-238-7777 cell

web site: www.martylavin.com

email mhlmvl@aol.com

Editor’s Note: As with Mr. Lavin’s earlier articles, we have honored his request to post his article “as is.” Read his other articles:

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …