As we come to the 4th of July or Independence day, I decided to carve out some time to add what I hope to be constructive ideas to the manufactured housing industry chattel lending issue.

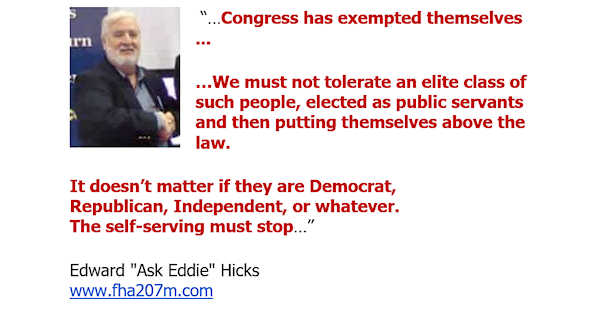

Being involved in the industry for over 25 years I have rode the shipment roller-coaster (like many of you) more than once. However, we cannot look to the past as our salvation for the future. Nor can we look to Washington D.C. for our salvation. Our “friends” in Washington D.C. can’t even balance a checkbook or a budget. As my kids learned in college, there’s book smart (passing the tests) and then there is the real business world. All the studying done in college has had very little to do with their business life experiences (or so they tell me).

So now what? While presenting my idea for the industry, I’m simultaneously having a Rep. Paul Ryan-Marty Lavin moment. Put your idea out there and let the attacks begin. Even so, I still wish to share my thoughts as they may springboard (or whiteboard) the manufactured housing industry to the answer we all seek.

1st – Washington D.C. – This is the land of unintended consequences. Where to start? Safe Act, Dodd-Frank, CFPB or TARP pick any of the alphabet soups, did they do anything for us? As an industry what did we do to them? Sure we can relive what the Green’s did to the bondholders on Wall Street. But they were bondholders who took on a risk for a return. Whether it was a straight deal or not is why people charge for due diligence reporting. Did we cause the mortgage backed security world to implode? No, for that, I say look to D.C. Fannie, Freddie, FHA, VA and Ginny Mae all were smarter than the rest of us. They wanted homeowners, so they put programs in place to get what they wanted. Forget underwriting, down payments, proof of income, job verification and speculators, they wanted loans. Did mortgage brokers take advantage of the system? Yes! Did they write the rules? No! Those that are guilty of fraud should be punished to the full extent of the law. Our industry was and still is collateral damage. I guess that’s what happens when you are to close too the bomb blast.

2nd – Banking Institutions – Coming originally from a bank and credit union background I understand where depositories are coming from with regard to the decisions they make for our industry. Over the years we have presented opportunities to a myriad of institutional sources of capital and over 250 said, “No thanks”. The irony was, most of them actually liked the opportunity and the plan behind it. Some of the ones that said no, even said it was an outstanding opportunity and program. The ones that signed on, had some of the best results they had ever experienced with installment loans. But a funny thing happened along they way. The keys to the vault were hijacked from the decision makers and placed into the hands of auditors and regulators. Many lenders cannot make loans due to the ever-changing capitalization requirements. If you really want to get your banker excited, ask them what has happened to the premiums for deposit insurance from FDIC & NCUA. With the new lending regulation and bookkeeping (ratios) requirement ball always on the move, my lenders became deposit acquisition specialists. The TARP (Trouble Asset Relief Program) program did not live up to it’s name and became a vehicle for the big banks to get bigger. If you are not familiar with the PNC – National City merger that alone should give anyone reason to pause. I know that lenders want to make loans; it’s how they derive their income. Not every bank can go to the Fed window and play the daily swap game between Fed funds and Treasuries (Citi). So we are left with an under capitalized banking system (in the regulators view) that has put a lid on lending. Based on current economic trends, the housing market inventory (both real & shadow), the troubled alphabet soups mortgage operations and D.C. politics, I unfortunately do not see lenders running to us with bags of money for a long time.

3rd – Ourselves – While we have been in a steady ten plus year shipment decline we cannot excuse ourselves. Our market has remained basically the same since I started all those years ago, newly wed and nearly dead. While parts of the industry have tried to morph into “traditional housing” e.g. bigger is better, we still had rampant documentation fraud, blown up invoices, backbreaking advances, excessive loan terms, lot rents increasing into un-affordability and our own “trick” lending programs (ersatz ARM’s & 30 year paper). We are now being treated like the child we presented ourselves as to the world. While everyone points the finger at everyone else as the culprit we all forgot the golden rule. The guy with the gold makes the rules and they decided to go home.

Over my years in this business, I have observed several areas where the industry system consistently fails. In order for homes to hold their value, there needs to be a healthy system for resale of homes owned by homeowners, just as there is in site built housing. Unfortunately, no such system exists in manufactured housing. MLS does not support our re-sale market in most states. We’ve talked about our own MLS for my whole career and while there have been some great attempts (for example mhvillage) we are still a second class citizens compared to the real estate market. By not having a re-sale market program we only hurt ourselves as our current residents cannot sell their home and, as a consequence, get mad, depressed and finally jingle mail the keys to the lender or community and leave.

Industry lending philosophies contribute to that problem by charging higher interest rates on pre-owned homes. Even after all my years in the business, it still stuns me to this day that we charge interest rates based on the age of the home. This does not happen in site built housing, thus giving site built an advantage, and manufactured housing a disadvantage, when it comes to the performance of the collateral from a lender perspective and investment performance of the home to everyone else. It also depresses any attempts to create a healthy system for reselling existing homes.

Another problem is the method in which repossessed inventory is handled. While the lenders should have a better plan than most do, many parts of the industry conspire to keep them trapped in a guaranteed to fail program. Almost every independent retailer, and many community operators treat outside finance companies like victims to be slaughtered rather than as important partners at the table. When a home is repossessed, many hands, motivated by self-centered greed are demanding money from the lender. Retailers want full profit fees to move homes onto their sales centers where they sit unsold until the lender gives up and allows the retailer to “steal” the home so that the retailer can then sell the home and “hit a home run” on the lender’s loss. The retailer is both short sighted and greedy in this transaction, and the lender lacks the fortitude they should have to shut the retailer off from future financing.

While the environment is somewhat better on the community side, it varies greatly from community to community. When Ken Rishel was a community owner, he correctly viewed outside lenders as important stakeholders. As a consequence, he saw the value of shared risks and never charged lenders lot rent, maintenance fees nor commissions for selling their repos if his people couldn’t get a sale price higher than the deficiency balance on the loan. When he began to focus on outside lending, he persuaded other community owners to the same view. When I started Precision Financial with Diane years ago, we asked community owners to agree to much of the same terms and many agreed.

Unfortunately, those community owners are not in the majority. Most expect lenders who own homes in the community to pay tenant’s back lot rent, the rent going forward until the home is sold, a commission for selling the home, and, learning from retailers, the lender’s home often goes unsold, with the hope of “stealing it” so, they to, can hit a home run on profits when the home is sold.

Until everyone involved possesses either the moral integrity, or sees the business wisdom to treat all the stakeholders fairly, the system is broken. It may limp along as it has been doing, but the problems that hold manufactured housing back will remain.

Appraisals have also become a problem in part because of the lower prices of repossessed homes. We have loans we cannot do because they will not appraise either through comps or through NADA, or even our own proprietary system of appraisal. We are now reaping the field we sowed. All the wholesale homes have lowered everyone’s collateral value. Not only have home values been depressed, but also what is happening to the community value if all the home values are 30% to 50% less and occupancy is going south?

Industry Image

To go RV’ing or not to go? There have been many ideas floated within the industry as to what is needed to change the public, regulator and banker’s perception. This issue is above my pay grade. However, Einstein defined insanity as “doing the same thing over and over but expecting different results.” All I know is that we have let others define us. It is time we define ourselves.

So now what?

I think there are 4 plausible solutions for everyone to ponder.

1. Everyone can subscribe to partnering with Clayton Homes. Who wants to fight Mr. Buffet? I have been an admirer of his for years and even own Berkshire Hathaway stock.

2. Captive Finance – while D.C. is not making it easy, it is a stable and reliable plan for those who have the expertise, or are willing to hire the expertise they need. That it creates new challenges is undisputed because, done correctly, it requires a whole new set of business skills that few community owners or retailer possess. Done incorrectly, it is a disaster waiting to happen. It is not a short-term solution, but rather a long-term one that almost demands affiliations with outside experts to succeed.

3. Current lenders – Be sure to take care of the ones left. They have been with us through the darkest of times. Take care of them today and they will be here tomorrow to take care of us.

4. Lastly, a new idea. While not a new idea, as it served its purpose in the past for another industry and may well serve a purpose for us. I’m talking about a manufacturer based captive lending program. While it carries risk, it also carries a stick. If you’ve never been involved in an auto dealership that had a sizeable portfolio with GMAC, Ford or Chrysler you do not understand the size of the stick the manufacturer captive lender holds. If you loaded them up with poor-bad paper and cause high losses, it could cost you your dealership franchise. No one wants to risk that decision. In the beginning, before the automobile captives became market share driven, they would only finance their own products and were the most profitable arm of the entire company. Our company has been researching this concept for a number of years, and we are in a position to help make this happen if a group of manufacturers would actually sit down in the same room and band together to make it happen. To this point, there have been no takers. Their dislike and mistrust of each other seems to color their survival instinct.

In the end, from my point of view, lending is about the 4 C’s:

Capacity – Can they afford the purchase without strain? Will that income continue?

Character – Would their word and their handshake be enough to make the loan?

Collateral – Are the ATF & LTV viable for the terms and conditions of the loan

Credit – Have they proven they have the self-control to manage their money and do they feel responsible for paying their bills on time?

The federal government controls none of these traits.

If you have made it this far, thank you. Will any of these ideas help? I hope so. If anything, at least a conversation may start. Years ago when people asked me what I thought, I told a few and they thought I’d lost my mind. When I investigated the current D.C. promulgations, people again thought I’d lost my mind. After awhile you begin not to speak up. I was hoping the whole time that I was wrong. Oh, I wanted to be so, so, wrong. To Marty Lavin, I want to wish you well and treasure all the things I learned from you. They painted you, Gubb Mix, Ken Rishel and I with the same brush; only they have been far harder on you than the rest of us.

I asked my dad one time to try and fix my golf swing. His advice after watching me was that there are 1,000 things going on in my swing and where would I like to start. Our industry has many things it can improve on. We need to start. We still have and always will have the best affordable housing option story to tell people. # #

By Pat Curran, President

Precision Capital Funding

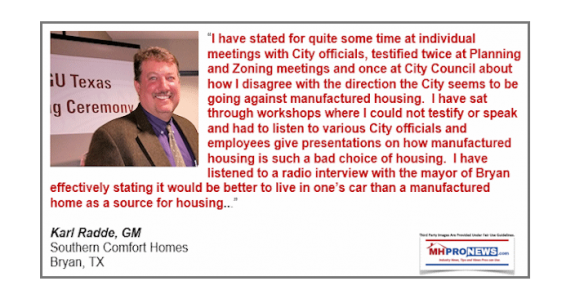

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …