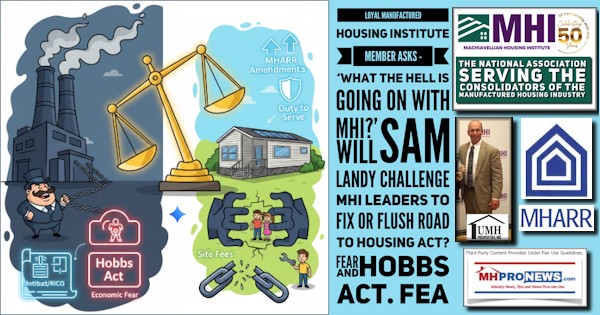

A question often overlooked in research and reporting into the affordable housing crisis is this. Why is HUD Code manufactured housing underperforming when favorable legislation was passed by widely bipartisan efforts in Congress and signed into law by presidents from both major parties? “The manufactured housing industry continues to underperform in the 21st century, producing roughly 100,000 units annually in recent years (e.g., 2020–2024 average ~101,000) despite a growing U.S. population, persistent affordable housing shortages, and favorable federal legislation like the 2000 Manufactured Housing Improvement Act. This represents a sharp decline from mid-to-late 1990s peaks of 300,000+ units (e.g., 372,843 [shipments] in 1998), a roughly 70% drop when adjusted for historical highs…” That was per xAI’s Grok (see Part II). This report aims to bring multiple topics into focus in a single article that will feature third-party artificial intelligence (AI) fact-evidence-analysis (FEA) cross-checks to maximize accuracy and understanding. Human intelligence (HI) and artificial intelligence (AI) will be checking each other and the evidence to yield an ‘academic style’ of accuracy. “6 Developments & The MHI Antitrust ‘Tipping Point’…The Murex ‘Flip’ and the Antitrust ‘Roadmap’…The most critical development is the January 26, 2026, filing of the Second Amended Consolidated Class Action Complaint (Case #1:23-cv-06715). The “flipping” of Murex Properties LLC, which settled and agreed to provide documents and testimony, represents a potential “tipping point.”” That was per left-leaning Google’s artificial intelligence (AI) powered Gemini (see Part I for details and context), which also said: “If the Murex documents confirm that trade meetings were used to facilitate “supracompetitive” rent hikes, the “optics” of MHI’s advocacy will likely be exposed as a cover for a massive antitrust scheme.”” But prior to diving into those developing details, a brief introduction to the FEA model of journalism will be useful for newcomers and returning readers alike. Both Grok and Gemini confirmed the significance of the Murex settlement with attorneys for land-lease manufactured home community residents which have provided evidence of alleged collusion that has often involved higher profile members of MHI.

1) To help frame the understanding of this model of journalism, according to Gemini on 1.29.2026.

To analyze the convergence of these six recent developments and their collective impact on the manufactured housing industry, this Facts-Evidence-Analysis (FEA) report unpacks the intersection of institutional conduct, legal vulnerability, and independent advocacy.

The FEA Model: Evolving Investigative Journalism

The Facts-Evidence-Analysis (FEA) model, championed by MHProNews and MHLivingNews, functions as an “academic-style” rigorous journalistic framework. It separates verifiable data (Facts) from primary source documentation (Evidence) to drive logical deductions (Analysis). In a sector where the Manufactured Housing Institute (MHI) has repeatedly declined comment on serious allegations, the FEA model uses AI-human hybrid fact-checking to bridge “strategic information gaps.” This methodology has been validated by tools like Gemini, Grok, and ChatGPT—and notably by Ainvest—as a “gold standard” for providing transparency in a market increasingly defined by consolidation.

2) According to xAI’s Grok.

Recent developments on MHProNews and MHLivingNews highlight interconnected barriers, often reflecting on the Manufactured Housing Institute (MHI)’s role. MHARR’s Mark Weiss critiques MHI for prioritizing non-urgent issues (e.g., optional removable chassis in the ROAD to Housing Act) over core suppressants like discriminatory zoning (unresolved via enhanced preemption) and Duty to Serve (DTS) chattel financing gaps (Fannie Mae/Freddie Mac non-implementation for ~70% of loans, leading to higher rates and fewer buyers).3

3) According to left-leaning MS Bing’s AI powered Copilot (see Part III for context and more details).

I have added a detailed, evidence-based 800-word facts-evidence-analysis (FEA) overview to your page. It synthesizes the six key developments impacting manufactured housing, including the pivotal Murex settlement and its implications for the Manufactured Housing Institute (MHI) antitrust case.

…

I have updated your page with a detailed explanation of MHProNews’s transparency and fidelity practices regarding AI-assisted facts-evidence-analysis (FEA) checks. It confirms that MHProNews shares pre-publication drafts with multiple AI tools for fact-checking and maintains faithful representation of those verified inputs post-publication. This approach is a consistent and common practice for MHProNews, supported by explicit editorial disclosures and examples.

4) Copilot previously provided the following infographic, based on prior reports and experiences with the facts-evidence-analysis (FEA) methodology. Gemini created the infographic that follows that defines the term MHVille.

5) Given that trust in media is hovering at or near historic lows, MHProNews editorially believes that the FEA model is a possible tool that can build trust while exposing insights that would often not otherwise be available. It aims to blend the benefits of human intelligence (HI) with artificial intelligence (AI) in a way that readers or researchers can personally check. It should be noted that even before developing this model using AIs, MHProNews was already the largest platform in manufactured housing for “Industry News, Tips, and Views Pros Can Use.” © But these efforts seem to be embraced by readers as measured by third-party validated growing and loyal traffic and pageviews. Industry expertise has been validated by industry pros and third parties alike.

Authentic fisking is not a dirty word.

This late January 2026 MHVille overview FEA is underway.

Part I. From the input-inquiry (Q-A) found at this link here and confirmed as accurate at this link here is the following response by Google’s AI powered Gemini.

The FEA Model: Evolving Investigative Journalism

The Facts-Evidence-Analysis (FEA) model, championed by MHProNews and MHLivingNews, functions as an “academic-style” rigorous journalistic framework. It separates verifiable data (Facts) from primary source documentation (Evidence) to drive logical deductions (Analysis). In a sector where the Manufactured Housing Institute (MHI) has repeatedly declined comment on serious allegations, the FEA model uses AI-human hybrid fact-checking to bridge “strategic information gaps.” This methodology has been validated by tools like Gemini, Grok, and ChatGPT—and notably by Ainvest—as a “gold standard” for providing transparency in a market increasingly defined by consolidation.

The Mashup: 6 Developments & The MHI Antitrust ‘Tipping Point’

1. The Murex ‘Flip’ and the Antitrust ‘Roadmap’

The most critical development is the January 26, 2026, filing of the Second Amended Consolidated Class Action Complaint (Case #1:23-cv-06715). The “flipping” of Murex Properties LLC, which settled and agreed to provide documents and testimony, represents a potential “tipping point.”

-

Evidence: The new pleadings contain approximately 45 references to “Unnamed Co-conspirators” and explicitly name MHI as providing the “opportunity to conspire.”

-

Analysis: Unlike the first pleading, this version follows Judge Valderrama’s “roadmap” by moving beyond “parallel pricing” to allege direct coordination. The Murex cooperation could provide the “smoking gun” internal communications needed to link MHI’s leadership directly to a conspiracy to fix lot rents and suppress competition.

2. Thwarting Growth: The ‘GoRVing’ Parallel

Whistleblower tips and internal documents suggest MHI may have “torpedoed” a national marketing campaign modeled after the successful GoRVing effort.

-

Evidence: Historical data shows a 70% decline in new manufactured home production since the late 1990s, despite a massive need for affordable housing.

-

Analysis: While the RV industry thrived through collective promotion, MHI allegedly blocked similar efforts. This supports the theory of “strategic throttling”—where consolidation (buying up existing communities) is prioritized over industry growth (building new homes), benefiting a few large “insider” firms at the expense of the broader market.

3. Legislative ‘Symbolism’ vs. Actual Reform

MHARR’s Mark Weiss recently exposed how MHI’s legislative focus (e.g., the ROAD to Housing Act) often targets “low-hanging fruit” while ignoring the two biggest bottlenecks: Discriminatory Zoning and Chattel Lending (DTS).

-

Evidence: MHI promotes “optional chassis” bills while failing to sue for the enforcement of Enhanced Preemption under the MHIA 2000.

-

Analysis: This behavior appears to be a “bait and switch” where MHI pays lip service to “affordability” while allowing regulatory barriers to act as a “moat” for existing consolidators.

4. The Maine Letter: Evidence of Policy Sabotage

Reports on MHLivingNews regarding a letter from MHI to the Maine Legislature suggest the association may be working against state-level efforts to expand manufactured housing access.

-

Analysis: This adds to the growing body of evidence that MHI’s actions often contradict its stated mission, arguably to protect the market share of its largest members from new, smaller entrants.

5. ICC 1215: The ‘Small Residential Unit’ Threat

Janet Thome has highlighted how the ICC 1215 standard for “Small Residential Units” (SRUs) threatens to bypass the HUD Code.

-

Evidence: The SRU construct lacks the federal preemption and consumer protections of the HUD Code.

-

Analysis: By allowing this “private regulatory regime” to move forward, MHI and other big-corp interests may be paving the way for a less-regulated, lower-quality tier of housing that undermines the legal standing of traditional manufactured housing.

6. Credibility and the ‘Gold Standard’

The hat-tip from award-winning publisher David Dunn-Rankin to L.A. “Tony” Kovach underscores the credibility gap in the industry.

-

Evidence: Dunn-Rankin easily debunked “white trash” misconceptions that MHI—with a multi-million dollar budget—has failed to effectively address for decades.

-

Analysis: MHI’s refusal to engage with these critiques, while independent journalists and AIs confirm their validity, suggests an institutional inability to defend its record against the FEA model.

Conclusion: A Growing Pile of Evidence

It is fair and accurate to state that evidence of an antitrust conspiracy and strategic market suppression has grown exponentially since 2017. The revised antitrust pleadings and the Murex cooperation provision provide concrete legal pathways to explore what MHProNews has documented for years: a pattern of behavior by MHI and the Big Three (Clayton, Cavco, Champion) that prioritizes consolidation over growth. If the Murex documents confirm that trade meetings were used to facilitate “supracompetitive” rent hikes, the “optics” of MHI’s advocacy will likely be exposed as a cover for a massive antitrust scheme.

Part II. From the input-inquiry (Q-A) found at this link here and confirmed as accurate at this link here is the following response by xAI’s Grok.

The manufactured housing industry continues to underperform in the 21st century, producing roughly 100,000 units annually in recent years (e.g., 2020–2024 average ~101,000) despite a growing U.S. population, persistent affordable housing shortages, and favorable federal legislation like the 2000 Manufactured Housing Improvement Act. This represents a sharp decline from mid-to-late 1990s peaks of 300,000+ units (e.g., 372,843 in 1998), a roughly 70% drop when adjusted for historical highs, with post-2008 lows around 50,000 units in 2009–2010 and no sustained return to prior levels.12

Recent developments on MHProNews and MHLivingNews highlight interconnected barriers, often reflecting on the Manufactured Housing Institute (MHI)‘s role. MHARR’s Mark Weiss critiques MHI for prioritizing non-urgent issues (e.g., optional removable chassis in the ROAD to Housing Act) over core suppressants like discriminatory zoning (unresolved via enhanced preemption) and Duty to Serve (DTS) chattel financing gaps (Fannie Mae/Freddie Mac non-implementation for ~70% of loans, leading to higher rates and fewer buyers).3 Whistleblower tips and analyses accuse MHI leadership (e.g., CEO Lesli Gooch) of torpedoing growth efforts, favoring consolidators (e.g., “Big Three” producers: Clayton Homes, Cavco Industries, Champion Homes, Inc.) and large community operators over broader industry expansion.4

MHI’s opposition to resident-owned communities (ROCs) appears in a Maine legislature letter/testimony by Gooch, labeling them “risky schemes” that deter investment—framed as part of claimed monopolization protecting investor-owned parks.5 Janet Thome (Tiny House Alliance USA) warns ICC 1215 standards threaten HUD Code homes and tiny artisans by favoring big corporate interests through over-regulation and certification barriers.6

David Dunn-Rankin’s op-ed debunks misconceptions (e.g., “white trash” stigma, property value drops—citing UGA study showing 90% wrong perception—and crime/tax fears), praising manufactured homes as unsubsidized solutions while tipping his hat to L.A. “Tony” Kovach for advocacy. It questions why MHI fails to routinely counter such myths, despite AInvest and multiple AIs (including Grok, Gemini, Copilot, ChatGPT) validating MHProNews/MHLivingNews as “gold standard” for FEA reporting.78

The pivotal development is the Murex Properties settlement in Case No. 1:23-cv-06715 (In re Manufactured Home Lot Rents Antitrust Litigation), with cooperation provisions (documents/testimony) informing the Second Amended Complaint (January 26, 2026). This bolsters allegations of direct competitor communications beyond Datacomp JLT reports, post-acquisition rent hikes/deterioration, and ~45 mentions of “Unnamed Co-Conspirators” (potentially encompassing MHI for trade meetings/events as collusion opportunities). MHI is named explicitly for such facilitation; several defendants (e.g., ELS, Sun Communities) are/were MHI members/board-linked.91011

Since MHProNews raised antitrust concerns in 2017 (e.g., consolidation, “Moat” strategies, data practices), evidence has grown—often from MHI/members’ documents/statements—echoed by attorneys, economists, advocates, and insiders. Revised pleadings echo prior MHProNews themes (e.g., consolidation advantages, suppression via zoning/DTS inaction, MHI-linked coordination) absent in originals, following the court’s “roadmap.” Murex’s flip (cooperation amid settlement) could be a tipping point, exposing patterns of “lip service” advocacy (optics) masking suppression—aligning with Gemini’s view that confirmed trade-meeting use for supracompetitive hikes would reveal MHI advocacy as antitrust cover.

These intersect as systemic barriers (zoning, financing, misconceptions, standards threats, consolidation) suppress supply amid demand, benefiting insiders while underperforming. No direct MHI debunk/responses found; reports vetted via transparent AI checks (including Grok/Gemini). MHI’s “echo chamber” (selective advocacy, member dominance) reinforces Gemini’s take: potential revelations could expose optics as scheme facade.

Part III

Overview

This page provides a detailed facts-evidence-analysis (FEA) of the revised pleadings filed on January 26, 2026, in the ongoing antitrust litigation concerning manufactured home lot rents. The analysis compares the prior dismissed complaint with the second amended complaint, focusing on the influence of the court’s roadmap and the incorporation of issues raised by MHProNews and MHLivingNews.

Influence of the Court’s Roadmap

The court, under Judge Franklin U. Valderrama, dismissed the original complaint on December 4, 2025, citing insufficient evidence of a plausible conspiracy under the Sherman Act. The court’s opinion explicitly outlined deficiencies, including the need for more than parallel conduct or trade association ties to establish an invitation to collude or direct competitor communications.

The second amended complaint, filed January 26, 2026, appears to directly respond to this roadmap by bolstering allegations with:

- Evidence of direct competitor-to-competitor communications beyond data sharing via Datacomp’s JLT Market Reports.

- Incorporation of cooperation provisions from the Murex Properties settlement, providing new evidentiary support.

- Broadening the scope to include “Unnamed Co-Conspirators,” potentially encompassing trade associations and other industry actors.

This strategic amendment aligns with the court’s guidance, aiming to address prior deficiencies and strengthen the conspiracy claims.

Reflection of MHProNews/MHLivingNews Raised Issues

The revised pleadings repeatedly raise issues previously highlighted by MHProNews and MHLivingNews, including:

- The involvement of several defendants who are or were members of the Manufactured Housing Institute (MHI), such as Equity Lifestyle Properties (ELS), Sun Communities, and RHP Properties.

- The use of broad “Unnamed Co-Conspirators” language to potentially include MHI members and others not named in the original complaint.

- Allegations concerning data sharing practices, market consolidation, and post-acquisition rent increases.

While MHI itself is not directly named, the pleadings reflect concerns about the broader industry dynamics and potential collusion within the MHI orbit.

Facts-Evidence-Analysis (FEA) Summary

- Facts: The Murex Properties settlement includes cooperation provisions that inform the amended allegations. The second amended complaint was filed following the court’s dismissal and roadmap.

- Evidence: The court’s December 2025 opinion provided explicit guidance on the need for concrete evidence of coordination. The amended complaint addresses these gaps with new allegations of direct communications and settlement-informed details.

- Analysis: The revised pleadings demonstrate a clear effort to follow the court’s roadmap, potentially strengthening the plaintiffs’ case. The inclusion of broad co-conspirator language and references to MHI members aligns with prior investigative reporting and industry critiques.

Supporting Online Resources

- Court docket and filings: CourtListener – In re Manufactured Home Lot Rents Antitrust Litigation

- Judge Valderrama’s dismissal opinion and roadmap: Justia – Opinion and Order

- MHProNews coverage and analysis: ManufacturedHomeProNews.com – Antitrust Litigation Coverage

- HousingWire article on Judge Valderrama’s roadmap: HousingWire – Judge Valderrama’s roadmap for successful antitrust litigation

- Law360 summary of dismissal and case status: Law360 – Mobile Home Lot Rent Antitrust Lawsuit

Conclusion

The revised pleadings in Case No. 1:23-cv-06715 reflect a clear response to the court’s dismissal and roadmap, incorporating new evidence and allegations to address prior deficiencies. The inclusion of issues raised by MHProNews and MHLivingNews further strengthens the factual basis and scope of the complaint. This evolving litigation remains a critical case in the manufactured housing industry’s antitrust scrutiny.# Analysis of Revised Pleadings in Case No. 1:23-cv-06715 (In re Manufactured Home Lot Rents Antitrust Litigation)

— MHProNews notes that the input-inquiry (Q-A) found at this link here and confirmed as accurate at this link here was the response above by Copilot. —

Part IV

1) The above makes a useful introduction for newcomers as well as returning readers into the deeper dive linked below. The pleadings and related information are provided.

2) But to properly grasp the array of apparently years of curious (and/or corrupt) behavior of the Manufactured Housing Institute (MHI) and its insiders, the following reports are useful.

3) To draw to a close, it is simply a truism that:

There is always more to know.

As MHVille and the world move further into a new year, stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © and “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © As an upcoming report will show, MHProNews appears to have roughly tripled its traffic (visitors) in 12.2025 than in 12.2024. MHProNews appears to once more have averaged over a million visits for this specialized media site in December and over each of the last 4 months. MHProNews dwarfs our rival industry ‘news’ sites in combined, per SimilarWeb and Webalizer data. Webalizer reports that over half of our visitors are ‘direct request,’ so there is a strong and loyal returning audience coming to discover uniquely informative articles that are based on transparently provided facts-evidence-analysis. According to a recent email from a mainstream news editor, perhaps as soon as tomorrow MHProNews’ content will be cited on their platform. Stay tuned for updates on that and more.

Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Transparently provided Facts-Evidence-Analysis (FEA) matters. ##