Financial Choice is back in the news, as the full House takes up the measure.

A Google search on Financial Choice Act 2017 brings up tens of millions of results. Depending on the media outlet you pick, the news or editorializing paints the bill to be either grand, or a horror, for businesses and consumers.

Partisan Politics, 2017

The Hill reports Maxine Waters, ranking Democrat from CA saying, “The ‘Wrong Choice’ Act is a vehicle for Donald Trump’s agenda to get rid of financial regulation and help out Wall Street. It’s a deeply misguided measure that would bring harm to consumers, investors and our whole economy. The bill is rotten to the core.”

By contrast, House Speaker Paul Ryan, (R-WI) said at a press conference Wednesday, “This legislation comes to the rescue of Main Street America.” Ryan called the bill “the crown jewel” of the GOP deregulatory agenda. “The Financial CHOICE Act makes it possible for small businesses across this country to stop struggling and to start hiring.”

MHI’s Attached Bill to Financial Choice

The Manufactured Housing Institute (MHI) celebrated several weeks ago that their Preserving Access bill was attached to the act, and thus passage of the act would mean passing their bill.

MHI’s Lesli Gooch’s May 4 email to members said in part, “MHI’s efforts to pass the Preserving Access to Manufactured Housing Act are multi-pronged. The association is seeking opportunities to move the legislation through the regular legislative process and is also seeking opportunities to attach the language to other legislative vehicles that are moving. MHI’s goal is to ensure the needed changes contained in the bill to make financing available for manufactured housing are passed into law as soon as possible. Inclusion of the language in the Financial CHOICE Act is a critical milestone, and an example of MHI’s comprehensive strategy.”

What’s missing from their self-proclaimed “compressive strategy,” as regular Daily Business News readers know was the opportunity to sign onto the PHH vs. CFPB case with an amicus brief. When MHProNews specifically raised the strategy for an amicus brief with MHI, how could that option have been overlooked?

The “10,000 grassroots contacts” MHI’s Gooch crows about, where is that heading?

The Preserving Access bill (version 4.0 – 2017’s version is dubbed HR 1699), is sponsored by Garland ‘Andy’ Barr, Republican from Kentucky’s 6th Congressional district. Barr has spoken as a true believer in manufactured homes, and one of his speeches in favor of manufactured homes is covered in a video and article, linked here.

Gooch notes in the message to MHI members that: “Preserving Access to Manufactured Housing Act, is bipartisan legislation introduced by Reps. Barr (R-KY), Sinema (D-AZ), Poliquin (R-ME), Sewell (D-AL), Kustoff (R-TN), and Rice (D-NY). The companion bill for the Senate is expected to be introduced soon.”

What is it that their allegedly weaponized messages to members fails to mention, again?

Uh, Oh…

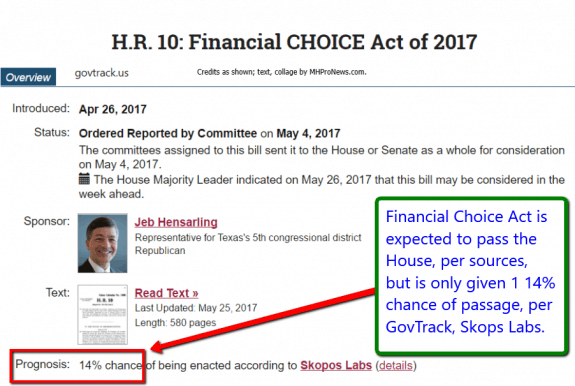

The challenge with the Financial Choice Act – even from the perspective of supporters – remains the same as was previously reported on the Daily Business News about Preserving Access. The odds of passage of the HR 1699 bill, per GovTrack is 1%, which today cites Skopos Labs as their source for their estimate.

What about the Financial Choice Act’s odds of passage?

GovTrack reports those odds are better, but are still a weak 14% chance of being enacted, again per Skopos Labs.

So while the Financial Choice Act is expected to pass in the House, what are the odds in the Senate?

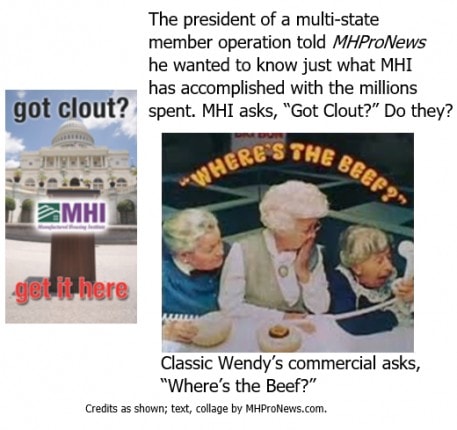

Will MHI alert their dozens of industry members, getting ready to fly into Washington, DC to hear about all that MHI is doing on this front, about those facts? Or will they instead send out a “Housing Alert,” once the bill passes the House – touting that “success” as they’ve done previously?

Do MHI members deserve the truth, the whole truth, or are they guilty of what they accused Ohio Governor John Kasich of, telling only half truths, or worse? Do the principles MHI applied to the governor, apply to themselves?

By-Bye Baby…

While MHI has made their primary focus the passage of Preserving Access, the $15 million dollars spent over the past 5 years – not counting PAC dollars – certainly went to places like salaries (of which Jennison, Gooch and her predecessor have made about $2.5 million in compensation over the past 5 years, per data MHI filed via form 990).

Industry success and veteran, Lance Inderman, prior chairman of the Texas Manufactured Housing Association (TMHA), told MHProNews that:

“It’s my personal opinion that we have incrementally given up every bit of financial freedom we had. Dodd Frank was a big increment, along with ObamaCare. I’m of the opinion that giving up key parts of the reform to get a “win” for posterity makes no sense.”

Inderman elaborated by saying, “We need to keep educating the populace and Congress on the facts that we [in manufactured housing] compete on a different price point, and therefore a different finance scale with their multi million dollar ocean front homes, paid for by their donors.”

Bob Crawford, multiple award winning retailer of historic Dick Moore Housing, told MHProNews that, state associations “do a great job.” But Crawford told MHProNews that he gives MHI at best “a 5 out of 10“ in their effectiveness.

As one source with deep ties to MHI told MHProNews, “MHI is acting like a secret society, with only the inner circle fully informed, and most other members trusting them, following in good faith, or unable to effectively protest or even question leadership.”

Award winning industry veteran, L.A . “Tony Kovach asks, “Why does MHI’s tight band at the top allegedly want only their side of the story told to the industry? Why have they threatened MHProNews with legal action for providing documents given to us – in many cases, by their members – or for reporting to the industry on issues such as DTS, Preserving Access, pending DOE energy standards, and others?”

A link to a comparison between MHI and MHARR their self-stated mission and budgets, per their 990s, is found here.

A link to an analysis of Richard “Dick” Jennison and Lesli Gooch’s compensation, is found here.

As dozens of MHI members prepare to fly into Washington, D.C. to listen to lectures by MHI staff on all they are doing, consider the words of MHI award winner, Marty Lavin.

Lavin has often said, “follow the money,” and “pay more attention to what people do” …and accomplish… “than to what people say.” ##

Related topics:

Source – Manufactured Housing Institute Violated Law, Conflict of Interest?

Faked, Weaponized News Harms Manufactured Housing Homeowners, Professionals?

Richard Jennison, Lesli Gooch, Worth Millions to MHI Industry?

Hot New, Different, Regulatory Topic that MHI is Missing a Key Point On (HUD, Pam Danner), linked here.

(Image credits are as shown above, and when they are the property of third parties, are provided under fair use guidelines.)