“…Assistant Attorney General nominee Gail Slater was asked about the Guidelines as part of her confirmation process. Ms. Slater’s written answers make clear that — should she be confirmed — the Antitrust Division plans to continue using the 2023 Merger Guidelines.” That is from the official Memorandum provided in Part I authored by Omeed Assefi, then Acting Assistant Attorney General Antitrust Division of the Department of Justice (DOJ). From Part II herein are items from those DOJ-FTC 2023 Merger Guidelines. Included in that is the following. “Section 7 of the Clayton Act (“Section 7”) prohibits mergers and acquisitions where “in any line of commerce or in any activity affecting commerce in any section of the country, the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.” Note that the statement uses the word “may.” If a merger “may” tend to “lessen competition, or to tend to create a monopoly” that can be barred.

Deeper into that document is this. “Guideline 1: Mergers Raise a Presumption of Illegality When They Significantly Increase Concentration in a Highly Concentrated Market.” Some have already described the manufactured housing industry as a “highly concentrated market.”

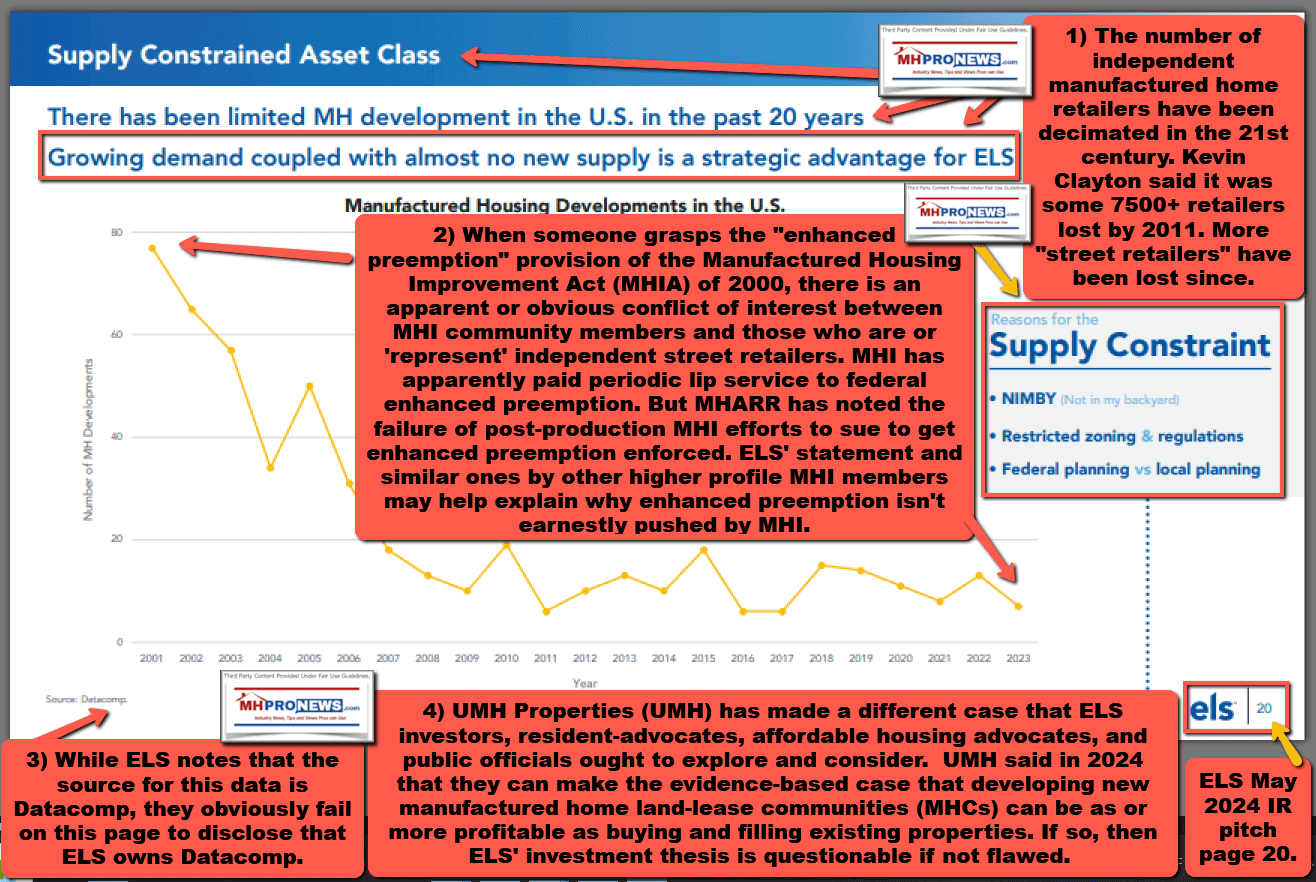

“The consolidation of key industry sectors is an ongoing and growing concern that MHI [i.e.: the Manufactured Housing Institute] has not addressed because doing so would implicate their own members. Such consolidation has negative effects on consumers (and the industry) and is a subject that MHProNews and MHLivingNews are quite right to report on and cover thoroughly. This is important work that no one else in the industry has shown the stomach or integrity to address.”

So said Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) in an on the record remark emailed to MHProNews. For more, see this link here.

Gail Slater was confirmed as the Assistant Attorney General. The press release referenced in this X post is provided further below in Part IV.

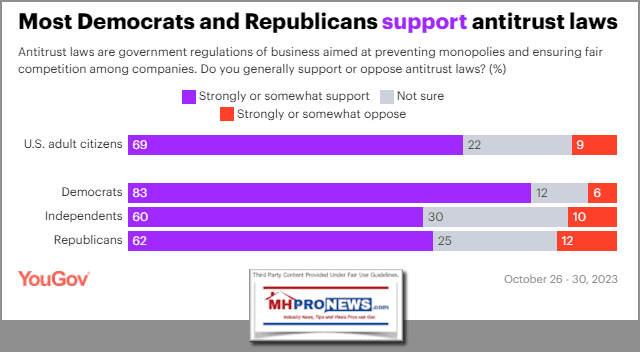

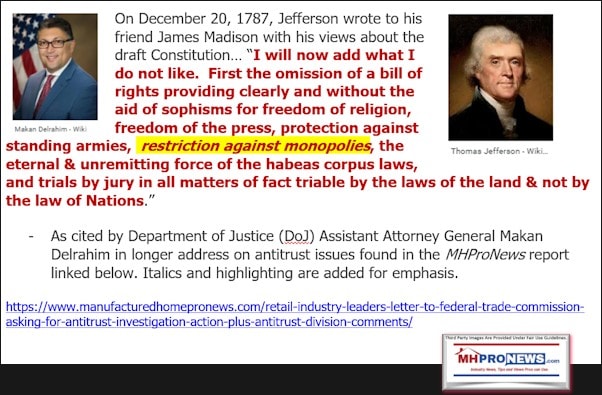

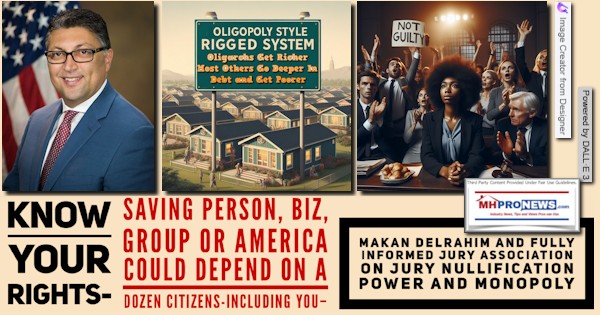

MHProNews reminds readers that interest in, and opposition to, monopolization is popular, per public polling.

With that brief backdrop, let’s dive into the details in this MHVille facts-evidence-analysis (FEA) the following sections.

Part I

In December 2023, the Antitrust Division and the Federal Trade Commission jointly issued the 2023 Merger Guidelines. These Guidelines reflect the culmination of an extensive process by the Agencies — with substantial public engagement — to explain the procedures and enforcement practices we most often use to investigate whether mergers violate the antitrust laws.

Recent public commentary has raised the question of whether the Antitrust Division will abandon use of the 2023 Merger Guidelines. Indeed, Assistant Attorney General nominee Gail Slater was asked about the Guidelines as part of her confirmation process. Ms. Slater’s written answers make clear that — should she be confirmed — the Antitrust Division plans to continue using the 2023 Merger Guidelines. In response to questions on her specific approach to merger review, Ms. Slater answered that she will “follow the legal and economic framework described in the 2023 Merger Guidelines.”

Ms. Slater elaborated on her rationale for continued use of the guidelines in her answer:

[FTC] Chairman [Andrew] Ferguson has explained that the Merger Guidelines work best when there is stability across administrations, though he has also indicated that there may be some aspects he would be open to reforming. He further explained that much of what is in the current merger guidelines simply restates longstanding law. [1] I agree with him. It is critical to the Antitrust Division ‘s law enforcement mission that its guidelines reflect the original meaning of the applicable statutory text as interpreted by the binding rules of the courts. The merger guidelines have been revised periodically when time and experience suggest changes are necessary, but when revisions are undertaken a careful and transparent process should be used to ensure our guidelines maintain the stability needed for rules of the road to serve their purpose.2

As Acting Assistant Attorney General for the Antitrust Division, I wholeheartedly agree with Ms. Slater and Chairman Ferguson on these points. The Antitrust Division will continue to use the 2023 Merger Guidelines until further notice.

This approach is consistent with the iterative, bipartisan approach to revisions that has long defined the Agencies’ approach to merger guidelines. The original guidelines were first issued in the Johnson Administration in 1968 and maintained through the Nixon, Ford, and Carter Administrations. They remained in force until the Reagan Administration’s release of the carefully-developed 1982 Merger Guidelines, which — with modest revisions — remained in force for ten years until the George H. W. Bush Administration revised them in 1992. The Clinton Administration’s Antitrust Division used the 1992 Merger Guidelines until it made minor modifications in 1997, and the George W. Bush Administration continued to rely on them throughout both terms. The Obama Administrated revised the guidelines in 2010, which the first Trump Administration relied on for the entire term, as supplemented by the 2020 Vertical Merger Guidelines. The 2023 Merger Guidelines built on these prior iterations.

The 2023 Merger Guidelines are not necessarily perfect. Indeed, there may be opportunities for revisions in the future. Any potential revisions, however, will be completed with the same transparency and careful thought that have become hallmarks of the merger guidelines since their inception. Until then — and consistent with applicable law — the Antitrust Division will continue use of the 2023 Merger Guidelines.

[1] See Flavia Fortes, Merger Guidelines Shouldn’t be Rescinded, But Could Be Reformed, FTC Commissioner Ferguson Says, Mlex, June 13, 2024. 2 Abigail Slater, Responses to Written Questions of Senator Peter Welch for Hearing on “Nominations,” submitted February 17, 2025 (emphasis added).

—-

MHProNews notes that the PDF of the above is linked here.

Part II – The official press release from the 2023 Merger Guidelines is as follows. Note that this press release is marked “updated” February 6, 2025

Justice Department and Federal Trade Commission Release 2023 Merger Guidelines

For Immediate Release

Today, the Justice Department and the Federal Trade Commission (FTC) jointly issued the 2023 Merger Guidelines, which describe factors and frameworks the agencies utilize when reviewing mergers and acquisitions. The 2023 Merger Guidelines are the culmination of a nearly two-year process of public engagement and reflect modern market realities, advances in economics and law, and the lived experiences of a diverse array of market participants.

“These finalized Guidelines provide transparency into how the Justice Department is protecting the American people from the ways in which unlawful, anticompetitive practices manifest themselves in our modern economy,” said Attorney General Merrick B. Garland. “Since releasing the Draft Merger Guidelines earlier this summer, we have engaged with stakeholders across the country, and the Guidelines are stronger as a result. The Justice Department will continue to vigorously enforce the laws that safeguard competition and protect all Americans.”

“The Guidelines we release today are faithful to the law and reflect how competition plays out in our modern markets,” said Assistant Attorney General Jonathan Kanter of the Justice Department’s Antitrust Division. “Ensuring that our merger enforcement protects that competition is our North Star. Competitive markets and economic opportunity for all Americans go hand in hand. We were grateful to hear from authors, nurses, farmers, and other concerned citizens from across the country as we worked to put together the 2023 Merger Guidelines. Their comments were invaluable — and our merger enforcement will be better as a result.”

“Fair, open, competitive markets have been essential to America’s dynamic, thriving economy, and policing unlawful mergers is our front line of defense against harmful corporate consolidation,” said FTC Chair Lina M. Khan. “The 2023 Merger Guidelines reflect the new realities of how firms do business in the modern economy and ensure fidelity to statutory text and precedent. I am grateful for the thousands of comments submitted by American workers, consumers, entrepreneurs, farmers, business owners, and other members of the public. This input directly informed the guidelines and allowed us to pursue this work with a deeper understanding of the real-life stakes of merger enforcement.”

The 2023 Merger Guidelines released today modify the Draft Merger Guidelines, released on July 19, to address comments from the public, including extensive engagement from attorneys, economists, academics, enforcers, and other policymakers at the agencies’ three Merger Guidelines Workshops. They emphasize the dynamic and complex nature of competition ranging from price competition to competition for the terms and conditions of employment, to platform competition. This approach enables the agencies to assess the commercial realities of the United States’ modern economy when making enforcement decisions and ensures that merger enforcement protects competition in all its forms.

The agencies protect competition through enforcement of the antitrust laws and other federal competition statutes. Since 1968, the agencies have issued merger guidelines to enhance transparency and promote awareness of how the agencies undertake merger analysis before deciding whether or not to challenge an acquisition. Over the years, the agencies have worked collaboratively to update the Merger Guidelines periodically to reflect changes in the law and market realities, including in 1982, 1984, 1992, 1997, 2010, and 2020.

The robust process to develop the 2023 Merger Guidelines began in January 2022. The agencies announced an initiative to evaluate possible revisions to the 2010 Horizontal Merger Guidelines and the 2020 Vertical Merger Guidelines and published a Request for Information on Merger Enforcement, which sought public comment on modernizing merger enforcement. The agencies received more than 5,000 comments. Commenters highlighted excessive market consolidation across industries and overwhelmingly urged the agencies to strengthen their approach to merger enforcement. At the agencies’ four listening sessions, business owners, workers, and other advocates similarly highlighted the potential for mergers and acquisitions to undermine open, vibrant, and competitive markets, in industries ranging from food and agriculture to health care.

Informed by this feedback, agency experience and expertise, as well as developments in the market, law, and economics, the agencies drafted and jointly released a proposed version of the 2023 Merger Guidelines for public comment in July 2023 and received more than 30,000 comments reflecting the views of consumers, workers, academics, interest organizations, attorneys, enforcers, and many others across various sectors of the American economy. The agencies also held three Merger Guidelines Workshops to discuss the draft Merger Guidelines. This engagement informed an in-depth revision process culminating in today’s release of the 2023 Merger Guidelines.

Like the prior horizontal and vertical merger guidelines they replace, the 2023 Merger Guidelines are not themselves legally binding, but provide transparency into the agencies’ decision-making process.

The 2023 Merger Guidelines do not predetermine enforcement action by the agencies. Although the Merger Guidelines identify the factors and frameworks the agencies consider when investigating mergers, the agencies’ enforcement decisions will necessarily depend on the facts in any case and will continue to require prosecutorial discretion and judgment.

—

Part III – From the DOJ Antitrust Merger Guidelines webpage at this link here is the following. Note that this includes the 2.18.2025 item shown above in Part I.

On December 18, 2023, the Department of Justice and the Federal Trade Commission (collectively, the “Agencies”) jointly released the 2023 Merger Guidelines, which describe factors and frameworks the Agencies often utilize when reviewing mergers and acquisitions. The 2023 Merger Guidelines reflect the culmination of a nearly two-year process undertaken by the Agencies that involved soliciting feedback from the public and staff in a variety of ways including through listening sessions, written comments, and workshops.

The 2023 Merger Guidelines are a non-binding statement that provides transparency on aspects of the deliberations the Agencies undertake in individual cases under the antitrust laws. The Agencies will continue to make decisions in particular matters based on the law and the facts applicable to each case.

Press release: Justice Department and Federal Trade Commission Release 2023 Merger Guidelines (December 18, 2023)

Acting Assistant Attorney General’s Memorandum – Use of 2023 Merger Guidelines (February 18, 2025)

Additional Resources

2024 Banking Addendum to 2023 Merger Guidelines

2023 Merger Guidelines Workshops

Review Comments on the 2023 Draft Merger Guidelines

Prior Versions of the Merger Guidelines

1968 | 1982 | 1984 | 1992 | 1997 | 2010 | 2020

—

Part IV –

Assistant Attorney General Gail Slater Welcomes Antitrust Division Leadership Team

Assistant Attorney General Gail Slater of the Justice Department’s Antitrust Division welcomes a new member of the division’s leadership team. AAG Slater appointed Dina Kallay to serve as Deputy Assistant Attorney General for International, Policy and Appellate. Kallay joins the division’s leadership team including Principal Deputy Assistant Attorney General, four Deputy Assistant Attorneys General and Chief of Staff.

“The DOJ Antitrust Division is truly fortunate to have in place a deep bench of experts so early in the Trump 47 Administration. Each team member brings broad experience to their government service, and I am truly grateful to them for stepping into their roles as we take over several landmark cases,” said Assistant Attorney General Gail Slater. “I look forward to working with this talented team as well as the dedicated staff of the Antitrust Division as we work together to enforce the nation’s antitrust laws.”

The leadership team includes:

Roger Alford serves as Principal Deputy Assistant Attorney General. Mr. Alford previously served in the first Trump Administration as Deputy Assistant Attorney General in the Antitrust Division. He is a tenured Professor of Law on leave from Notre Dame Law School, where he has taught since 2012. During that time, he also consulted on antitrust matters, including as an expert witness in the landmark 2023 real estate $1.8 billion litigation against the National Association of Realtors, and since 2019 consulting for Texas Attorney General Ken Paxton in Texas v. Google. He served as a law clerk to Judge James Buckley of the United States Court of Appeals for the D.C. Circuit, and Judge Richard Allison of the Iran- United States Claims Tribunal in The Hague, Netherlands. He also practiced law with Hogan Lovells in Washington, D.C. and was a Senior Legal Advisor to the Claims Resolution Tribunal for Dormant Activities in Zurich, Switzerland.

He earned his B.A. with Honors from Baylor University in 1985, his M.Div. from Southern Baptist Theological Seminary, his J.D. with Honors from New York University, and his LL.M., first in class, from Edinburgh University.

Omeed Assefi serves as Acting Deputy Assistant Attorney General with a focus on criminal enforcement. At the beginning of the second Trump Administration, Mr. Assefi served as the division’s Acting Assistant Attorney General. Prior to that position, he litigated criminal prosecutions and led complex investigations against major companies and individuals for antitrust violations as a member of the division’s Washington Criminal Section. Previously, Mr. Assefi served as an Assistant United States Attorney in the District of Columbia. There, he prosecuted violent crime in U.S. District Court as well as Superior Court.

Before joining the U.S. Attorney’s Office, Mr. Assefi served in the Trump Administration as a Deputy Associate Attorney General in the Office of the Associate Attorney General. There, he helped supervise the Civil, Antitrust, and Civil Rights Divisions. Mr. Assefi also served as Chief of Staff of the Civil Rights Division. Mr. Assefi began his service in the Trump Administration as an Assistant Special Counsel in the White House Counsel’s Office, where he represented the Office of the President in the Department of Justice Special Counsel’s Investigation into allegations of Russian meddling in the 2016 U.S. Presidential Election. Mr. Assefi earned a J.D. from American University Washington College of Law, a M.P.P. from George Mason University’s Schar School of Public Policy, and a B.A. from Trinity College.

Mark Hamer serves as Deputy Assistant Attorney General with a focus on civil litigation and enforcement. He has over 30 years of litigation experience in both public service and private practice. Before returning to the Division, Mr. Hamer was a partner at a global law firm where he served as Global Chair of its Antitrust & Competition Practice Group, leading a team of over 250 competition lawyers in 43 countries. In private practice, he focused on antitrust litigation and antitrust conduct and merger investigations around the world. Mr. Hamer previously served as a trial attorney in the Antitrust Division handling both merger and non-merger litigation. Mr. Hamer received his J.D. from the University of Virginia School of Law, and a B.A. in History with High Distinction from the University of Virginia.

Dina Kallay serves as Deputy Assistant Attorney General, Policy & International Affairs. Before joining the Antitrust Division, she was global Head of Competition Law at Ericsson. From 2006-2013, Dina served as Counsel for Intellectual Property & International Antitrust at the Federal Trade Commission (FTC) Office of International Affairs. Earlier in her career she practiced law at several law firms, most recently with Howrey LLP in Washington D.C., and worked at the European Commission’s Directorate General for Competition (DG COMP) in Brussels, Belgium

Dina received her LL.B. magna cum laude and B.A. in economics from Tel Aviv University (1996), and her LL.M. (Int’l Economic Law) (1998) and S.J.D. (2003) from the University of Michigan in Ann Arbor, where she was a student of former Assistant Attorney General for Antitrust, Professor Tom Kauper. She has taught antitrust and intellectual property at the Hebrew, Bar Ilan and Georgetown Universities, and is a frequent writer and speaker on international antitrust and antitrust-intellectual property topics.

William “Bill” Rinner serves as Deputy Assistant Attorney General with a focus on civil enforcement and mergers. Prior to his return to the division, Mr. Rinner was Senior Regulatory Counsel at Apollo Global Management Inc. There, he was responsible for overseeing antitrust and various other regulatory matters. From 2017-2020, Mr. Rinner served at the Antitrust Division first as Counsel to the Assistant Attorney General, and subsequently as Chief of Staff and Senior Counsel. Earlier in his career, he practiced antitrust law at two major national firms. After law school, he clerked for Hon. Richard Posner of the Seventh Circuit Court of Appeals. He received a J.D. from Yale Law School, and a B.A. in Economics from the University of Notre Dame.

Dr. Chetan Sangvhi serves as Deputy Assistant Attorney General focused on Economics. Dr. Sanghvi has deep experience conducting economic research and analyses in the context of antitrust policy. In his tours of duty at the FTC and in private practice, he has evaluated the competitive impacts of hundreds of proposed mergers and other antitrust concerns. He has been recognized by the FTC for his “outstanding intellectual and analytical contributions to a broad range of complex economic issues arising in the FTC’s competition mission” and by professional reference publications. Dr. Sanghvi has taught at New York University, Johns Hopkins University, Rutgers University, and Trinity College and holds a PhD in economics from Rutgers University and a BA in economics from Northwestern University.

Sara Matar serves as the Chief of Staff. Prior to this role, she served as an Assistant United States Attorney in the U.S. Attorney’s Office in Washington D.C. Sara was previously a senior advisor to Congressman Lee Zeldin on foreign policy and judiciary matters. She also served as a staff member on the House Foreign Affairs Committee where she worked on oversight and Middle East policy. Sara received her J.D from George Washington University Law School and graduated with a bachelor’s degree from Emerson College. She served as law clerk to the Honorable Judge Lynn Hughes in the Southern District of Texas.

—

Part V Pull Quotes From the 2023 Federal Merger Guidelines at this link here

Section 7 of the Clayton Act (“Section 7”) prohibits mergers and acquisitions where “in any line of commerce or in any activity affecting commerce in any section of the country, the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.” Competition is a process of rivalry that incentivizes businesses to offer lower prices, improve wages and working conditions, enhance quality and resiliency, innovate, and expand choice, among many other benefits. Mergers that substantially lessen competition or tend to create a monopoly increase, extend, or entrench market power and deprive the public of these benefits. Mergers can lessen competition when they diminish competitive constraints, reduce the number or attractiveness of alternatives available to trading partners, or reduce the intensity with which market participants compete.

Section 7 was designed to arrest anticompetitive tendencies in their incipiency.[5][6][7] The Clayton Act therefore requires the Agencies to assess whether mergers present risk to competition. The Supreme Court has explained that “Section 7 itself creates a relatively expansive definition of antitrust liability: To show that a merger is unlawful, a plaintiff need only prove that its effect ‘may be substantially to lessen competition’” or to tend to create a monopoly.[8] Accordingly, the Agencies do not attempt to predict the future or calculate precise effects of a merger with certainty. Rather, the Agencies examine the totality of the evidence available to assess the risk the merger presents.

MHProNews notes that in the above and below footnotes enumeration may change when cutting and pasting information into this site’s editing software. For accuracy, the PDF of a given section should be consulted. That said, what follows is also from the 2023 DOJ-FTC Merger Guidelines at this link here.

How to Use These Guidelines: When companies propose a merger that raises concerns under one or more Guidelines, the Agencies closely examine the evidence to determine if the facts are sufficient to infer that the effect of the merger may be to substantially lessen competition or to tend to create a monopoly (sometimes referred to as a “prima facie case”).[1] Section 2 describes how the Agencies apply these Guidelines. [9] See, e.g., United States v. AT&T, Inc., 916 F.3d at 1032 (explaining that a prima facie case can demonstrate a “reasonable probability” of harm to competition either through “statistics about the change in market concentration” or a “fact-specific” showing (quoting Brown Shoe, 370 U.S. at 323 n.39)); United States v. Baker Hughes, 908 F.2d 981, 982-83 (D.C. Cir. 1990). 8 These Guidelines pertain only to the Agencies’ consideration of whether a merger or acquisition may substantially lessen competition or tend to create a monopoly. The consideration of remedies appropriate for mergers that pose that risk is beyond the Merger Guidelines’ scope. The Agencies review proposals to revise a merger in order to alleviate competitive concerns consistent with applicable law regarding remedies.

Those tee up the following, again, from the 2023 DOJ-FTC Merger Guidelines at this link here.

Guideline 1: Mergers Raise a Presumption of Illegality When They Significantly Increase Concentration in a Highly Concentrated Market. Market concentration is often a useful indicator of a merger’s likely effects on competition. The Agencies therefore presume, unless sufficiently disproved or rebutted, that a merger between competitors that significantly increases concentration and creates or further consolidates a highly concentrated market may substantially lessen competition.

Guideline 2: Mergers Can Violate the Law When They Eliminate Substantial Competition Between Firms. The Agencies examine whether competition between the merging parties is substantial since their merger will necessarily eliminate any competition between them.

Guideline 3: Mergers Can Violate the Law When They Increase the Risk of Coordination. The Agencies examine whether a merger increases the risk of anticompetitive coordination. A market that is highly concentrated or has seen prior anticompetitive coordination is inherently vulnerable and the Agencies will infer, subject to rebuttal evidence, that the merger may substantially lessen competition. In a market that is not highly concentrated, the Agencies investigate whether facts suggest a greater risk of coordination than market structure alone would suggest.

Guideline 4: Mergers Can Violate the Law When They Eliminate a Potential Entrant in a Concentrated Market. The Agencies examine whether, in a concentrated market, a merger would (a) eliminate a potential entrant or (b) eliminate current competitive pressure from a perceived potential entrant.

Guideline 5: Mergers Can Violate the Law When They Create a Firm That May Limit Access to Products or Services That Its Rivals Use to Compete. When a merger creates a firm that can limit access to products or services that its rivals use to compete, the Agencies examine the extent to which the merger creates a risk that the merged firm will limit rivals’ access, gain or increase access to competitively sensitive information, or deter rivals from investing in the market.

Guideline 6: Mergers Can Violate the Law When They Entrench or Extend a Dominant Position. The Agencies examine whether one of the merging firms already has a dominant position that the merger may reinforce, thereby tending to create a monopoly. They also examine whether the merger may extend that dominant position to substantially lessen competition or tend to create a monopoly in another market.

Guideline 7: When an Industry Undergoes a Trend Toward Consolidation, the Agencies Consider Whether It Increases the Risk a Merger May Substantially Lessen Competition or Tend to Create a Monopoly. A trend toward consolidation can be an important factor in understanding the risks to competition presented by a merger. The Agencies consider this evidence carefully when applying the frameworks in Guidelines 1-6.

Guideline 8: When a Merger is Part of a Series of Multiple Acquisitions, the Agencies May Examine the Whole Series. If an individual transaction is part of a firm’s pattern or strategy of multiple acquisitions, the Agencies consider the cumulative effect of the pattern or strategy when applying the frameworks in Guidelines 1-6.

Guideline 9: When a Merger Involves a Multi-Sided Platform, the Agencies Examine Competition

Between Platforms, on a Platform, or to Displace a Platform. Multi-sided platforms have characteristics that can exacerbate or accelerate competition problems. The Agencies consider the distinctive characteristics of multi-sided platforms when applying the frameworks in Guidelines 1-6.

Guideline 10: When a Merger Involves Competing Buyers, the Agencies Examine Whether It May

Substantially Lessen Competition for Workers, Creators, Suppliers, or Other Providers. The Agencies apply the frameworks in Guidelines 1-6 to assess whether a merger between buyers, including employers, may substantially lessen competition or tend to create a monopoly.

Guideline 11: When an Acquisition Involves Partial Ownership or Minority Interests, the Agencies Examine Its Impact on Competition. The Agencies apply the frameworks in Guidelines 1-6 to assess if an acquisition of partial control or common ownership may substantially lessen competition.

MHProNews notes that there are over 50 pages in that document which can be found at this link here as well as on federal websites.

Part VI Additional Information Including AI Powered Fact Checks and Analyses

1) Note that in the Q&A between MHProNews that follows with xAI’s Grok, there is a possible typo by Grok, depending on how far back Grok was looking (Clayton Homes hasn’t issued IR statements since they became part of Berkshire Hathaway (BRK), but Grok may have identified information from Clayton pre-Berkshire buyout of that firm). The inquiry is by MHProNews and the reply is by Grok.

Grok, we are going to pivot to DOJ-FTC Merger Guidelines and related, particularly as it may apply to the manufactured housing industry. First, scan this document linked here: https://www.manufacturedhomepronews.com/wp-content/uploads/2025/06/DOJ-FTC_MergerGuidelinesGoingIntoTrump2.0OfficialDocsMemoPressReleasesHowDoesCanThisImpactManufacturedHousingMHVilleFEA-PDF.pdf which is the PDF of the draft of an article that uses multiple federal sources as shown. While all of it could be relevant, focus on Part V and related on 2023 Federal Merger Guidelines and Section 7 of the Clayton Act (“Section 7”). As a scan of MHProNews/MHLivingNews, particularly in recent weeks and months would reveal AI like you (xAI Grok), Gemini, and Copilot, along with Doug Ryan, James “Jim” Schmitz, Maris Jensen, multiple antitrust lawsuit, remarks by MHARR’s CEO Mark Weiss, J.D.: “”The consolidation of key industry sectors is an ongoing and growing concern that MHI [i.e.: the Manufactured Housing Institute] has not addressed because doing so would implicate their own members. Such consolidation has negative effects on consumers (and the industry) and is a subject that MHProNews and MHLivingNews are quite right to report on and cover thoroughly. This is important work that no one else in the industry has shown the stomach or integrity to address.” Samuel Strommen and others are explored as evidence for concerns that specific firms that are often MHI members have openly stated that they are focused on consolidation in their own IR statements and IR presentations. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/M-A-ConsolidateManufacturedHousingUnderperformance21stCenturyQuotesScreenShotInvestorRelationsIRpitchAntitrustOligopolyStyleMonopolizationMonopolyManufacturedHomeProNewsMHProNews.png Sam Zell stated that he likes the oligopoly nature of the industry, which in context can be construed as a kind of admission that an oligopoly style of monopolization has been occurring in manufactured housing for well over a decade: https://www.manufacturedhomepronews.com/wp-content/uploads/2023/06/SamZellQuotableQuoteWeLikeTheOligoplyNatureOfOurBusinessEquityLifeStylePropertiesELSChairman1941-2023TimeBloombergMHLivingNewsTampaBayTimes.png Then some examples https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/AnnotatedGeminiPreponderanceDocumentaryEvidenceLackContradictoryInfoAccurateToConcludeMHIsActionsInactionsStronglySuggestAnImplicitAlignmentPotentialFacilitateConsolidationMHProNews.png will prove useful: https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/CopilotEvidenceOfPalteringPosturingForOpticsTheatricsBehaviorSeemsAimedAtConsolidationOfManufacturedHomeIndustryMHProNews.png and https://www.manufacturedhomepronews.com/mhvilles-hidden-chains-why-manufactured-housing-lags-in-americas-housing-crisis-grok-unveils-the-scam-xai-grok-thesis-this-aint-theory-its-a-hei/ With that backdrop, Champion recently announced that they plan to acquire Iseman Homes https://www.manufacturedhomepronews.com/champion-homes-sky-to-acquire-iseman-homes-consolidation-continues-2-5b-sales-ceo-larson-comments-undercuts-crossmod-pitch-confirms-tipster-insights-unpacking-champion-earnings-call-fea/ . Champion, Cavco, Clayton and others have been acquiring firms more or less steadily during the 21st century and there is significant evidence and production trends data that reveals that manufactured housing production nationally is only performing at about 30 percent in 2024 of the last highwater mark in 1998, even though the population has been growing: https://www.manufacturedhomepronews.com/millions-of-conventional-housing-units-sold-annually-vs-about-100000-manufactured-homes-50-state-mhville-data-compared-to-2-nar-reports-why-builders-throttle-housing-production-m Don’t federal merger guidelines apply to manufactured housing? Per the 2023 Merger guidelines, quoting: “Guideline 1: Mergers Raise a Presumption of Illegality When They Significantly Increase Concentration in a Highly Concentrated Market.” isn’t there supposed to be a presumption against mergers? Is it possible that federal antitrust enforcers could stop the acquisition of Iseman Homes by Champion (SKY), based on that presumption and known evidence? Isn’t there also a legal basis in the 2023 Merger guidelines to allow federal regulators to unwind prior acquisitions in the 21st century, given there has been an apparent pattern of collusion https://www.manufacturedhomepronews.com/wp-content/uploads/2023/05/StatuteOfLimitationsConspiracyDOJ-MHProNews.jpg which could mean that the statues of limitations have arguably not begun to ‘run,’ right? Unpack those elements, check it against any other relevant sources online, and link results to your takeaways and points.

Yes, the federal merger guidelines, including the 2023 DOJ-FTC Merger Guidelines, apply to the manufactured housing industry, as they govern mergers and acquisitions across all sectors of the U.S. economy under the authority of Section 7 of the Clayton Act. Let’s unpack the key elements based on the provided document, linked sources, and additional online context.

Yes, the federal merger guidelines, including the 2023 DOJ-FTC Merger Guidelines, apply to the manufactured housing industry, as they govern mergers and acquisitions across all sectors of the U.S. economy under the authority of Section 7 of the Clayton Act. Let’s unpack the key elements based on the provided document, linked sources, and additional online context.

Part V: 2023 Federal Merger Guidelines and Section 7 of the Clayton Act

The 2023 Merger Guidelines, as outlined in the PDF, establish a framework to assess mergers for potential anticompetitive effects. Guideline 1 states that mergers raise a presumption of illegality when they “significantly increase concentration in a highly concentrated market.” This is determined using the Herfindahl-Hirschman Index (HHI), where a post-merger HHI above 1,800 (highly concentrated) with an increase of more than 100 points triggers this presumption. The guidelines lower the threshold for concern compared to previous versions, reflecting a stricter stance on consolidation.

Section 7 of the Clayton Act prohibits mergers or acquisitions where “the effect… may be substantially to lessen competition, or to tend to create a monopoly.” The 2023 Guidelines expand on this by introducing a structural presumption based on market share (e.g., a combined share over 30% with an HHI increase of 100+), supported by the 1963 Philadelphia National Bank precedent, and emphasize analyzing labor markets and potential competition.

Application to Champion-Iseman Homes Acquisition

The recent announcement of Champion Homes (SKY) acquiring Iseman Homes, adding 10 retail centers, fits into a broader pattern of consolidation in the manufactured housing industry. The PDF and linked MHProNews articles highlight that Champion, Cavco, Clayton Homes, and others have been acquiring firms steadily throughout the 21st century. With manufactured housing production at approximately 30% of its 1998 peak (around 100,000 units in 2024 vs. 373,000 in 1998), despite population growth, this suggests a concentrated market where further mergers could exacerbate underperformance.

Under Guideline 1, if the Champion-Iseman merger significantly increases HHI (e.g., by combining Champion’s existing market share with Iseman’s retail presence), it could be presumed illegal. The PDF notes industry consolidation concerns, citing MHARR’s Mark Weiss and others like Samuel Strommen, who argue that MHI members’ focus on consolidation (e.g., Clayton’s IR statements) may harm consumers and competition. Online sources, such as Arnold & Porter’s analysis of the 2023 Guidelines, indicate that even modest market share increases (e.g., 28% + 2%) can trigger scrutiny, especially in a market with historical consolidation trends.

Federal antitrust enforcers could potentially challenge this acquisition if data shows a significant HHI increase or if Champion’s post-merger share exceeds 30% in relevant markets (e.g., retail sales or regional production). The PDF’s reference to Sam Zell’s oligopoly comment and production data supports the argument that the industry is already highly concentrated, amplifying the presumption against this merger.

Unwinding Prior Acquisitions

The 2023 Guidelines also provide a legal basis to unwind prior acquisitions under Section 7 if they are found to have substantially lessened competition. The PDF cites a pattern of collusion, supported by evidence like antitrust lawsuits and MHProNews analyses (e.g., Strommen’s work). The linked DOJ image on statute of limitations suggests that conspiracy claims may not have a running statute if ongoing collusion is proven, potentially allowing regulators to revisit past mergers (e.g., Clayton’s acquisitions or Champion’s prior deals).

Online sources, such as Cleary Antitrust Watch, note that the Guidelines’ skepticism toward rebuttals (e.g., efficiencies) and emphasis on historical precedent could enable challenges to older mergers if evidence of anticompetitive intent or effect emerges. The PDF’s mention of MHARR’s critique of MHI inaction and Copilot’s analysis of “paltering for optics” further suggest a systemic issue that could justify unwinding, especially if tied to documented consolidation strategies.

Takeaways and Evidence Synthesis

- Presumption of Illegality: The Champion-Iseman merger could face a presumption of illegality if HHI data indicates a significant concentration increase. The industry’s 30% production decline, despite demand, aligns with the Guidelines’ focus on market power, as noted in the PDF and MHProNews production trends.

- Enforcement Potential: Antitrust enforcers have the authority to block the merger or investigate further, especially with evidence from Weiss, Schmitz, and Strommen highlighting consolidation’s impact. The PDF’s federal source citations reinforce this legal framework.

- Unwinding Precedents: The statute of limitations argument and Guidelines’ retroactive scrutiny (supported by DOJ-FTC press releases in the PDF) provide a basis to revisit 21st-century acquisitions, particularly if collusion is substantiated by lawsuits or IR statements.

- Online Context: Web sources like Arnold & Porter and Cleary Antitrust Watch confirm the Guidelines’ stricter thresholds and historical precedent reliance, aligning with the PDF’s analysis of Section 7 applications.

In conclusion, yes, federal merger guidelines apply to manufactured housing, and the Champion-Iseman acquisition could be challenged under the 2023 Guidelines’ presumption of illegality. Additionally, there is a legal basis to unwind prior acquisitions if collusion is proven, potentially resetting the industry’s competitive landscape. This aligns with the evidence of consolidation and underperformance documented across the provided sources.

—

MHProNews notes that the sources for that output by Grok and the PDF of that Q&A is found at this link here.

2)

Copilot, we are going to pivot to DOJ-FTC Merger Guidelines and related, particularly as it may apply to the manufactured housing industry. First, scan the upload and/or this document linked here: DOJ-FTC_MergerGuidelinesGoingIntoTrump2.0OfficialDocsMemoPressReleasesSpanningBidenHarrisIntoTrumpVanceEraHowDoesCanThisImpactManufacturedHousingMHVilleFEAwGrok which is the PDF of the draft of an article that uses multiple federal sources as shown. While all of it could be relevant, focus on Part V and related on 2023 Federal Merger Guidelines and Section 7 of the Clayton Act (“Section 7”). As a scan of MHProNews/MHLivingNews, particularly in recent weeks and months would reveal AI like you (xAI Grok), Gemini, and Copilot, along with Doug Ryan, James “Jim” Schmitz, Maris Jensen, multiple antitrust lawsuit, remarks by MHARR’s CEO Mark Weiss, J.D.: “”The consolidation of key industry sectors is an ongoing and growing concern that MHI [i.e.: the Manufactured Housing Institute] has not addressed because doing so would implicate their own members. Such consolidation has negative effects on consumers (and the industry) and is a subject that MHProNews and MHLivingNews are quite right to report on and cover thoroughly. This is important work that no one else in the industry has shown the stomach or integrity to address.” Samuel Strommen and others are explored as evidence for concerns that specific firms that are often MHI members have openly stated that they are focused on consolidation in their own IR statements and IR presentations. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/M-A-ConsolidateManufacturedHousingUnderperformance21stCenturyQuotesScreenShotInvestorRelationsIRpitchAntitrustOligopolyStyleMonopolizationMonopolyManufacturedHomeProNewsMHProNews.png Sam Zell stated that he likes the oligopoly nature of the industry, which in context can be construed as a kind of admission that an oligopoly style of monopolization has been occurring in manufactured housing for well over a decade: https://www.manufacturedhomepronews.com/wp-content/uploads/2023/06/SamZellQuotableQuoteWeLikeTheOligoplyNatureOfOurBusinessEquityLifeStylePropertiesELSChairman1941-2023TimeBloombergMHLivingNewsTampaBayTimes.png Then some examples https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/AnnotatedGeminiPreponderanceDocumentaryEvidenceLackContradictoryInfoAccurateToConcludeMHIsActionsInactionsStronglySuggestAnImplicitAlignmentPotentialFacilitateConsolidationMHProNews.png will prove useful: https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/CopilotEvidenceOfPalteringPosturingForOpticsTheatricsBehaviorSeemsAimedAtConsolidationOfManufacturedHomeIndustryMHProNews.png and https://www.manufacturedhomepronews.com/mhvilles-hidden-chains-why-manufactured-housing-lags-in-americas-housing-crisis-grok-unveils-the-scam-xai-grok-thesis-this-aint-theory-its-a-hei/ With that backdrop, Champion recently announced that they plan to acquire Iseman Homes https://www.manufacturedhomepronews.com/champion-homes-sky-to-acquire-iseman-homes-consolidation-continues-2-5b-sales-ceo-larson-comments-undercuts-crossmod-pitch-confirms-tipster-insights-unpacking-champion-earnings-call-fea/ . Champion, Cavco, Clayton and others have been acquiring firms more or less steadily during the 21st century and there is significant evidence and production trends data that reveals that manufactured housing production nationally is only performing at about 30 percent in 2024 of the last highwater mark in 1998, even though the population has been growing: https://www.manufacturedhomepronews.com/millions-of-conventional-housing-units-sold-annually-vs-about-100000-manufactured-homes-50-state-mhville-data-compared-to-2-nar-reports-why-builders-throttle-housing-production-m Don’t federal merger guidelines apply to manufactured housing? Per the 2023 Merger guidelines, quoting: “Guideline 1: Mergers Raise a Presumption of Illegality When They Significantly Increase Concentration in a Highly Concentrated Market.” isn’t there supposed to be a presumption against mergers? Is it possible that federal antitrust enforcers could stop the acquisition of Iseman Homes by Champion (SKY), based on that presumption and known evidence? Isn’t there also a legal basis in the 2023 Merger guidelines to allow federal regulators to unwind prior acquisitions in the 21st century, given there has been an apparent pattern of collusion https://www.manufacturedhomepronews.com/wp-content/uploads/2023/05/StatuteOfLimitationsConspiracyDOJ-MHProNews.jpg which could mean that the statues of limitations have arguably not begun to ‘run,’ right? Unpack those elements, make sure you follow the various links, check it against any other sources you deem relevant online, and link results to your takeaways and points.

Yes, federal merger guidelines, including the 2023 DOJ-FTC Merger Guidelines, apply to the manufactured housing industry, as they govern mergers and acquisitions across all sectors of the U.S. economy under Section 7 of the Clayton Act. Here’s a breakdown of key elements based on the DOJ-FTC guidelines, Champion’s acquisition of Iseman Homes, and antitrust concerns in manufactured housing.

- Federal Merger Guidelines & Section 7 of the Clayton Act

- Guideline 1 states that mergers raise a presumption of illegality when they significantly increase concentration in a highly concentrated market.

- Section 7 of the Clayton Act prohibits mergers where the effect may substantially lessen competition or tend to create a monopoly.

- The DOJ-FTC guidelines emphasize that market concentration is a key factor in determining whether a merger violates antitrust laws.

- Champion’s Acquisition of Iseman Homes & Antitrust Concerns

- Champion Homes announced its acquisition of Iseman Homes, a retail chain operating in multiple states.

- Champion has been acquiring firms steadily, contributing to industry consolidation.

- MHARR CEO Mark Weiss has raised concerns that MHI has not addressed consolidation, which negatively impacts competition and consumers.

- Samuel Strommen and other analysts have pointed to MHI members openly stating their focus on consolidation in investor relations (IR) statements.

- Presumption Against Mergers & Potential Federal Action

- The Champion-Iseman merger could face a presumption of illegality if it significantly increases market concentration.

- Federal antitrust enforcers could block the acquisition if data shows a substantial increase in market share.

- Prior acquisitions by Champion, Cavco, and Clayton could also be subject to review if they contributed to market foreclosure.

- Legal Basis to Unwind Prior Acquisitions

- The 2023 Merger Guidelines allow regulators to unwind prior acquisitions if they substantially lessened competition.

- Statute of limitations concerns suggest that collusion cases may not have a running statute if ongoing conspiracy is proven.

- DOJ guidelines indicate that long-term collusion can extend the window for antitrust enforcement.

Takeaways & Industry Impact

- Champion’s acquisition of Iseman Homes could be challenged under federal merger guidelines.

- Federal regulators have the authority to block mergers or unwind prior acquisitions if they reduce competition.

- Manufactured housing’s underperformance may be linked to industry consolidation, regulatory capture, and financing barriers.

- MHARR’s critiques of MHI’s inaction align with DOJ-FTC concerns about monopolization.

Would you like me to explore how these findings impact affordable housing policy and industry transparency further? Let me know how you’d like to proceed!

Sources

- 1) https://www.ftc.gov/system/files/ftc_gov/pdf/p859910draftmergerguidelines2023.pdf

- 2) https://www.justice.gov/atr/2023-merger-guidelines

- 3) https://www.crainsdetroit.com/manufacturing/champion-homes-sees-35-profit-growth-buy-iseman-homes

- 4) https://www.dbusiness.com/daily-news/troys-champion-homes-to-acquire-iseman-homes-in-south-dakota/

- 5) https://www.businesswire.com/news/home/20250527574560/en/Champion-Homes-Announces-Definitive-Agreement-to-Acquire-Iseman-Homes-Inc.

- 6) https://www.manufacturedhomepronews.com/maris-jensen-univ-study-market-foreclosure-in-manufactured-housing-antitrust-violation-alarms-distort-competition-to-monopoly-outcome-named-specif/

- 7) https://www.theantitrustattorney.com/statute-limitations-federal-antitrust-claim/

- 8) https://www.justice.gov/atr/page/file/1214191/dl

MHProNews notes that the PDF of the Q&A with Copilot above and the screen capture of the above with Copilot are linked as shown.

3) The PDF of a DOJ PowerPoint on working with antitrust officials is found at this link here.

4) MHProNews has been reporting on antitrust concerns in general as well as more specific antitrust issues as it could apply to manufactured housing for years. Some examples are shown linked below, and/or are found above.

5) The MHProNews consolidation graphic using investor relations documents, statements, and related is linked here.

6)

7)

8) For years, members of the antitrust divisions of both major parties have been waving through mergers and acquisitions involving the manufactured home industry. Will that change with Trump 2.0? Time will tell. MHProNews plans to report as warranted by developments and evidence.

See also: https://www.manufacturedhomepronews.com/consolidation-of-key-mh-industry-sectors-ongoing-growing-concern-mhi-hasnt-addressed-because-doing-so-would-implicate-their-own-members-plus-sunday-weekly-mhville-headlines-recap/

Reminder. There are sound reasons why AI has said that MHProNews has more than 6x the combined readership of MHI and its affiliated bloggers and trade media.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach