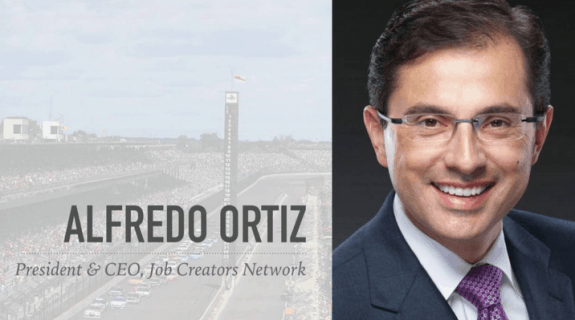

“The federal government does not suffer from a lack of revenue; it has a problem with overspending our hard-earned tax dollars,” per an Op-Ed in The Hill contributed by Jonathan Williams and Alfredo Ortiz.

Jonathan Williams is the chief economist at the American Legislative Exchange Council, and Alfredo Ortiz is the president and CEO of Job Creators Network.

In the op-ed that the above quote comes from, Williams and Ortiz are encouraging Republicans to pass the tax reform that President Trump has been promising. They propose that Republicans pass a bill that would address tax breaks for small businesses and middle-class workers, without making big spending cuts as well.

“The president is determined to energize the American economy, especially with the necessary tax cuts for job creators – small businesses all across the country who create 70 percent of all new jobs,” Ortiz said in a statement, per Newsmax.

“Job Creators Network will be very vocal and supportive over the coming weeks and months in an all-out effort to ensure small businesses and the country’s hard-working taxpayers get the help they’ve been asking for over so many years.”

Williams and Ortiz suggest that rather than going with a tax reform plan that is based off revenue neutrality, that there would be more success in a plan that was aimed towards deficit neutrality instead.

Revenue Neutrality Vs. Deficit Neutrality

“If policymakers adhere to the false revenue neutrality notion that all tax cuts must be matched, dollar for dollar with tax increases so that total revenue stays the same, they create far too many economic losers in the tax reform process and minimize the benefits to the economy. Numerous well-intentioned tax reform efforts have succumbed to that fate,” per The Hill.

They went on to point out that, “Deficit neutral tax changes provide real tax cuts for hardworking taxpayers, and by nature, bring discipline to the spending side of the ledger.”

“Advocates of big government will say some federal tax burdens should be increased as a part of “tax reform,” Williams and Ortiz wrote.

However, they go on to point out that academic evidence says otherwise, and that the U.S. Treasury reported that in the first 10 fiscal months of 2017 the federal government collected more than $1.3 trillion.

“Fiscal hawks should also be reminded of the fiscal benefits of tax cuts. Keeping more money in communities to be spent on Main Streets and less money shipped off to Washington to be spent on the federal workforce would be a massive economic stimulus.”

They go on to cite a nationwide poll conducted by Job Creators Network, which found that owners of small businesses would use their tax savings to

- Raise wages,

- Hire new employees,

- Or expand their business.

Overall, the economic boost from those tax cuts would end up providing more revenue for the government in the long-run. That was the case with Democratic President John F. Kennedy’s tax cuts, as well as Republican President Ronald Reagan.

Growing the Public Call for Tax Reform

Job Creators Network is one of the largest grassroots, pro-jobs organizations in the country. They have partnered with Freedom Works for a two weeks-long bus tour as a part of their “Tax Cuts Now” tour, per Breitbart.

During the tour, the goal is to encourage Americans to sign the organizations petition. Signing the petition sends a pre-written letter to Congress, asking them for meaningful tax reform.

Are Republicans Running Out of Time?

“To regain their legislative momentum and keep their majority, Republicans must clearly demonstrate they are fighting for the country’s hardworking taxpayers. This means passing a major tax cut by Thanksgiving — and making it retroactive to the start of this year,” per a USA Today op-ed by Newt Gingrich and Brad Anderson.

Gingrich is a former speaker of the House, and Anderson is the former CEO of Best Buy and a current member of the Job Creators Network.

Their belief is that if Republicans want to keep control of Congress they absolutely must pass a meaningful piece of legislation that benefits American workers before Thanksgiving this year – with the suggested bill being one on tax reform.

“Republicans must get on the offensive now and argue not only that hardworking taxpayers deserve a tax cut but also that tax cuts need only be deficit neutral, not revenue neutral, in order to preempt the inevitable attack from the Congressional Budget Office,” Williams and Ortiz wrote.

Tax reform has been a hot topic again in recent weeks. Democratic U.S. Representative Tim Ryan suggested simplifying tax codes and increasing the Earned Income Tax Credit in order to boost the economy.

There has been even more talk of tax reform since President Trump’s speech in Missouri where he said that he “doesn’t want to be disappointed by Congress.”

The National Federation of Independent Businesses (NFIB) has been calling on tax reform that would benefit small businesses and entrepreneurs for a long time.

Many NFIB members are manufactured housing professionals who understand how simplifying the tax code and reducing the amount paid into taxes will benefit both businesses and consumers.

Small business owners and entrepreneurs confidence has been starting to fade with the lack of action on repeal and replace of ObamaCare, the Daily Business News previously reported. Passing a beneficial tax reform bill would certainly be a step in the right direction for the Trump Administration – which must wait on action from Congress on this matter.

“We are excited by the Trump Administration’s dedication to the small business owner and the American Dream. If we give tax relief to these job creators we can grow the economy and provide opportunity for millions. These small business entrepreneurs can’t wait any longer. They need tax relief now,” Ortiz said. ## (News, analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)