The goal of the incoming Trump administration with regard to Dodd-Frank has been made clear.

“To dismantle the Dodd-Frank Act and replace it with new policies to encourage economic growth and job creation.”

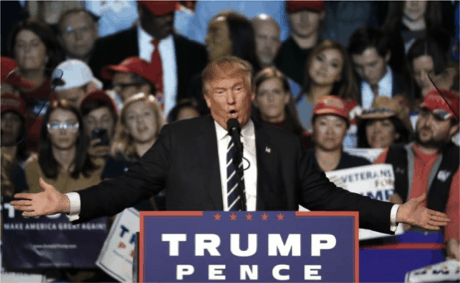

President-elect Donald Trump pledged throughout his campaign to get rid of what he called “stifling regulations.”

According to some experts, while an all out repeal of Dodd-Frank is unlikely, significant changes to key parts of the law are a real possibility.

“I don’t think it eviscerates Dodd-Frank, but I think it takes away some parts,“ said James Cox, a Duke University expert on securities law speaking on the Trump team’s approach.

According to the Associated Press, Republicans have long attacked Dodd-Frank and a central component, the Consumer Financial Protection Bureau (CFPB).

As Daily Business News readers are aware, we’ve covered the CFPB extensively, both with regard to Wells Fargo and a D.C. Court ruling that the organization is unconstitutional. Critics targeted the agency’s leadership structure, which consists of a single director.

Opponents of the CFPB favor a new five-member commission, which would lessen the power of the director, who’s appointed by the president.

The CFPB expanded regulators ability to police consumer products, and critics say Dodd-Frank and the CFPB went too far in their efforts, hindering banks from making loans that people and businesses need to spend and hire.

Other experts have said that a relaxing of Dodd-Frank’s rules could raise the likelihood of another crisis fed by high risk-taking. Dodd-Frank limits many of the high-risk practices that, in part, led to the 2008 financial crisis.

Other parts of Dodd-Frank that could be targeted include the Financial Stability Oversight Council, rules that hurt regional and community banks due to the cost of compliance, and the “Volcker Rule” which in many instances bars the biggest banks from trading for their own profit. The idea was to prevent high-risk trading bets that could implode at taxpayer expense.

The Impact on the MH Industry

In light of the ruling by the D.C. Court, pro-CFPB opponents to the ruling want to see it appealed.

What an appeal to the nation’s highest court would mean is that President-elect Trump’s appointment to the Supreme Court could be the deciding vote on an issue that has major impact for manufactured housing, other industries such as lending and hundreds of millions of Americans.

MHProNews and MHLivingNews have documented the harm to manufactured housing’s businesses, homeowners and would-be buyers that Dodd-Frank has created, with CFPB director Richard Cordray stating on CSPAN “I don’t think there was ever much high cost lending in the manufactured housing market.”

The full story, including Cordray’s testimony, is here.

As for the future of Dodd-Frank and the CFPB, while it appears that changes will be made, details are still unclear.

“We’ll see some significant changes to Dodd-Frank,” said Tom Quaadman, a Chamber of Commerce executive. “We’re not necessarily going to see a wholesale repeal.” ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News, MHProNews.