A manufactured home retailer recently contacted MHProNews on condition of anonymity, with a very specific concern about the validity of a loan approval. The loan in question was made with restrictions by the lender on a manufactured home (MH) shopper. The applicant reportedly was a senior citizen, the consumer was qualified and while the (MH) loan was approved, the retailer asked the lender – why was the loan term so short?

The lender’s representative replied that they are permitted to shorten the loan term, based upon an actuarial table – a reasonable life expectancy for a prospective consumer’s loan.

First the retailer, and then another party with a related concern, contacted MHProNews, asking us to look into the issue. Their concerns were documented and forwarded. Was this age discrimination, or was this a lawful practice? MHProNews contacted informed parties to better understand all sides of this issue.

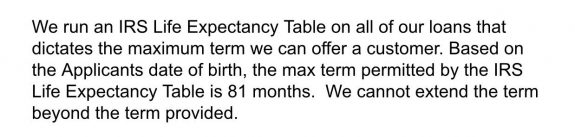

The legal question revolves around ECOA – The Equal Credit Opportunity Act. Here’s the key part of the lender-in-question’s reply to the MH retailer. Quoting:

IRS Life Expectancy Table

“We run an IRS Life Expectancy Table on all of our loans that dictates the maximum term we can offer a customer. Based on the Applicants date of birth, the max term permitted by the IRS Life Expectancy Table is 81 months. We cannot extend the term beyond the term provided.”

Based upon the above and the age of the applicant, the documentation provided by the lender to the retailer reflected that the loan term offered was just under 7 years.

MHProNews then asked a number of manufactured home lenders not involved in the transaction about this concern over possible age discrimination, based upon a shorter than normal loan term for an otherwise qualified applicant. Here is what we learned.

An MH Compliance Officer’s Take

“While you cannot discriminate solely on age, you can take age into consideration with respect to other underwriting criteria, for example income,” said Danielle C. Howard, Vice President, Chief Compliance Officer, Triad Financial Services.

Howard explained that “If the borrower’s income were to only continue for the next 15 years you could use that to determine you did not want to extend a 30 year mortgage because they would not have the income to repay it.”

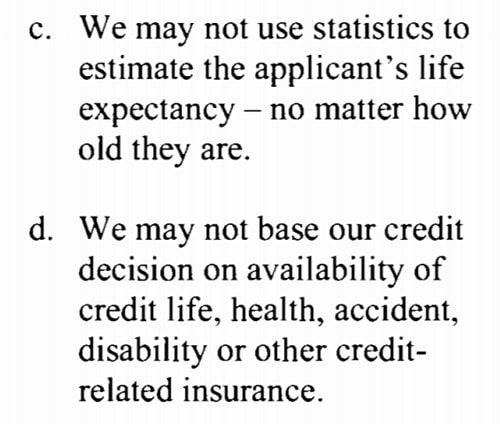

Howard provided the Daily Business News some additional information, which are linked below and here as a download. Examples of the information provided, from ECOA guidelines and third party guidance include the following.

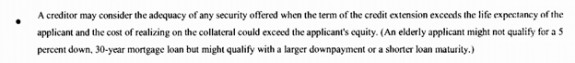

However, that same document, also provided the following additional insight, which a lender could apply to this or a similar case.

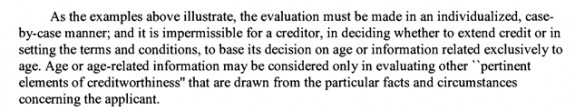

Further, the ECOA guidance stated:

MHProNews hereby notes that this article doesn’t purport to give any specific legal guidance.

Some Yes, Some No…

What the documentation and replies from various lenders revealed is that there seems to be a fine line, and that a reasonable argument can be made that allows for the lender involved to do precisely what they did.

There are also one-or-more MH lenders who stated off-the-record that they would not use age in this fashion, if the customer qualified, they would make the loan under their normal underwriting terms and conditions. An example is the quote that follows.

“I treat an 85 year old just like a 21 year old. This is a touchy subject. I am told that you can take the average life expectancy and use it to deny and or shorten the terms of a loan request. I have not tested this and don’t intend too. I know some lenders do and feel comfortable with it.

In most cases these older borrowers come in with a pretty good sized down payment (normally as the result of selling a home) and take care of their home. There is an attitude with some that want to buy a home with the minimum down knowing that they will not survive the mortgage and don’t care.”

So there are lenders that are willing to make such a loan, but a common view among professionals is that it could be done just as the lender stated to the retailer.

It should be noted too that some lenders will have a larger down payment requirement or tougher credit standards to begin with. All of these are factors involved in assessing the risk and making – limiting, or declining – a loan.

The Bigger Picture Involved

In the current over-regulated environment that exists since the passage of Dodd-Frank and the Consumer Financial Protection Bureau (CFPB) onerous and harmful implementation of the act, and their director’s testimony to Congress that demonstrates a remarkable ability to ignore those facts that harm consumers and lenders alike, lending has demonstrably been driven out of the marketplace. U.S. Bank is one prime example of a lender that had a successful loan program, a profitable one.

Yet because of the

- risks from regulators and their interpretations of the rules,

- the chance for loss is so great that giant U.S. Bank,

- and other previous lenders on manufactured housing

have left the marketplace due to the high costs and risks of litigation and compliance.

Given that reality, would it be wise for a retailer or community to push a discrimination argument on a relatively uncommon issue, knowing that it might create a cascade effect that would end up driving yet another HUD Code chattel (Personal property, home only) lender from the business?

No One Condemned The Practice

While some privately acknowledged that they might have approached this loan differently, without all of the facts of the file in front of them, no one would condemn or seriously question that lender’s decision.

All current “national” or even regional MH lenders today have compliance officers who are tasked with making sure that no discrimination of any type takes place.

Based upon the information available, and given the many outlined variables, it seems reasonable to give the lender in question the benefit of the doubt. ##

Submitted by Frank Griffin, Daily Business News, MHProNews.