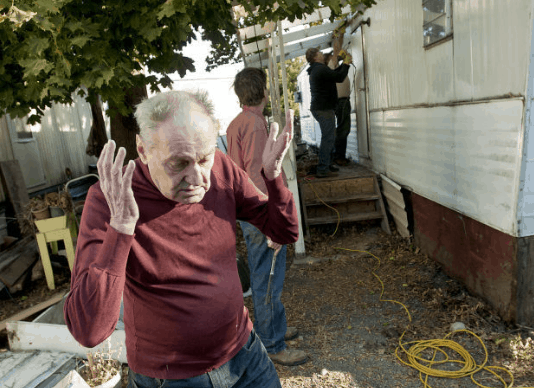

A Montana and Idaho nonprofit agency has launched a program to help people who live in what they called “mobile homes” to make repairs and improvements without having to resort to taking out high interest loans.

Missoula based Montana and Idaho Community Development Corp. (MICDC) is rolling out the new Mobile Home Improvement Loan Program, per the Missoulian.

As Daily Business News readers are aware, most references to “mobile homes” by publications are incorrect, as the last mobile home was built in the U.S. in 1976.

In this instance, about 20 percent of the homes in Montana and Idaho are pre-HUD code homes, which means that they technically are mobile homes. Of course, that means the other some 80 percent are manufactured homes. For a more detailed history on the journey from mobile to manufactured homes, please click here.

Missoula resident Laila Huson was the first person to be approved for the program, and took out a loan of 3200 dollars. The amount the borrower pays monthly on the loan is on a sliding scale and based on monthly income and expenses.

“Every year, we go up on the roof to try to seal the leaks, but it’s an aluminum roof with the hot and cold expanding and contracting, it’s a regular problem,” said Huson.

“Most places where I could get a loan would charge a 36 percent interest rate and require me to use my car as collateral. If I missed a payment due to illness, I could lose my only means of transportation.”

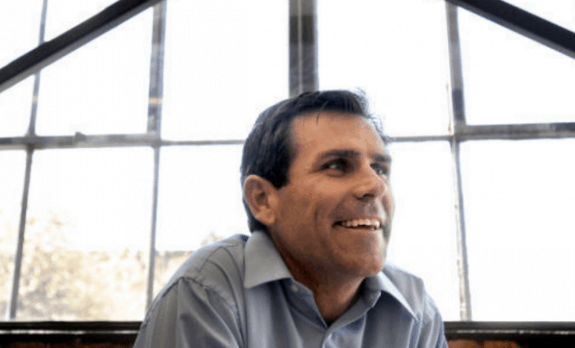

Dave Glaser, President of the MICDC, says that mobile home owners tend to have a significantly harder time with financing for home repairs, which can lead to uncomfortable and unhealthy living conditions.

He also decided to take the extra step of having his staff go door to door in Huson’s community to share information with residents about the program. The loans can also be used by communities for things such as playgrounds, lighting, signage, and landscaping.

“These are really low interest rate loans,” said Glaser. “The exact interest rate depends on the borrower, but it’s far better than what they could expect to find elsewhere. The idea is to help them afford these upgrades and make them affordable to their cash flow on a case by case basis. We take a look at the family’s income and help them decide upon an interest rate and a loan amount they can afford.”

The program is available to residents in Montana and Idaho. For more information, homeowners and communities can contact Julie Ehlers at 844-728-9235 ext. 225. ##

(Editor’s note: for a fun look at extreme “mobile home makeovers” click here or the image above.)

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.