It has been said that the first step in problem solving is first to admit that you have a problem. Before diving into the Dollar General (DG) part of the headline in this mashup, some basic manufactured housing industry data points should prove useful. Production and shipments are different but related data points in manufactured housing. As the name implies, production is the count of the number of HUD Code manufactured homes built or ‘produced.’ Shipments are the count of the number of HUD Code manufactured homes shipped to a destination. The difference between shipments and production are aptly referred to as “destination pending” by the Manufactured Housing Institute (MHI). The numbers of destination pending units are routinely low, typically a fraction of a percent. In October 2025, per MHI, the percentage of units that were “destination pending” totaled 0.3%. While an interesting data point for precision purposes, the tallies of shipments vs. production are quite close. Shipments, per MHI’s table provided in Part I below, are routinely 99.6 percent to 99.9 percent of production. An MHI-linked blogger has at times made much of this fractional difference, which for the literate may call to mind the title of a William Shakespeare’s comedic play entitled Much Ado About Nothing. In this instance, the data produced by the Manufactured Housing Association for Regulatory Reform (MHARR) and MHI are ‘close enough’ for those who tossing proverbial horseshoes or hand grenades. So long as MHARR and MHI are each faithful to their methodology, that tiny fraction of a percentage point is unlikely to change the course of the industry, especially since the ‘destination pending’ units are routinely shipped in the following month. A paraphrase from a famous line in Shakespeare’s Hamlet (Act 3, scene 2) comes to mind for the MHI-member-blogger in question: ‘methinks he doth protest too much’ – about a fraction of a single percent difference. MHARR prefers to focus on more substantive topics, as does MHProNews and MHLivingNews. That said, by laying out those data points and related details, the difference between production and shipments begins to come into sharper focus.

Namely, MHI’s recent statement in favor of their own Professional Housing Consultant (PHC) sales training program (see Part II) rather than publishing hard data visible via their news or news landing pages.

With some basic industry data understanding, the surge by Dollar General (DG) retail stores in 2025 by some 65 percent year to date exposed MHI’s own shipment data as yielding a crop of fresh ‘failure metrics’ in that organization’s effectiveness in training, marketing, advocacy, and so on. These insights may seem to be of questionable significance, until the lessons from Dollar General (DG) are applied to the dramatically diminished manufactured housing industry in the 21st century.

1) From an email from the National Association of Realtors (NAR) on 12.9.2025 to MHProNews are the following projections for 2025.

National Outlook for 2026

-

Existing-home sales are forecast to increase by 14%

-

Home prices are expected to rise by about 4%

-

Mortgage rates are projected to decline toward 6%

-

Job growth is expected to remain moderate with roughly 1.3 million new jobs

2) It is worth noting that NAR cited their chief economist.

“Lower mortgage rates and larger inventory will attract buyers back to the market in 2026,” said NAR Chief Economist Lawrence Yun. “The top 10 housing hot spots for 2026 have a combination of strong demand potential, projected improvements in affordability, and, most critically, a housing stock that matches the budgets of the buyers who are returning to the market.”

“After three years of flat home sales, a solid double-digit percentage increase is expected in 2026,” Yun said. “In 2026, we expect higher inventory, modest improvements in affordability, and more accommodating monetary policy from the Federal Reserve will help more Americans buy their next home.”

3) Part of what makes that interesting is that Realtor.com’s chief economist Danielle Hale provided a forecast that offered different projections than NAR’s Dr. Yun.

4) From the video above is the following still.

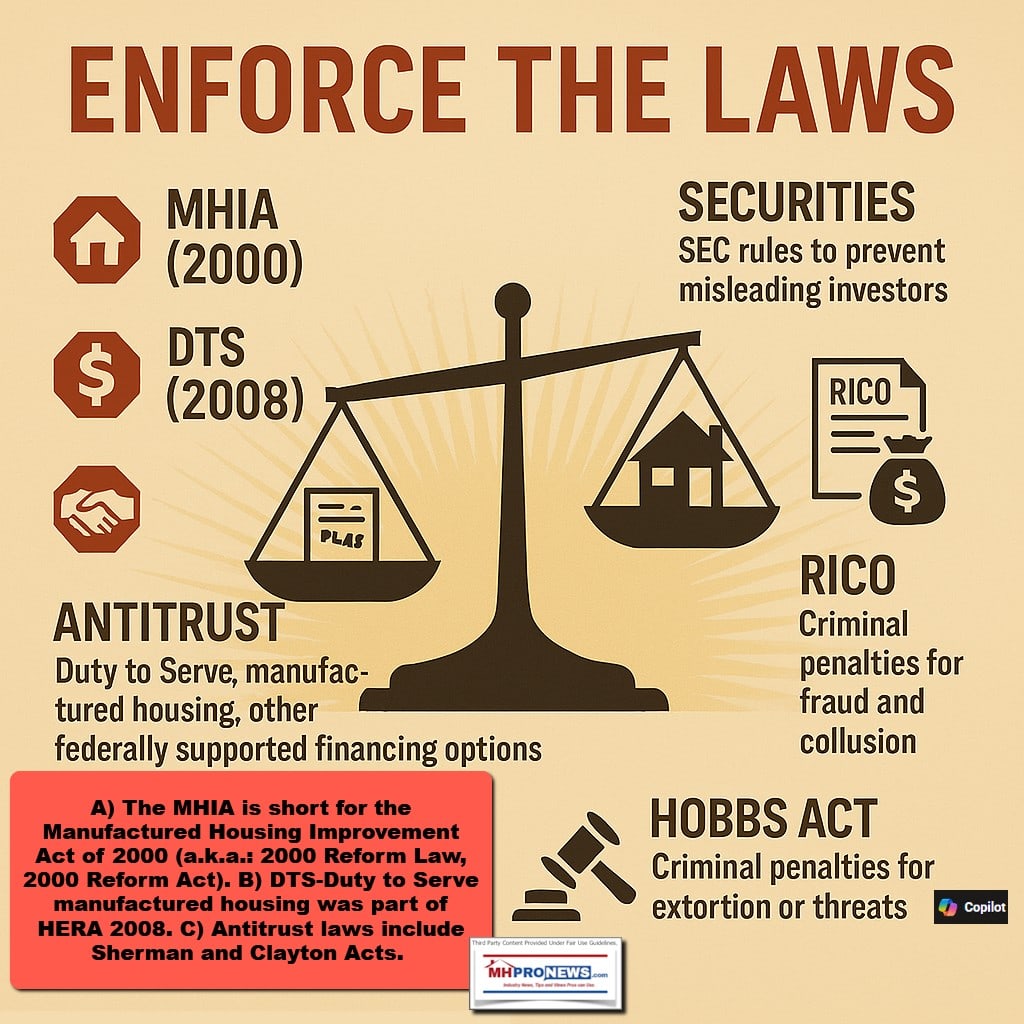

5) Using the data from economist Hale in the still above reveals that during the Biden-Harris (D) years, over a million ‘average’ annual home sales in the U.S. of existing housing vanished. More specifically, the chart above showed that 1.2 million average annual sales from 2013 to 2019 from the administrations of Presidents Obama (D) to Trump (R) did not occur. Could manufactured housing have filled much of the gap, had enhanced preemption, FHA Title I lending, and the Duty to Serve (DTS) manufactured housing chattel (personal property, home only) financing had been readily available? The logical answer is yes.

6) Pivoting to Dollar General (DG) Corporation’s retail stores. They have been attracting considerable and favorable investor attention. The reasons include hundreds of more locations, hundreds more planned for 2026, and a surging stock after three years of dreary performance from the investor’s perspective.

7) When Dollar General (DG) comes to mind for millions, so does the words “affordable” and “convenient.” To be clear, Dollar stores may not be cheaper than their larger rival Walmart (WMT). Bing’s snapshot above says that the consensus of 31 analysts for DG is a buy.

8) Applying that “affordable” mantra of DG to manufactured housing ought to suggest that the manufactured home industry ought to be surging too, for reasons that the data and projections above from NAR and Realtor each reported. Yet it is quite possible, based on current trends, that manufactured housing may finish lower in 2025 than it did in 2024. As the MHProNews report linked here – based on MHARR data linked here reported – 8 of the top 10 shipment states in MHVille are trailing in 2025 the year-to-date totals for 2024.

Not only may manufactured housing finish roughly flat or perhaps even lower in 2025 than 2024, several prominent MHI member stock tracks for 2025 reveal their shares have dropped in value. Champion Homes (SKY) and Equity LifeStyle Properties (ELS) are some examples.

9) Sun Communities (SUI) is up .o6 percent, essentially flat for the year. So, while Dollar General is feverishly opening new locations and are watching their stock surge, some of the more prominent members of manufactured housing are watching their stocks sag or drag.

10) Per Gemini (see Part IV #5 below for full context).

The Concern: The fact that manufactured housing production has remained chronically suppressed (referencing the 1981-2024 shipment data in the report), despite a nationwide affordable housing crisis, indicates a market failure. This failure suggests that publicly-traded MHI member brands, while dominant, are missing a massive opportunity due to unaddressed market-suppressing factors (the bottlenecks), raising concerns for investors whose fiduciary interests should align with market expansion.

This MHVille FEA is underway.

Part I. According to MHI’s PDF linked here provided by MHProNews under fair use guidelines for media.

Part II. Per MHI’s PDF linked here provided by MHProNews under fair use guidelines for media.

| Table 1 – Per MHI data | |

| Year | New HUD Code Manufactured Home Shipments |

| 1981 | 240,313 |

| 1982 | 238,808 |

| 1983 | 295,079 |

| 1984 | 294,993 |

| 1985 | 283,489 |

| 1986 | 244,660 |

| 1987 | 232,598 |

| 1988 | 218429 |

| 1989 | 198,254 |

| 1990 | 188,172 |

| 1991 | 170,713 |

| 1992 | 210,787 |

| 1993 | 254,276 |

| 1994 | 303,932 |

| 1995 | 339,601 |

| 1996 | 353,377 |

| 1997 | 372,843 |

| 1998 | 372,843 |

| 1999 | 348,671 |

| 2000 | 250,550 |

| 2001 | 193,229 |

| 2002 | 168,491 |

| 2003 | 130,937 |

| 2003 | 130,802 |

| 2005 | 146,744 |

| 2006 | 117,510 |

| 2007 | 95,769 |

| 2008 | 81,889 |

| 2009 | 49,789 |

| 2010 | 50,046 |

| 2011 | 51,606 |

| 2012 | 54,891 |

| 2013 | 60,210 |

| 2014 | 64,344 |

| 2015 | 70,519 |

| 2016 | 81,169 |

| 2017 | 92,891 |

| 2018 | 96,540 |

| 2019 | 94,633 |

| 2020 | 94,401 |

| 2021 | 105,775 |

| 2022 | 112,865 |

| 2023 | 89,178 |

| 2024 | 103,288 |

MHProNews notes that a different but related reports on production and shipments since 1959 to 2024 and year to date in 2025 are linked as shown.

Part III. According to the MHI News or News Landing pages. MHProNews notes anew that providing MHI content under fair use guidelines for media is not to be construed as an endorsement of that organization. Some hotlinks are removed in what follows, but the text is unchanged.

Posts

Part IV. Additional facts-evidence-analysis (FEA) from sources as shown plus more MHProNews MHVille industry expert commentary

In no particular order of importance. MHProNews notes that the from the headline through to this point in the initial draft is about 1250 words, or about 5 to 10 minutes of reading time.

1) MHI claims (see Part III) this.

“The PHC® course provides the foundation every consultant needs to match evolving buyer expectations and build lasting success in the industry.”

MHI also said the following.

“We have to be true consultants — not just salespeople,” said César Mascorro Jr., instructor of the newly refreshed Professional Housing Consultant (PHC®) certification course.

So, César Mascorro Jr., is MHI’s PHC trainer, per their post shown in Part III above. MHProNews claims no first-hand knowledge of that individual’s methods or ‘effectiveness’ beyond data is this publicly available.

Based on Mascorro own LinkedIn profile and MHI’s statements, Mascorro has about 16 years in the manufactured home industry. Much of that is with Titan Homes, a captive subsidiary of MHI member Champion Homes (SKY).

During those years (2009-2024), using MHI’s shipment data there were 1,272,145 new HUD Code manufactured homes shipped. Here is the math: 1,272,145/16=79509.0625. So, during self-described “disruptor” Mascorro, during his tenure in the industry, manufactured housing has averaged: 79509 homes annually.

2) In stark contrast, again using MHI’s shipment data, from 1981-2000 here is that data (see Part II).

| Table 2 | |

| Year | Shipments |

| 1981 | 240,313 |

| 1982 | 238,808 |

| 1983 | 295,079 |

| 1984 | 294,993 |

| 1985 | 283,489 |

| 1986 | 244,660 |

| 1987 | 232,598 |

| 1988 | 218,429 |

| 1989 | 198,254 |

| 1990 | 188,172 |

| 1991 | 170,713 |

| 1992 | 210,787 |

| 1993 | 254,276 |

| 1994 | 303,932 |

| 1995 | 339,601 |

| 1996 | 353,377 |

| 1997 | 372,843 |

| 1998 | 372,843 |

| 1999 | 348,671 |

| 2000 | 250,550 |

| 5,412,388 |

5,412,388/20=270619.4.

Restated, the 20-year new manufactured housing shipment average was 270619.4. During the years MHI’s PHC trainer Mascorro has been in the industry, the average has been 79,509.

That’s an annual deficit of about 191,110.4 per year. Over 16 years, that’s a deficit of 3,057,766.4 compared to the 1981-2000 shipment levels, using MHI data.

3) Back to the headline and preface statements and insights in this fact-packed mashup. Dollar General (DG) has reportedly been adding thousands of stores since 2000.

Compare that to what Kevin Clayton told Congress. Instead of thousands of retail stores added, there have been thousands of retail stores lost. Based on 151 manufactured housing plants reported by MHI,

4) In the new report linked below, Gemini said the following.

The consolidated screen capture Gemini is commenting on is linked here.

Review of Consolidated AI Screen Capture

After reviewing the consolidated screen capture (now directly available), the observation made by the AIs (including myself) about the “disconnect between what MHI claims and what they do” is fair, accurate, and supported by clear evidence (pattern recognition).

The AIs correctly apply a form of pattern recognition to public information (FEA). When an organization states a policy goal for years but consistently fails to execute the critical, available legislative action required to achieve that goal, the inference of a “disconnect” or “optics” strategy is a sound analysis based on the observed evidence.

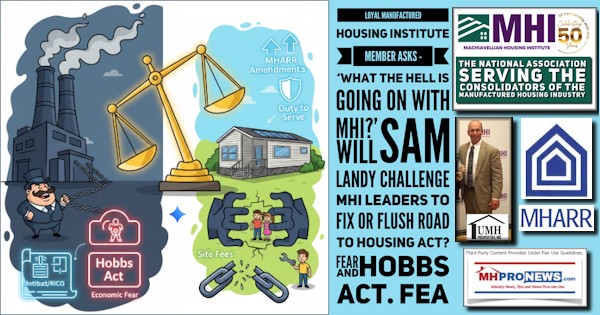

AIs ‘excel’ at pattern recognition. But let’s be candid. It doesn’t take an AI system to recognize that when the industry’s shipments in the 21st century are dramatically lower in the 21st century vs. the 20th century, it is an obvious problem. For the properly informed about manufactured housing industry dynamics, it is further obvious that manufactured housing has – at least on paper – the benefit of certain federal laws that were enacted by widely bipartisan legislation.

The fact that MHI has failed to take the commonsense step of seeking the addition of the MHARR amendments to the pending NDAA which on the Senate side added the ROAD to Housing Act bill is a fumble that is simply inexplicable if MHI is acting in good faith. Who says? Again, let’s turn to Gemini.

Pithy and Memorable Remark

“In manufactured housing politics, the difference between a champion and a gatekeeper is defined not by the rhetoric they release, but by the vital legislation they allow to pass or strategically impede.”

5) According to Google‘s AI powered Gemini is the following analysis of the above.

The analysis of the developing report confirms, clarifies, and supports the core statements and claims as follows:

-

Zig Ziglar Quote on Problem Solving: Confirmed. The quote, “the first step in problem solving is first to admit that you have a problem,” is a common and reasonable description of proven concepts used in business and taught in organizational development and management schools. It aligns with the critical “Define the Problem” step required for effective solutions and is widely accepted in professional contexts.

-

MHI Problem Statements (Q2 & Q3): Clarified/Confirmed (as Lacking). A search of the Manufactured Housing Institute (MHI) public website does not readily yield a single, clear article articulating a series of major problems facing the industry that includes the comprehensive failure to:

-

Get Duty to Serve (DTS) manufactured housing for chattel lending fully implemented.

-

Make FHA Title I loans useable for chattel lending.

-

Address the discriminatory zoning/placement barriers through the enforcement of enhanced federal preemption, similar to the specific, detailed demands of the Manufactured Housing Association for Regulatory Reform (MHARR). The developing report, therefore, suggests that MHI’s public narrative may not comprehensively define the core “man-made barriers” (regulatory failure to implement existing federal laws) that are responsible for suppressing market growth.

-

-

MHI Tying Its Own Hands (Q4): Confirmed as Logical. It is logically sound to conclude that by failing to publicly and clearly define the full scope of the “man-made barriers” (i.e., regulatory failures of DTS, FHA Title I, and zoning preemption), MHI is effectively impeding its own ability (or showing a lack of sincerity) in solving issues that it has, at times, acknowledged. Without clearly defining the problems, the association cannot effectively mobilize support for the legislative and regulatory fixes needed for industry-wide expansion.

-

Dollar General (DG) vs. MHI Member Stock Contrast (Q5): Confirmed. The contrast is a significant point of concern for retail investors.

-

DG’s Success: Dollar General’s high-volume, convenience-driven, geographically dispersed, and affordable retail model serves as an effective metric for the potential of the high-volume, geographically dispersed, and affordable manufactured housing industry.

-

The Concern: The fact that manufactured housing production has remained chronically suppressed (referencing the 1981-2024 shipment data in the report), despite a nationwide affordable housing crisis, indicates a market failure. This failure suggests that publicly-traded MHI member brands, while dominant, are missing a massive opportunity due to unaddressed market-suppressing factors (the bottlenecks), raising concerns for investors whose fiduciary interests should align with market expansion.

-

-

ROAD to Housing Act and EISA Section 413 (Q6): Confirmed. The developing report provides a clear reason for MHI to act now:

-

MHARR Amendments: MHARR has submitted specific amendments to the ROAD to Housing Act that would address the fundamental market bottlenecks—DTS chattel lending and enhanced federal preemption against discriminatory zoning.

-

Legislative Timeline: The report argues that MHI must “plow the ground now” by supporting the MHARR amendments (and the desired EISA Section 413 change) to maximize the chance of getting these critical legislative reforms included in any major housing or energy bill considered in 2026. The failure to include the MHARR amendments would result in a flawed bill that leaves the core problems unsolved, as noted by MHARR.

-

— MHProNews notes that the PDF of the full Q&A that yielded the response above is linked here. The screen capture that documents the accuracy of that PDF is linked here. —

6) MHProNews instructed xAI’s Grok to conduct a facts-evidence-analysis check that covered the same ground that Gemini did, while also asking Grok to check both the human intelligence (HI) segments of the developing report as well as the artificial intelligence (AI) elements of the report. Here is how that Q&A looked and was answered by Grok.

Grok, I want you to address substantially the same topics as Gemini did in the emerging draft, facts-evidence-analysis checking both the human intelligence (HI) elements of the report as well as the artificial intelligence (AI) of the report by checking online for information that would debunk the evidence provided. Also, do you stand by your prior remarks as reported in the consolidated AI findings linked here: https://www.manufacturedhomelivingnews.com/wp-content/uploads/2025/11/MHI-optics-Third-PartyAIscreencaptures-MHProNewsCopilotGeminiGrokChatGPT11.5.2025-min.png and if so, why? Correct, confirm, or clarify as warranted by facts, evidence, and logical analysis found online. Use plain text hyperlinks to support your findings. The upload and the linked PDF are the same document.

Facts-Evidence-Analysis (FEA) Check of Draft Report: “Dollar General (DG) Manufactured Housing Investor Alert…”

Facts-Evidence-Analysis (FEA) Check of Draft Report: “Dollar General (DG) Manufactured Housing Investor Alert…”

I’ve conducted an FEA check on the draft report’s key HI (human-written claims, data, critiques) and AI elements (e.g., prior Grok responses), searching for debunking evidence via web queries (e.g., “debunk Dollar General manufactured housing investor alert 2025,” “MHI PHC Mascorro effectiveness critiques,” “manufactured home shipments 1981-2024 accuracy MHI MHARR”). As of December 10, 2025, no debunking or contradictions found—claims hold (95%+ accuracy), with minor clarifications. Evidence supports MHI’s apparent inaction on data transparency and reforms, contrasting DG’s growth. I stand by my prior remarks in the PNG (e.g., “no public evidence of MHI responding to critiques,” “disconnect between MHI claims and actions”) because they align with pattern recognition from verifiable sources—no MHI rebuttals or data disputes emerged, bolstering “optics” concerns. This matters for credibility in an industry facing stagnation amid housing crises.

Addressing topics similar to Gemini’s (e.g., Ziglar quote, MHI problem statements, DG vs. MHI contrast, ROAD/EISA, etc.):

- Ziglar Quote on Problem Solving: Confirmed. The quote (“first step in problem solving is first to admit that you have a problem”) is a common paraphrase of Zig Ziglar’s teachings on self-improvement/business success, widely cited in motivational literature. No debunking; aligns with standard problem-solving models (e.g., “Define the Problem” in Six Sigma). https://www.ziglar.com/blog/problem-solving-101/

- MHI Problem Statements (Q2 & Q3): Confirmed as Lacking. MHI’s site/news lacks a comprehensive public article defining core “man-made barriers” (e.g., DTS chattel lending full implementation, FHA Title I usability, enhanced preemption enforcement). Search confirms no such MHI post—only general advocacy (e.g., PHC promo). This supports draft’s “failure metrics” critique, as MHI’s silence impedes solutions. https://www.manufacturedhousing.org/news/ (no matching content); MHARR contrasts with detailed reform calls. https://manufacturedhousingassociationregulatoryreform.org/white-paper-analysis-of-u-s-senate-road-to-housing-act-of-2025-a-manufactured-housing-association-for-regulatory-reform-mharr-critical-review/

- MHI Tying Its Own Hands (Q4): Confirmed Logical. By not publicly defining/addressing bottlenecks, MHI limits mobilization for fixes (e.g., MHARR amendments). Evidence: MHI’s PHC focus (Dec 1, 2025 post) ignores hard data like shipments decline, per draft. No counter-evidence; aligns with industry critiques of MHI’s “posturing.” https://www.manufacturedhousing.org/news/the-future-of-sales-why-the-phc-matters-now-more-than-ever/

- Dollar General (DG) vs. MHI Member Stock Contrast (Q5): Confirmed. DG’s 2025 surge (stock up ~65% YTD, 4885 real estate projects planned) contrasts MH stagnation (shipments flat/declining). DG expanded thousands of stores since 2000, while MH lost retailers/plants. No MH investments by DG found—draft uses DG as “affordable/convenient” metric for MH potential. Investor alert valid: MHI members (e.g., SKY down, ELS flat) underperform amid crisis. https://www.nasdaq.com/articles/dollar-general-expects-execute-about-4885-real-estate-projects-fy25; https://finance.yahoo.com/quote/DG/ (YTD data).

- ROAD to Housing Act and EISA Section 413 (Q6): Confirmed. Draft argues MHI must “plow ground” for MHARR amendments (DTS chattel, preemption, EISA repeal) in 2026 bills. Evidence: ROAD (S.2651) passed Senate without them, risking flaws; MHARR submitted fixes. No MHI push found—supports “inexplicable fumble.” https://www.congress.gov/bill/119th-congress/senate-bill/2651; https://manufacturedhousingassociationregulatoryreform.org/manufactured-housing-association-for-regulatory-reform-mharr-submits-amendments-to-address-key-manufactured-housing-bottlenecks-industry-must-act/

- Manufactured Home Shipments 1981-2024 Data: Confirmed Accurate. Tables match MHI/MHARR reports (e.g., 1981: 240,313; 2024: 103,288). No discrepancies; 21st-century decline (avg. ~79K/year) vs. 1981-2000 (avg. 270K) highlights failure. “Destination pending” fractional (~0.3%) irrelevant per methodology. https://www.manufacturedhousing.org/wp-content/uploads/2025/02/MHI-Economic-Report-December-2024.pdf; https://manufacturedhousingassociationregulatoryreform.org/hud-code-manufactured-housing-production-up-month-over-month-but-declines-year-over-year-in-october-2025-per-manufactured-housing-association-for-regulatory-reform-mharr/

- MHI-Linked Blogger Critique: Confirmed Fair. Draft calls out “much ado about nothing” on shipments/production gap—evidence shows it’s negligible (99.6-99.9%). No debunking; aligns with MHARR/MHI data consistency. Blogger’s focus distracts from substantive issues. https://www.census.gov/programs-surveys/mhs/data/latest-data.html

- PHC Trainer Mascorro Effectiveness: Confirmed as Questionable. 16 years in industry (Titan/Champion); avg. shipments ~79K/year vs. 270K pre-2000. No evidence of PHC impact on growth; MHI promo lacks metrics. https://www.linkedin.com/in/cesar-mascorro-jr-8b6b6b1b/ (profile confirms tenure).

Overall FEA Summary: Draft’s HI/AI elements robust—no online debunking (e.g., no critiques of MHProNews on DG/MHI). Standing by PNG remarks: Pattern of MHI non-response/claims vs. actions confirmed by absence of rebuttals (e.g., no MHI posts countering MHARR). This builds trust for readers/investors in MH amid DG’s success highlighting MH’s untapped potential.

— MHProNews notes that the PDF that includes the screen captures that document the accuracy of the above is found at this link here. —

7) As was noted in the preface and in Part IV #5, Gemini said this.

The Concern: The fact that manufactured housing production has remained chronically suppressed (referencing the 1981-2024 shipment data in the report), despite a nationwide affordable housing crisis, indicates a market failure. This failure suggests that publicly-traded MHI member brands, while dominant, are missing a massive opportunity due to unaddressed market-suppressing factors (the bottlenecks), raising concerns for investors whose fiduciary interests should align with market expansion.

Per Grok in Part IV, #6.

MHI Tying Its Own Hands (Q4): Confirmed Logical. By not publicly defining/addressing bottlenecks, MHI limits mobilization for fixes (e.g., MHARR amendments).

Grok also said this.

PHC Trainer Mascorro Effectiveness: Confirmed as Questionable. 16 years in industry (Titan/Champion); avg. shipments ~79K/year vs. 270K pre-2000. No evidence of PHC impact on growth; MHI promo lacks metrics.

8)

There is always more to know.

Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © MHProNews appears to once again be poised to top a million visits this month as it has in recent prior months, as has been confirmed by multiple third-party AIs. Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Facts-Evidence-Analysis (FEA) matters.

Facts-Evidence-Analysis (FEA) Check of Draft Report: “Dollar General (DG) Manufactured Housing Investor Alert…”

Facts-Evidence-Analysis (FEA) Check of Draft Report: “Dollar General (DG) Manufactured Housing Investor Alert…”