As part two on our series on federal taxation, the Daily Business News spotlights today what private and federal research reveals to be hundreds of billions of dollars in waste, fraud and abuse. The Trump Administration has made tax reform a hallmark of their agenda, and President Donald J. Trump pledged to cut the waste and inefficiency of government.

Reforming spending and taxations, along with regulatory reform, are among the factors that caused so many manufactured home professionals to vote for the nation’s new president.

Citizens Against Government Waste (CAGW)

With the national debt at a hefty $19.3 trillion and estimated by the Congressional Budget Office (CBO) to grow another $534 billion in fiscal year (FY) 2016, which runs through Oct. 2017, Citizens Against Government Waste (CAGW) suggests 618 recommendations that would save taxpayers $644.1 billion in the first year and $2.6 trillion over five years. CAGW says it has helped save taxpayers $1.4 trillion since 1984 when it began.

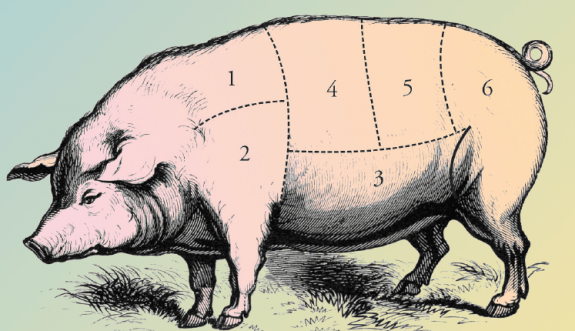

As an example, Prime Cuts, CAGW’s house organ, proposes eliminating the Market Access Program (MAP), which aims to help agricultural producers promote U. S. products overseas, but is in fact a corporate welfare program that sends millions of dollars to profitable, large corporations and trade associations that can afford their own promotional efforts. This would save $1 billion over five years.

Prime Cuts goes after just about every department of government, attacking many programs that been considered sacrosanct for years. Eliminating the Rural Utilities Service, which originally provided electrification to rural areas and now expanded to provide broadband to those areas would save $9.6 billion in one year, $48.1 billion over five years; since FY 2002, members of Congress have added six earmarks for high energy cost grants totaling $113.5 million.

The sugar subsidy adds $1.5 billion to the budget annually, and additionally costs consumers of baked goods ”$3.5 billion more each year in artificially inflated prices for commodities that use sugar, including baked goods, beverages, candy, cereal, dairy products, snack foods, and hundreds of other products.” The program needs to be replaced with a market-oriented system.

Similarly, the U. S. dairy price supports add $1.1 billion annually to the budget, and eliminating the peanut subsidy would save taxpayers $275 million over five years.

The Hollings Manufacturing Extension Partnership (HMEP), named for U. S. Senator Ernest ‘Fritz’ Hollings was designed to increase the efficiency and profitability of American manufacturing firms, but amounts to corporate welfare for advisors and consultants. Potential savings if halted: $715 million in five years.

The Department of Defense has multiple contracts spread over numerous congressional districts, but representatives cry “national security” and the programs continue. One example is the M1 Abrams tank retrofit program. “In 2011, Army Chief of Staff General Ray Odierno told Congress that the Army had a sufficient number of tanks; the Pentagon proposed suspending production until 2017, saving $3 billion.” Earmarks to the budget have increased continually, adding jobs for constituents, including a $40 million project in FY 2016. Since FY 1994, there have been 39 earmarks for the M1 Abrams program, requested by at least 13 members of Congress, costing taxpayers $948.6 million.

The Southeastern Power Administration, which consists of 23 hydroelectric projects in Alabama, Florida, Georgia, southern Illinois, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee, and Virginia, and the Tennessee Valley Authority’s electric power assets could be sold and privatized, saving $2.3 billion over five years. Fears of huge rate increases to consumers are unfounded.

Reducing the fraud and waste in the Medicare system would save taxpayers $21.7 billion over five years. Congress has fortunately enacted the Recovery Audit Contractor program which has recovered $11.3 billion for the Medicare Trust Fund since it began doing audits in 2005. RAC has an average accuracy rate of 96 percent.

As the average life expectancy has increased. raising the Normal Retirement age for Social Security beneficiaries would save $119.9 billion over the next ten years. Raising the eligibility age for Medicare recipients by two months every year until it reaches the age of 67 would reduce Medicare costs by ten percent by 2035, saving taxpayers $124.8 billion over the next ten years.

Eliminating Community Development Block Grants in the Department of Housing and Urban Development (HUD) would produce a $15 billion savings over ten years. Intended for infrastructure investments, housing rehabilitation, job creation, and public services in metropolitan cities and urban counties, the program has fallen short on both accountability and results.

For the entire CAGW report on savings in the Department of the Interior with its vast swaths of land that could be leased, the Department of Justice’s Community Oriented Policing Services which has failed to meet its goal of reducing crime and has become an overlay of hundreds of million of dollars in waste and fraud, and the Davis-Bacon Act which requires employees of federally-contracted projects to be paid a prevailing wage, click here.

Meanwhile, the Government Accountability Office (GAO) has similarly produced a report documenting 92 actions that could be taken by Congress or the executive branch to reduce waste and improve efficiency in 37 areas covering a wide range of governmental functions.

The Internal Revenue Service has referral programs to award individuals who help uncover tax noncompliance by others in its attempt to reduce the $385 billion taxes that go uncollected. This information referral process, which covers under reporting of income, false tax claims, failure to file a return and failure to withhold and pay taxes resulted in 87,000 referrals in 2015 and $209 million in tax assessments.

In Medicaid services, the GAO uncovered federally facilitated exchanges that allowed for duplicate coverage. One state reported duplicate coverage for 3,500 people from January to July 2014.

In 2014, the Departments of Defense (DOD), Energy (DOE), and Commerce (Commerce) collectively had signed agreements to establish 11 manufacturing innovation institutes involving partnerships with private nonfederal entities, but a review determined that agencies that could benefit the program, such as the Department of Labor, were not included in the projects.

For the full report, click here. For our prior report on Tax Facts, Business and You, click here. ##

(Image credits are as shown above.)