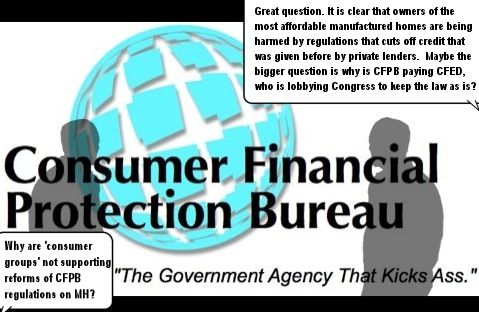

While the Corporation for Enterprise Development’s (CFED) Doug Ryan nominally supports manufactured homes (MH) as affordable housing for low income consumers, his response to The Hill about Rep. Steve Fincher’s call to ease the regulatory burdens on prospective purchasers of MH demonstrably misses the mark. As MHProNews and MHLivingNews publisher L. A. “Tony” Kovach points out in The Hill Congressional Blog today, Ryan said recently that longtime MH finance expert Dick Ernst knows more about MH financing. “Ryan said that weeks after Ernst and a non-Berkshire-Hathaway MH lender privately walked him through the realities of MH financing,” notes Kovach.

Congressman Fincher pointed out that payments on an MH personal property loan are typically less than rent on an apartment or house. Kovach says, “The reason for higher rates on MH is simple business math. The cost to originate a $35,000 loan is similar to the cost of originating a $350,000 loan. Since there are no federal guarantees for conventional MH lending, no real secondary market and thus no risk to tax payers – naturally the rates, points and fees for an MH lender need to be higher to have a chance to profit.” Unlike the traditional mortgage market, interest rates are not kept artificially low via federal supports of the GSEs, FHA or VA loans.

Current CFPB regulations have caused a number of smaller and low rate lenders, as well as huge U S. Bank, to leave the MH finance market because of regulatory burdens. Why aren’t lenders pouring into the market if it was so profitable (i.e. “predatory”)?

While millions of MH loans have been made over the years, consumer complaints reported by the CFPB do not show MH lenders ranking high in originating or servicing. Even when MH consumers are forced by CFPB regulations to turn to 36 percent interest rate payday-style loans, we know of real world examples of their payments on an inexpensive home still being less than rent. So why shut the door on lenders making smaller loans and give a break to consumers on interest charges?

Rep. Fincher’s measure, The Preserving Access to Manufactured Housing Act (HR 650/S682) gives manufactured home owners the opportunity to sell their homes if it has a value that would be financed under $20,000. It also allows MH sales people the ability to help MH consumers in their purchase, much like a realtor does in a conventional mortgage scenario.

Kovach says, “That’s all good for homeowners, consumers and business. That’s good public policy. The Senate should promptly pass the bill, and/or CFPB should change their policies on MH lending ASAP.” MH associations are encouraging industry members to read and share the article with their Senators and staffs, because it documents and refutes opposition arguments, point by point. The link to the full blog post on the Hill is here. ##