The Collingwood Group tells the Daily Business News about new research that may signal a looming challenge in manufactured home lending.

“…a recent study tracking delinquencies among mobile-home [sic] loans could signal the build-up of troubling trends,” said DS News. “Are increasing mobile home delinquencies the “canary in the coal mine” that foreshadows larger problems impending for the housing market and for the broader economy?”

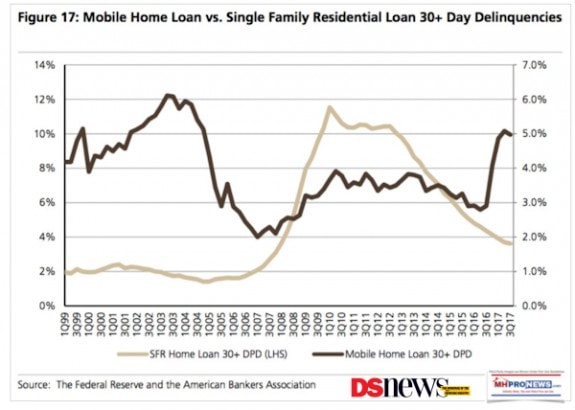

“According to research cited by USB,” DS said, “a global financial services firm, mobile-home loan delinquencies are up 2 percent year-over-year. Moreover, the 30-day-plus delinquency rate has reached nearly 5 percent, which puts it at the highest level since 2005.”

DS states that “This spike among mobile-home delinquencies is not being echoed among single-family rental (SFR) home loans. As seen in the chart below, SFR 30-day-plus delinquencies have been on a steady downward trend for several years now. Mobile-home 30-day-plus delinquencies, however, began an upward climb around Q3 2016.”

Zero Hedge and Business Insider say that there is no similar spike in single family home loans.

Per UBS says “We interpret this data to mean that these individuals have not largely benefitted from these macro-dynamics, and may also be disproportionately exposed to industries that have experienced compression—rather than expansion—in the current economic conditions, such as retail or some areas of energy extraction.”

MH Industry Lenders Say…

What isn’t mentioned is what industry lenders have said to MHProNews, that some of this may be a result of the hurricane season that impacted big manufactured home states such as Texas and Florida.

That said, if the pattern truly isn’t being reflected in the site built lending market, it is a data point that deserves attention. Certainly, the GSEs will be watching this kind of data. “We Provide, You Decide.” © ## (News, analysis, and commentary.)

To sign up in seconds for our industry leading emailed news updates, click here.

To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

Marketing, Web, Video, Consulting, Recruiting and Training Resources

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.