“FHA is in good hands, guarding against excessive risks, protecting the American taxpayer, and remaining true to our core mission to facilitate safe and affordable mortgage options for qualified borrowers.”

– HUD Secretary Ben Carson, M.D.

“As we look to the future, FHA must continue to seek the right balance between facilitating access to mortgage credit and managing risk.”

– FHA Commissioner Brian Montgomery.

As hundreds, perhaps thousands, of manufactured home professionals know, manufactured housing qualifies for various kinds of Federal Housing Administration (FHA) lending.

So, today’s report from HUD and the FHA program they control to Congress is of general interest.

The Daily Business News on MHProNews reached out to a manager in the manufactured home lending community to get some insights on aspects of what follows.

Here’s what that veteran of FHA lending, from a firm that does both forward and ‘reverse’ loans, said via a message to MHProNews.

“As for the business, the current quality of this post-Sept 2015 block of business is insanely awesome. Tony Soprano couldn’t make this much $$. The ills of the HECM business stem from the 05-2010 block of business combined with HUD incompetence in REO disposition. Once we get out of that (as we will in a few years) the business is extremely profitable.

That said, there is a shift to more private business (about 10-20% of overall production in 2019) that will continue as FHA keeps tinkering with the product.”

With that backdrop, let’s dive into today’s formal statement from HUD to MHProNews.

FHA RELEASES 2018 ANNUAL REPORT TO CONGRESS

Capital Reserves remain above statutory minimum for fourth straight year

WASHINGTON – The Federal Housing Administration (FHA) today released its 2018 Annual Report to Congress on the economic condition of the agency’s Mutual Mortgage Insurance Fund (MMI Fund). FHA reports that at the end of Fiscal Year (FY) 2018, the MMI Fund had a total Economic Net Worth of $34.8 billion and a Capital Reserve Ratio that remains above the statutory minimum for a fourth consecutive year.

The MMI Fund supports FHA’s single-family mortgage insurance programs, including all forward mortgage purchase and refinance transactions, as well as mortgages insured under the Home Equity Conversion Mortgage (HECM), or reverse mortgage program. While the value of FHA’s forward mortgage portfolio is growing, the latest independent actuarial report finds the value of the agency’s reverse mortgage portfolio continues to decline, representing a continuing economic drain on the MMI Fund from books of business in 2018 and earlier.

“The financial health of FHA’s single-family insurance fund is sound,” said U.S. Housing and Urban Development Secretary Ben Carson. “FHA is in good hands, guarding against excessive risks, protecting the American taxpayer, and remaining true to our core mission to facilitate safe and affordable mortgage options for qualified borrowers.”

FHA Commissioner Brian Montgomery added, “As we look to the future, FHA must continue to seek the right balance between facilitating access to mortgage credit and managing risk. Our number one mission is to make certain FHA remains a stable and reliable resource for first-time and minority homebuyers, and other underserved borrowers.”

This year’s report continues to offer greater transparency, consistency and accountability in the economic fundamentals of the MMI Fund. For the second consecutive year, FHA is providing separate stand-alone capital ratios for its forward and reverse mortgage portfolios to better assess the impact of each on the MMI Fund. For a second year, the report also includes stress-testing of the portfolio based on historical scenarios.

FHA’s 2018 Annual Report also includes important technical revisions to last year’s report that reflect adjustments to the MMI Fund’s Capital Ratio and Economic Net Worth for FY 2017.

KEY HIGHLIGHTS FROM FHA’S 2018 ANNUAL REPORT

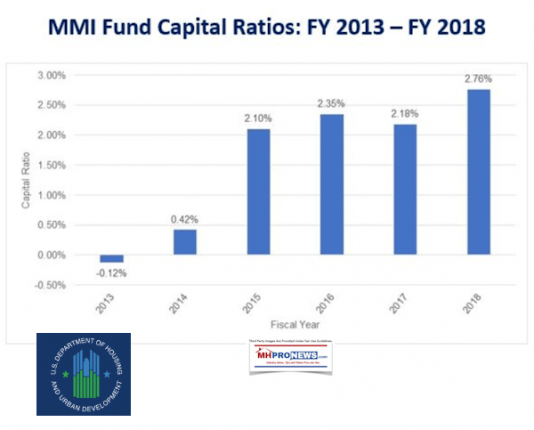

The MMI Fund’s FY 2018 Capital Ratio is 2.76 percent, a 0.58 percentage point increase over the restated FY 2017 Capital Ratio of 2.18 percent. This is the fourth consecutive year this ratio exceeded the statutory minimum of 2.00 percent.

The MMI Fund’s overall Economic Net Worth for FY 2018 is $34.86 billion, an increase of over 8 billion from FY 2017. Economic Net Worth is comprised of Total Capital Resources of $49.24 billion and a negative Cash Flow NPV of -$14.38 billion.

FHA’s cumulative Insurance-in-Force (IIF) reached $1.26 trillion of Unpaid Principal Balance (UPB) at the end of FY 2018, largely unchanged from FY 2017.

FHA endorsed over one million forward mortgages in FY 2018 (including 776,284 purchase loans) totaling $209 billion in UPB.

First-time homebuyers accounted for 641,921 or 82.7 percent of all FHA forward purchase loans.

Minority homebuyers accounted for 33.8 percent of all FHA forward purchase loans.

The average loan amount of FHA-insured forward mortgages was $206,041.

The average borrower’s credit score was 670 compared to 676 in FY 2017.

FHA’S HISTORICAL CAPITAL RESERVE RATIO

FHA maintains reserves to cover both future claims, as well as an additional statutorily required capital cushion of 2.0 percent of all Insurance-in-Force (IFF). This ‘Capital Ratio’ is calculated by dividing the Fund’s Economic Net Worth ($34.8 billion in FY 2018) by total IFF of $1.26 trillion. As noted above, the FY 2018 Capital Ratio of the Fund is 2.76 percent, an increase from the end of FY 2017.

MMI Fund Capital Ratios: FY 2013 – FY 2018

This year’s Annual Report includes an examination of loan performance of FHA-insured homeowners impacted by last year’s devastating hurricanes, analyzing the serious delinquency rate and early payment defaults among borrowers in Texas, Florida, Puerto Rico and the U.S. Virgin Islands impacted by Hurricanes Harvey, Irma and Maria.

HECM HIGHLIGHTS

FHA’s HECM, or reverse mortgage, program continues to serve eligible seniors, 62 years and older, with a financing option that can help them remain in their home and age in place. Like last year, the 2018 Annual Report includes separate, stand-alone estimates of the capital resources and capital ratios for insured forward mortgages and HECMs.

The fiscal condition of FHA’s forward mortgage portfolio is materially better than the HECM portfolio. Excluding HECMs, FHA’s FY 2018 forward mortgages have a capital ratio of 3.93 percent and a positive Economic Net Worth of $46.8 billion. By contrast, the 2018 HECM portfolio has a negative capital ratio of 18.83 percent and a negative economic net worth of $13.63 billion.

In 2017, FHA implemented a set of changes to mortgage insurance premiums and Principal Limit Factors (PLFs) and followed in FY 2018 with changes to appraisal requirements. The impact of these changes on new HECM endorsements, and the ongoing performance of the outstanding HECM portfolio, will continue to be closely monitored and managed by FHA.

The 2018 Annual Report finds:

HECM endorsements declined 12.6 percent since last year, with 48,327 new mortgages endorsed.

Total Capital Resources in the HECM portfolio totaled $2.11 billion for FY 2018, which was offset by a negative $15.75 billion in Cash Flow Net Present Value.

HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all.

###

Will the powers that be in MHVille use the overall positive report to press for reform of the 10-10 rule, and get more manufactured home personal-property lending? That’s MH “Industry News, Tips, and Views Pros Can Use,” where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

Affirmatively Furthering Fair Housing, a Novel Yet Proven Solution to the Affordable Housing Crisis That Will Create Opportunities, Based Upon Existing Laws – manufacturedhomelivingnews.com

Affordable quality housing is one of the most critical issues of our time. So too is affordable home ownership, which should be the ideal goal over rental housing. A challenge is zoning and land use, which is highly politicized, and thus is often misunderstood. What follows is adapted from the comments letter addressed as shown below.