The Federal Housing Finance Authority (FHFA) will soon issue a draft Duty to Serve (DTS) rule. The final rule that follows the brief comment period will tell Freddie Mac and Fannie Mae what the two Government Sponsored Enterprises (GSEs) will have to do in terms of providing loans to consumers for manufactured homes (MH). The ruling will influence things for as long as the two GSEs are in fact government-sponsored, which I bet will be a very long time.

Everyone involved in the land-lease community (LLC) sector wants there to be more chattel lenders. Clearly, a healthy housing sector cannot rely on just three national lenders and a bunch of captives.

Will DTS add the GSEs to this short list of chattel lenders?

The short answer is no. The FHFA will not require the GSEs to start financing chattel MH loans.

There are three very basic political realities that make calls for GSE chattel lending entirely hollow:

- The GSEs will do everything possible to not add chattel lending to their products list. They were burned in the late 90s by large pools of chattel MH loans and they still remember it.

- The FHFA won’t make them. The FHFA has both a “safety and soundness” responsibility for GSE oversight and a Duty to Serve mandate. Under safety and soundness, the FHFA will not require the GSEs to incorporate chattel based solely upon the record of chattel loan performance.

- Industry and consumer groups are not working together to create any real pressure though they’re not far apart from my read of things. That said, even together they probably couldn’t overturn factors 1 and 2.

I note #3 because it’s been my experience that lawmakers and regulators don’t like being in the position of settling debates between opposing parties. When faced with that sort of disagreement, regulators will, whenever possible, choose deferral and non-action.

Before you get caught up in the inevitable diatribe that will follow the draft DTS rule, consider an alternative based upon an opening that I expect we will see in the rule.

I expect the FHFA will look at bringing back a pilot program that Freddie Mac and some well-known industry leaders implemented in early 2000’s. Specifically, that program had Freddie providing conventional residential home only mortgage loans in LLCs where there was a long-term lease.

Don’t say it can’t be done. It’s been done. I and the other LLC owners who spearheaded the program with Freddie Mac have done it. Home only mortgages that don’t compromise the underlying land (the LLC) or your ability to finance or sell the LLC. But, they do make conventional rates and terms available in communities possible.

How would buyers of homes in your LLC respond to a bank making conventional residential home loans in your community? Could you sell more homes on vacant sites if lender would do 10% down-payment and 30-year fixed rate financing?

Such a program would require long-term leases because conventional lenders won’t lend long-term on a home that doesn’t have a long-term lease. I know of community owners with 20 year leases today so this isn’t too much of stretch, really.

And, don’t be confused with the term mortgage. Yes, the home would be titled as real estate and the security interest would be a mortgage on the home only. The titling of the home and the mortgage instrument don’t include the land and don’t interfere with your commercial mortgage. This type of lending has been done in a range of leasehold arrangements. It works.

Understandably, not all “parks” would make the trade-off. But, higher-end LLCs where the highest and best use is a LLC and where the homes are relatively expensive, conventional loan rates would be a significant benefit to both buyers and LLC owners. It’s a different value proposition and a different public image than a “park”, indeed.

But, for those who are interested, let’s pull together and urge the FHFA to keep or include home only mortgage lending in LLCs in the final rule. Let’s make sure the GSEs know that there’s interest in using home only mortgages in some LLCs.

What we can’t have is a chorus in unison saying, “Make them do chattel!” That’s the equivalent of spitting into the wind. Join the chorus if you want more of the same, just cover your face.

The Duty to Serve is too important to squander. Drop me a line if you want to learn more and coordinate input to the FHFA’s draft rule when it gets released. It will happen fast, which is why I’m going public with my assessment of where we’ll be once the draft rule is published.

We as an industry need to let the FHFA and GSEs know that some innovators in the market want to find a solution to getting 4% home only mortgage loans in our communities. ##

Paul Bradley, President, ROC USA.

Paul Bradley, President, ROC USA.

(Editor’s Note: Paul Bradley is featured in a new video interview, see this link here. As on any MH issue, we welcome confirming or other viewpoints.)

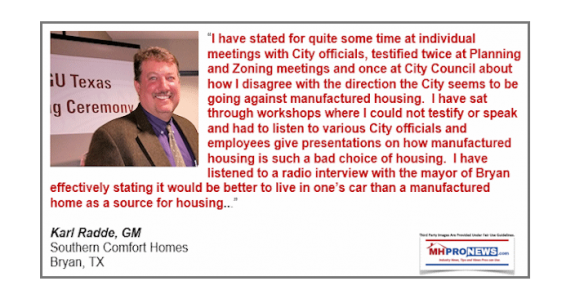

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …