“Since 1988, our annual State of the Nation’s Housing report has provided an overview of housing market conditions in the U.S.,” said Harvard University’s Joint Center for Housing Studies (JCHS) to the Daily Business News via a press release.

“As we mark the 30th anniversary, this year’s report not only examines recent trends, but assesses whether and how key metrics have changed over the last three decades and serves as a yardstick to measure whether or not the nation has met its goal of producing decent and affordable homes for all,” said the JCHS statement.

JCHS’ Executive Summary

“The inaugural State of the Nation’s Housing report in 1988 noted that the majority of Americans were well housed and some conditions have improved since then. More than 40 million units have been built over the past three decades, accommodating 27 million new households, replacing older homes, and improving the quality of the nation’s housing stock,” said the Harvard researchers’ statement.

“Homeownership rates among young adults are even lower than in 1988, and the share of cost-burdened renters is significantly higher, with almost half of all renters paying more than 30 percent of their income for housing,” said the 2018 JCHS report.

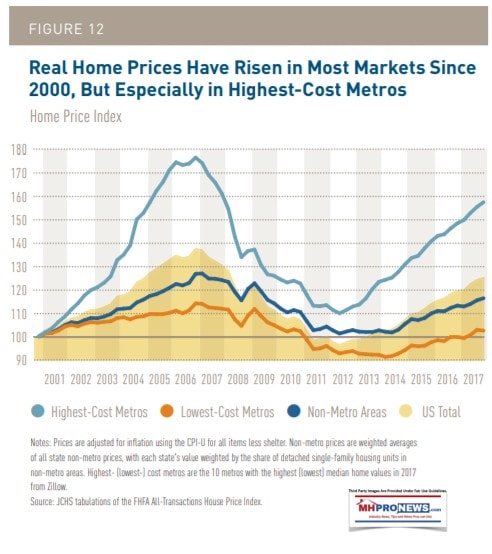

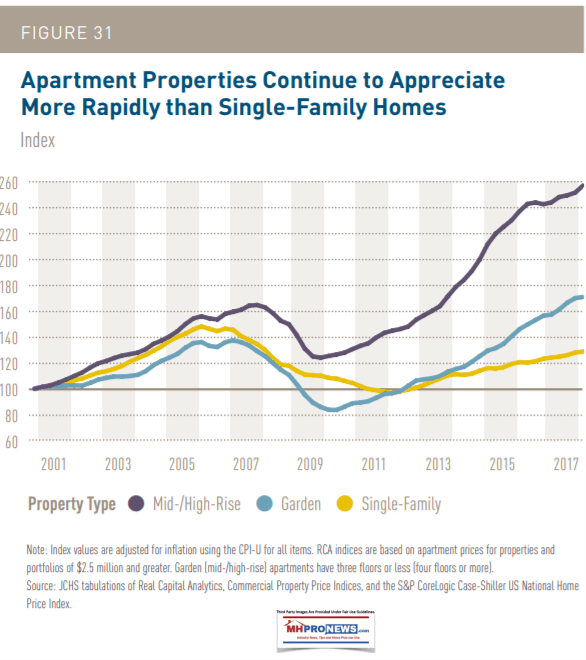

“Soaring housing costs are largely to blame. The national median rent rose 20 percent faster than overall inflation between 1990 and 2016 and the median home price rose 41 percent faster,” per the JCHS. “While better housing quality accounts for some of the increased costs, higher costs for building materials and labor, limited productivity gains, increased land costs, new regulatory barriers, and growing income inequality all played major roles as well.”

To help busy professionals manage the length of the 44 page report – and keep it as relevant and useful as possible for manufactured housing industry professionals, investors, and researchers – what will follow are a series of unedited ‘pull quotes’ from the JCHS report.

Fair warning. Modular housing gets very little attention, essentially a modest mention.

HUD Code manufactured housing fares significantly better. Still, there’s not a lot of details in what follows that a well informed MHProNews reader wouldn’t already know.

So why bother?

4 Reasons for Factory-Built Home Pros to Read This JCHS Report:

The above noted, why read this? Simply because it’s a million-dollar road map for a variety of reasons, but let’s note 4 of them:

- As noted, the university level data is like a road map – a gold-mine of the opportunities – for manufactured housing or other factory-crafted housing professionals to explore. Almost every page is a description of possible opportunities for the industry.

- The State of the Nation’s Housing 2018 gives an independent review of data compiled by a respected institution – Harvard – has been doing for 3 decades. Rephrased, it has credibility.

- It largely confirms or clarifies dozens of reports previously shared on MHProNews from a variety of other sources.

- It will be an anchor for several planned reports by MHProNews that manufactured housing advocates, investors and others will be able to rely upon.

What will follow are pull quotes, without commentary. The headings will often be our phrasing, not JCHS’. While the Daily Business News will skip some sections, the meatiest material for our audience is covered in the quotated statements below.

The 2018 JCHS entire report, complete with an array of graphics and charts, will be provided at the end of this article. We’ll conclude with a hyper-brief analysis of our key takeaway from the document. Let’s dive in.

Housing Costs

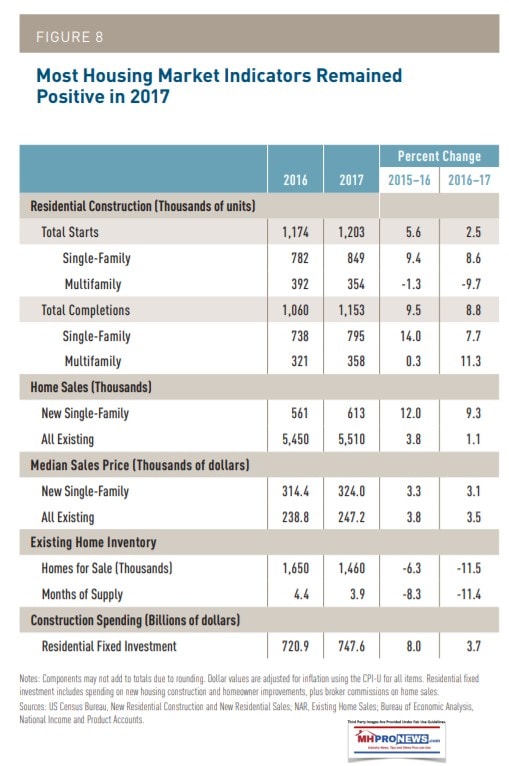

“Another factor is the low level of single-family construction. Despite six consecutive years of increases, single-family starts stood at just 849,000 units in 2017, well below the long-run annual average of 1.1 million. Indeed, only 610,000 single-family homes were added to the stock annually in 2008–2017…

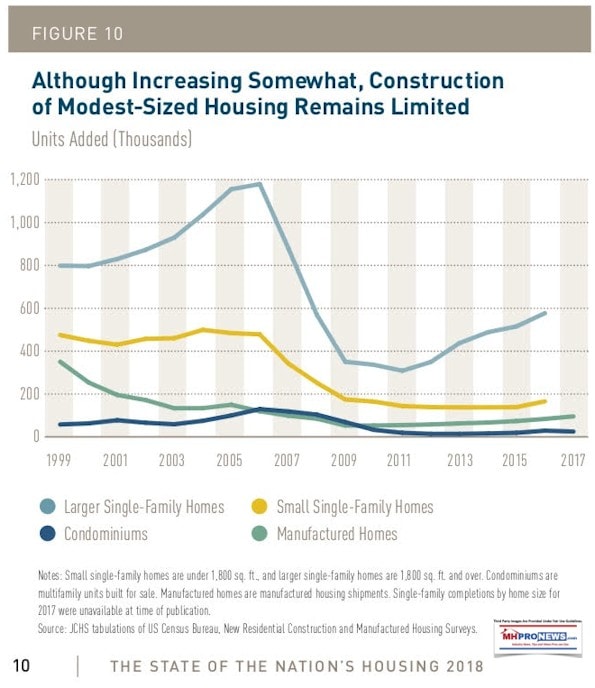

Along with limited land, respondents to builder surveys cite rising input costs as adding to the difficulty of constructing entry-level homes. As a result, the share of smaller homes (under 1,800 square feet) built each year fell from 50 percent in 1988 to 36 percent in 2000 to 22 percent in 2017. Of this latest drop, 9 percentage points occurred in 2010–2013 alone…

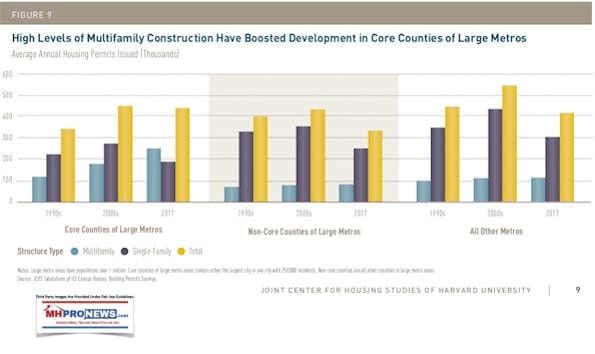

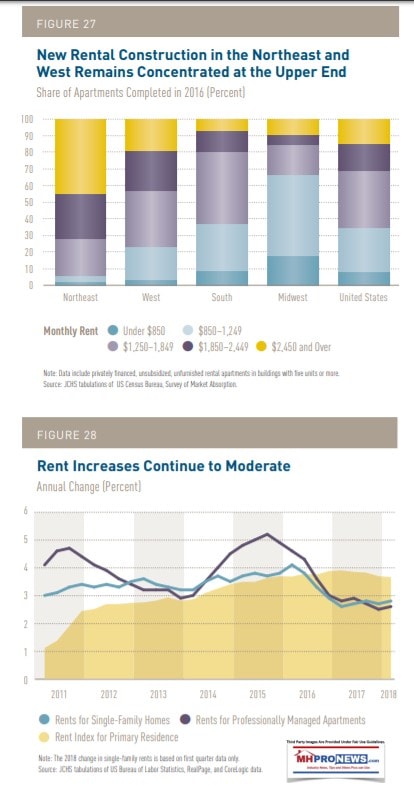

Unlike single-family homebuilding, multifamily construction ramped up quickly after the crash as rental demand surged. From a low of 109,000 units in 2009, construction of multifamily units peaked at 397,000 starts in 2015 and accounted for more than half the gains in housing starts over that period. However, the multifamily construction wave is now moderating, with starts down 1 percent in 2016 and 10 percent in 2017…

This slowdown comes in response to both weaker overall rental demand and increasing slack at the upper end of the market…

Indeed, the cumulative effect of strong growth in housing costs and modest gains in household incomes has left nearly half of today’s renters with cost burdens, including a quarter with severe burdens. The rising cost of homes for sale also raises downpayment and closing costs, making it more difficult for individuals and families to make the transition to owning…

National efforts are necessary to close the affordability gap. Housing policymakers have many opportunities to address the cost side of the equation, including the increasing size and quality of homes; lack of productivity improvements in the residential construction sector; escalating costs of labor, building materials, and land; and barriers created by a complex and restrictive regulatory system. However, tackling this broad mix of conditions will require collaboration of the public, private, and nonprofit sectors in a comprehensive strategy that fosters innovation in the design, construction, financing, and regulation of housing…

But even if successful, these efforts will not produce decent, afford- able homes for the millions of households that simply cannot pay enough to cover the costs of producing that housing. For these families and individuals, there will always be a need for public subsidies. The federal government’s failure to respond adequately to this large and growing challenge puts millions of households at risk of housing instability and the threats it poses to basic health and safety. Many state and local governments are doing their part to expand assistance, but a more robust federal response is essential to any meaningful progress in combatting the nation’s housing affordability crisis…”

Page 8 Before Manufactured Housing Gets Mentioned

(Bold Added for Emphasis. one editorial note is made)

“Nonetheless, entry-level housing still accounts for a small share of new construction. Only 163,000 small single-family homes were completed in 2016, or 22 percent of single-family construction— down significantly from the 33 percent share averaged in 1999–2007. Moreover, manufactured home shipments totaled just 93,000 units in 2017, far below the 291,000 annual average in the 1990s and even the 137,000 annual average in the 2000s…

“Modest-sized homes are considerably more affordable for first-time and middle-market buyers. According to the Survey of Construction, the median price for a small home sold in 2016 was $191,700. The average sales price for a new manufactured home in 2017 was even lower, at $72,000. By comparison, the median price for all other single-family homes was $324,700 in 2016…

“With few additions of smaller units, most modestly priced homes are found in the existing housing stock. Indeed, small homes make up nearly half of single-family homes. In 2015, there were 37.3 million single-family homes under 1,800 square feet. The stock of small homes is generally older, with nearly two-thirds (65 percent) built before 1980 compared with 43 percent of larger homes…”

“Manufactured housing is prevalent primarily in the South, where some 58 percent of the 6.6 million units nationwide are located. Another 21 percent are in the West, 14 percent in the Midwest, and just 7 percent in the Northeast. Nearly two-thirds of manufactured housing shipments between 2009 and 2017 were also to the South.”

Daily Business News Notice: A more common figure used for all pre-HUD Code and post-HUD Code MH is roughly 8.8 million units. What possibly explains the difference? Because about 1 out of 5 MH are mobile homes, not manufactured homes. We’ve reached out to Harvard and ask for that number to be clarified, and will update once received.

“As a result, manufactured homes make up 9 percent of the total housing stock in the South, with especially large shares in South Carolina (16 percent) and in West Virginia and Mississippi (14 percent each). While the share in other regions is only 4 percent, a few states also have high concentrations of manufactured housing, including New Mexico (17 percent) and Wyoming (13 percent). Manufactured housing also provides 14 percent of homes in non-metro communities, more than double the share in the country as a whole.”

4 Prime Factors Hamper Housing Growth

“First is the shortage of skilled workers. In a 2017 survey of homebuilders, 82 percent of respondents cited the cost and availability of labor as a significant problem…

Second, the cost of building materials has risen…”

Third, developed land has become scarcer. Metrostudy data for 98 metro areas indicate that the number of vacant developed lots declined from 1.26 million in 2008 to just 802,000 in 2017…

Finally, local zoning and other land use regulations can reduce the amount of new construction by constraining the type and density of new housing allowed…

“Modular housing, constructed in factory conditions before being transported and assembled on site, could provide at least part of the answer. Including the value of land, the median price for a new modular unit was $217,200 in 2016—nearly $90,000 less than for a new site-built home. To date, however, homebuilders have been slow to adopt this innovation, with only 15,000 modular homes added in 2016. Indeed, modular housing has never accounted for more than 4 percent of single-family construction in the United States. By comparison, modular housing accounts for 9 percent of new homes in Germany, 12–16 percent in Japan, and 20 percent in the Netherlands.”

Housing – The Outlook

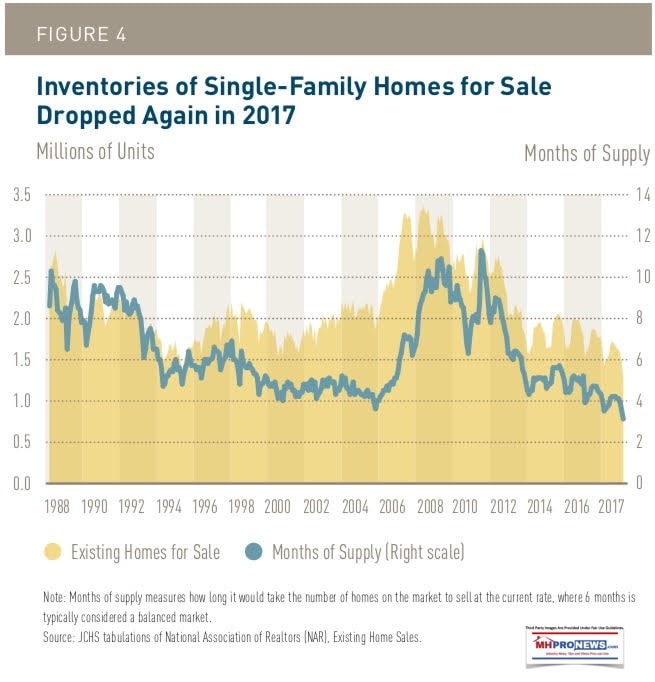

“The housing sector faces significant challenges in the short term. Labor shortages, rising materials costs, limited land availability, and land-use regulations are all holding down growth in new residential construction. Meanwhile, inventories of existing homes for sale are at all-time lows, pushing up prices and making homebuying more difficult, especially for low- and moderate-income households…

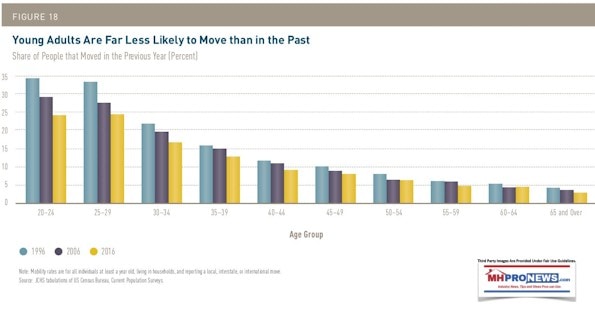

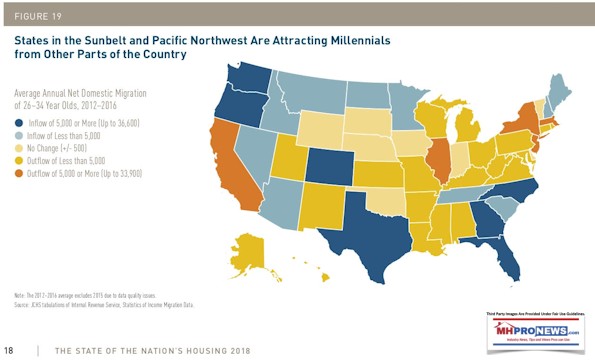

With its oldest members now in their late 20s and early 30s, the millennial generation is forming new households in greater numbers and moving to different states in search of opportunity. At the same time, nearly 10,000 baby boomers turn 65 every day, raising the average age of US households. Although wealth is growing, homeowners and those at the top have captured most of the gains, and millions of households have little or no wealth. Going forward, immigration will become an increasingly large, albeit unpredictable, source of population growth and therefore housing demand…”

Immigration and Housing

“According to Census Bureau data, the number of foreign- born households more than doubled from 7.7 million in 1990 to 17.8 million in 2016, accounting for more than a third of the growth in households over that time…”

Housing and Minorities

“Minorities made up half of the nation’s low-wealth households in 2016, up from 39 percent in 1995. They also accounted for more than three-quarters of the growth in low-wealth households between 1995 and 2016. Indeed, as the number of minority house- holds increased over this long span, the shares with low wealth remained consistently high at 52 percent for blacks, 49 percent for Hispanics, and 30 percent for Asians and other minorities. Meanwhile, the share among whites also remained steady at a relatively low 22 percent…”

Interstate Migration

“Resuming past trends, total net domestic migration to the Southeastern states of Florida, Georgia, and the Carolinas rebound- ed from a low of 86,000 in 2009 to 317,000 in 2017. Meanwhile, domestic outflows from the Northeast and Midwest continued to increase in 2017. The three states with the largest net domestic outflows—California, Illinois, and New York—lost 443,000 residents to domestic migration in 2017, more than double the 207,000 net losses in 2011…”

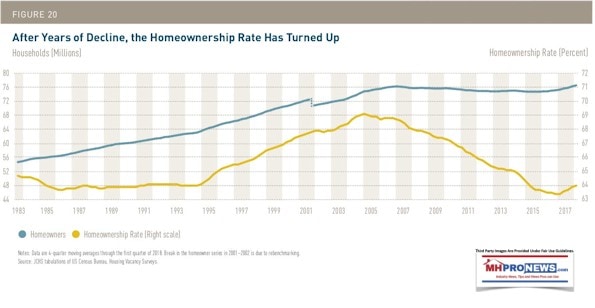

Homeownership Rates

“The national homeownership rate ticked up in 2017 for the first time in 13 years, buoyed by growth in the number of homeowner households. Despite the ongoing rise in home prices, low interest rates have helped to keep monthly housing costs relatively affordable for new homeowners. Still, the upward climb of interest rates, limited inventory of homes for sale, widespread increases in student loan debt, and insufficient savings for downpayments raise important concerns about the ability of many potential buyers to access homeownership…”

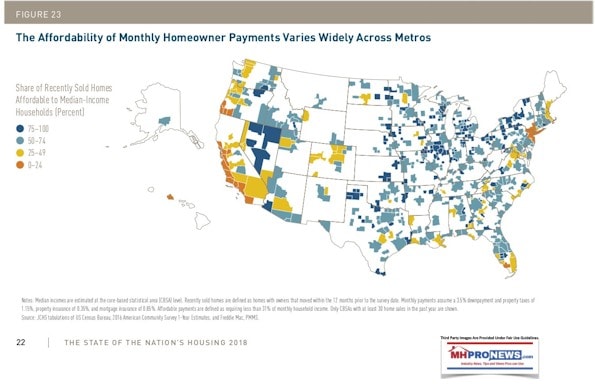

Rising Prices but Relative Affordability

“Continuing a steady upward climb, the nominal median sales price of existing homes increased from $233,800 in 2016 to $247,200 in 2017…

In the high-cost Los Angeles market, for example, a household with the area median income would be able to afford the monthly mortgage payments on only 11 percent of recently sold homes. And because these homes include studio apartments and other small units suitable for only one or two people, the affordable options for families are even more limited. By contrast, even a low- income (bottom-quartile) household in Pittsburgh would be able to afford 26 percent of recently sold homes. Such dramatic differences in affordability contribute to large disparities in homeownership across metro areas. Of the nation’s 50 largest metros, Pittsburgh has the highest homeownership rate of 70 percent, while Los Angeles has the lowest rate of 48 percent…”

Financing

“The FHA and VA shares of home purchase loan originations have also leveled out in recent years following a significant jump during the foreclosure crisis (Figure 24). Indeed, even as the number of 1–4 unit, first-lien, owner-occupied mortgage originations rose from 2.7 million in 2013 to 3.5 million in 2016, the FHA share remained near 20–25 percent. While down sharply from the high of 41 percent in 2009, the FHA share is still well above the 6 percent low in 2005. The VA share held at 10 percent in 2016, up from 2 percent in 2005. Meanwhile, the conventional share of originations stayed close to 60 percent…”

Rent vs. Own

“…However, survey evidence points to continued strong interest in homeowning. The 2018 Survey of Consumer Expectations found that 67 percent of renters would prefer or strongly prefer to own homes assuming they had the financial resources to do so. Only 19 percent would prefer or strongly prefer to rent. Moreover, 61 percent of renters think buying a home in their ZIP code today is a somewhat or very good investment, and just 12 percent believe it is a somewhat or very bad investment…

The Survey of Consumer Finances shows that the median net worth of renters was just $5,000 in 2016, about the same in real terms as in both 1995 and 2007. Moreover, fewer than one in three renters had more than $10,000 in financial assets, and only 21 percent had more than $25,000. As a result, only a small share would be able to cover even a 3.5 percent downpayment and 2 percent closing costs on a median- priced home, which amounted to $13,596 in 2016…”

Rentals

“There are signs that the rental market is cooling, although primarily at the upper end. The number of multifamily starts declined slightly over the past year, and expanding supplies of new luxury apartments pushed up vacancy rates, helping to slow rent growth. Although the number of high-income renters is still growing, lower rentership rates among key groups—particularly younger households—may indicate a turn toward homeownership. Meanwhile, the supply of rentals affordable to the nation’s lowest- income households continues to shrink…

The Survey of Construction indicates that nearly half of the rentals completed in 2016 were in buildings with 50 or more units, compared with just 13 percent in 1999. Most other new units were in buildings with at least five apart- ments. In addition, 86 percent of new apartments in 2016 were in properties with swimming pools, up from 69 percent in 1990. Some 89 percent of new units in 2016 also had in-unit laundry services, significantly higher than the 61 percent share of existing units with this amenity…

Both rising construction costs and added amenities have pushed up asking rents. The nominal asking rent for new apartments increased average rents for new units in certain major metros (including Chicago, Miami, and Washington, DC) were $2,000 or higher.”

Easing at the High End of Rentals

“The national vacancy rate for all rental units averaged 7.2 percent in the year ending in the first quarter of 2018, up 0.3 percentage point from a year earlier. But the rate for rental units built since 2010, as measured by the Housing Vacancy Survey, hit 21 percent in 2017. While not unprecedented compared with the rates for similarly new units in 2007 and 2008, this high vacancy rate far exceeds the 15 percent reported a year earlier…”

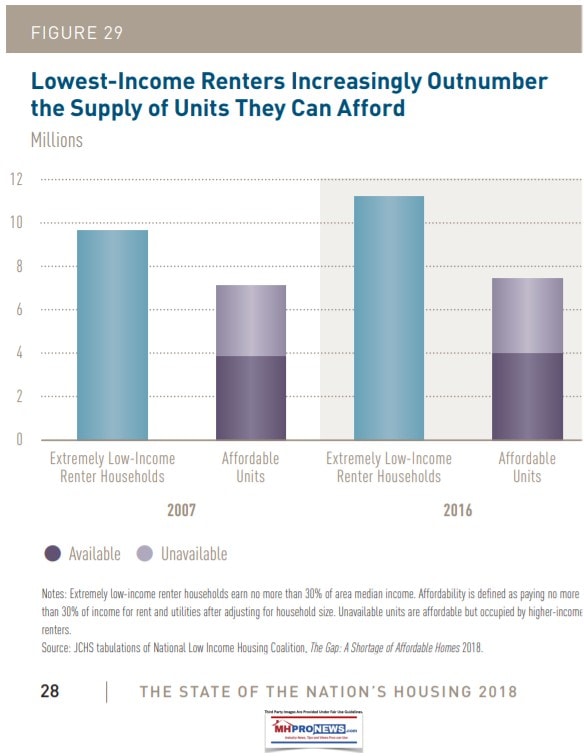

Shortfall in Lower Cost Rentals

“The nation’s supply of low-cost rental housing shrank significantly after the Great Recession and has remained essentially unchanged since 2015. A National Low Income Housing Coalition study found that for every 100 extremely low-income renters, only 35 rental units were affordable and available in 2016—a nationwide shortfall of more than 7.2 million units (Figure 29). Conditions for very low-income renter households were little better, with 56 affordable and available rentals per 100 households…”

Housing Cost Burdens

“More than 38 million US households have housing cost burdens, leaving little income left to pay for food, healthcare, and other basic necessities. As it is, federal housing assistance reaches only a fraction of the large and growing number of low-income households in need. Between the shortage of subsidized housing and the ongoing losses of low-cost rentals through market forces, low-income households have increasingly few housing options. Meanwhile, the rising incidence and intensity of natural disasters pose new threats to the housing stocks of entire communities…

About a third of the households in metropolitan areas struggle to find affordable housing (Figure 35)…

Threats To The Affordable Supply

“The National Low Income Housing Coalition reports that the gap between supply and demand for rental units affordable and avail- able to very low-income households is 7.7 million…”

Homelessness

“HUD’s Annual Homeless Assessment Report shows that nearly 554,000 people were living in shelters or on the street on a given night in January 2017…”

State and Local Initiatives

“According to the National Low Income Housing Coalition database, about 100 state and local programs provide either tenant-based assistance or capital support for affordable rental housing development…”

Housing Losses to Natural Disasters

“The 16 major disaster events in 2017 caused a record-setting $306 billion in damages. These events caused destruction of hundreds of thousands of homes and widespread displacement of households across California, Florida, Puerto Rico, and Texas. In Puerto Rico alone, storms destroyed or severely damaged an estimated 472,000 housing units…

FEMA direct assistance filled some of the gaps for households without flood insur- ance, providing financial help for 1.6 million households…

The rebuilding process has its own challenges. The three states with significant disaster damage last year—California, Florida, and Texas—have large populations of undocumented immigrants, households that are unlikely to apply for assistance in fear of depor- tation. In Puerto Rico, relief is complicated by the fact that much of the housing stock was built without permits or without regard to building codes…

Recovery will no doubt be long…”

MHProNews Analysis in Brief

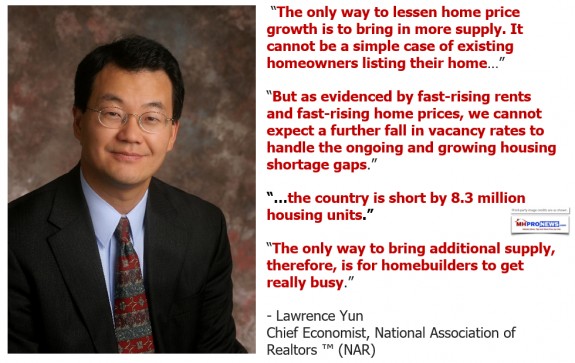

The National Association of Realtors (NAR) Chief Economist Lawrence Yun has noted before that the nation needs some 8.3 million housing units. What Harvard’s annual report indicates are an array of other facts that point to tens of millions of possible opportunities for forward thinking HUD Code manufactured housing and modular builders.

Earlier today, in the Manufactured Housing Association for Regulatory Reform (MHARR) noted their request to have multi-family housing units approved by HUD.

Manufactured Housing Program Review Addressed by HUD Secretary Carson during Oversight Hearing

Harvard didn’t in this report look at specific issues such as acceptance, financing, political, zoning, or any other reasons why manufactured housing wasn’t performing better than it is. That said, their report uses correct terminology, and is on balance, respectful of the industry. Harvard’s Eric Belksy has been cited before as saying he expected manufactured housing to surpass conventional housing by 2010. We know that didn’t happen, some of the debatable reasons why are linked in related reports below.

But the bottom line is this. There are millions of housing units needed now, and millions more that will be needed in the years ahead. With the proper approaches, the opportunities are available. With hundreds of billions in capital pouring into the U.S. the best time in about 2 decades to tap those opportunities may be right now.

The entire report is available at this link here. “We Provide, You Decide.” © ## (News, commentary, and analysis.)

(Third party images, and content are provided under fair use guidelines.)

Related Reports:

Celebrate National Home Ownership Month, with 26 Cool Prefab Cribs, a $1 Billion Dollar Hybrid Mansion, 4 Fun Videos – manufacturedhomelivingnews.com

It’s National Home Ownership Month, and today we’ll celebrate it by sharing some videos that includes a sneak peak into a 27 story custom hybrid palace, that is home to one of the world’s richest men. The private residence known as Antilia, was built by tycoon Mukesh Dhirubhai Ambani for his family of four.

Evolutionary American Dream, from Tiny Trailer Houses, Mobile Homes, to “Amazing” Modern Manufactured Homes – manufacturedhomelivingnews.com

Evolutionary American Dream, from Tiny Trailer Houses, Mobile Homes, to “Amazing” Modern Manufactured Homes, Lucille Ball, Desi Arnez, Long, Long Trailer movie trailer, evolution trailer houses, mobile homes, manufactured homes, HUD Secretary Ben Carson, Amazing, mobile home living news, Manufactured home living,

By L.A. “Tony” Kovach – Masthead commentary, for MHProNews.com.

By L.A. “Tony” Kovach – Masthead commentary, for MHProNews.com.

Tony is the multiple award-winning managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

Office 863-213-4090 |Connect on LinkedIn:

http://www.linkedin.com/in/latonykovach

Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates.