In a release to the Daily Business News on MHProNews, Fannie Mae (OTCQB: FNMA) said that they have “provided more than $65 billion in financing to support the multifamily market in 2018 with its Delegated Underwriting and Servicing (DUS®) program. Fannie Mae continued to serve as a key source of liquidity by attracting a diverse investor base to purchase our DUS Mortgage-Backed Securities (MBS), while building a profitable and sustainable book of business.”

“For more than 30 years, the DUS platform has brought stability to the multifamily market. Our innovative thinking is driving the industry forward and our commitment to serving our customers remains our top priority,” said Jeffery Hayward, Executive Vice President of Multifamily, Fannie Mae. “Our lender partnerships are also propelling Fannie Mae to be part of a global movement to transform rental housing to be healthier for residents and to help reduce energy and water consumption at the properties we finance.”

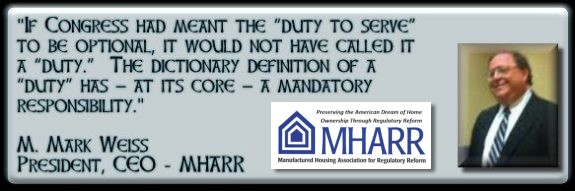

The Government Sponsored Enterprises (GSE) of Fannie Mae and Freddie Mac have both been given some latitude by the Federal Housing Finance Agency (FHFA)) for using certain qualifying loans on manufactured home communities as credits toward their Duty to Serve (DTS) requirements. Right or wrong, that use of DTS has been far more robust than it has toward single family manufactured home loans.

“Fannie Mae was recognized in 2018 as the largest issuer of Green Bonds in the world, with more than $20 billion in Green MBS backed by either green certified properties or properties targeting a reduction in energy or water consumption. Fannie Mae increased its Green Financing portfolio to over $50 billion in 2018, driven by $20 billion in Green Financing. In 2018, Fannie Mae made LIHTC equity investment commitments towards meeting FHFA’s $500 million volume cap by deploying equity to rural and other underserved housing markets throughout the United States. Additionally, Fannie Mae led the affordable market with overall production of $7.4 billion, an increase of 9% from 2017,” stated their release to MHProNews.

“Multifamily had another outstanding year in 2018, thanks to our lenders,” said Rob Levin, Senior Vice President for Multifamily Customer Engagement, Fannie Mae. “Together, we supported all market segments, bringing liquidity to the market, while building a balanced portfolio that reflects our strategy with strong credit quality and mission-rich business.”

The following list are the top 10 DUS Lenders produced the highest business volumes in 2018. Also listing that follows also includes the Top 5 Lender rankings for highest volumes in 2018 for Multifamily Affordable Housing, Small Loans, Green Financing, Seniors Housing, Structured Transactions, Manufactured Housing Communities, and Student Housing:

Top 10 DUS Producers in 2018 Volume ($Billion)

- Wells Fargo Multifamily Capital $8.1

- Walker & Dunlop, LLC $6.9

- Berkadia Commercial Mortgage, LLC $6.6

- CBRE Multifamily Capital, Inc. $6.1

- Newmark Knight Frank $4.3

- Greystone Servicing Corporation, Inc. $3.9

- Capital One, National Association $3.8

- KeyBank National Association $3.4

- PGIM Real Estate Finance $3.3

- Arbor Commercial Funding I, LLC $3.2

Top 5 DUS Producers for Multifamily Affordable Housing in 2018

- Wells Fargo Multifamily Capital

- CBRE Multifamily Capital, Inc.

- Greystone Servicing Corporation, Inc.

- PGIM Real Estate Finance

- Jones Lang LaSalle Multifamily, LLC

Top 5 DUS Producers for Small Loans in 2018*

- Greystone Servicing Corporation, Inc.

- Arbor Commercial Funding I, LLC

- Hunt Mortgage Group

- Walker & Dunlop, LLC

- Bellwether Enterprise Real Estate Capital, LLC

Top 5 DUS Producers for Green Financing in 2018

- Berkadia Commercial Mortgage, LLC

- Greystone Servicing Corporation, Inc.

- Arbor Commercial Funding I, LLC

- CBRE Multifamily Capital, Inc.

- Capital One, National Association

Top 5 DUS Producers for Seniors Housing in 2018

- Berkadia Commercial Mortgage, LLC

- Grandbridge Real Estate Capital, LLC

- Capital One, National Association

- CBRE Multifamily Capital, Inc.

- M&T Realty Capital Corporation

Top 5 DUS Producers for Structured Transactions in 2018

- Wells Fargo Multifamily Capital

- Newmark Knight Frank

- Walker & Dunlop, LLC

- PNC Real Estate

- Berkadia Commercial Mortgage, LLC

Top 5 DUS Producers for Manufactured Housing Communities in 2018

- Walker & Dunlop, LLC

- Wells Fargo Multifamily Capital

- KeyBank National Association

- Berkadia Commercial Mortgage, LLC

- Capital One, National Association

Top 5 DUS Producers for Student Housing in 2018

- Wells Fargo Multifamily Capital

- Walker & Dunlop, LLC

- CBRE Multifamily Capital, Inc.

- PGIM Real Estate Finance

- KeyBank National Association

Listed below are 2018 production highlights for individual business categories, which are included in the total multifamily production number.

- Affordable Housing – $7.4 billion comprised of $6.0 billion in Multifamily Affordable Housing (for rent-restricted properties and properties receiving other federal and state subsidies), an increase of 10 percent from $5.4 billion in 2017; and $1.4 billion for properties with rent restrictions between 60 percent and 80 percent AMI, in line with $1.4 billion in 2017

- Small Loans* – $2.2 billion

- Green Financing – $20.1 billion (properties with Green Building Certifications or loans targeting a 25 percent reduction or more in energy or water consumption)

- Student Housing – $2.7 billion

- Structured Transactions – $9.5 billion

- Seniors Housing – $2.3 billion

- Manufactured Housing Communities – $2.9 billion, an increase of 56 percent from $1.9 billion in 2017

Footnotes:

*Small Loans are defined as loans of $3 million or less nationwide and $5 million or less in high-cost markets, and typically finance multifamily properties with five to 50 units.

**Due to rounding, amounts reported may not add up to overall totals.

The above is insightful on several levels. First, note that more than one of those manufactured home community DUS lenders has ties to Berkshire Hathaway.

Next, is that this is arguably part of the give-take mechanism that Arlington, VA based Manufactured Housing Institute (MHI) has used to get some of their community members in the National Community Council (NCC) to swallow and ignore the single-family chattel lending that the Manufactured Housing Association for Regulatory Reform (MHARR) has stressed should be at the core of DTS by the GSEs.

It also brings back into focus what some in manufactured housing call the “sell-out” or “betrayal” of the industry’s independent producers of manufactured homes. How so? Consider this from Fannie Mae’s own site, which stresses their ‘support’ for manufactured housing as:

- A) The Multifamily Manufactured Housing Communities Market . …

- B) Develop an enhanced manufactured housing loanproduct for quality manufactured (homes)…

It must not be forgotten that MHI leaders held closed door meetings with Fannie and Freddie, to which none of the parties have released the meeting minutes, that ultimately resulted in the “new class of homes” program that has emerged…

…and so far has landed with a thud. While Fannie and Freddie are both mum on specifics, the new HUD Code manufactured home shipments data is all the proof that is needed. That data, combined with anecdotal information from various sources have made it clear that little has occurred from the new class of homes, other than noise from MHI, their allies, and Omaha-Knoxville puppet masters.

For more, see the related reports, linked below. That’s MH “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” ## © (News, analysis, and commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

MHI CEO Dick Jennison’s Pledge – 500,000 New Manufactured Home Shipments

GSEs’ “Duty To Serve Underserved Markets” Plans | Manufactured Housing Association Regulatory Reform

TO: INDUSTRY MANUFACTURERS, RETAILERS, COMMUNITIES RE: GSEs’ “DUTY to SERVE UNDERSERVED MARKETS” PLANS FHFA REQUESTS INPUT ON PROPOSED MODIFICATIONS TO AND FINANCE COMPANIES Attached for your review and information is a copy of a notice issued by the Federal Housing Finance Agency (FHFA) on October 3, 2018, seeking public comment on proposed revisions to the initial “Duty to Serve Underserved Markets” (DTS) implementation plans submitted by Fannie Mae and Freddie Mac to FHFA in 2017.

Midwest Manufactured Housing Federation Official Louisville Show Communique to MHProNews

Independent National Manufactured Housing Post-Production Association Takes Major Step | Manufactured Housing Association Regulatory Reform

Washington, D.C., January 8, 2019 – The National Association of Manufactured Housing Community Owners (NAMHCO), a new, independent association representing a key manufactured housing industry post-production constituency, has announced a major step in its initial organization and the start of national-level advocacy activities to better and more effectively represent the post-production sector in Washington, D.C.

Production Decline Continues in November 2018 | Manufactured Housing Association Regulatory Reform

Washington, D.C., January 3, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured home production declined once again in November 2018.