by Bill Matchneer, JD

One is a CFPB rule that amends the Equal Credit Opportunity Act (ECOA) to require lenders to provide consumers with copies of all appraisals and other valuations developed for the loan. The other is a six-agency rule CFPB wrote together with the major banking regulators that amends the Truth in Lending Act (TILA) to require full appraisals by licensed or certified appraisers for most so-called higher-priced mortgage loans.

These are loans with annual percentage rates at least 1½ percent higher than the prevailing average prime offer rate, which describes many if not most manufactured housing loans. The lender must sometimes pay for a second such appraisal if the property is being “flipped,” meaning held for less than 180 days.

As many of you know, I supervised the Manufactured Housing Construction and Safety Standards program at HUD for many years. While there, I often interacted with people in the FHA Title I and Title II programs, and got to know more about manufactured housing finance.

Therefore, as we began the work of giving life to these new Dodd-Frank requirements, it became apparent that the drafters of these provisions had probably not considered how these appraisal and valuation requirements would apply in the unique world of manufactured housing marketing and finance.

I had come up against this same square peg in a round hole problem when we were preparing the SAFE Act regulations at HUD, and I knew some industry specific compromises would probably be necessary.

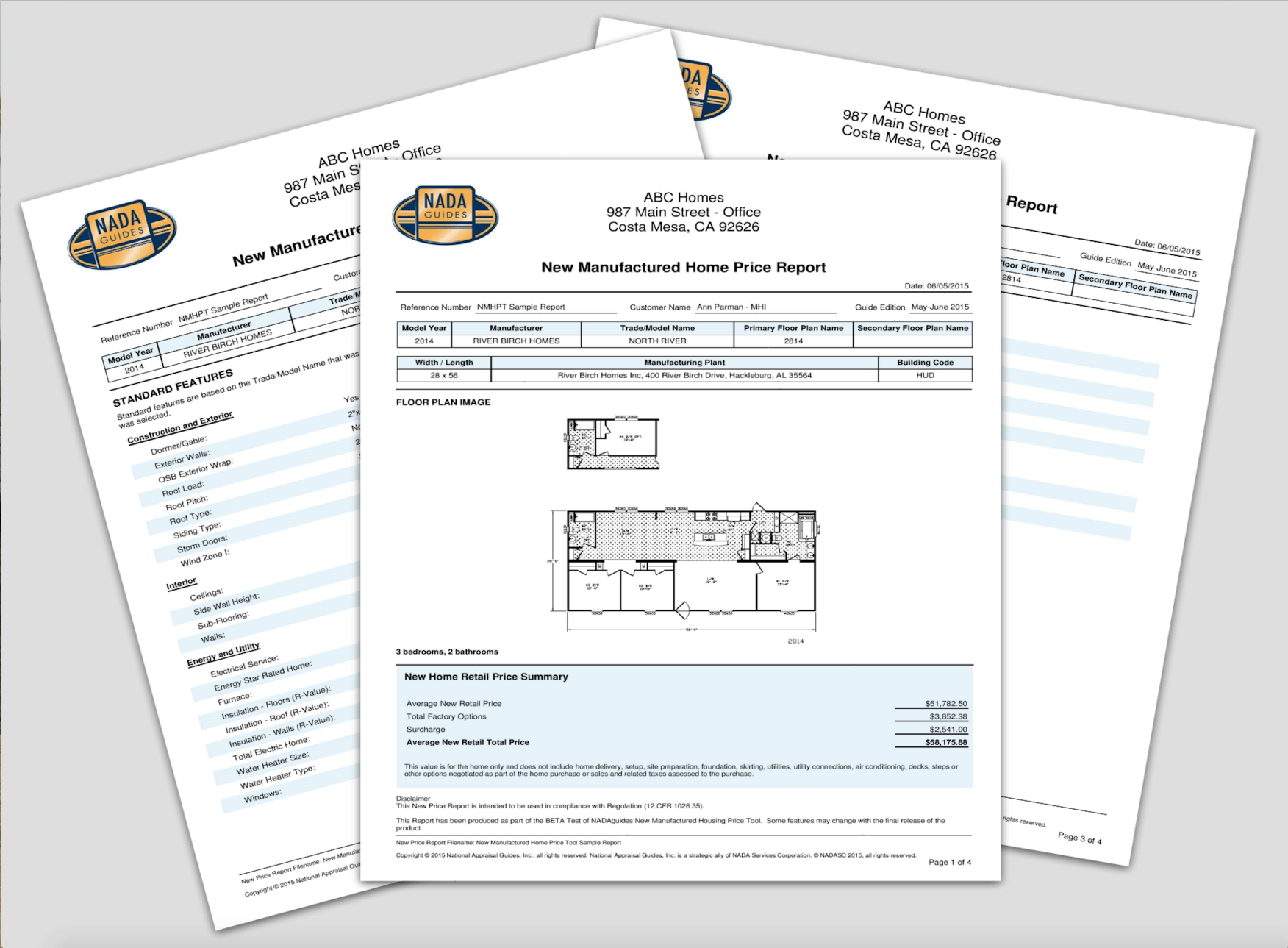

For the ECOA rule, CFPB exempted the manufacturer’s invoice as a “valuation” that must be provided. For the TILA appraisal rule, the six agency group was truly stumped by manufactured housing issues. As a result, additional time was required, and a supplemental rule for manufactured housing has just been published. That rule only requires full interior appraisal for used homes converted to realty. No interior appraisal is required for a new home converted to realty. For new and used chattel-only homes, the agencies allowed four options, including value reports that can be easily obtained from NADA, Data Comp and Marshall & Swift.

As the person at CFPB who was supposed to “know about manufactured housing,” I was often consulted by staff colleagues working on other Dodd-Frank rules who were discovering that their part of the statute had also failed to address issues unique to manufactured housing marketing and finance.

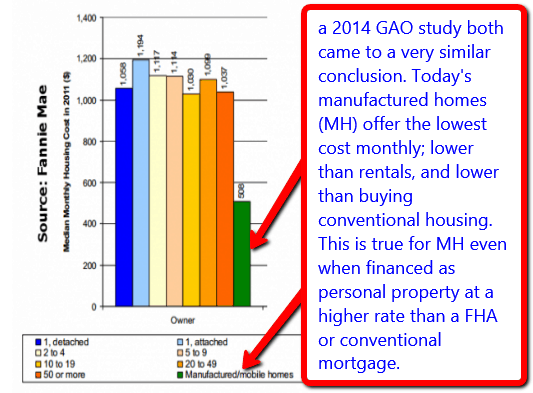

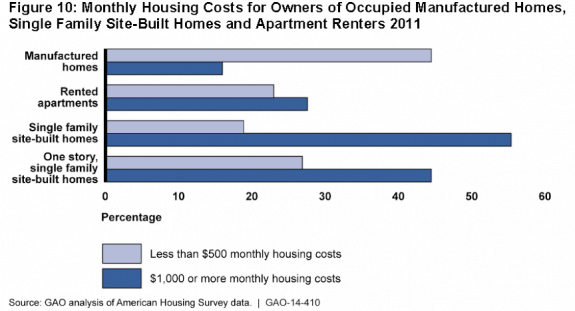

Ten years in charge of the HUD program made me a believer in manufactured housing as one of the best affordable housing values there is in the United States. As Dave Stevens, Mortgage Bankers Association President, made clear during his luncheon remarks at the MHI Winter meeting, the numbers strongly favor manufactured housing as an affordable housing option in coming years.

To make sure the industry actually benefits from these trends though, there needs to be a strong cooperative effort to educate lawmakers and regulators at all levels. That way issues unique to manufactured housing marketing and finance are more likely to be properly considered as laws and regulations that affect the industry are being written or reviewed. Hopefully, the days of wasting the industry’s limited government relations resources on petty insults and complaints can be put behind us. ##